- Morgan Stanley upgrades its 2023 growth outlook for China (cnbc)

- China to Hold Meeting on Economic Targets Despite Covid (bloomberg)

- Stocks Wait for the Fed. Beware the Dots. (barrons)

- Opinion: The Fed should pause its rate hikes now that inflation has slowed significantly. But it won’t. (marketwatch)

- Here’s why Amazon is Citi’s top internet stock idea (marketwatch)

- This Treasury dealer just slashed its Fed interest-rate forecast on the eve of the FOMC decision (marketwatch)

- Home Buyers Are Inching Back Into the Market (barrons)

- Slowing Inflation Could Intensify Fed Debate Over When to Stop Raising Rates (wsj)

- Nuclear-Fusion Breakthrough Accelerates Quest to Unlock Limitless Energy Source (wsj)

- Moderna’s mRNA Cancer Vaccine Shows Promise in Preliminary Study (wsj)

- Hong Kong Scraps Covid-19 Entry Restrictions in Latest Reopening Move (wsj)

- How Costco keeps $1.50 hot dog-and-soda combo despite inflation (nypost)

- China Asks Banks to Buy Bonds Via Prop Desks After Market Slump (bloomberg)

- China’s New Covid Approach Is to ‘Let it Rip,’ Analyst Says (bloomberg)

- Here’s everything the Federal Reserve is expected to do Wednesday (cnbc)

- Sea Change (Howard Marks)

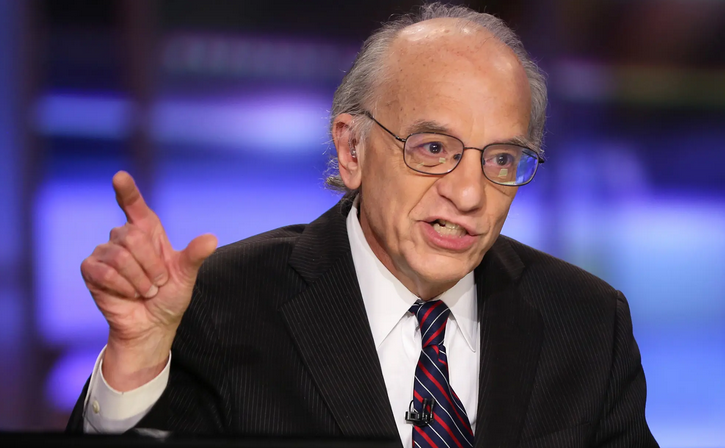

- Wharton professor Jeremy Siegel predicts the Fed will end its interest-rate hikes this month – and stocks will surge 15% next year (businessinsider)

- UK Inflation Eases More Than Expected From 41-Year High (bloomberg)

- CFO optimism falls for third quarter to 2020 low (foxbusiness)

- Over $1 Million Bet On Wolverine World Wide? Check Out These 4 Stocks Insiders Are Buying (benzinga)

Be in the know. 20 key reads for Wednesday…