- Chinese Stocks to Outperform Global Peers, Morgan Stanley Says (bloomberg)

- China’s Muted Inflation Leaves Room for Policy Stimulus (bloomberg)

- China’s Covid Exit Could Boost Europe and Latin America (barrons)

- Leuthold’s Paulsen Sees S&P 500 at 5,000 in New Bull Cycle (bloomberg)

- Elon Musk to remove 1.5 billion Twitter accounts, announces new feature for users’ tweets (foxbusiness)

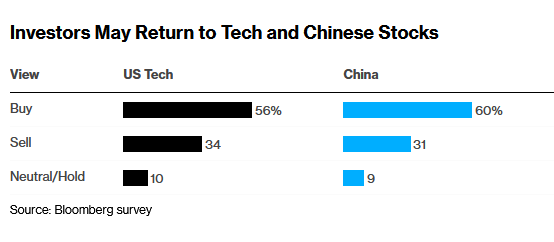

- World’s Top Money Managers See Double-Digit Stock Gains in 2023 (bloomberg)

- Shanghai Disneyland Reopens as Businesses in China Welcome Covid-Control Easing (wsj)

- Asian stocks tick higher as China switches focus to growth (ft)

- Santa Claus rallies are a ‘meaningful’ trend, says financial advisor: What one could mean for investors this year (cnbc)

- Letter From Apple Supplier Foxconn’s Founder Prodded China to Ease Zero-Covid Rules (wsj)

- Amazon’s Bull Case Just Got Stronger Thanks to a Huge Pentagon Contract (barrons)

- Higher-Quality Junk Bonds: Worth a Careful Look (barrons)

- ‘I’m bullish because everybody is bearish’: Investment managers see gains possible in 2023 despite recessionary jitters (marketwatch)

- JPMorgan looks at ‘Armageddon scenario’ of Fed jacking rates up to 6.5%. Its conclusion may come as a surprise. (marketwatch)

- The $42 Billion Question: Why Aren’t Americans Ditching Big Banks? (wsj)

- S. vs. China: Can Comac’s C919 Compete With Boeing’s 737? (wsj)

- Amazon Launches TikTok-Style Feed in Push to Accelerate Social Shopping (wsj)

- US home prices will post first year-over-year decline in decade in 2023: experts (nypost)

- TSMC bucks broader chip slump with 50% revenue surge, helped by iPhone orders (cnbc)

- China’s Covid Pivot Sounds Like the Real Thing, Bumps and All (bloomberg)

- Fed Expected to Keep Peak Rates for Longer, Dashing Hopes for 2023 Cuts (bloomberg)

- China, Saudi Arabia stress importance of oil market stability as Xi visits Riyadh (cnbc)

- China’s yuan is set to get a boost as Covid measures ease: BK Asset Management (cnbc)

- Hong Kong stocks notch 2%; China reports inflation data in line with expectations (cnbc)

- JP Morgan asset managers buck the doomsayers of Wall Street, predicting a better 2023 for stocks and bonds (businessinsider)

- S. wholesale price inflation rate picks up in November but is lower for year (marketwatch)

- Opinion: Without more immigrants to America, high interest rates and sluggish growth will persist (marketwatch)

- China Stocks Cap Another Week of Hefty Gains on Reopening Moves (bloomberg)

- Santa Claus rallies are a ‘meaningful’ trend, says financial advisor: What one could mean for investors this year (cnbc)

- JPMorgan’s Kolanovic issues a tactical trade to sell energy stocks (streetinsider)

- Hong Kong Internet Rally Goes Free Solo on the Wall of Worry (chinalastnight)

Be in the know. 31 key reads for Friday…