Last week, in the midst of the Omicron/Accelerated Taper fears/selloff, we suggested the market was due for a bounce. The indicators we pointed to are as follows (click on image to see original article from last Wednesday night):

The S&P 500 is up 4.36% since Wednesday night when the article went out:

The S&P 500 is up 4.36% since Wednesday night when the article went out:

On Thursday morning I went on Cheddar with Brad Smith to discuss the Fed, Accelerating Taper and what stocks we are buying on weakness. Thanks to Brad and Ally Thompson for having me on. You can watch it here:

Last week I suggested that Chair Powell take a breather on his rush to speed up the taper. Our primary reasoning was that most of the commodity basket was rolling over (for the past few months), and will be felt by the consumer on a lagged basis (3-5 months out). Supply chain backlogs have started to ease – and in some pockets (like semiconductors) – somewhat faster than expected.

“The number of ships at anchor now is down to 35. That’s about a 60% reduction in just the past six weeks alone.” – Gene Seroka, exec director of @PortofLA

(via @CNBC) #supplychain pic.twitter.com/yddOzew7t3

— Carl Quintanilla (@carlquintanilla) December 9, 2021

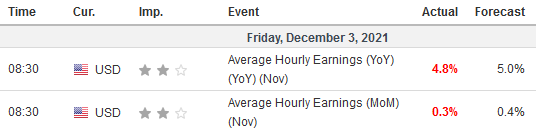

We also saw in the November jobs report (which came out on Friday) – that as more labor came into the marketplace – wage increases came in less than expected (this is the key part of inflation which is expected to be sticky, but perhaps the rate of change will slow meaningfully as labor supply comes back online):

What the jobs report also showed us is that the Fed has NOT reached their mandate on Full Employment – as there are still 6.9M people unemployed. This compares to 5.7M pre-pandemic – or a difference of 1.2M more people still unemployed. With commodity prices weakening in recent weeks and months, and 1.2M people still structurally unemployed, the idea of speeding up the taper seems hasty and imprudent.

The market is now pricing in the accelerated taper (ending by March versus June), and 3 rate hikes (~75bps) in total before the end of 2022.

What is confusing about the response is that the market is not behaving as if this (accelerated taper) is a foregone conclusion. If it was clear that the bond buying would end in March and rate hikes would commence shortly thereafter, cyclicals/value should be dramatically outperforming and long-duration earnings assets (tech/growth) should be selling off more meaningfully. This has started to happen (particularly with high Price/Sales multiple stocks), but not in a convincing manner (of yet):

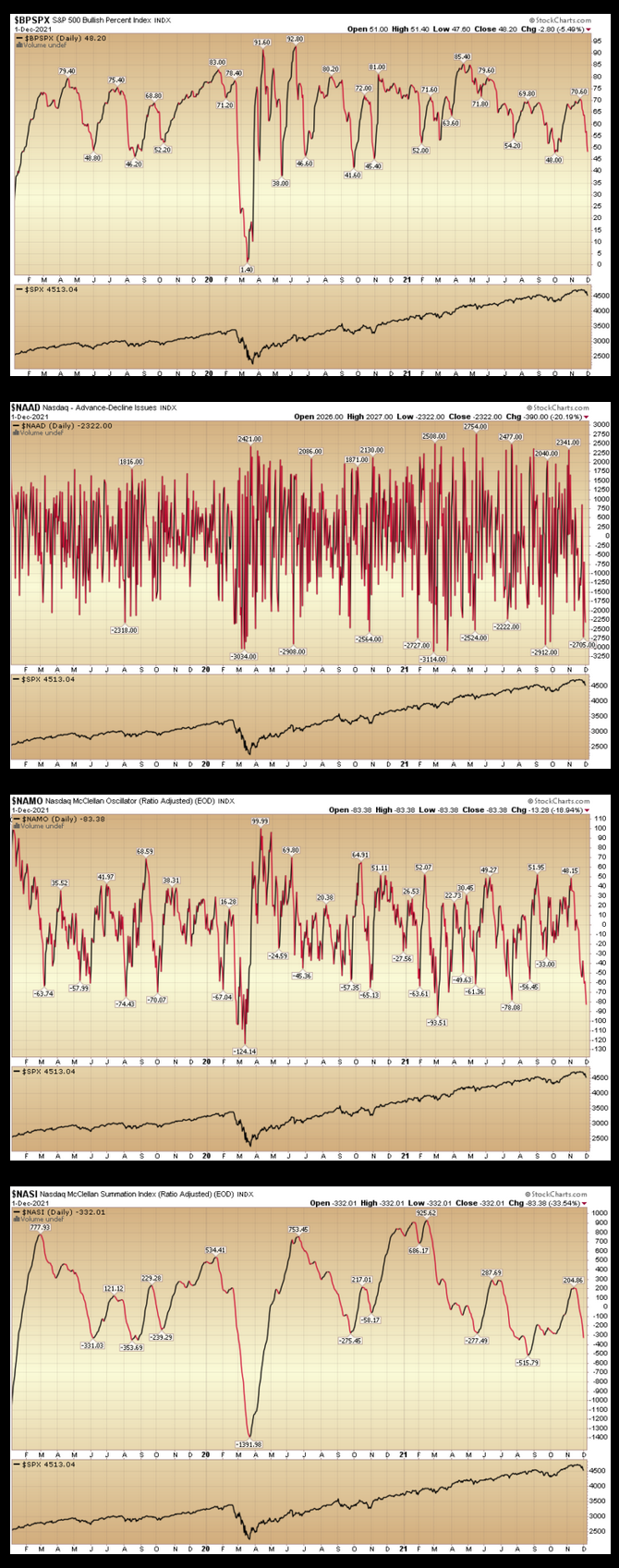

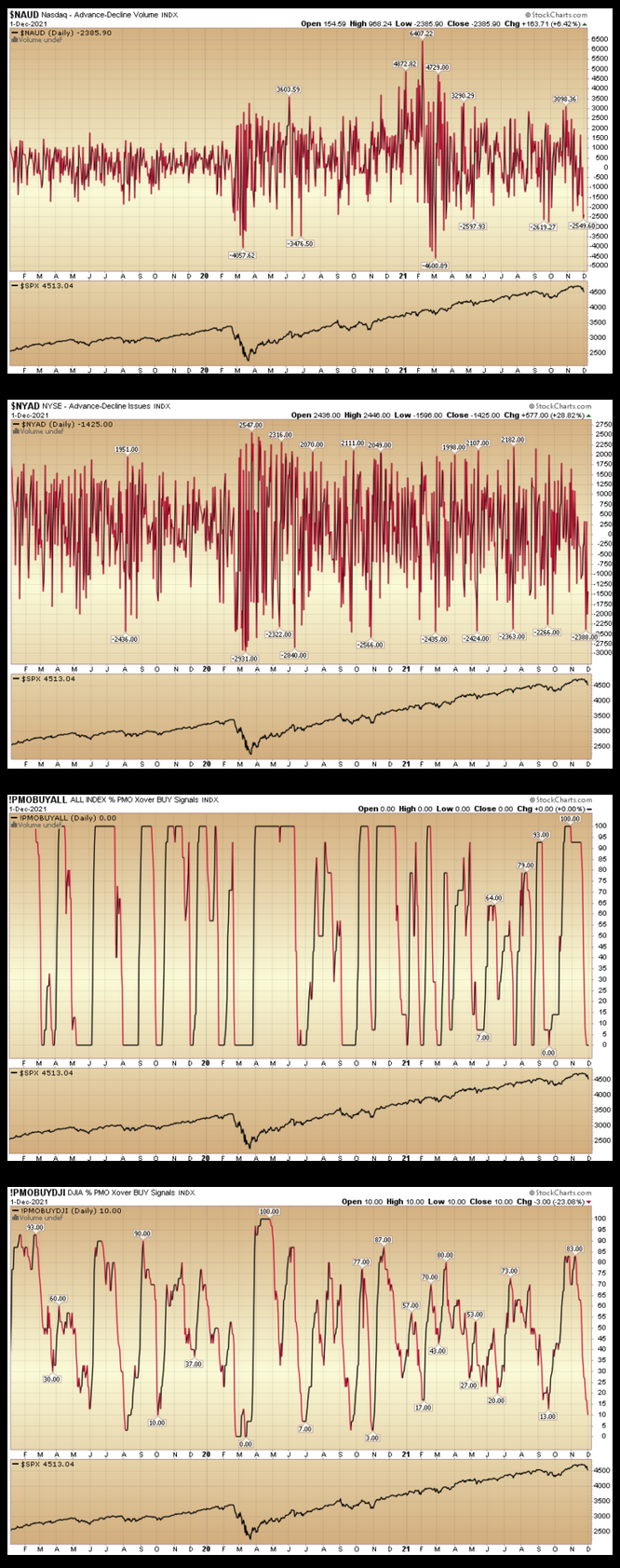

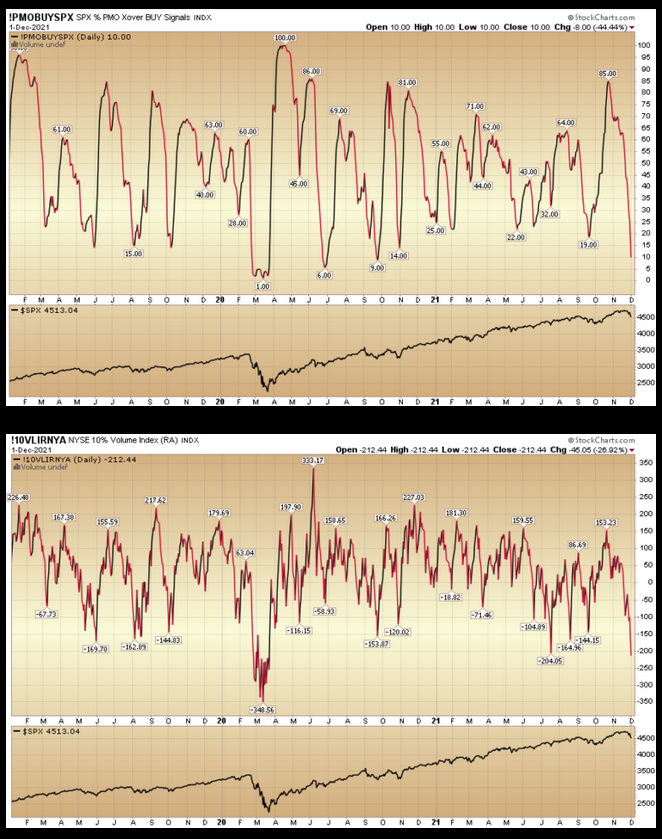

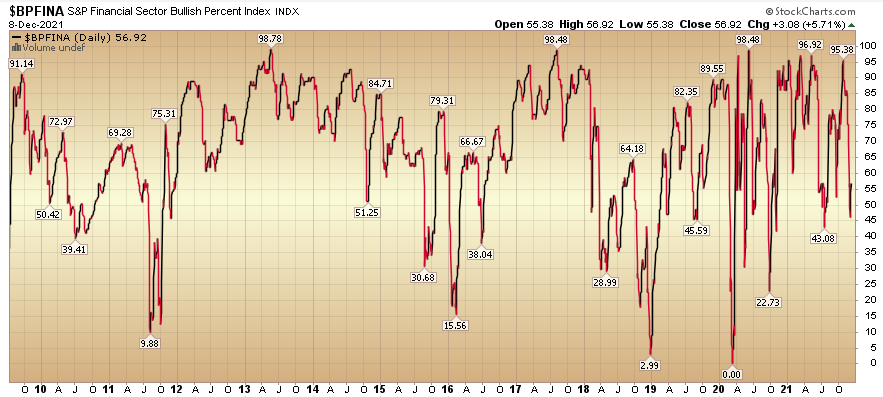

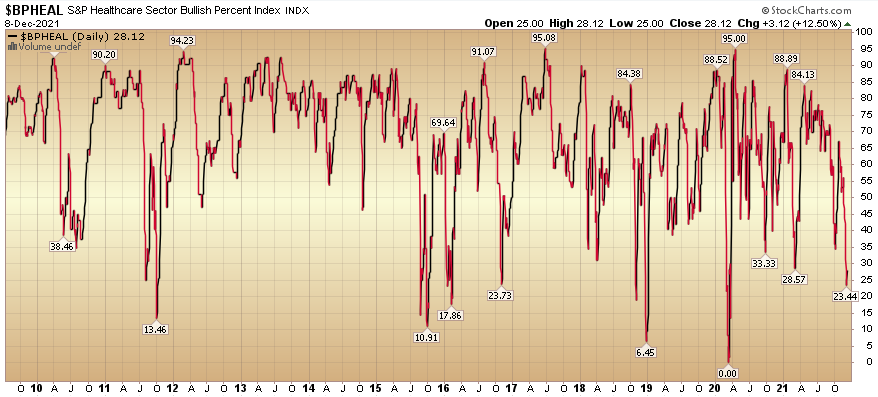

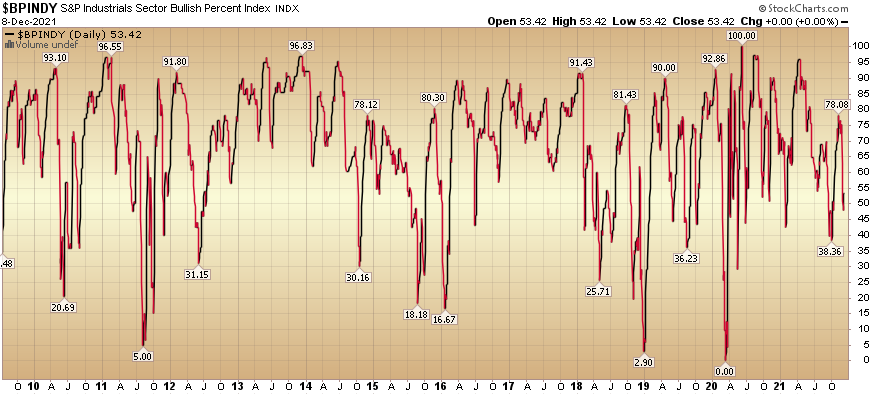

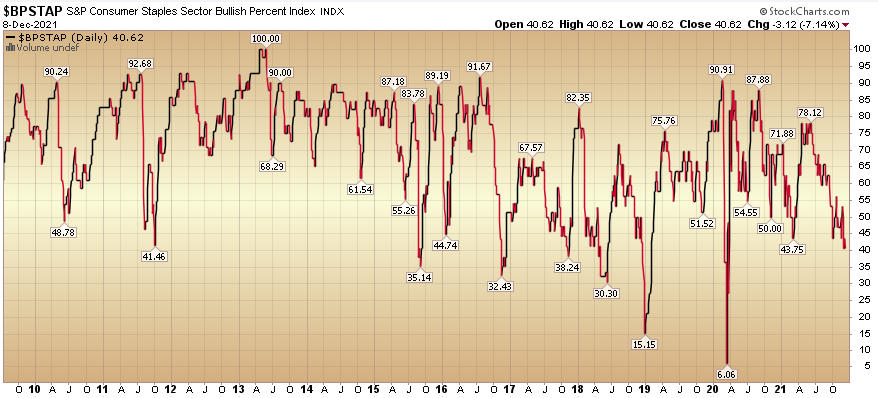

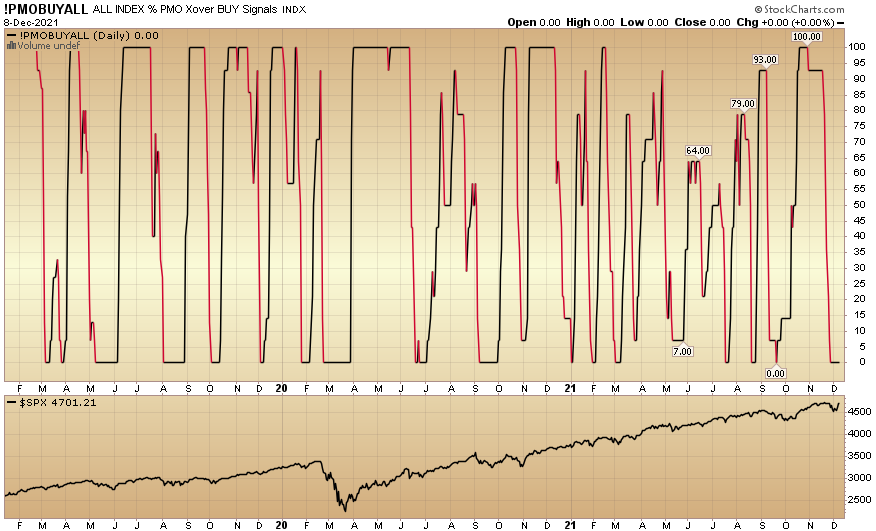

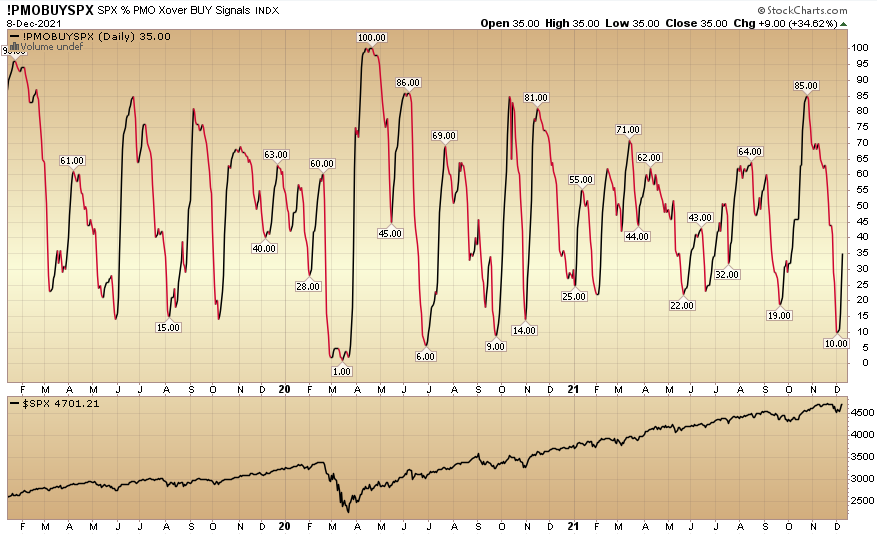

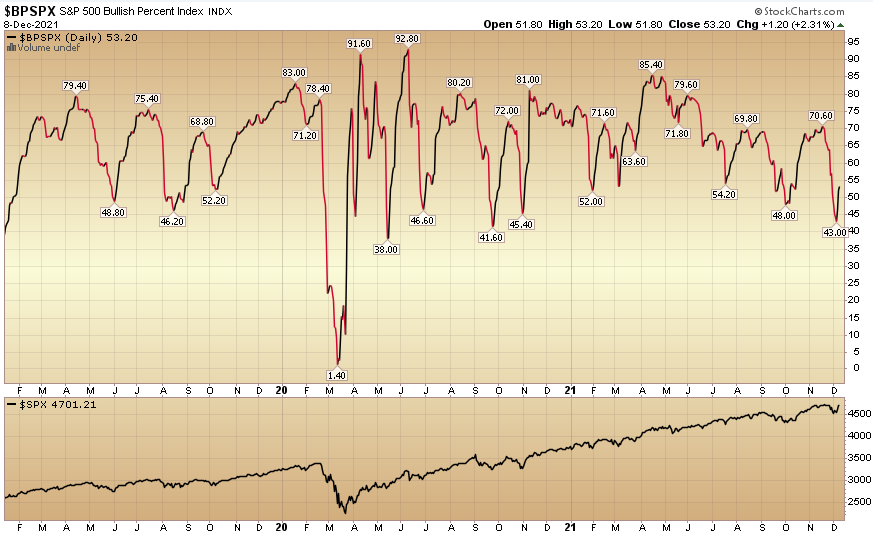

