- Alibaba Jumps as SoftBank Denies Involvement in Stock Filing (bloomberg)

- Billionaire investor and Carlyle co-founder David Rubenstein says the US won’t spiral into a recession and inflation will dip to as low as 4% in 2022 (businessinsider)

- BlackRock says markets are expecting too many interest rate hikes, stays bullish on stocks (businessinsider)

- Disney’s Earnings Are Today. Parks and Streaming Are Key. (barrons)

- Streamers Are Dominating Hollywood. Netflix Has Chance for Its First Best Picture Prize. (barrons)

- Debt Could Become a Problem for the Market. These Stocks Could Offer Protection. (barrons)

- GlobalFoundries Stock Is Rising. Earnings Bucked the Chip Shortage. (barrons)

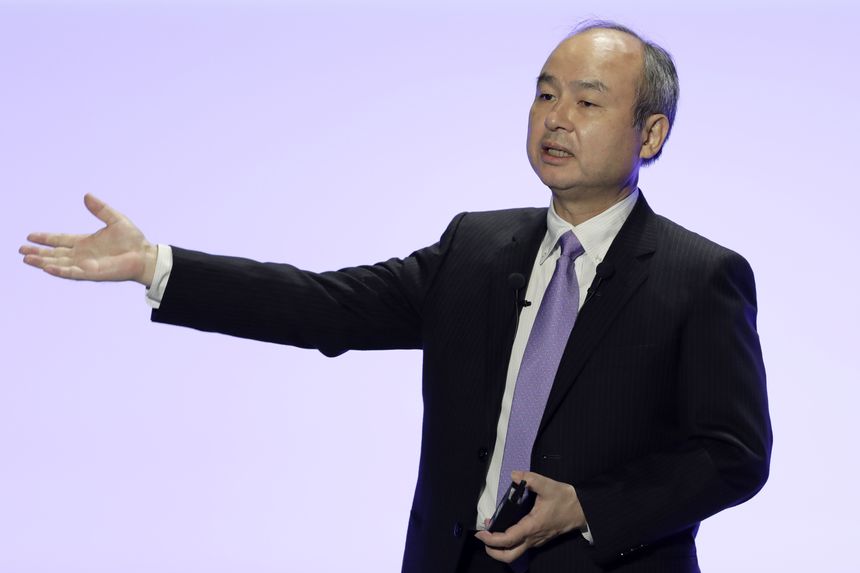

- SoftBank Pitches IPO for Arm After Deal With Nvidia Falls Through (wsj)

- Relentless Wall Street Billionaire Has a Secret Cause (wsj)

- S. Households Took On $1 Trillion in New Debt in 2021 (wsj)

- The Big Read. Luckin Coffee: can China’s Starbucks win back investors? (ft)

- Lyft’s Revenue Jumps 70% as Higher Fares Offset Fewer Riders (wsj)

- He Retired. He Coached Pop Warner. Now He’s Playing in the Super Bowl. (wsj)

- Hong Kong stocks in for a roaring Year of the Tiger, Feng Shui Index shows (scmp)

- China’s “National Team” Is Good At Killing Stock Volatility (zerohedge)

- Fed’s Bostic says more than 3 hikes possible this year, but needs to see how economy responds (cnbc)

- Alphabet’s 20-for-1 stock split could entice other companies to do the same and draw fresh inflows into the stock market this year, Bank of America says (businessinsider)

- Fusion Energy Moves ‘Huge’ Step Closer After Landmark Experiment (bloomberg)

- China and Taiwan Have a Big Stake in What Happens in Ukraine (bloomberg)

- Edgewell CEO Says the Worst of Supply-Chain Snarls Are Behind It (bloomberg)

Be in the know. 20 key reads for Wednesday…