- Tax hikes are the next big investor worry: Morning Brief (Yahoo! Finance)

- Biden Team Prepares $3 Trillion in New Spending for the Economy (New York Times)

- Campbell and B&G Foods Have Outperformed. Only One Is a Buy for This Analyst. (Barron’s)

- Infrastructure Plan Seeks to Address Climate and Equality as Well as Roads (New York Times)

- Regeneron says its COVID-19 treatment still works even at a lower dose (MarketWatch)

- Top Yale Doctor/Researcher: ‘Ivermectin works,’ including for long-haul COVID (trialsitenews)

- Change of menu: Kraft Heinz bets on old brands to win new consumers (Financial Times)

- Here Are 6 REITs Set to Gain as Economy Reopens (Barron’s)

- Germany To Enter Strict Easter Shutdown Amid ‘New Pandemic’ (Barron’s)

- Short and Hot: How Investors Can Play This Economic Cycle (Barron’s)

- Why the Canadian Pacific-Kansas City Southern Deal Is Bullish for Railroad Stocks (Barron’s)

- Bank of America CEO Says Its Earnings Are Poised to ‘Substantially Increase’ (Barron’s)

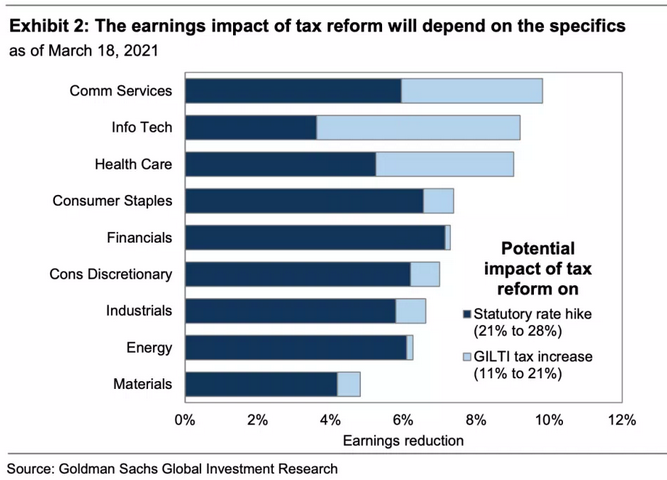

- Joe Biden Wants to Raise Taxes. What It Would Mean for the Stock Market. (Barron’s)

- Fed’s Powell Says Recovery Is Far From Complete (Wall Street Journal)

- Lockheed Martin partners with startup Omnispace to build space-based 5G network (CNBC)

- Pension funds to buy bonds to rebalance portfolios, and that may help stocks (CNBC)

- Billionaire investor Howard Marks touts value stocks, trumpets high-quality growth stocks, and says he’s open-minded about bitcoin in a new interview. Here are the 9 best quotes. (Business Insider)

- 5 Goldman Sachs Conviction List Stocks to Buy Now That Pay Big Dividends (24/7 Wall Street)

- UK unemployment rate unexpectedly falls to 5% in January as the country looks ahead to reopening (Business Insider)

- Stocks slump at the open Tuesday as fresh lockdowns sweep the globe (MarketWatch)