Skip to content

Episode 21-13 The Birth of CRISPR (Tech Nation )

Mean Reversion After Biggest 1-Year Spike Since 1949? (Almanac Trader )

Democrats confident they can pass $3tn infrastructure bill (Financial Times )

The Economy Doesn’t Need The Fed’s Easy Monetary Policy To Keep Booming, BofA Says (Forbes )

Are we heading for a post-pandemic ‘Roaring 2020s,’ with parties and excess? (Washington Post )

Amazon could get its first unionised workforce in America (The Economist )

Electric Air Taxis Must Be Just as Safe as Commercial Planes, VTOL Exec Says (robbreport )

Watch this $1.2M supercar EV drift on ice like a ballerina (thenextweb )

F1 live stream: how to watch every 2021 Grand Prix online from anywhere (techradar )

Boats And Bull Markets: Indicators Of The Week (NPR Planet Money )

Succession Season 3: Everything We Know So Far (Town & Country )

Block-Trade Bevy Wipes $35 Billion Off Stock Values in a Day (Bloomberg )

GSK and Vir Submit Covid-19 Drug for FDA Authorization (Barron’s )

Gilded Age or Roaring Twenties? (investoramnesia )

The Value Stock Rotation Isn’t Over—Not by a Long Shot (Barron’s )

Higher Taxes? Deficit Spending? Why the Stock Market Isn’t Worried. (Barron’s )

European Stocks Look Tempting. No, Really. (Barron’s )

Here’s what tax hikes could mean for the stock market as Biden pushes infrastructure plan (MarketWatch )

China Signs 25-Year Deal With Iran in Challenge to the U.S. (Bloomberg )

‘It’s crazy. There is no inventory.’ Housing industry veteran marvels at real estate boom (CNN Business )

US fears China is flirting with seizing control of Taiwan (Financial Times )

Big Oil lobbyist throws weight behind carbon pricing (Financial Times )

What Discord Is, and Why Microsoft Covets It (Bloomberg )

John Stuart Mill’s Philosophy of Equality (Farnam Street )

Influencers with Andy Serwer: Ray Dalio (Yahoo! Finance )

Payday Might Be Coming for U.S. Bank Investors (Wall Street Journal )

Fed lifts curbs on US banks’ share buybacks and dividends (Financial Times )

Aston Martin bets on a Formula One comeback to revive the brand (Financial Times )

Earnings Forecasts Are Low. What That Means for Stocks (Barron’s )

Merck’s Little Brown Pill Could Transform the Fight Against Covid (Bloomberg )Street Insider )

5 High-Yielding Dividend Aristocrat Stocks Are Perfect Now for Worried Investors (24/7 Wall Street )

Race to dislodge Suez blockage as shipping rates surge, tankers diverted away (Reuters )

Global money market funds get highest inflows in 13 weeks, Lipper data show (Reuters )

The Pandemic Has Hurt Rite Aid and Walgreens. Here’s Why That Might Change. (Barron’s )

Yes, You Can Retire on Dividends. 10 Stocks to Build an Income Stream for the Long Haul. (Barron’s )

Andrew Left Channels GameStop, Naming Heavily-Shorted Root as Best Stock Pick of 2021 (Institutional Investor )

Companies raise record $140bn in US junk bond market in first quarter (Financial Times )

Powell Says Now Is Not the Time to Focus on Reducing Federal Debt (Wall Street Journal )

Berkshire Hathaway Offers to Spend $8.3 Billion on Emergency Power Plants in Texas Wall Street Journal )

With Negative Rates, Homeowners in Europe Are Paid to Borrow (Wall Street Journal )

Powell says Fed will ‘gradually’ cut its bond-market footprint — some think this year (MarketWatch )

Amazon Faces Growing Worker Pressure in Shadow of Alabama Union Vote (Wall Street Journal )

Green Energy Spinoffs Can Help Investors Clean Up (Wall Street Journal )

Consumer Spending Explodes, Driven By Vaccine Recipients, Millennials Splurging On Airlines, Restaurants (ZeroHedge )

Stock futures slide as Powell warns Fed could taper asset purchases (Fox Business )

Institutional Investors Have Been Influenced by Reddit — But They Still Don’t Trust It (Institutional Investor )

Billionaire Investor Ray Dalio Believes That Governments Are Likely To Outlaw Bitcoin (Benzinga )

3 Oil Stocks to Buy After the Selloff (Barron’s )

Banks to Continue Benefiting from Ongoing Growth-to-Value Rotation – Morgan Stanley (Street Insider )

It’s ‘all systems go’ for global growth and the risk rally, Barclays says. Here’s how to play it. (MarketWatch )

Pfizer says Ibrance gives more survival time to some breast-cancer patients (MarketWatch )

