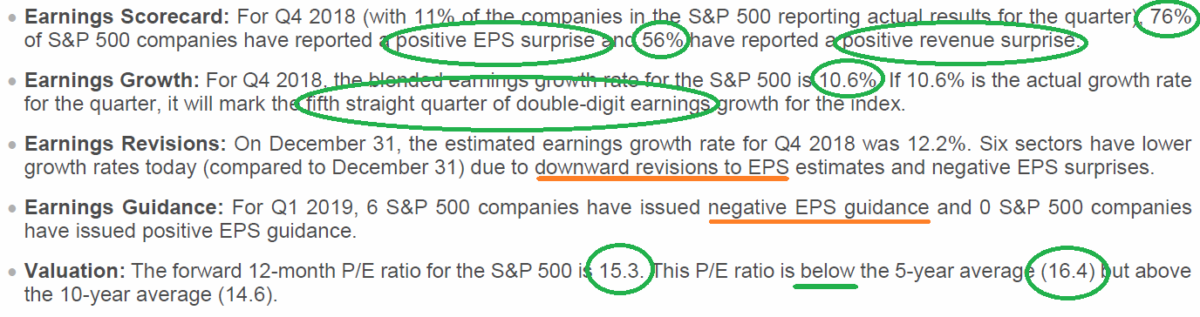

Per FactSet, eps and revenues continue to beat by 76% and 56% respectively – after 11% of S&P 500 having reported Q4 earnings so far.

Guidance is a bit light but 2019 eps estimates remain ~$171.50 per share. If the Fed pauses and we get multiple expansion back to 16.5 or 17x – this could take the S&P 500 as high as ~2915 or 9.1% higher from here.

Keep in mind A LOT has to go right for that to happen. A clear resolution with China trade could potentially increase estimates, but that is not done until it’s done. Need more confirmatory “tweets” from China and less from US.

An outlier positive catalyst would be a new referendum vote for Brexit – which would result in the UK staying in the EU – and be very surprising and very bullish for markets.

On the flip side, any NEW mistakes by the Fed – and we found out in Oct & Dec how capable the Fed is of making mistakes – and all bets are off. For now they have reversed course and the market is responding. Keeping a vigilant eye on guidance in coming days and weeks to determine if $171.50 2019 EPS is realistic for S&P and will adjust as data comes in.

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.