“Famous Friends” is a song recorded by American country music singers Chris Young and Kane Brown. It was released on November 20, 2020. In December 2021, it was declared by Billboard the number one Country Airplay single of the year:

This week’s note is all about “Famous Friends” that you’ve never heard of. We’ll start with with the most important “Friend” for this week – Governor of the Bank of Canada – Tiff Macklem.

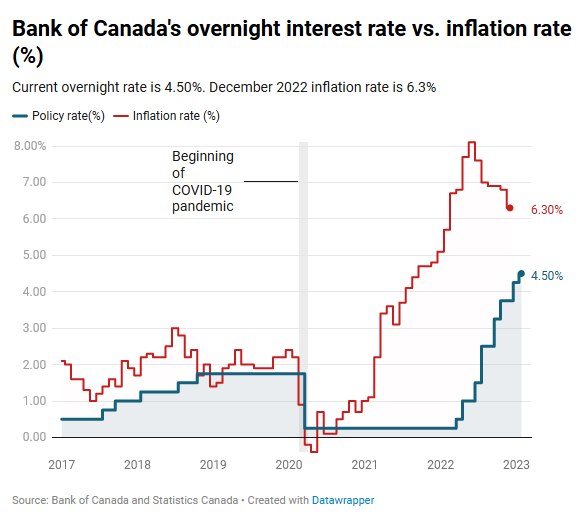

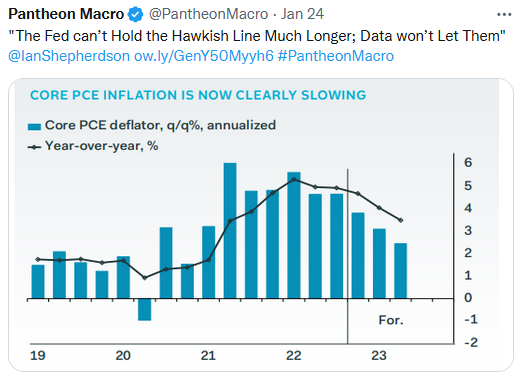

On Wednesday, the Bank of Canada announced its eighth consecutive rate hike since March 2022 – moving its policy rate to 4.5% (from 4.25%). With the announcement, Macklem signaled a PAUSE at its current rate while the Bank assesses the full impact (lagged effect) of its hikes on the economy.

Macklem also said that he thinks the Bank has “done enough” and isn’t planning to raise rates further, however if the economy doesn’t evolve as Canada’s central bank is currently forecasting (3% inflation by mid-2023) it may need to raise rates again.

Here are the key quotes of Macklem talking to Joyce Napier of CTV News:

Joyce Napier: You signaled today that there would be a pause in your rake heights, and I want to ask you: is the worst over and, you know, has inflation peaked? Is that what’s going on?

Tiff Macklem: “Joyce, inflation is still too high, but it is cooling. And we do think we’ve turned the corner or we’re turning the corner on inflation. And we’ve done a lot at the Bank of Canada. We’ve raised our policy rate more than four percentage points over the last year. It’s now time to take a pause and see if we’ve done enough.”

Napier: But it is coming down. It’s gone from 8.1 per cent to 6.3 per cent. So it is coming down, is it that it’s not fast enough for you?

Macklem: “It is coming down and we think it’s going to continue to come down. In fact, our own forecast is when we get to the middle of the year, we’re going to be about three per cent inflation, that’s going to feel a lot better. It’s not job done, but it’s going to feel a lot better.”

Macklem: “I don’t have a crystal ball. We don’t have a crystal ball. We don’t know.”

Napier: Which makes your job a lot harder.

Macklem: “It does, because monetary policy works with a lag. We’ve done a lot. We’ve raised rates, as you said more than four percentage points over the course of a year. And we know that the effects of those interest rate increases, they’re still feeding through the economy.

“As you said, inflation has come down. We expect it’s going to continue to come down and if it comes down in line with our forecast, we’ve done enough. If it hasn’t, we’re prepared to do more. What we’re looking for is an accumulation of evidence. If that evidence starts to come in in-line with our forecast, we will become more confident that we’ve done enough.”

Macklem: “You know, as I’ve said in the past, when circumstances changed, as soon as we saw the momentum and inflation, we did move forcefully. We raised rates rapidly, and it’s working.

“We are trying to balance the risks of over tightening and under tightening. But the reason that we raised rates so rapidly, so forcefully last year, was really to try to avoid the need for even higher rates in the future. And it was by raising rates rapidly that we’re starting to the cool the economy, we’re starting to get inflation to come down. Had we moved more slowly, we would we wouldn’t be on pause. We would still be rising, and there’d be more pain to come.”