Wall Street Anxious to See How New Citigroup CEO Can Improve Returns (Barron’s )

U.S.-China Tensions Are Rising. Nike Stock Is Paying the Price. (Barron’s )

Biogen Investors Want News on Alzheimer’s Therapy. 2 More Key Points to Watch. (Barron’s )

H&R Block Wants to Do More Than Your Taxes. Why Its Stock Is a Buy (Barron’s )

Chinese Tech Stocks Slump in Hong Kong as SEC Implements Delisting Law (Barron’s )

Suez Canal Is Blocked by Container Ship Causing Huge Traffic Jam (Wall Street Journal )

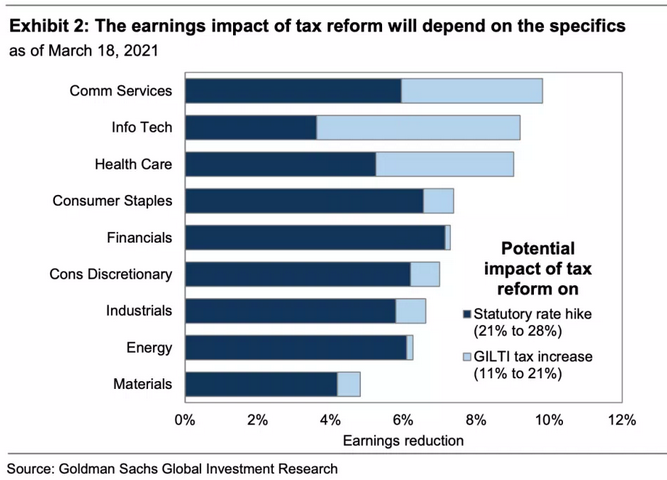

Democrats Weigh Increases in Corporate, Personal Income-Tax Rates (Wall Street Journal )

Carbon Tax Sidelined in Biden’s Push on Climate, Taxes (Wall Street Journal )

Jerome Powell Says Better Outlook Reflects Vaccine Progress, Fiscal Aid (Bloomberg )

Ed Yardeni Can Live With Higher Yields for the Sake of Earnings (Bloomberg )

U.S. State Jobless Claims Fell to Pandemic-Era Low Last Week (Bloomberg )

Clorox Bets Big on Not Going Back to Normal (Bloomberg )

Drill, Baby, Drill Hasn’t Died in the U.S. Shale Patch (Bloomberg )

U.S. GDP growth in fourth quarter raised slightly to 4.3% — and all signs point to economy speeding up (MarketWatch )

JPMorgan says stimulus checks are driving less retail-investing activity than the last round of payments (Business Insider )

Northrop and Lockheed win missile defense contracts valued at up to $7.6 billion (StreetInsider )

Pfizer Will Test a Pill to Kill the Covid-19 Virus (Barron’s )

Pfizer Goes It Alone to Expand Vaccine Business Beyond Covid-19 Pandemic (Wall Street Journal )

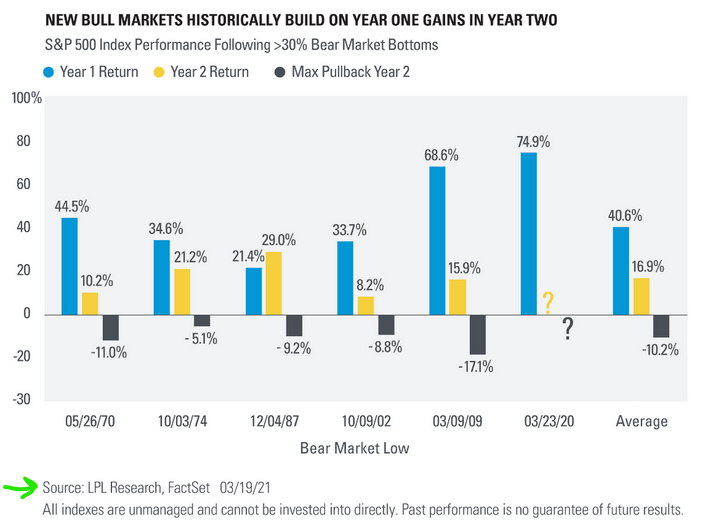

The new S&P 500 bull market is about to enter its second year. Now what? (MarketWatch )

Powell and Yellen’s game plan is evocative of the World War II playbook. Here’s what happened then. (MarketWatch )

Convertible Bonds Are Booming. Here’s What You Need to Know. (Barron’s )

Regeneron Stock Climbs on Positive Covid-19 Antibody Data (Barron’s )

Citigroup and 5 More Lenders Poised for Gains in ‘Bank Renaissance’ (Barron’s )

5 Beaten-Down Renewable Energy Stocks That May Be Worth a Look (Barron’s )

Intel’s New CEO Is Spending $20 Billion to Double Down on Chip Manufacturing (Barron’s )

