- China’s Economy Shows Signs of Life. It Isn’t Out of the Woods Yet. (barrons)

- Individual investors sold nearly $16 billion worth of stocks in October (bloomberg)

- Ford Stock Rises. The Company’s Guidance Surprised. (barrons)

- Xi’s Shanghai Trip Demonstrates Support For Real Estate, Technology Sectors (chinalastnight)

- Inflation hits lowest level since 2021, Fed’s preferred gauge shows (yahoo)

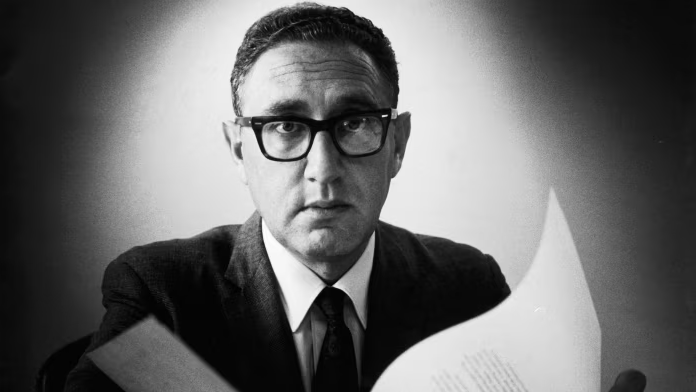

- Henry Kissinger, Who Helped Forge U.S. Foreign Policy During Vietnam and Cold Wars, Dies at 100 (wsj)

- Former secretary of state and national security adviser preached and personified realpolitik (ft)

- GM’s $10 Billion Apology (wsj)

- Alibaba pushes new AI tool to help wholesale merchants manage overseas clients (scmp)

- Consumer-spending slowdown could add to improving inflation picture (marketwatch)

- US Clean Energy Stocks Have Lost $30 Billion In Value In The Last 6 Months (zerohedge)

- “Mr. President, Tap The Brakes”: 3,900 Auto Dealers Warn EV Demand Crumbling (zerohedge)

- It’s Tesla Cybertruck Day. Price Is a Big Mystery. (barrons)

- PCE Inflation Slips as Expected. The Fed Could Mull Rate Cuts. (barrons)

- 7% Dividend Yields or Higher: The S&P 500’s 6 Best Payouts (barrons)

- Tesla CEO Elon Musk on the EV Slowdown and ‘Terrible’ Human Drivers (barrons)

- Fed’s Beige Book finds economy has slowed — and so has inflation (marketwatch)

- The Fed Is Tightening More Than It Says (barrons)

- How ‘Value’ Stocks Like Bank of America Can Trounce Growth for a While (barrons)

- For Collector Cars, Specialized Insurance Is Both Cheaper and Much Better (barrons)

- Jobless claims tick higher, and continuing claims are highest in two years (marketwatch)

- Charlie Munger’s Life Was About Way More Than Money (wsj)

- Fed’s Bostic Says Evidence Points to Downward Path for Inflation (bloomberg)

- Why No One Wants to Pay for the Green Transition (wsj)

- Billionaires amass more through inheritance than wealth creation, says UBS (ft)

- Fed’s Williams Expects Policy to Stay Restrictive for Some Time (bloomberg)

- Schizophrenia Is Coming for the Election-Year Economy (bloomberg)

Be in the know. 27 key reads for Thursday…