- Johnson & Johnson to Settle Talc Claims for $8.9 Billion (barrons)

- The Economy May Be Weakening. Here’s What That Means for Interest Rate Hikes. (barrons)

- Google-Owner Alphabet Says Its Chips Can Beat Nvidia’s. What This Means for AI. (barrons)

- Companies See a Slowdown Ahead. This Figure Tells the Story. (barrons)

- How the Dollar’s Decline Could Add to Inflation Problems (barrons)

- Here’s what is really behind OPEC+ oil-production cuts, say energy analysts (marketwatch)

- Alibaba’s Split-Up Brings Back Cash Inflow Into China’s Bourses (finance.yahoo)

- Telecom Competition Is ‘Destructive.’ Why Comcast Is Rated as a Winner. (barrons)

- ADP data show private sector of U.S. economy adding a fewer-than-forecast 145,000 jobs in March (marketwatch)

- The commodity supercycle is still young, these strategists say. Here’s why. (marketwatch)

- Good Friday complicates how stock-market traders will digest March U.S. jobs report (marketwatch)

- U.S. Job Openings Dropped in February (wsj)

- Tech Shines, Cyclicals Lose as Traders Bet on Growth Shock (wsj)

- Jamie Dimon Says Effects of Banking Crisis Will Be Felt for ‘Years to Come’ (nytimes)

- UBS Chairman’s Top-Secret Prep Paid Off in Credit Suisse Moment (bloomberg)

- US 30-Year Mortgage Rate Falls to Seven-Week Low (bloomberg)

- You Can Go on the Ultimate James Bond Vacation for $74,000 (bloomberg)

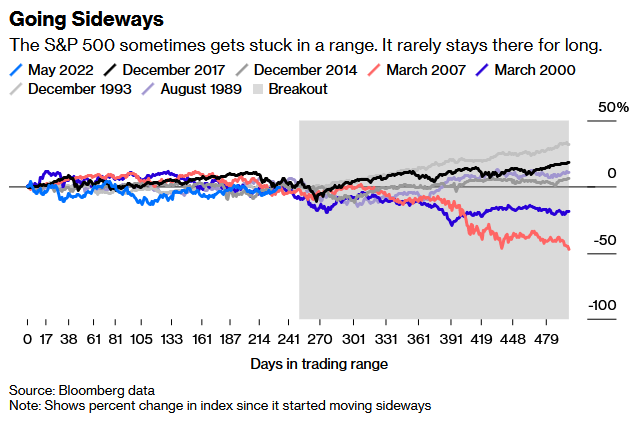

- Stock Market Cassandras and Pollyannas Are Stuck in Limbo (bloomberg)

- How the market’s biggest companies manage their cash and investments (cnbc)

- Adani could deliver ‘multibagger’ returns, an investor who bet $2 billion on the troubled business empire says (businessinsider)

- Jimmy Buffett, LeBron James, Tom Ford, and Tiger Woods are all officially billionaires (businessinsider)

- BofA witnessed the biggest week of equity outflows since October (streetinsider)

- China, Malaysia to discuss Asian Monetary Fund to reduce dependence on US dollar (foxbusiness)

- China’s reopening expected to release pent-up demand for art after 2022 decline

- Fund Star Terry Smith Builds $1 Billion Fortune With Riches Held Offshore (bloomberg)

- How China Aims to Counter US ‘Containment’ Efforts in Tech (bloomberg)

- The US Warehouse Capital Boomed During the Pandemic. Now It’s Facing a Slowdown bloomberg)

Be in the know. 27 key reads for Wednesday…