- Amazon Stock Split and Buyback Could Deliver Much-Needed Liftoff (bloomberg)

- House Passes $1.5 Trillion Spending Bill (barrons)

- China Supports Tech Firm U.S. IPO Revival, Signaling End to Freeze (bloomberg)

- JD Revenue Rises 23% in Defiance of China’s Consumption Slowdown (bloomberg)

- European Central Bank surprises markets with plan to wind down stimulus sooner than planned (cnbc)

- China’s 5.5% Growth Target Is a Big Reach (wsj)

- Inflation rises 7.9% in February, a new 40-year high (foxbusiness)

- Roblox (RBLX) for PlayStation Appears to Be on the Horizon (streetinsider)

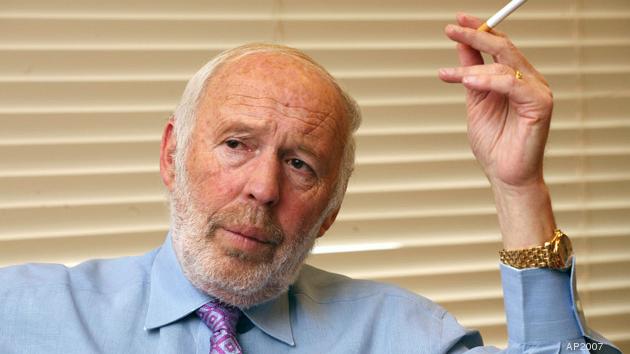

- The Rich List: The 21st Annual Ranking of the Highest- Earning Hedge Fund Managers (institutionalinvestor)

- Russia rejects Ukraine ‘neutrality’ proposals at deadlocked talks (ft)

- The Big Read. The rising costs of China’s friendship with Russia (ft)

- ‘Brutal’ selling in speculative tech stocks knocks Tiger Cub hedge funds (ft)

- S. unemployment claims climb 11,000 to 227,000, but still near pandemic low (marketwatch)

- ‘We can’t stay in a state of panic.’ Forecaster who predicted a series of rolling bear markets has just turned bullish. (marketwatch)

- Walk and Chew Gum. The Energy Report 03/10/2022 (Phil Flynn)

- GE Holds the Line on 2022, Lays Out Its Future at Investor Meeting (barrons)

- These Beaten-Up Closed-End Funds Are Future Bargains (barrons)

- Wall Street Sends Fresh Alarms on Bond Liquidity as QE Era Ends (bloomberg)

- China’s February Auto Sales Get Boost From New-Energy Vehicles (bloomberg)

- United Airlines to Let Unvaccinated Workers Return (wsj)

Be in the know. 20 key reads for Thursday…