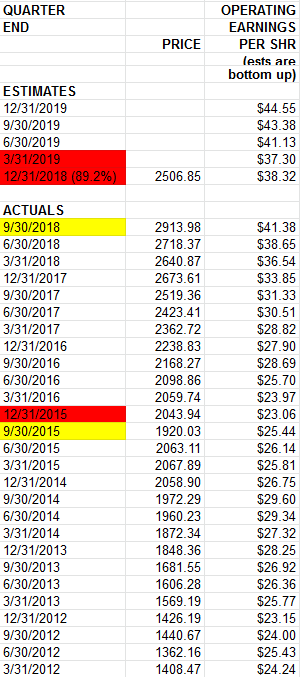

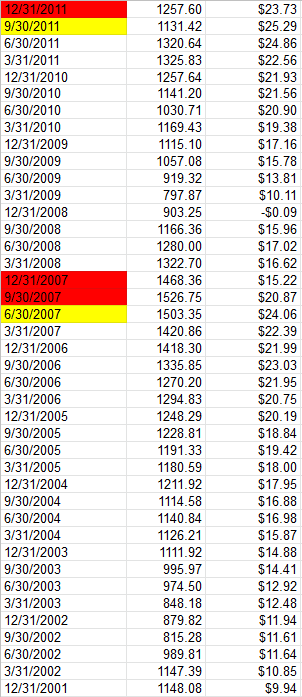

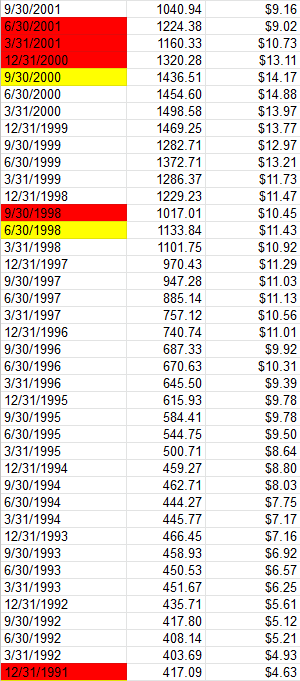

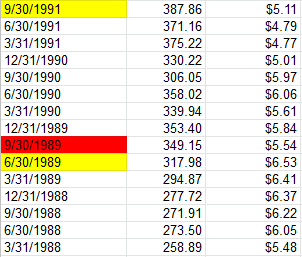

Historical Data Source: S&P Global – Howard Silverblatt

In the past 30 years, we have had 7 instances of sequential earnings drops of 7% or greater. In each case, it was not a positive – and a stock market correction reflected the downturn in economic activity. There is a KEY distinction when referring to sequential earnings declines:

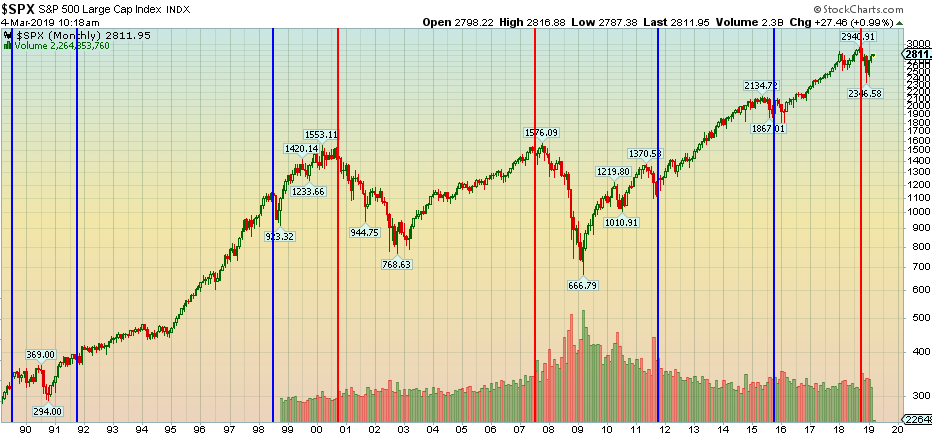

In 5 out of the 7 times, the sequential drop was limited to 1 quarter (SEE Blue Vertical Lines Above) – meaning the following quarter came in above the previous quarter where there was the precipitous earnings drop of more than 7% sequentially.

In those 5 instances, the market recovered after the correction and did not make new lows.

In the 2 of 7 times that you had sequential earnings drops of 7% or greater AND the quarter after the big drop was also lower by any amount, it led to lower lows and continued deterioration (SEE RED VERTICAL LINES ABOVE).

Why is this important?

From Q3 2018 to Q4 2018 we had the first sequential earnings drop of 7.39%. We also got a big stock market correction of ~20% to go along with it. In 5 out of 7 instances, it’s not a problem. Maybe you partially retrace the bounce before making eventual new highs (like 2011), but the low is in.

This time is currently worrisome and here is why: At present, operating earnings for the S&P 500 for Q1 2019 are also expected to decline sequentially from Q4 2018 earnings. This only happened in 2007 and 2000. Keep in mind, 2 instances is not a large enough sample to expect the same result with certainty – but it is enough to be mindful and WATCH it carefully (earnings for Q1 2019).

Can this outcome potentially be avoided? YES. Expectations are more often than not LOWER than what is actually reported and in this case they would have to be off by 2.66% (the expected decline) WHICH IS HIGHLY POSSIBLE. Couple that with the possibility of positive a outcome with China/Brexit (which will yield better forward guidance) and we avert the ominous outcome ascribed to 2 quarters of sequential consecutive earnings declines.

I think the likely outcome is a partial retrace of Jan/Feb gains and then we stabilize, BUT we need to see sequential earnings recover and estimates start to improve. If the 2.66% 2nd sequential drop manifests (less than 50% probability), I would get more defensive moving forward. Please see referenced historical earnings data below: