- As Credit Markets Rebound, Neediest Borrowers Are Left Behind (Bloomberg)

- Majority of Americans who qualify for coronavirus aid are expected to receive direct deposits by April 15 (Business Insider)

- N.Y. Deaths Dip; Gilead Drug Shows Early Promise: Virus Update (Bloomberg)

- The Terrible Costs of Keeping—or Ending—the Lockdowns (Barron’s)

- Time to Hit ‘Buy It Now’ Button on eBay Stock (Barron’s)

- This Market Is Made For Warren Buffett. Why Has He Gone Quiet? (Barron’s)

- In the Face of a “Rare Mispricing,” an Oil-Services Bear Turns Bull (Barron’s)

- Fed’s Emergency Lending Has Peaked. At Least for Now. (Barron’s)

- Martin Scorsese Courts Apple and Netflix to Rescue Costly DiCaprio Film (Wall Street Journal)

- Apple, Google Bring Covid-19 Contact-Tracing to 3 Billion People (Bloomberg)

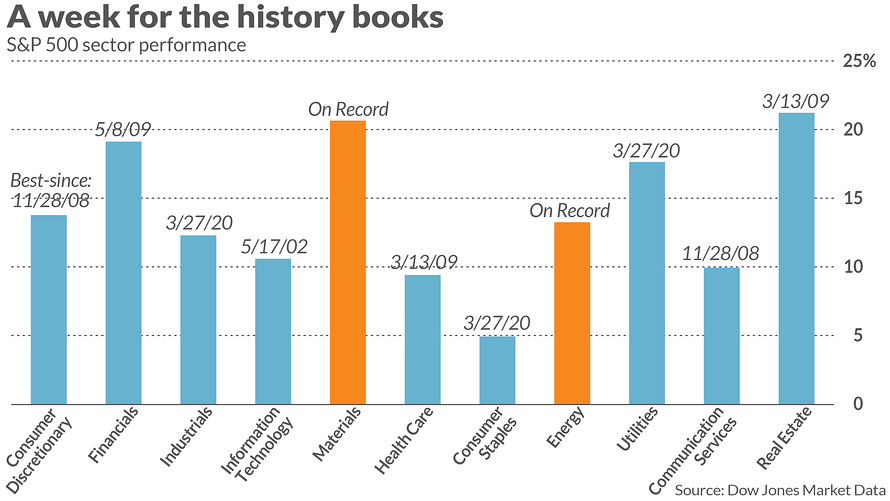

- 16 million people just got laid off but U.S. stocks had their best week in 45 years (MarketWatch)

- Ex-FDA commissioner says ‘widespread screening’ needed to reopen economy (CNN)

- The Asset Class That’s Not Getting Crushed by Coronavirus (Institutional Investor)

- The Relationship Between Earnings and Bear Markets (A Wealth of Common Sense)

- Markets Have Priced In the Lockdown Period. Now What? (Wall Street Journal)

- IRS Launches Registration Tool For Stimulus Checks (Forbes)

- Coronavirus: Is your auto insurer giving refunds? (ValueWalk)

- WEEKLY AND MONTHLY CHARTS SHOW IMPROVEMENT (John Murphy)

- America’s Best Trump Impersonator Has Some Thoughts About CNN And Dr. Fauci (Digg)

- Paul Walker’s 1969 Ford Mustang Boss 429 Is Headed to Auction (Maxim)

Be in the know. 20 key reads for Saturday…