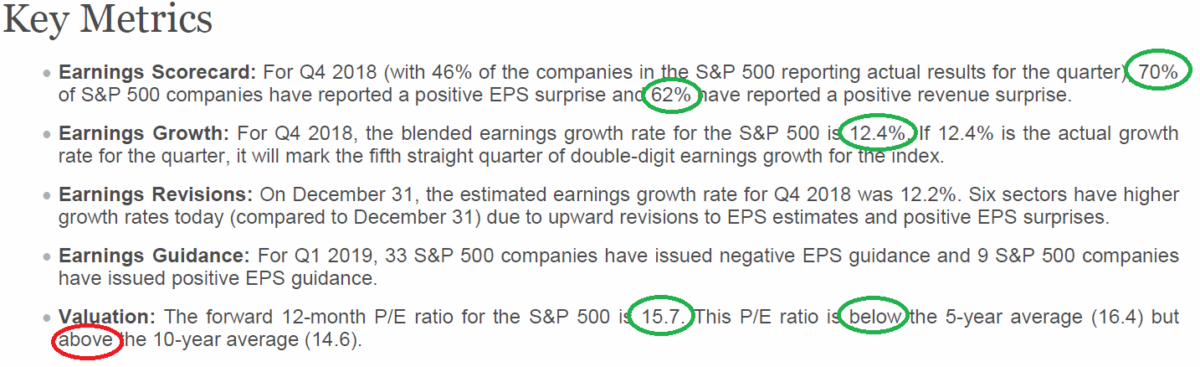

Per FactSet, eps and revenues continue to beat by 70% and 62% respectively – after 46% of S&P 500 having reported Q4 earnings so far. Guidance is a bit light but 2019 eps estimates remain ~$170 per share. We may need a few weeks of rest to consolidate the January gains. Here is why:

At 2709 on the S&P 500, we are trading at ~15.9x forward earnings (as of this morning). While this P/E is below the 5yr avg. of 16.4x, it is above the 10yr avg. of 14.6x. Keep in mind that the discount rate has gone UP in the last 12 months as well.

So what would have to happen for the S&P 500 to go up from here?

Either: 1) Estimates go UP from here, or 2) the P/E multiple goes UP from here.

A few things could happen to bring up Estimates:

1. Dollar could weaken (USD was up ~ 5% yoy in Q4 which impacted US earnings and helped European earnings).

2. We could close a real China trade deal (but this looks to be end of February – when Trump meets Xi Jinping – at the earliest).

3. New Brexit referendum (Brits vote to stay in EU) – lower probability and further away from above two possibilities.

4. Post earnings buybacks will help some, but at the same time with earnings moving into the background, so do many catalysts for a move higher (in the short term).

On the flip side, another shut down or unforeseen event – and all bets are off. For now the Fed has reversed course and the market is responding. Keeping a vigilant eye on guidance in coming weeks to determine if ~$170 2019 EPS is realistic for the S&P and will adjust as data comes in.

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.