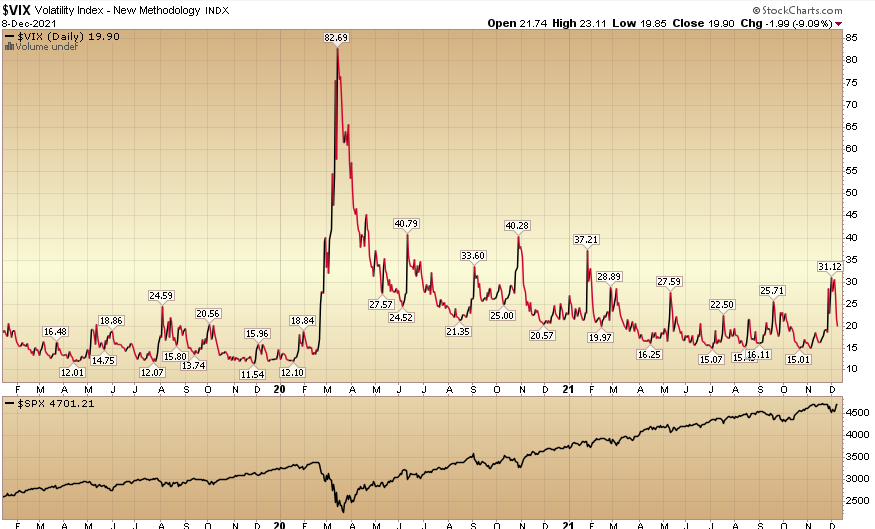

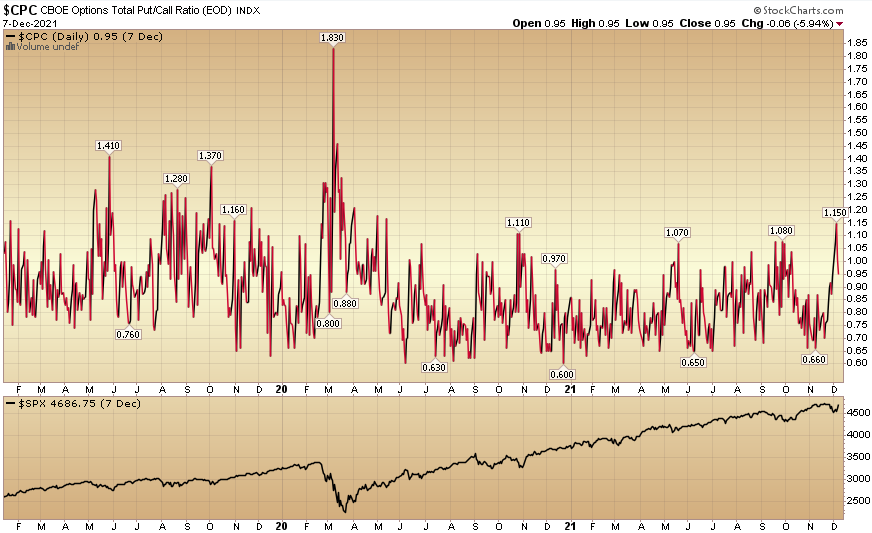

Without replicating the 13 charts above, we can look at a few below to see that despite the 4.3% bounce, many of the indicators have barely come off the mat. There is more room to run after some fits and starts/consolidation (likely related to Fed anticipation and outcome in the coming weeks).

Selected Sectors:

General Indices:

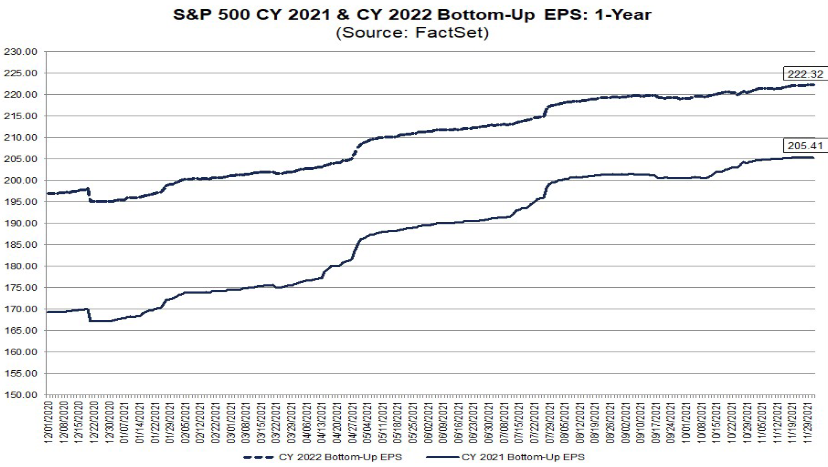

Earnings estimates for the S&P 500 for 2022 ticked up again this week:

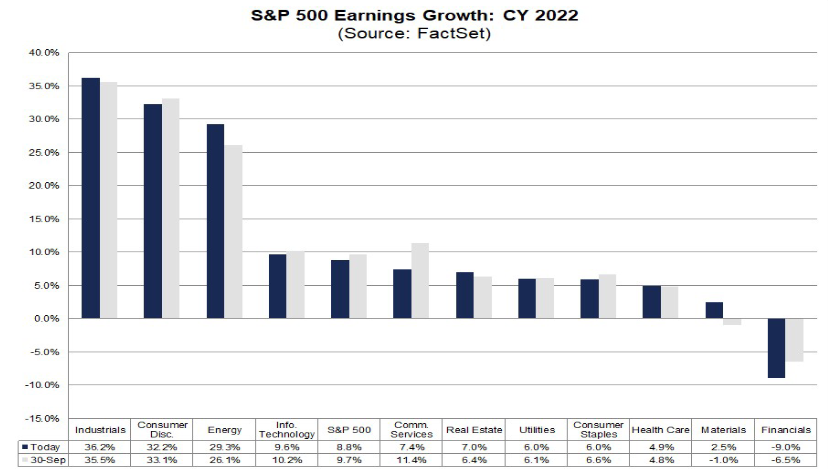

Industrials are expected to be the star of the show in 2022:

