On Tuesday, I joined the MoneyShow “Virtual Accredited Investor Conference” to present “Turnaround Tom’s Top Picks and Outlook for 2024.” Thanks to Mike Larson, Debbie Osborne and Shelly Coyle for having me on:

CLICK HERE for the accompanying notes/slide deck

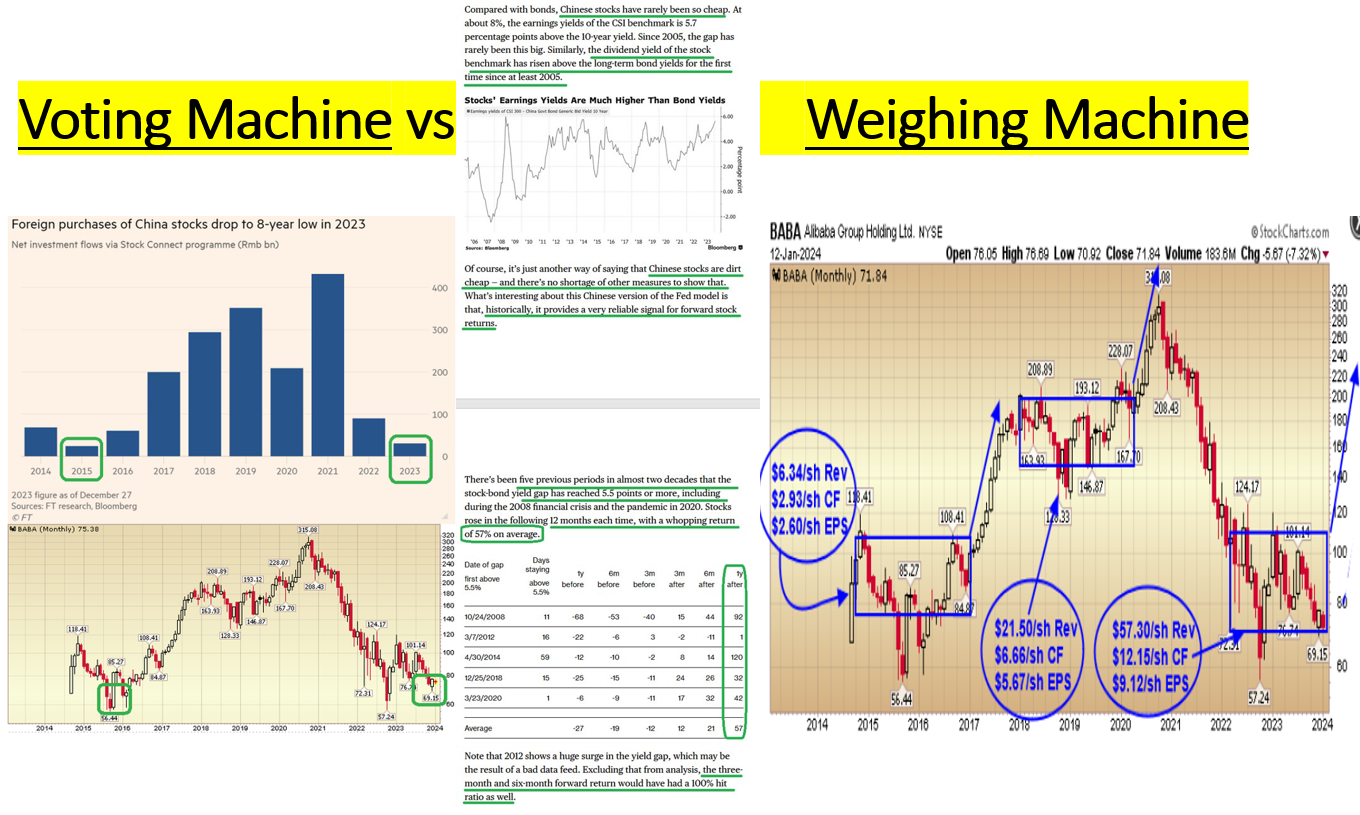

There were a lot of important slides in this deck, but for my money, this is the most important one:

This Tuesday, Bank of America published its monthly “Fund Manager Survey.” I posted a summary here:

This Tuesday, Bank of America published its monthly “Fund Manager Survey.” I posted a summary here:

January 2024 Bank of America Global Fund Manager Survey Results (Summary)

Here were the 3 key points:

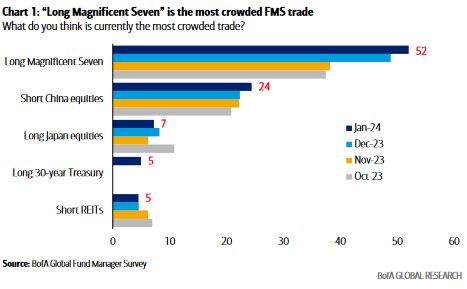

1) Being short and pessimistic China has become very crowded:

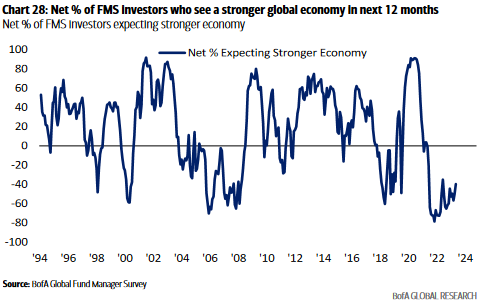

2) Sentiment still pessimistic and skeptical, NOT euphoric:

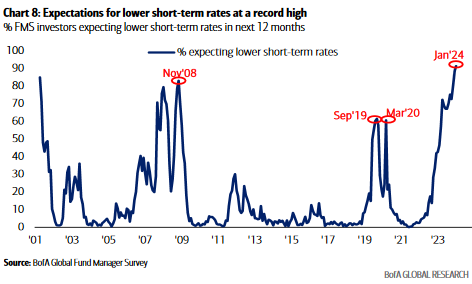

3) Previous instances of lower short rates at this level of extreme proved to be correct:

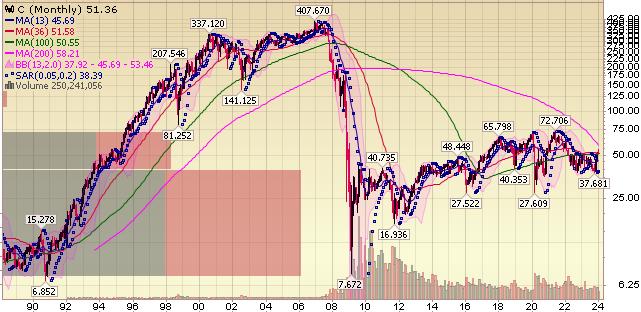

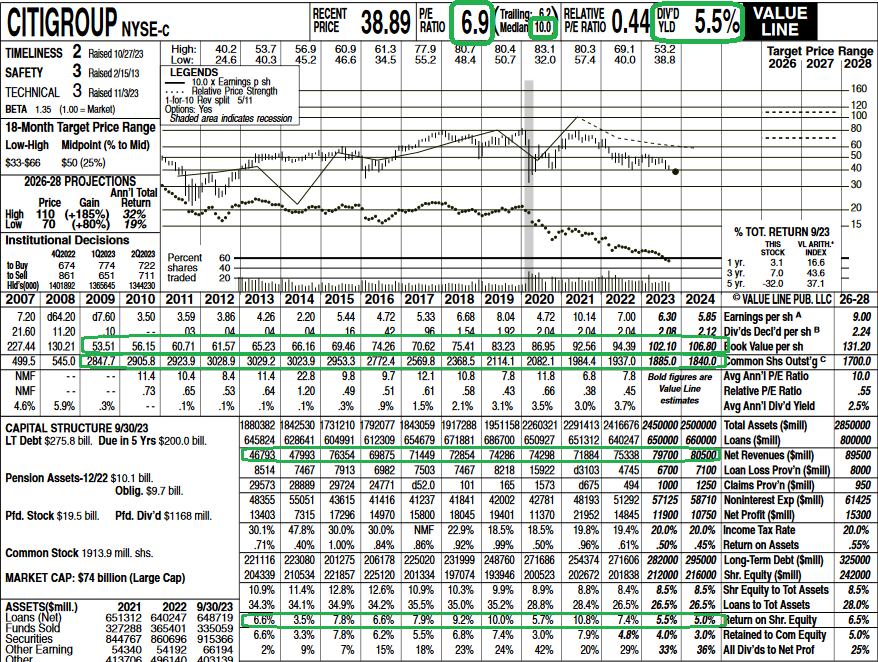

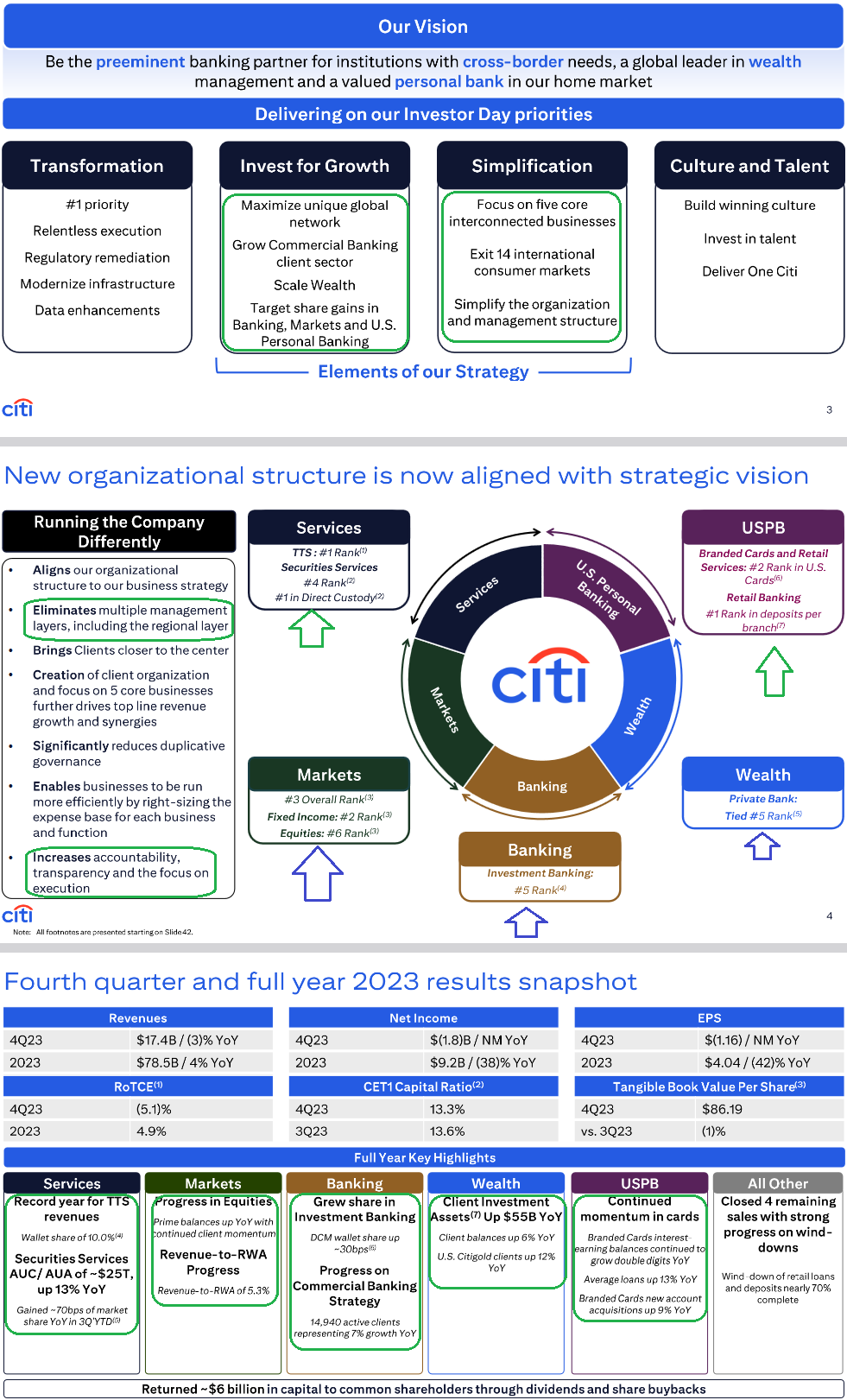

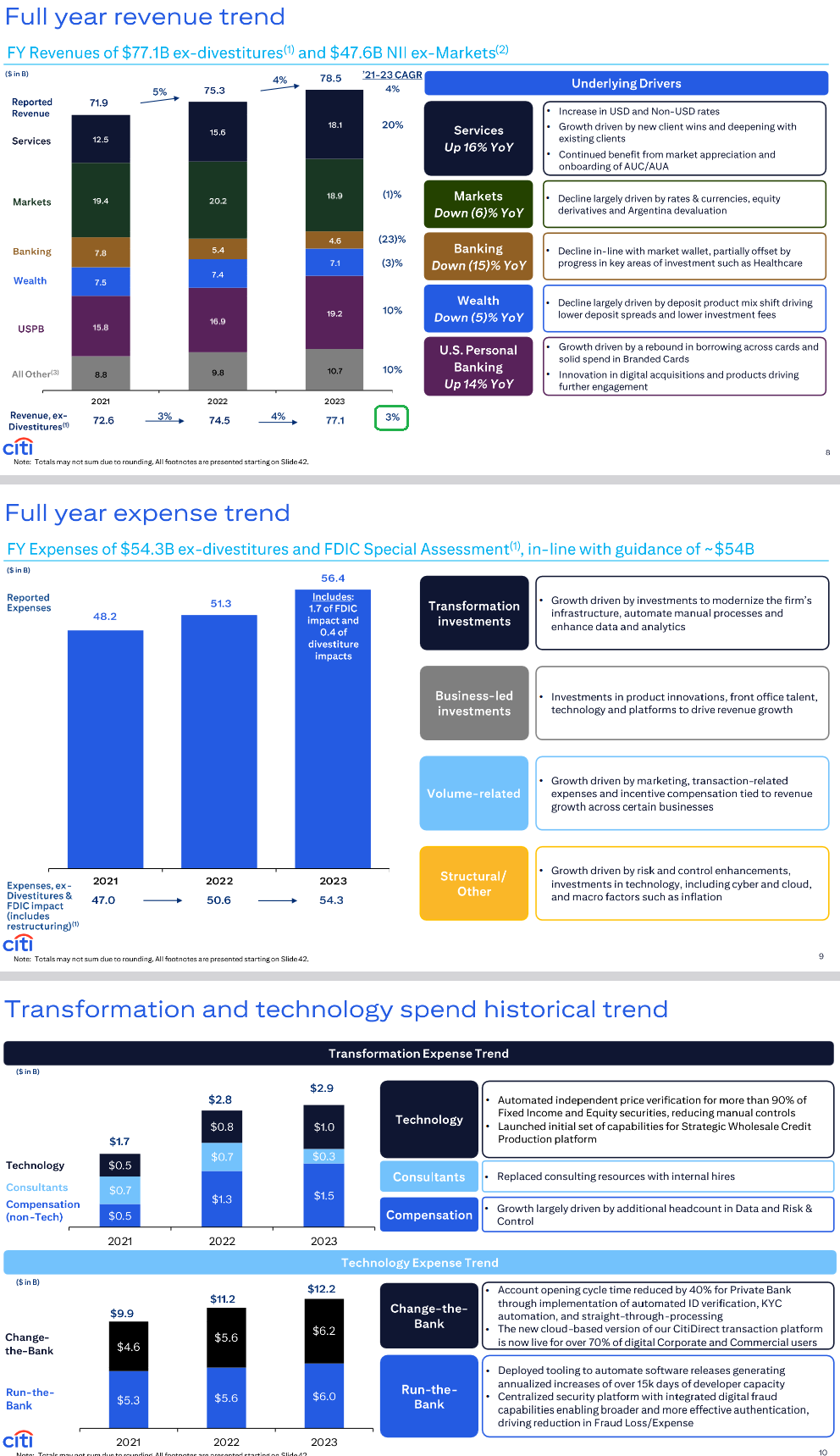

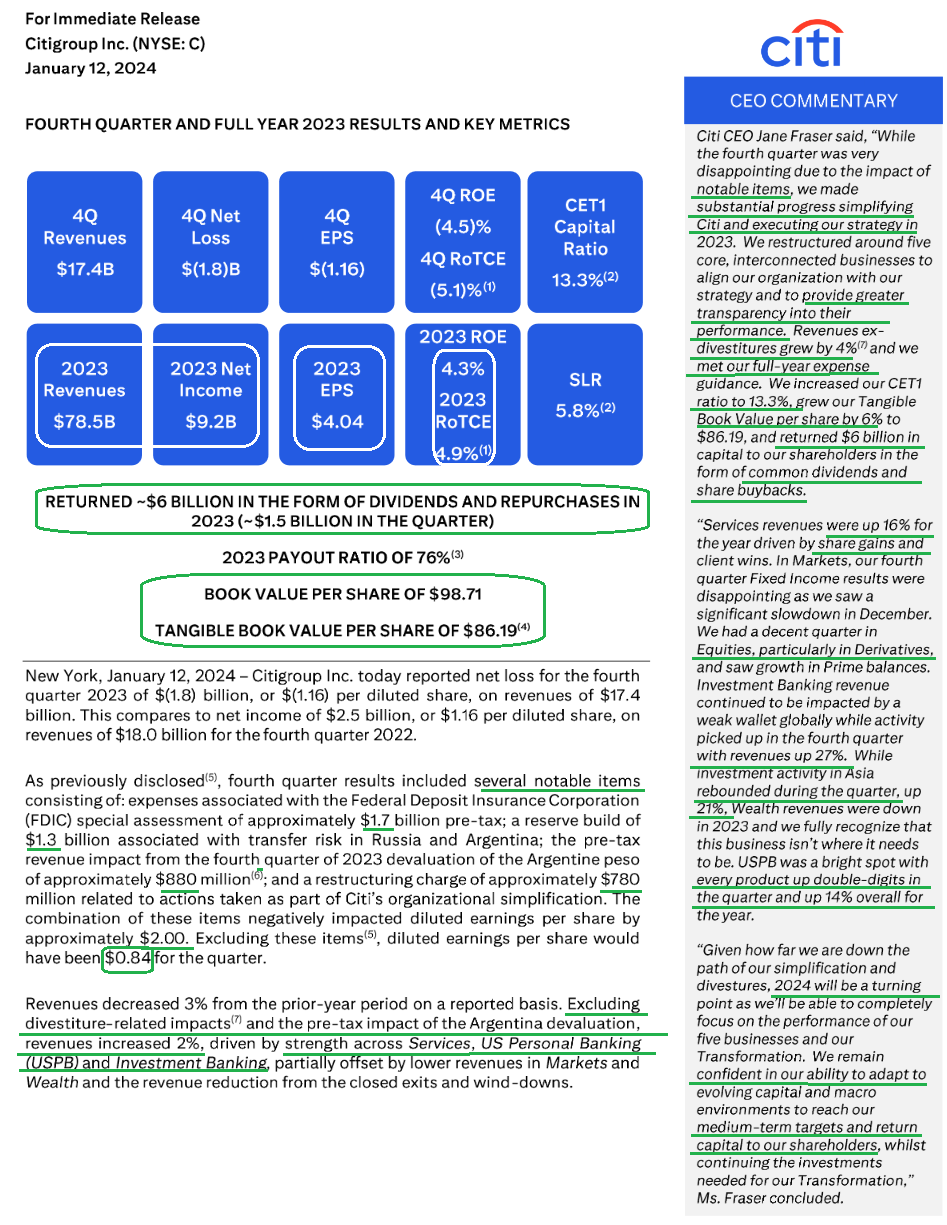

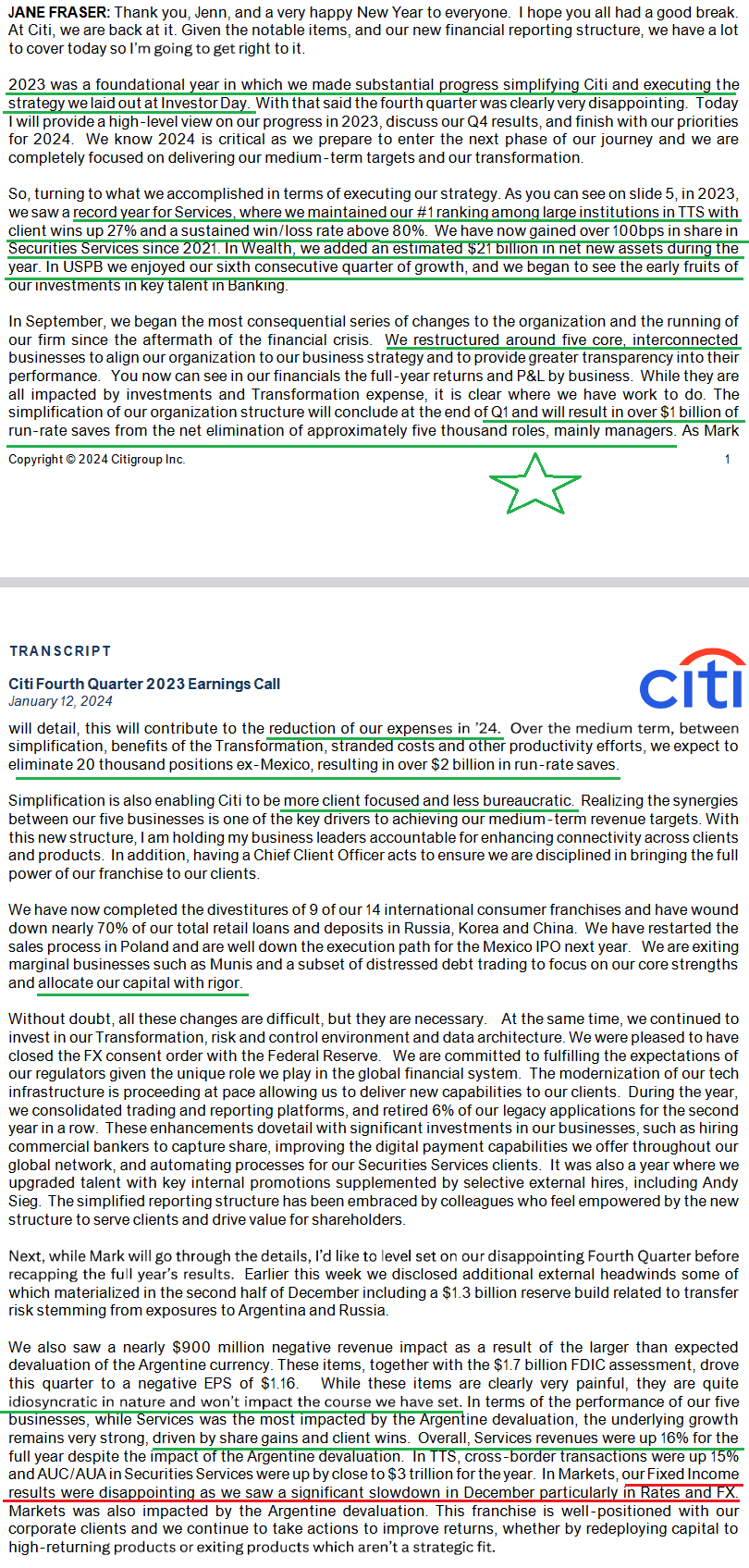

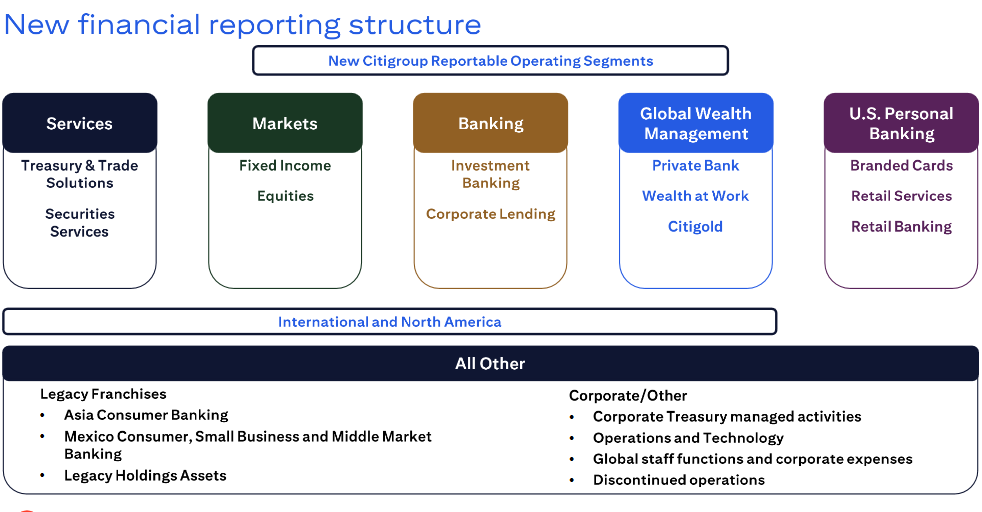

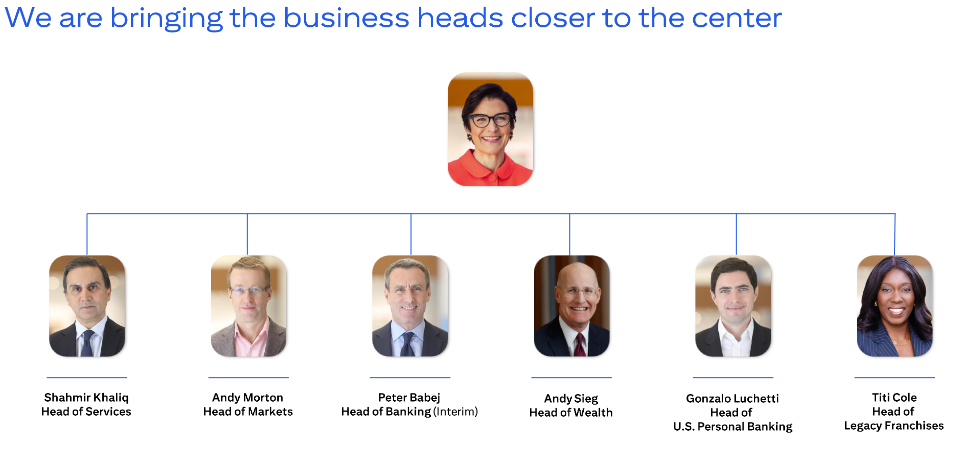

Citi Never Sleeps (except for the last 15 years)! Is the giant awakening from its slumber?

On 9/1/2023 when Citi was trading ~$41.50 I joined Charles Payne on Fox Business to talk markets and a few stocks:

