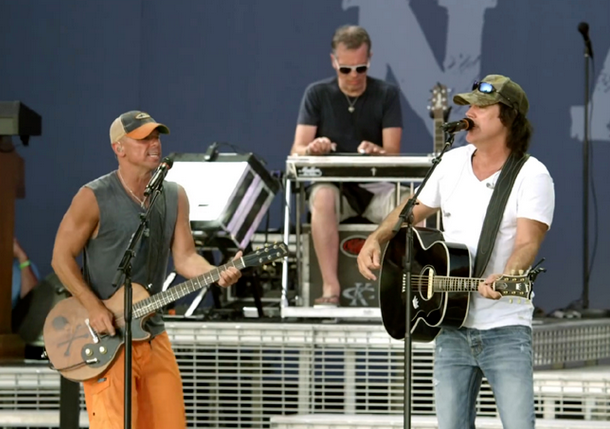

“‘Everything’s Gonna Be Alright’ is a song by American country music artist David Lee Murphy as a duet with Kenny Chesney. It was released in November 2017 as the lead single to Murphy’s 2018 album No Zip Code. The song reached number one on the US Billboard Country Airplay chart.” Wikipedia.

After this week’s inflation numbers and knee-jerk reaction, investors need to keep in mind the following lyrics:

Everything’s gonna be alright

Everything’s gonna be alright

And nobody’s gotta worry ’bout nothing

Don’t go hittin’ that panic button…

I echoed this sentiment on Tuesday evening (after the 4% correction) on CNBC Street Signs (Asia) with Will Koulouris. Thanks to Will, Gabrielle See and Celestine Francis for having me on:

Here were my show notes ahead of the segment:

Put it in perspective: Haven’t even reversed last week’s gains in the market. Nowhere near June lows. Wait a day or so to settle, then pounce selectively.

-The good news is “peak narrative” holds as June report was the highest print. The bad news is the upside miss cements a third 75bps hike next week (which was already expected). Key will be November and December: 50 then 50 or 50 then 25?

-Rents, food (+11.4% yoy) and healthcare account for increase in CPI.

-Consumers got some relief from a (-10.6% mom) decline in gasoline prices.

-WSJ Nick Timiraos put out trial balloon for 100bps hike in Sept (which took odds up to 47% in the afternoon session). UNLIKELY

The market will trade heavy for a day or two until participants can refocus on fundamentals/earnings of businesses – which are holding up nicely despite a challenging environment. 2023 S&P Estimates still ~$243.73.

5 year inflation breakevens down from 3.59% in March to 2.62%. Fed more focused on expectations than actual inflation because it effects behavior.

Key Is Positioning/Sentiment (BofA Survey Fund Manager released this week):

Managers were already positioned for the worse case. They got it. Now who’s left to sell? Pain trade is UP (looking out a few months).

–Highest expectations for Recession since Apr 2020 and March 2009 (bottom was in in both cases).

–Lowest Percent of Managers taking higher than normal risk.

-Lowest Percent of Managers “Overweight Equities” in history (-52%). Lower than 2020 Pandemic and GFC in 2008.

–Growth Expectations near all time low. 72% expect weaker economy next year.

-Allocations to cash highest since 2001 (6.1%). Higher than GFC and Pandemic Lows.

-Relative to the past 10 years, investors are long cash, defensives and energy, while being underweight equities, the euro zone, emerging markets and cyclicals.

-The most crowded trades are long US dollar, long oil and commodities, long ESG assets, short US Treasuries, long growth stocks and long cash.

Take the other side. Looking a few months out, pain trade is UP. Market will start to discount GRIDLOCK after November elections: NO NEW TAXES/POLICY CHANGE = bullish.

Contrarian Trades (watch the smart money, not the emotional knee jerk):

-If you can step in at extremes when volatility and fear are high (AND BE PATIENT IN THE SHORT TERM), you will make outsized returns over time.

–Short USD: Commercial Hedgers (green line at bottom) aggressively short (as was the case before peaks in 2020, 2017, 2015, 2013, 2009, 2006).

–Long US Treasuries 10 year note: Commercial Hedgers (green line at bottom) aggressively long (as was case before rally in bonds 2018, 2014, 2011, 2009)

–Long S&P Futures: Commercial Hedgers (green line at bottom) aggressively long (as was case before rally in equities 2020, 2016, 2011, 2009)

EXPE: TSA air travel passthrough numbers higher than 2019 for 5 days so far this month. Expedia CEO on CNBC US, “Business Travel is Back.” People are underestimating the pent-up demand to re-establish business/client relationships (as we saw in leisure over the summer). EXPE trades at 11.5x 2023 Est. with 34.8% earnings growth. Expect to initiate in coming days.

EEM/BABA: Wait to see weakness in the USD then load up on Emerging Markets/Highest Quality Chinese Equities with a 1-3 year view. We are long Alibaba. Covid (Zero) is temporary. Business moat is permanent. Cloud will triple by 2025. BABA has 36% share. Numerous shot term catalysts: Audit clearance, Stock Connect (dual-listing) ~$30B new buyer demand from Mainland China, continued massive stimulus, Ant Financial.

LEN: Wait to see strength in Treasuries then load up on US homebuilders (starter homes) with a 1-3 year view. We are will be buying LEN (no position yet. 72M millennials average age 31 need small starter homes (undersupplied by 3.8M units). Trades at 5x 2023 EPS Est.

_________________________________

Has inflation Peaked? Just follow the trends…

Consumer

Producers (LEADING INDICATOR):

If you don’t understand all of the data above, you need only listen to one of the best sell side strategists in the business – Jim Paulsen of Leuthold – laying out the exact case we have been making since the June lows:

Auto-Suppliers

On a final note for auto-suppliers, a core part of our $CPS thesis is playing out:

The second catalyst – Credit Markets (refinancing) however are still relatively closed. We’ll see if that improves somewhat after next week’s Fed meeting and presser.

Now onto the shorter term view for the General Market:

In this last week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose to 26.1% from 18.1% the previous week. Bearish Percent dropped to 46.0% from 53.3%. Retail Sentiment has picked up a bit this week:

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 27.33% this week from 32.36% equity exposure last week. Any good news and managers will be forced to chase up into year-end: