- Will Food Prices Stop Rising Quickly? Many Companies Say Yes. (nytimes)

- China Tightens Grip on Stocks With Net Sale Ban at Open, Close (bloomberg)

- Did The India Bubble Just Burst (zerohedge)

- Natural-gas prices bounce 8% as Chesapeake plans production cuts (marketwatch)

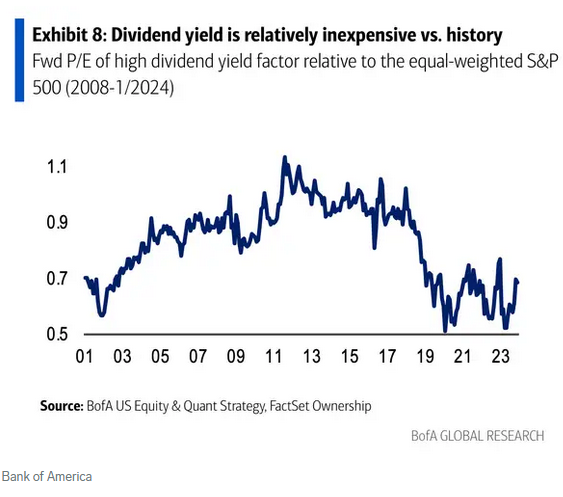

- Bank of America: These 25 stocks with sustainable dividends trading at a 50% discount to the market should outperform during this recovery (businessinsider)

- China Drafts Law to Protect Private Firms to Boost Confidence (bloomberg)

- Quant Hedge Funds Face China Clampdown After Rare Account Freeze (bloomberg)

- China Stocks Jump to Highest in Weeks (bloomberg)

- Why Nuclear Power Should Be Ramped Up (bloomberg)

- Two years after Apple quit Russia over Ukraine, Vision Pros are for sale in Moscow (cnbc)

- Amazon to replace Walgreens in Dow Industrial Average next week (cnbc)

- Crown Castle co-founder launches proxy fight after Elliott rejection (cnbc)

- Oppenheimer’s Stoltzfus expects stock rally to expand beyond the tech sector (streetinsider)

- Goldman turns positive on global equities (streetinsider)

- UBS now sees Fed starting to cut rates in June (streetinsider)

- China circumvents US tariffs by shipping more goods via Mexico (ft)

- Mortgage Rate Cut and New CSRC Head’s Outreach Lift Markets (chinalastnight)

- Nvidia is all about risk management and exposure maintenance, says Tim Urbanowicz (cnbc)

- UBS says hot, demand-driven inflation is positive for stocks, raises its S&P 500 target to a Wall Street high (businessinsider)

- AI’s golden child takes center stage today (businessinsider)

- 3 things could pop megacap stock bubble — and ‘weigh heavily’ on broader market (marketwatch)

- Fed Minutes May Shed Light on Rate-Cut Calculus (barrons)

Be in the know. 22 key reads for Wednesday…