Data Source: FactSet

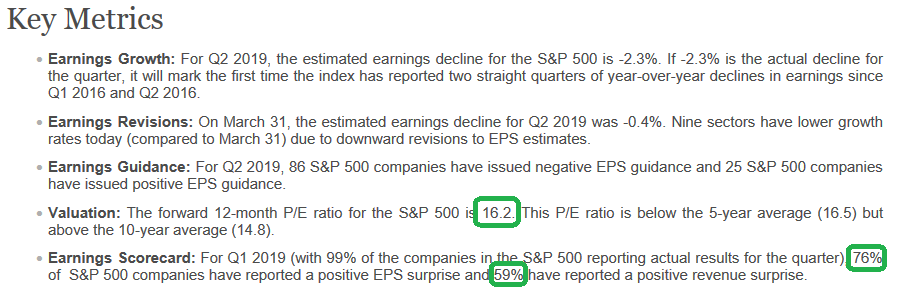

As was the case in Q1, estimates are starting out negative and should come in flat or slightly positive. The growth for 2019 has been back half loaded since January so no surprises there…Key Points (FactSet):

-In terms of estimate revisions for companies in the S&P 500, analysts have made smaller cuts than average to EPS estimates for Q2 2019 to date. On a per-share basis, estimated earnings for the second quarter have fallen by 2.2% since March 31. This percentage decline is smaller than the 5-year average (-2.5%), equal to the 10-year average (-2.2%), and smaller than the 15-year average (-3.1%) for the first two months of a quarter.

-Estimate Revisions: Largest Decline in Industrials, while Largest Increase in Energy

-Guidance: More S&P 500 Companies Issuing Negative EPS Guidance for Q2 than Average

-Revenue Growth Expectation for Q2: 4.0%

____________________________________________

-For Q3 2019, analysts are projecting earnings growth of 0.2% and revenue growth of 4.1%.

-For Q4 2019, analysts are projecting earnings growth of 7.0% and revenue growth of 4.5%.

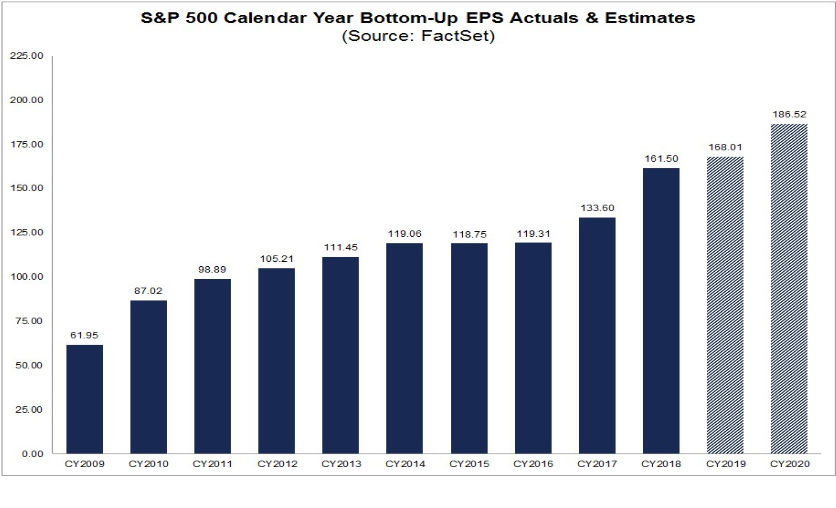

-For CY 2019, analysts are projecting earnings growth of 3.1% and revenue growth of 4.5%.

-For Q1 2020, analysts are projecting earnings growth of 10.5% and revenue growth of 6.2%.

-For Q2 2020, analysts are projecting earnings growth of 12.9% and revenue growth of 6.8%.