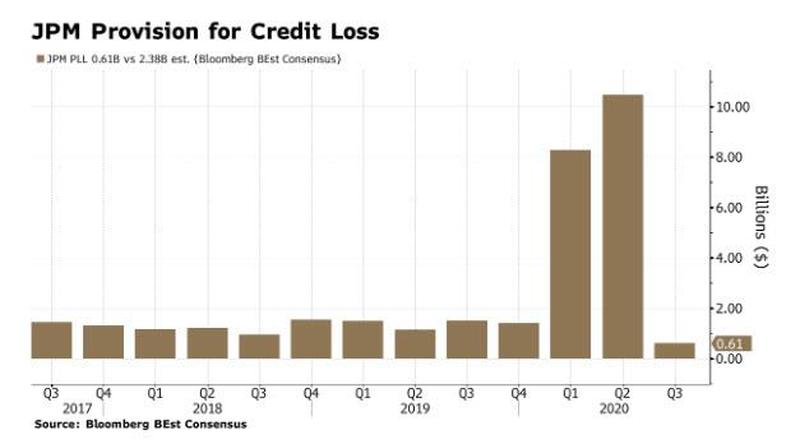

- Dimon Signals The All Clear: JPMorgan Earnings Smash Expectations As Loss Provisions Plummet 94% (ZeroHedge)

- Exxon Mobil upgraded to Neutral from Sell at Goldman Sachs (TheFly)

- Citi Posts Biggest Quarterly Profit of Pandemic (Bloomberg)

- Day-Trader Options Action Is Spotted Yet Again in Nasdaq Surge (Bloomberg)

- Desperate Americans hit by pandemic beg Congress, Trump to pass economic relief bill (Reuters)

- U.S. small business confidence at highest since February (Reuters)

- China’s imports, exports surge as global economy reopens (Reuters)

- Johnson & Johnson Covid-19 vaccine study paused due to illness: report (FoxBusiness)

- “Nancy Pelosi take this deal!” Andrew Yang, a former Democratic presidential candidate, tweeted on Saturday. “Put politics aside people are hurting.” (FoxBusiness)

- Why You Didn’t Notice a Japanese Stock Index Beating the Nasdaq This Year (Wall Street Journal)

- JPM: Credit costs of $611 million included $569 million of net reserve releases (Street Insider)

- Ford and General Electric are headed back to the double digits, Jim Cramer says (CNBC)

- JPMorgan’s Earnings Were Better Than Expected. Here’s How the Bank Did. (Barron’s)

- A New Roaring ‘20s Is Coming for Industrial Stocks (Barron’s)

- The American Dream: Bringing Factories Back to the U.S. (Barron’s)

- Lotus Goes Electric With a US$2.1 Million Hypercar (Barron’s)

- Oil bounces after sharp jump in Chinese imports (MarketWatch)

- JPMorgan beats analysts’ profit estimates as the bank sets aside less for loan losses (CNBC)

- Disney Elevates Streaming Business in Major Reorganization (Wall Street Journal)

- BofA Survey Shows Investors Braced for Contested U.S. Election (Bloomberg)

- Natural Gas Surges as Traders Brace for Cold Winter (Wall Street Journal)

- Key U.S. Inflation Gauge Rises at Slowest Pace in Four Months (Bloomberg)

- Warren Buffett once used LeBron James to explain the risk of diversification, and compared his return to Cleveland to new Coke’s demise (BusinessInsider)

- Top Analyst Raises Price Targets on 4 High Dividend-Paying Bank Stocks (24/7 Wall Street)

- Citi Posts Biggest Quarterly Profit of Pandemic. Loan provisions return to normal after surging in first half. (Bloomberg)

Be in the know. 25 key reads for Tuesday…