- Why Wall Street’s growth-heavy Nasdaq Composite is still rallying as Treasury yields rise (marketwatch)

- Investors risk missing next big market move by staying in bonds (foxbusiness)

- Dividends and Share Buybacks Could Fuel High “Total Yield.” (barrons)

- China’s Banks to Overhaul Risk Exposure Rules to Aid Rebound (bloomberg)

- Redfin Is Upbeat About This Year. So Is Wall Street. (barrons)

- Coca-Cola Raises Dividend for 61st Year, and More Payout News (barrons)

- Wharton Professor Jeremy Siegel now sees a stronger economy post-CPI (cnbc)

- As Big Tech cuts workers, other industries are desperate to hire them (marketwatch)

- Amazon wants workers back in the office three days a week (marketwatch)

- The stock market’s pullback is healthy (marketwatch)

- Natural-Gas Slump Could Last, Says Producer EQT (barrons)

- Disney return-to-office plan may cause ‘long-term harm,’ workers say (nypost)

- Hard-up Russia pushes to replenish sagging Viagra supply (nypost)

- The Big Read. Beyond the balloon: the US-China spy game (ft)

- Shein gives investors lofty revenue projections as it prepares for IPO (ft)

- Five Million Carnival Goers Descend on Rio as Brazil Seeks Comeback (bloomberg)

- Wanted: Interns Who Can Make TikTok Hits (nytimes)

- Charlie Munger On BYD, Tesla, Alibaba and Bitcoin — Daily Journal’s Shareholders Meeting — 2/15/2023 (CNBC)

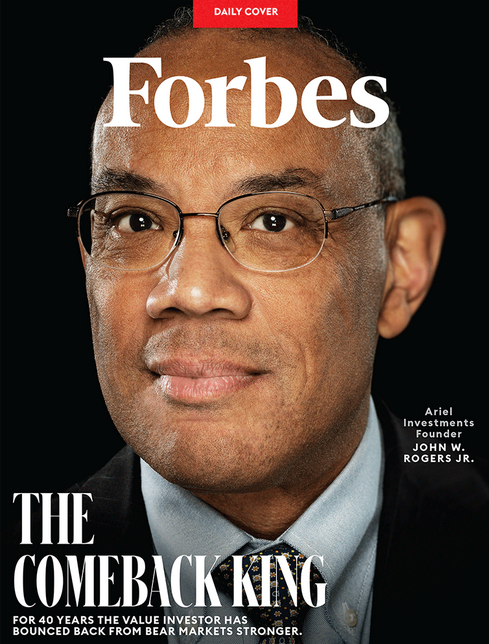

- The Comeback King: For 40 Years, John Rogers Has Come Out Of Bear Markets Stronger (forbes)

- A Practical Guide to Measuring Opportunity Cost (morganstanley)

- 3 Warren Buffett Stocks to Buy (morningstar)

- AutoNation beats profit estimates as new-vehicle demand improves (reuters)

- Factbox: Chinese tech firms working on ChatGPT-style technology (reuters)

Be in the know. 23 key reads for Saturday…