- JPMorgan’s Kolanovic Says Stocks Will Rise on Pandemic End, China Stimulus (bloomberg)

- Iran Moves More Oil Onto Ships in Preparation for a Nuclear Deal (bloomberg)

- Don’t sell during the Russia-Ukraine ‘panic’ because stocks will bounce back, Fundstrat’s Tom Lee says (businessinsider)

- Intel (INTC) Stock Pops After Raymond James Upgraded to Market Perform; BofA Sees AMD (AMD) and Nvidia (NVDA) Outperformance (streetinsider)

- Companies Shelling Out More Capital in 2022 (thestreet)

- What is Putin’s endgame in Ukraine? Here’s what you need to know (cnbc)

- The Oil Is Still Flowing. The Energy Report 02/23/2022 (Phil Flynn)

- Stocks Are Actually 21% Cheaper (Due Largely To 10 Epic Drops) (investors)

- Why AstraZeneca Could Be a Sound Long-Term Bet (barrons)

- Alibaba ‘s quarterly profit is expected to fall almost 60% year over year when the Chinese tech giant reports earnings on Thursday. Investors shouldn’t worry too much — it’s not as bad as it might seem on the surface. (barrons)

- GE Dives Into Hydrogen Plane Technology With Airbus (barrons)

- Facebook Is Expanding Reels, Its Answer to TikTok. (barrons)

- Opinion: I’m a former Moscow correspondent. Don’t let Vladimir Putin fool you: Russia’s war in Ukraine is only about one thing. (marketwatch)

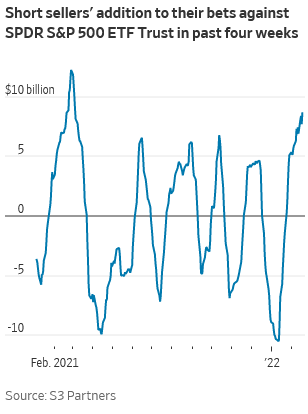

- Bearish Bets Against Markets Are Surging (wsj)

- How Reagan Would Have Handled Putin (bloomberg)

- Hedge Funds Slash Tech in Pivot to Other Strategies, Goldman Report Says (bloomberg)

- Mark Mahaney is Wall Street’s most veteran tech analyst. He told us why he expects a recovery in late 2022 (businessinsider)

- Retailers seek real-world profits in the metaverse (ft)

- Traders leave US penny stocks in sign speculative fever is cooling (ft)

- Hong Kong opens tap for more mortgage loans to first-home buyers (scmp)

Be in the know. 20 key reads for Wednesday…