Powell Says Stimulus Package Isn’t Likely to Fuel Unwelcome Inflation (Wall Street Journal )

New York Business Leaders Urge State Lawmakers to Not Raise Taxes (Wall Street Journal )

Fed’s Bullard won’t forecast any interest-rate hikes until he sees proof of strong economy (MarketWatch )

Bostic expects Fed to lift rates in 2023 – WSJ (Reuters )

Hawaii gets tourism surge as coronavirus rules loosen up (Fox Business )

Coronavirus latest: Merkel reverses course on Easter lockdown in Germany (Financial Times )

BofA Raises Price Targets for US Banks on Faster-Than-Expected Recovery (StreetInsider )

Banks stand firm on calls for oil ‘supercycle’ even as price drops (Financial Times )

Tax hikes are the next big investor worry: Morning Brief (Yahoo! Finance )

Biden Team Prepares $3 Trillion in New Spending for the Economy (New York Times )

Campbell and B&G Foods Have Outperformed. Only One Is a Buy for This Analyst. (Barron’s )

Infrastructure Plan Seeks to Address Climate and Equality as Well as Roads (New York Times )

Regeneron says its COVID-19 treatment still works even at a lower dose (MarketWatch )

Top Yale Doctor/Researcher: ‘Ivermectin works,’ including for long-haul COVID (trialsitenews )

Change of menu: Kraft Heinz bets on old brands to win new consumers (Financial Times )

Here Are 6 REITs Set to Gain as Economy Reopens (Barron’s )

Germany To Enter Strict Easter Shutdown Amid ‘New Pandemic’ (Barron’s )

Short and Hot: How Investors Can Play This Economic Cycle (Barron’s )

Why the Canadian Pacific-Kansas City Southern Deal Is Bullish for Railroad Stocks (Barron’s )

Bank of America CEO Says Its Earnings Are Poised to ‘Substantially Increase’ (Barron’s )

Joe Biden Wants to Raise Taxes. What It Would Mean for the Stock Market. (Barron’s )

Fed’s Powell Says Recovery Is Far From Complete (Wall Street Journal )

Lockheed Martin partners with startup Omnispace to build space-based 5G network (CNBC )

Pension funds to buy bonds to rebalance portfolios, and that may help stocks (CNBC )

Billionaire investor Howard Marks touts value stocks, trumpets high-quality growth stocks, and says he’s open-minded about bitcoin in a new interview. Here are the 9 best quotes. (Business Insider )

5 Goldman Sachs Conviction List Stocks to Buy Now That Pay Big Dividends (24/7 Wall Street )

UK unemployment rate unexpectedly falls to 5% in January as the country looks ahead to reopening (Business Insider )

Stocks slump at the open Tuesday as fresh lockdowns sweep the globe (MarketWatch )

Bank of America CEO Says Its Earnings Are Poised to ‘Substantially Increase’ as Rates Rise (Barron’s )

AstraZeneca Vaccine Found to Be Safe and 79% Effective in U.S. Trial (Barron’s )

How to Play the Next Space Race (Barron’s )

Value Could Outpace Growth for Years. Here’s How. (Barron’s )

These Stocks Are More of a Gamble Than an Investment — and the #1 Is a Reddit Favorite (Barron’s )

Recast as ‘Stimmies,’ Federal Relief Checks Drive a Stock Buying Spree (New York Times )

Canadian Pacific Railway to buy Kansas City Southern for $25 billion (CNBC )

Summers Sees ‘Least Responsible’ Fiscal Policy in 40 Years (Bloomberg )

Scion of Billionaire Family Hunts for Cheap Assets in Venezuela (Bloomberg )

U.S. economy is ‘on the brink’ of a complete recovery, says Richmond Fed’s Barkin (CNBC )

Israel Is a Vaccine Leader. Now Its Economy Is Improving. (Barron’s )

GameStop Earnings Are Coming. Nobody Knows What to Expect. (Barron’s )

Turkish lira and stocks slump after Erdogan fires central bank chief (MarketWatch )

Blackstone’s Crown Deal Has Dice Loaded in Its Favor (Wall Street Journal )

Stock Market Reshuffle Has Room to Run (Wall Street Journal )

Stimulus Checks Have Left U.S. Households Ready to Spend (Wall Street Journal )

Americans Are Ready to Travel. But Where Can They Go? (Wall Street Journal )

CBS Looks for Growth Abroad—With David Hasselhoff’s Help (Wall Street Journal )

Fed’s Reversal on Bank Capital Requirements Serves No Purpose (Wall Street Journal )

Value stocks are so in favor they’ve become momentum stocks (MarketWatch )

Opinion: Here’s the secret of how great companies get to the top of their game (MarketWatch )

Fed may hike rates sooner than 2023: NABE (FoxBusiness )

Investors inject almost $170bn into global stocks in 4 weeks (Financial Times )

Saudis Launch Major Gulf Naval Drills To Protect Oil Facilities Against Terror Attacks (ZeroHedge )

U.S. existing home sales drop sharply; prices surge (Reuters )

9 Best Pharmaceutical Stocks to Buy for Income (US News & World Report )

CP Rail to buy Kansas City Southern to create first rail network connecting Canada, the United States and Mexico (Financial Post )

Bill Gurley on Entrepreneurs and Technology (Podcast) (Bloomberg )

Private Schools Have Become Truly Obscene (The Atlantic )

How CVS And Walgreens Help Biden Get To 200 Million Covid-19 Shots (Forbes )

Why A Multi-Family Office Co-Founded By Stuart Miller Invested $100 Million In A Vacant Beverly Hills Hotel (Forbes )

The Design Story Behind The Exotic Maserati MC20 (Forbes )

Lamborghini Will Debut Two New V-12 Supercars This Year (Robb Report )

Larry Summers Versus the Stimulus (The New Yorker )

The Ferrari F8 Is Astounding (R& T )

The S&P 500 still has 12% upside with spiking yields set to stabilize amid strong earnings, JPMorgan’s global markets chief says (Business Insider )

Fed Will Need to Buy Bonds as Stimulus Boosts Yields, Dalio Says (Bloomberg )

Corporate America Primed to Join Warren Buffett in Buyback Binge (Bloomberg )

How to Play the New Space Race (Barron’s )

Warren Buffett’s Berkshire Hathaway scores $17 billion gain across 5 stocks as value stages a comeback (Business Insider )

The OODA Loop: How Fighter Pilots Make Fast and Accurate Decisions (Farnam Street )

Economy Revs Up as Americans Increase Spending on Flights, Lodging, Dining Out (Wall Street Journal )

Bill Gates Says Some Tax Proposals Have Gone ‘Too Far’ (Bloomberg )

Why Goldman Sachs sees a ‘buying opportunity’ in oil’s recent selloff (MarketWatch )

The Fed Will End Emergency Relief for Banks. It Might Not Make Much Difference for Markets. (Barron’s )

Modern Issues, Old Solutions (Investor Amnesia )

Stock Market’s Weakest Links Dominate With Full-Throttle Fed (Bloomberg )

Bitter Alaska Meeting Complicates Already Shaky U.S.-China Ties (Wall Street Journal )

Visa Faces Antitrust Investigation Over Debit-Card Practices (Wall Street Journal )

Deep Value by Tobias Carlisle (Novel Investor )

Saudi Arabia Says Missiles in Aramco Attacks Were Made in Iran (Bloomberg )

The Fed could be a source of market volatility as Powell and others speak in the week ahead (CNBC )

Jerome Powell on the Pandemic Year: Tools to Avoid a Meltdown and Save Livelihoods (Wall Street Journal )

Value stocks are so in favor they’ve become momentum stocks (MarketWatch )

Elon Musk and Amazon Are Battling to Put Satellite Internet in Your Backyard (Wall Street Journal )

Tom Hanks on the Pandemic Year: Never Play Solitaire Again (Wall Street Journal )

More Than 420 Million Shots Given: Covid-19 Tracker (Bloomberg )

GE Is Finally Trading Its Bankers’ Stripes for a Hard Hat (Bloomberg )

All About Clubhouse, a Gabfest Behind a Velvet Rope (Bloomberg )

Staying Power (DGI )

Fed won’t extend relief for banks from key capital rule (MarketWatch )

Penny-stock trading volume has exploded by 2,000% amid the growing influence of retail traders (Business Insider )

Acting FTC chair calls for ‘bold action’ to rein in tech, other monopolies (MarketWatch )

Covid Flares. The Energy Report 03/19/2021 (Phil Flynn )

The Amazon Unionization Vote: What to Know (New York Times )

First U.S.-China meeting under Biden gets off to a rocky start (CNBC )

Bank stocks just hit their highest level since 2007. Two traders on when to buy in (CNBC )

Putin fires back at Biden after ‘killer’ comments: Takes one to know one (USA Today )

FCC enforces largest fine ever of $225 million against telemarketers who made 1 billion robocalls (USA Today )

Jerome Powell’s Fed Wants the Bond Market to Hear Three Messages (Bloomberg )

The ‘three pillars’ of this bull market are still in place: Morning Brief (Yahoo! Finance )

UBS Upgrades Carnival Corporation (CCL) to Buy (Street Insider )

Gene Therapy Data Breathes New Life Into Battered Sarepta Stock (Barron’s )

Boeing Moon Rocket Passes NASA Test (Wall Street Journal )

Oil Investors Hunt for Cash Gushers (Wall Street Journal )