This is not yet reflected in their price. We think there is a major opportunity in this sector in 2022 and have discussed several names in recent podcast|videocast(s).

Now onto the shorter term view for the General Market:

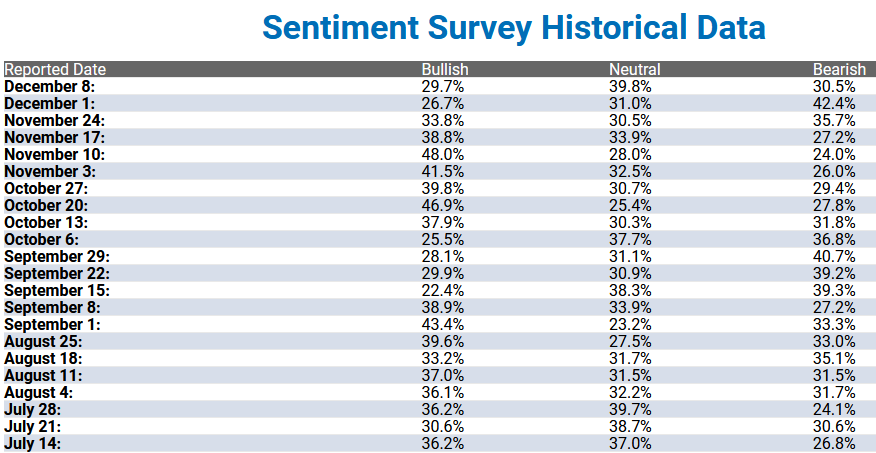

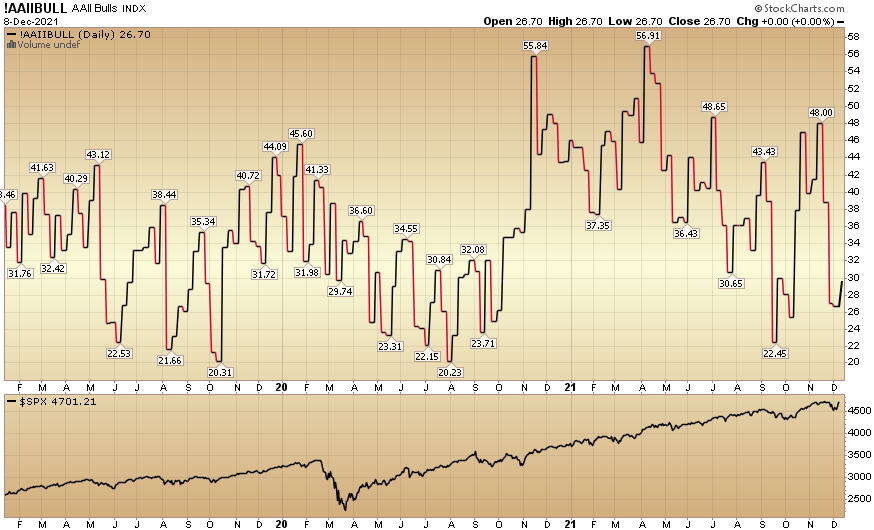

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 29.7% this week from 26.7% last week.

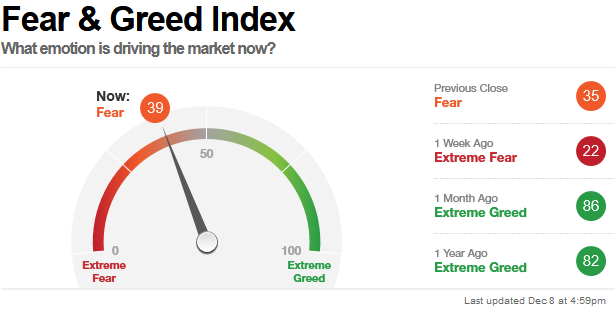

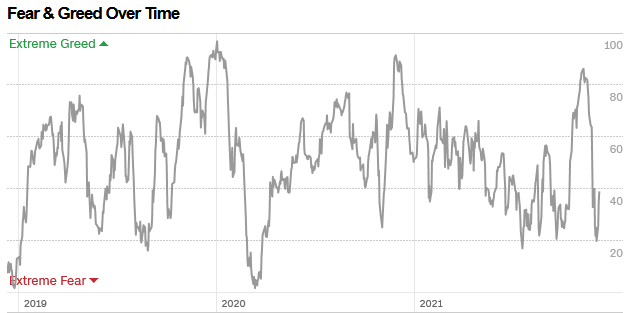

The CNN “Fear and Greed” Index rose from 22 last week to 39 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

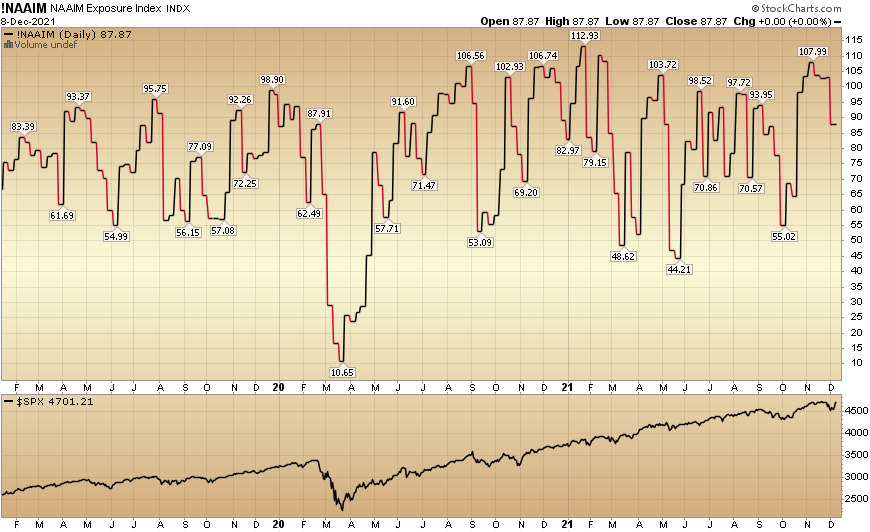

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 87.87% this week from 103.14% equity exposure last week.

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 87.87% this week from 103.14% equity exposure last week.

While we have made it clear that an accelerated taper is not needed at present (with wage increases slowing and commodities weakening), it seems probable at this point that Powell will bow to the pressure (as he did in December 2018 – which was a mistake).

The most likely consequence will be that the 1.2M structurally unemployed people will get left in the dust – and even as prices rise modestly in the short term – they will normalize in a few months time. At that point, we will see if the Fed listens to the data and holds off on rate hikes until at least summertime. For those of you reading this who interact with the Fed, I would suggest you remind them of this important chart:

The yield curve is flattening QUICKLY, and if they accelerate taper – and then hike rates too quickly – they will invert the curve (2yr yield > 10yr yield). Once that happens, a bear market (and recession) – in the following 6-18 months – is inevitable as credit is choked off and the economy grinds to a halt. This is NOT our base case, but has a reasonable probability if Powell steers the ship incorrectly.

The yield curve is flattening QUICKLY, and if they accelerate taper – and then hike rates too quickly – they will invert the curve (2yr yield > 10yr yield). Once that happens, a bear market (and recession) – in the following 6-18 months – is inevitable as credit is choked off and the economy grinds to a halt. This is NOT our base case, but has a reasonable probability if Powell steers the ship incorrectly.

Powell needs to show a spine and not succumb to backward looking pressure. Move ahead with the taper at the original reasonable pace, but push off rate hikes as long as possible. If you re-steepen the curve, those 1.2M people will be back to work in 2022. If you fold to the backward looking pressure/data, you will have a recession by 2023 and few bullets left to solve it. Zero or hero…your choice.

Our base case is still high single-digit to low double digit returns for the S&P 500 in 2022 (with greater volatility than 2021). Fed policy will largely determine which sectors outperform versus under-perform (as rates determine everything). We have used this short term volatility to buy/add to high quality franchises that will grow over 6-12 months despite policy and virus surprises along the way. We do it steadily, methodically (on down days) and not all at once…