- BofA Survey Shows Full Investor Capitulation Amid Pessimism (bloomberg)

- Shanghai bourse to name market makers for tech stocks in boost for liquidity (scmp)

- Citigroup sees another 20 per cent upside in Chinese stocks this year on spending stimulus (scmp)

- Rich Chinese Worth $48 Billion Want to Leave — But Will Xi Let Them? (bloomberg)

- Chinese Regulator to Fine Didi More Than $1 Billion Over Data-Security Breaches. Move ends yearlong investigation and will free firm to pursue a second listing in Hong Kong (wsj)

- Boeing Nears 787 Dreamliner Order With Aircraft Lessor (wsj)

- Why There’s a Chance the Stock Market Has Hit Bottom (barrons)

- How to Explain the Metaverse, According to Its Biggest Booster (barrons)

- Natural-Gas Stocks Are Beating Oil Names. Here’s Why. (barrons)

- Netflix Is Serious About Cracking Down on Password Sharing. It’s Trying Out a New Test. (barrons)

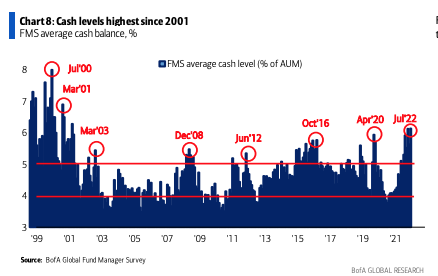

- Full capitulation: Fund managers have never been this pessimistic on growth or profits (marketwatch)

- ‘Hot inflation is over.’ Here’s what that means for investors, says portfolio manager. (marketwatch)

- Senate Votes on Semiconductor Bill Today. What It Means for Intel and Other Chip Stocks. (barrons)

- No Deals, No Problem on Wall Street (wsj)

- Barclays bankers kvetch over ‘skimpy’ bonuses, say their morale is ‘killed’ (nypost)

- Apple reportedly to slow hiring, spending in some divisions next year (nypost)

- Valuable wheat stuck in Ukraine may soon be on a ship (foxbusiness)

- Euro Surges On Report ECB Looking “Closely” At 50bps Rate Hike As Lagarde Rushes To Complete “Italian Bond Purchase” Mechanism (zerohedge)

- The Big Read. European economy: Lagarde wrestles with an ‘impossible situation’ (ft)

- Incyte gets FDA approval for a new vitiligo treatment (marketwatch)

Be in the know. 20 key reads for Tuesday…