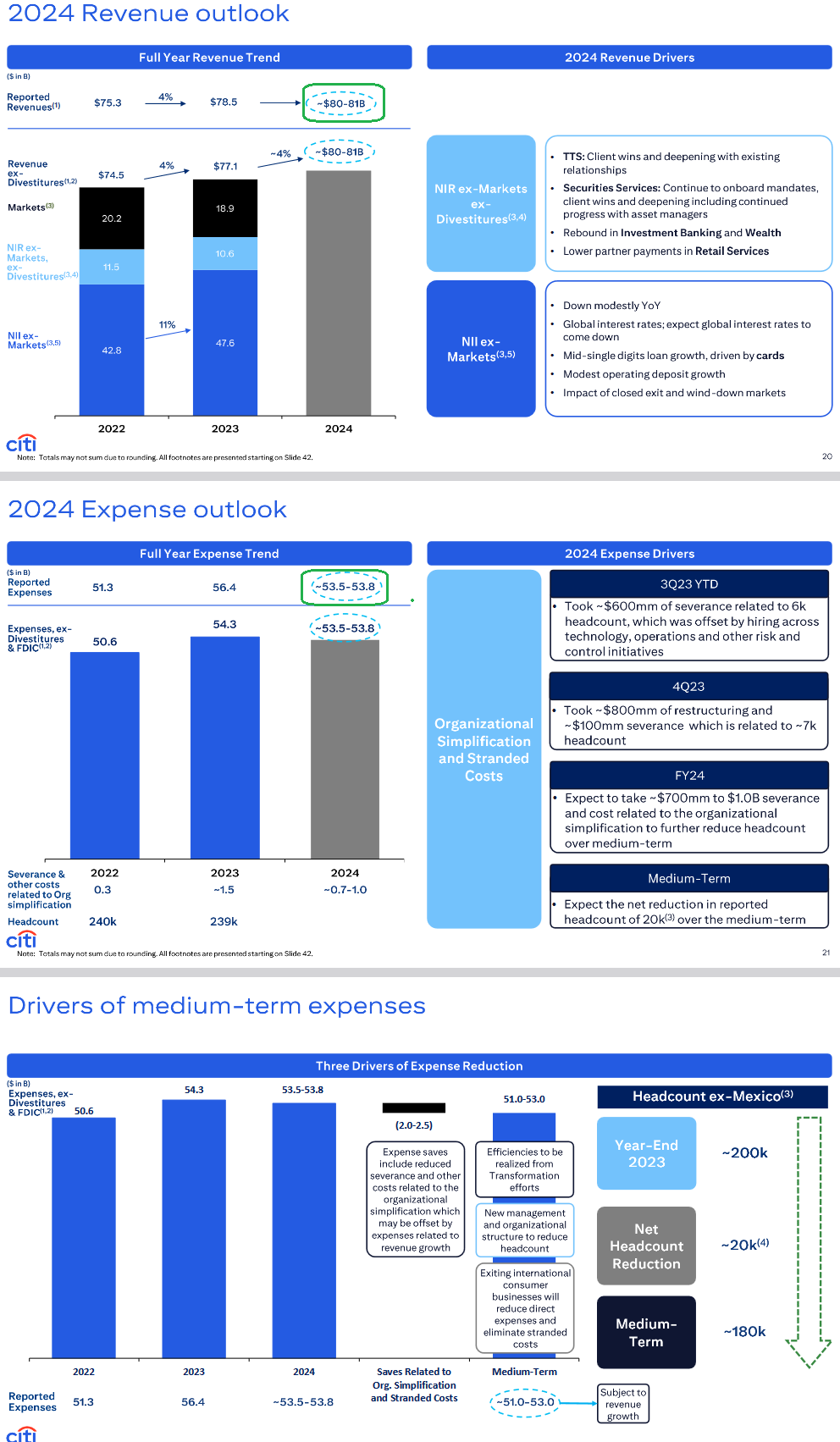

While it has started to move in the last few months, we believe it could have meaningful upside over the next couple of years as the restructuring plays out and capital markets re-open for deals, IPO’s and financings:

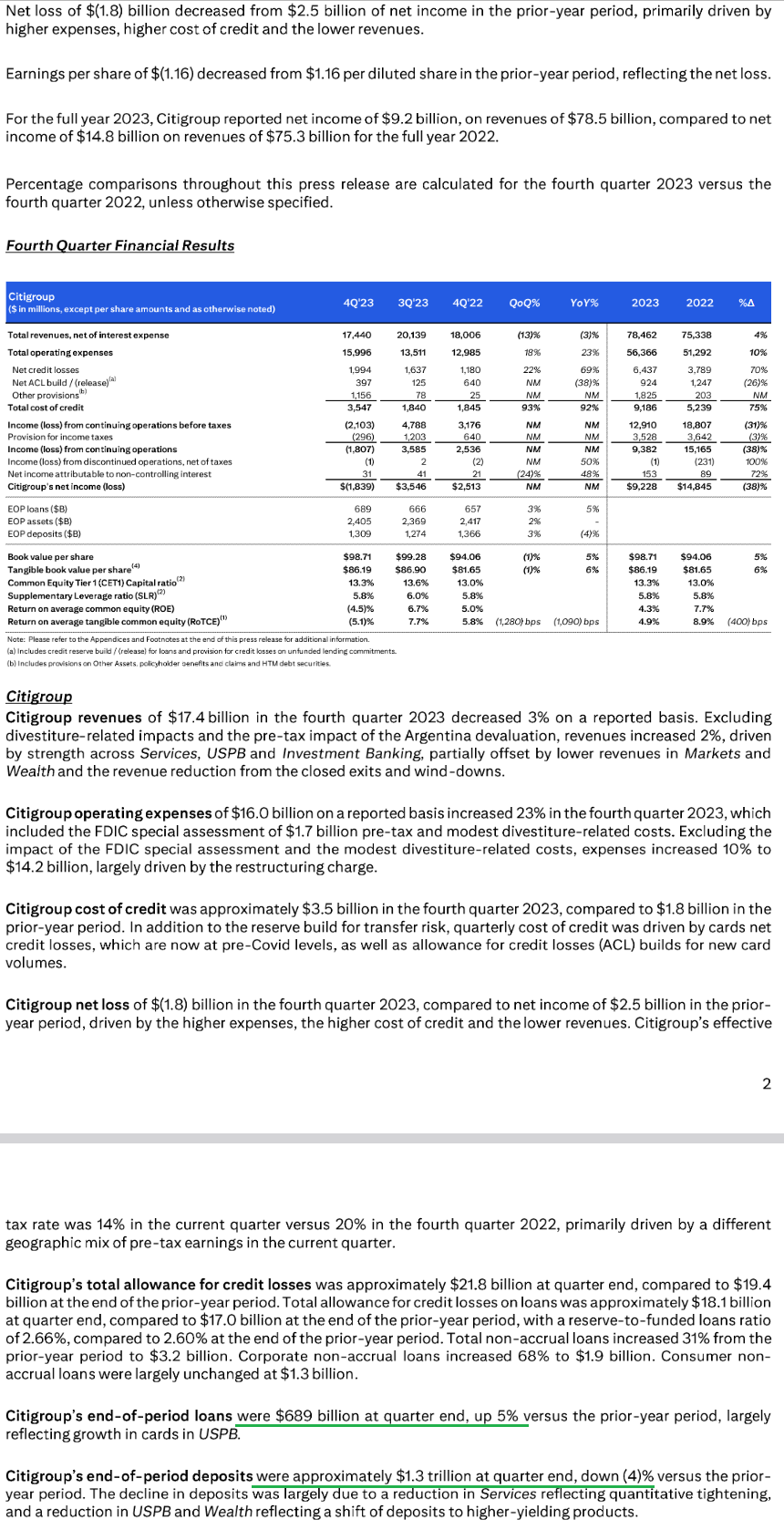

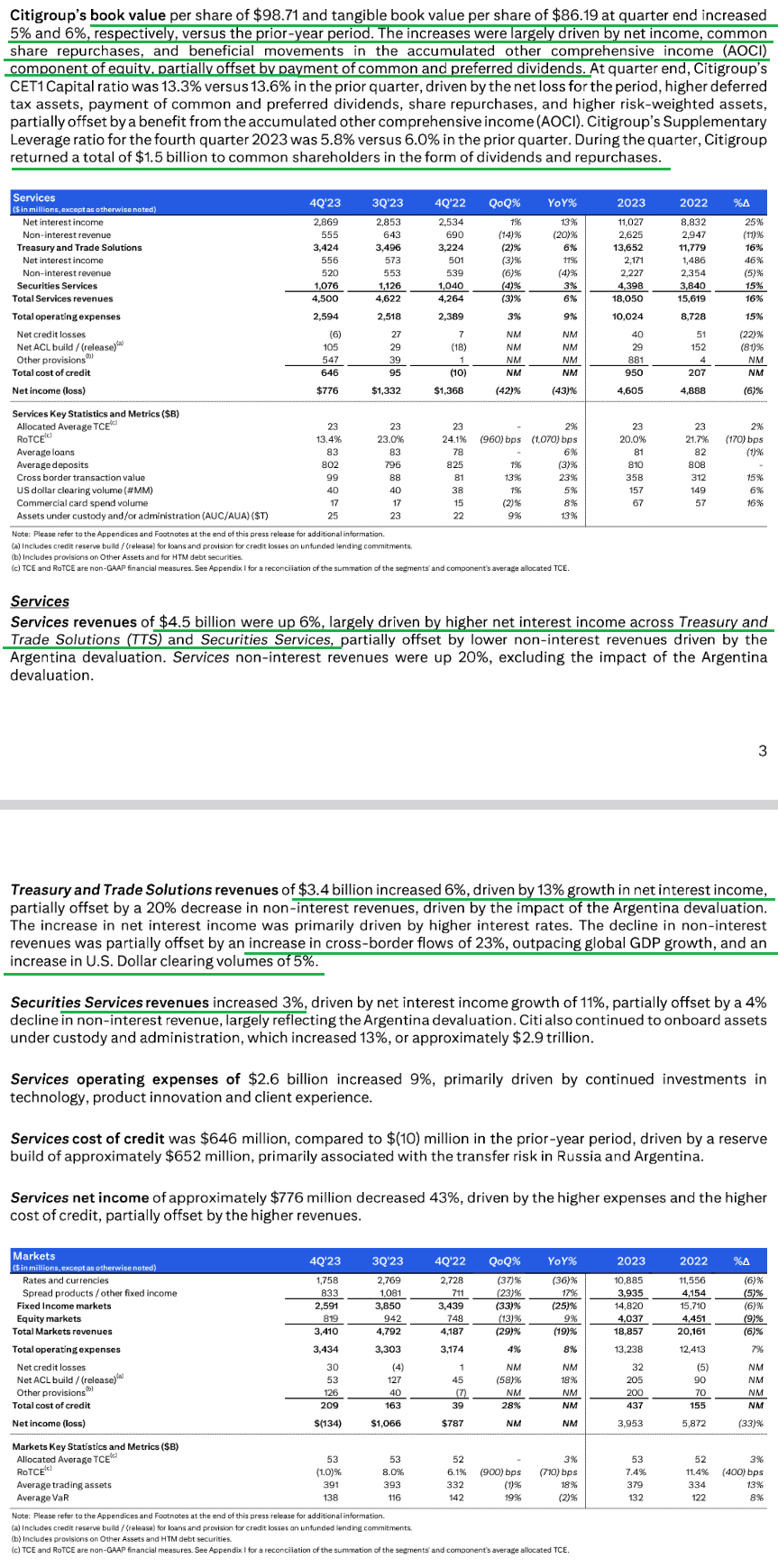

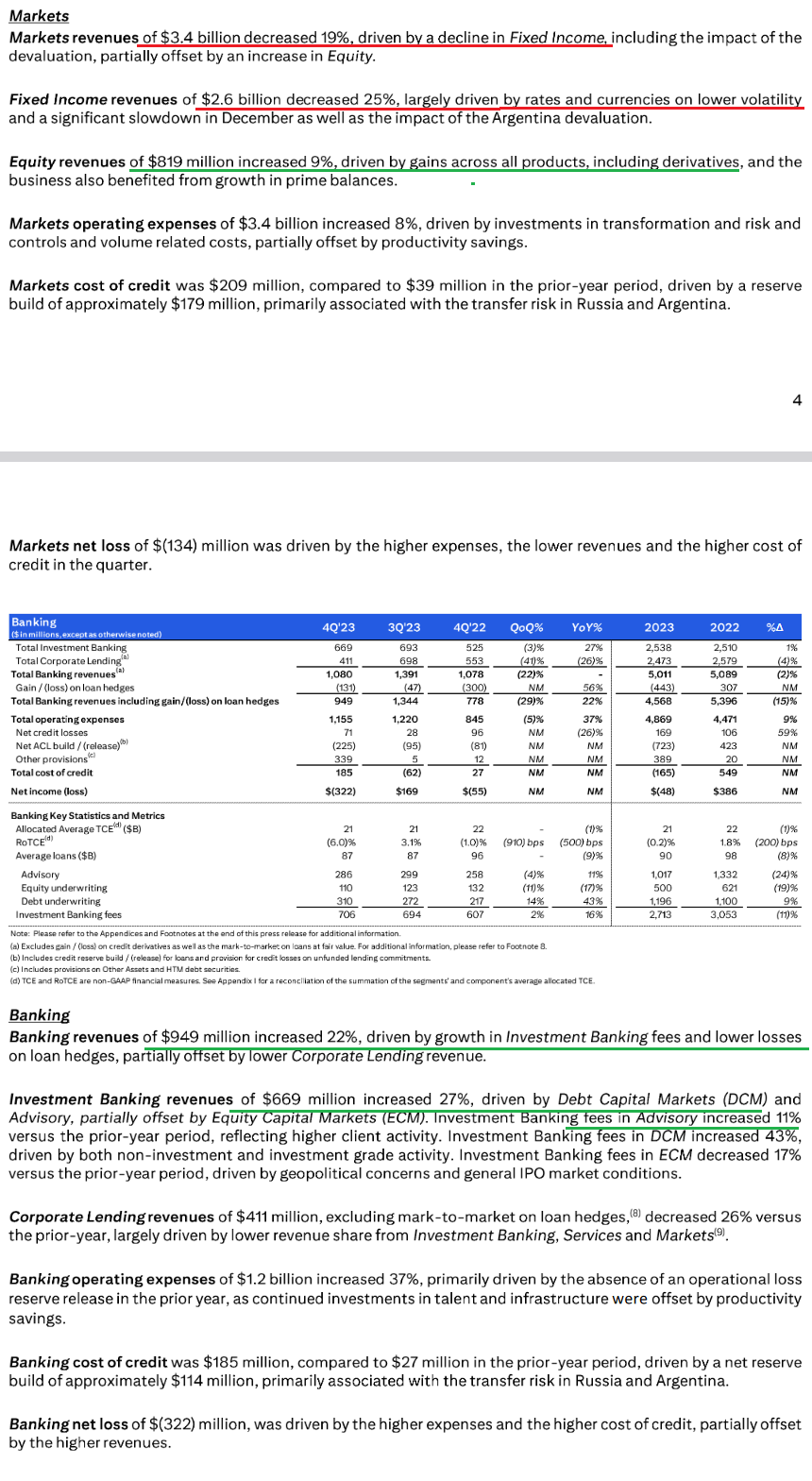

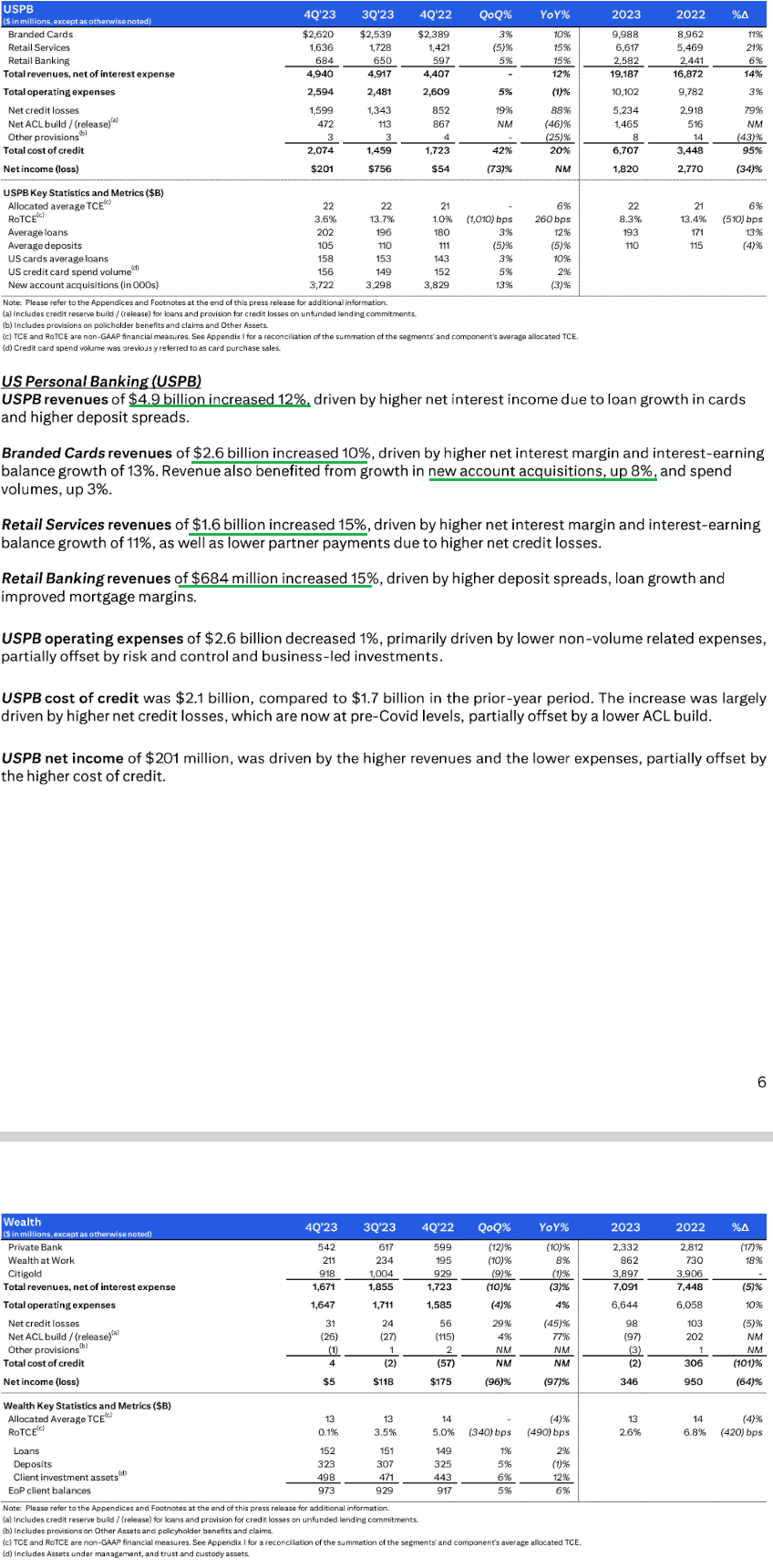

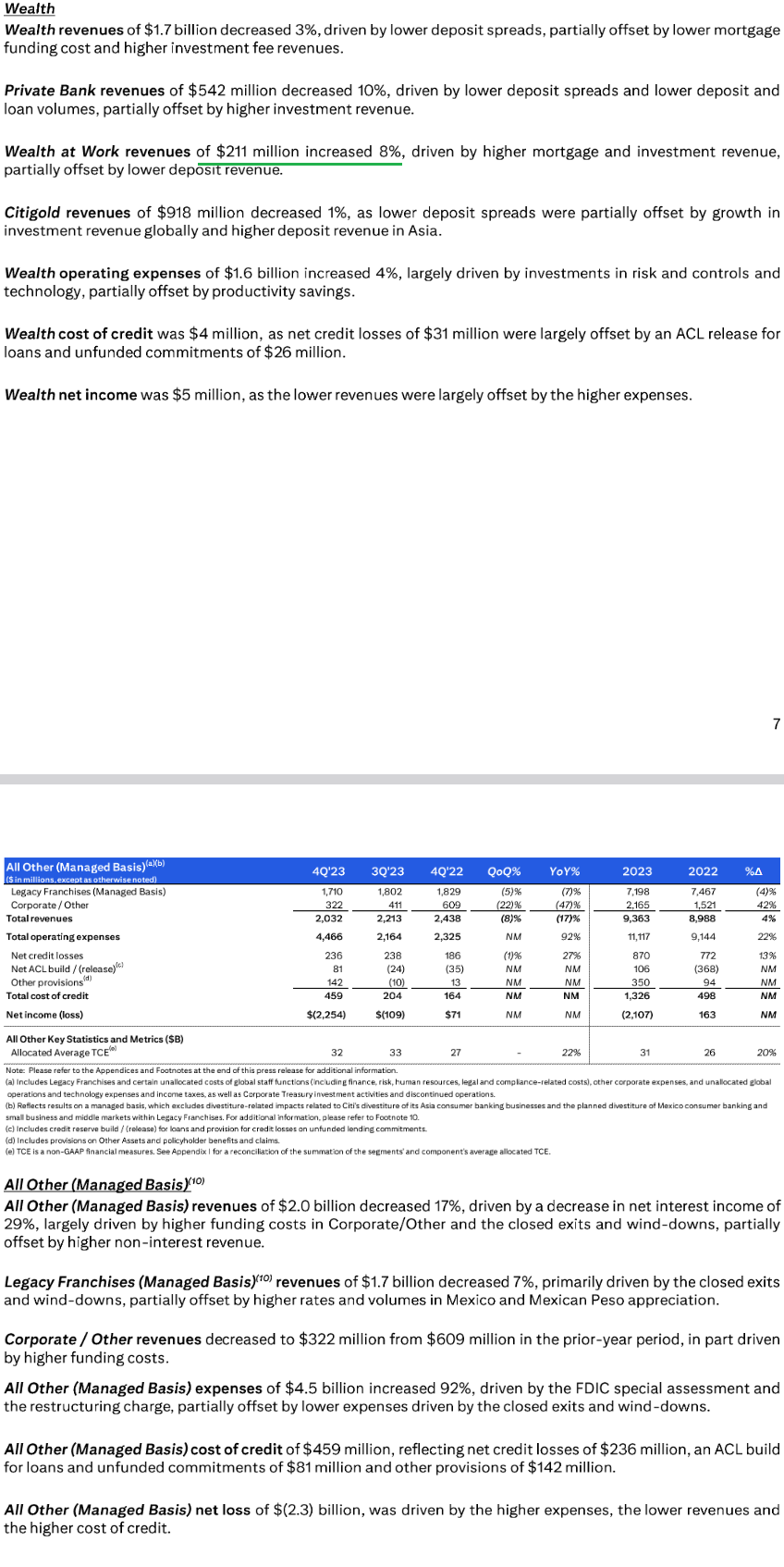

As we begin Q4 earnings season, I’m trying to highlight the results from 1-2 companies per week that we have talked about on our weekly podcast|videocast(s). Today we’ll do a deep dive on CITI’s results:

Paypal Update

“We will Shock the World on January 25” Alex Chriss:

More than 20 years ago, PayPal revolutionized commerce. We’re going to do it again. Tune in to the must watch #PayPalFirstLook on YouTube January 25 at 9:30 a.m. PT to hear from CEO Alex Chriss. https://t.co/yer0qGBsL9 pic.twitter.com/0T8oyLfvV7

— PayPal (@PayPal) January 16, 2024

Now onto the shorter term view for the General Market:

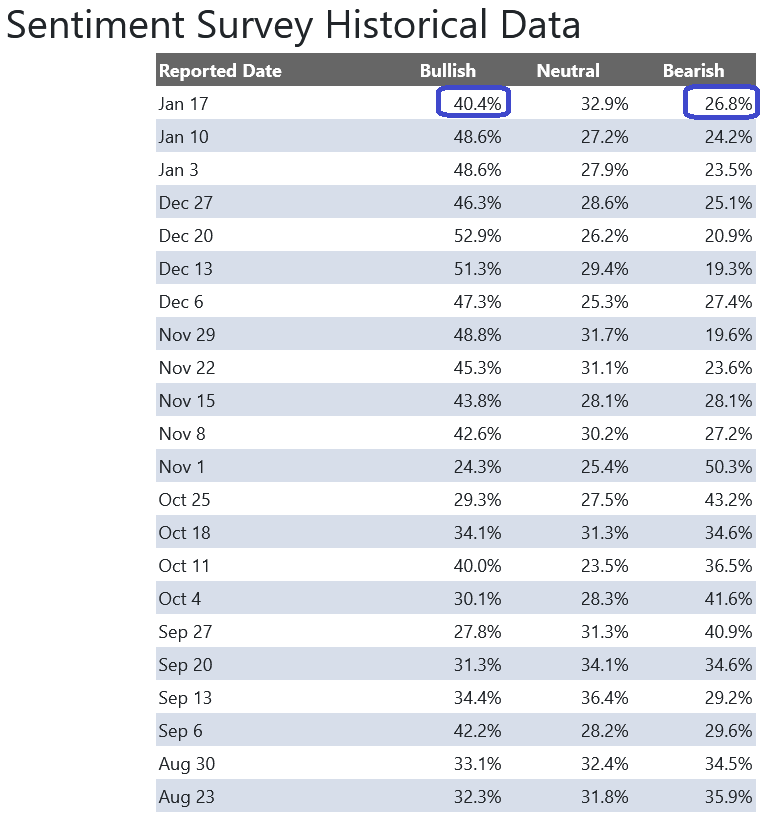

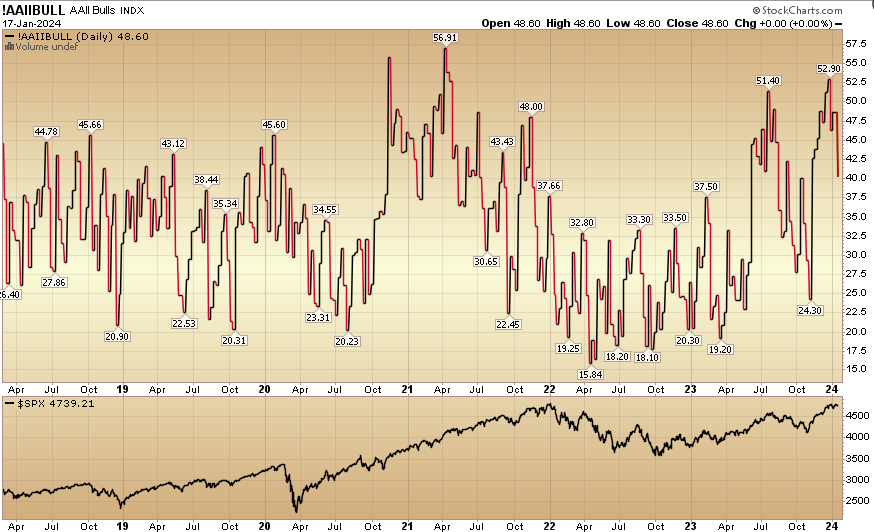

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 40.4% from 48.6% the previous week. Bearish Percent ticked up to 26.8% from 24.2%. Retail investors are cooling their jets a bit.

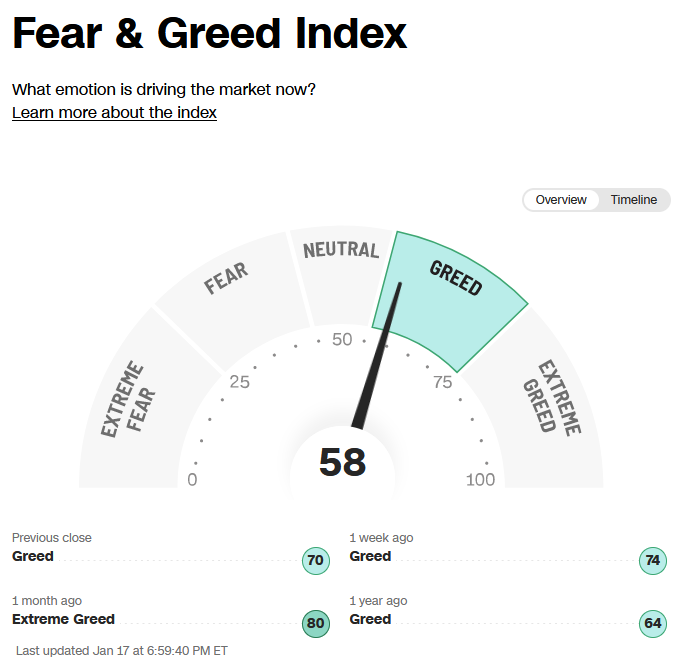

The CNN “Fear and Greed” dropped from 73 last week to 58 this week. By this metric, investors are neutral. You can learn how this indicator is calculated and how it works here: (Video Explanation)

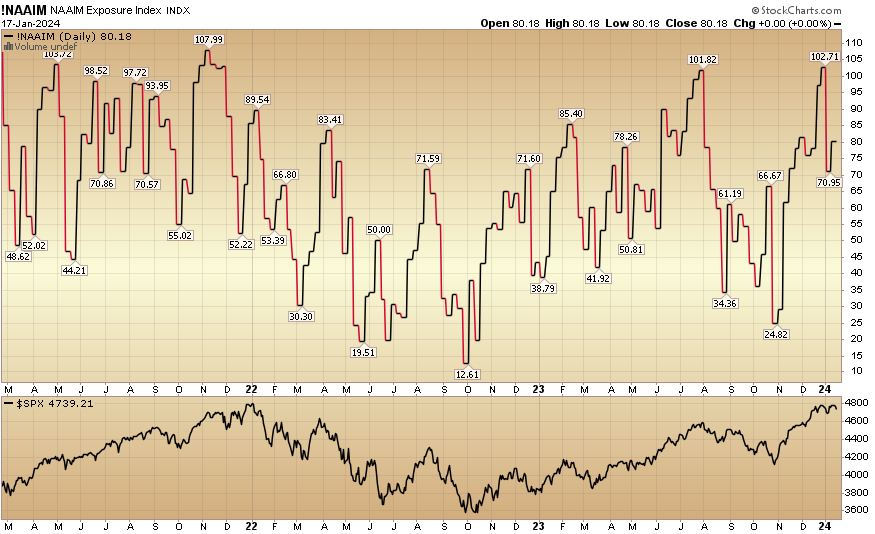

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 80.18% this week from 70.95% equity exposure last week ago.

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 80.18% this week from 70.95% equity exposure last week ago.

Our podcast|videocast will be out late today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

***After being highly exclusive since 2019 (and closed to new investors prior to that), our business expanded to serve an additional tier of clients in 2023. The response we have received since opening up this past summer has dramatically exceeded our expectations.

If you missed our opening in early Q4, we decided to begin our Q1 opening for smaller accounts ($1M+) last week. We will close out our Q1 opening at the end of this weekend. For details, and to see if you qualify, go here.

$5M+ and $10M+ accounts can always reach out directly for bespoke service.

*Opinion, Not Advice. See Terms