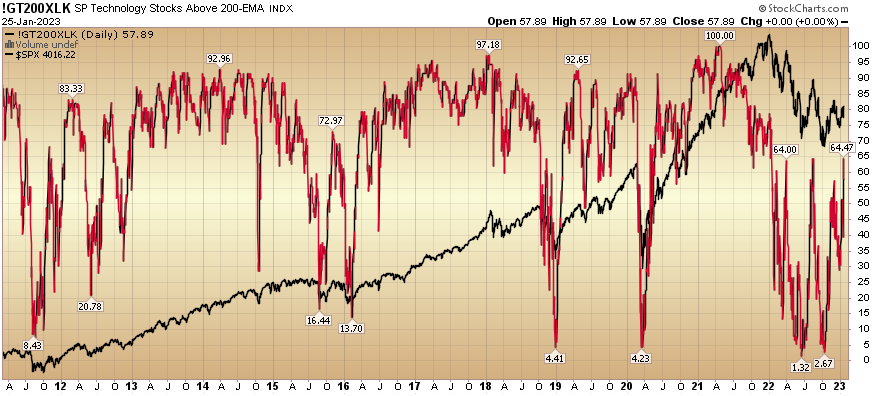

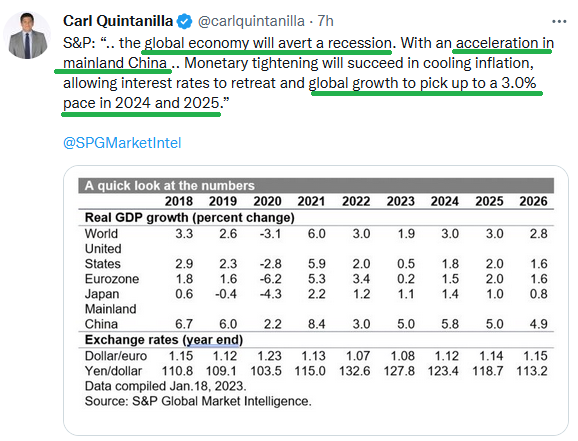

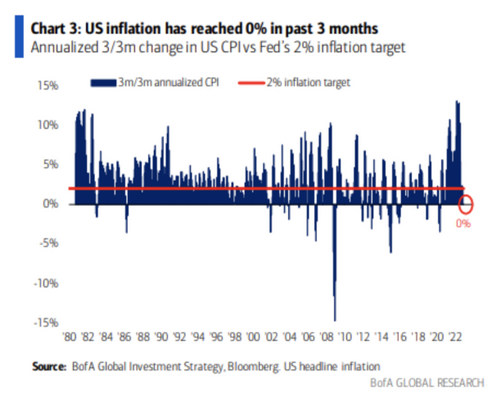

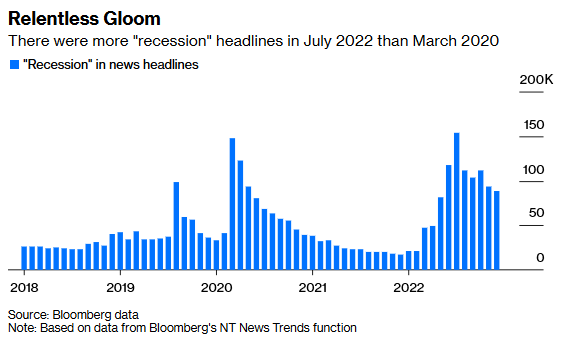

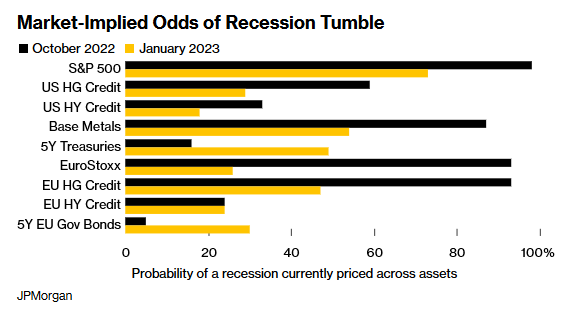

This is by far the most important development of the past 12 months. Chairman Powell could literally take this transcript and read it next week. I’m not betting that he will because it would make too much sense, but it would be reasonable to expect an iteration of this action/stance (if not on Feb 1) by the meeting on March 22. It’s time for the Fed to declare victory and move on. Conditions are tight enough:

Our second “Famous Friend” that many people have never heard of is Andy Jassy, the CEO that took over running Amazon for Jeff Bezos. On Wednesday I joined Phil Yin on CGTN America to discuss Amazon. Thanks to Phil and Ninar Keyrouz for having me on:

In this segment we discussed the “sum of the parts” analysis, new business initiatives and more…

US in Last Place 2023

While many have their eyes fixated on a “Magical Trendline” that has struggled to break on the S&P 500 (exclusively due to the Tech heavy weighting), the rest of the world has broken above the similar trend line and are in new Bull Markets. We expect the US to follow:

Hong Kong

Germany

United Kingdom

Mexico

United States

The one trendline we HAVE taken out in the US is the uptrend in the 10yr yield:

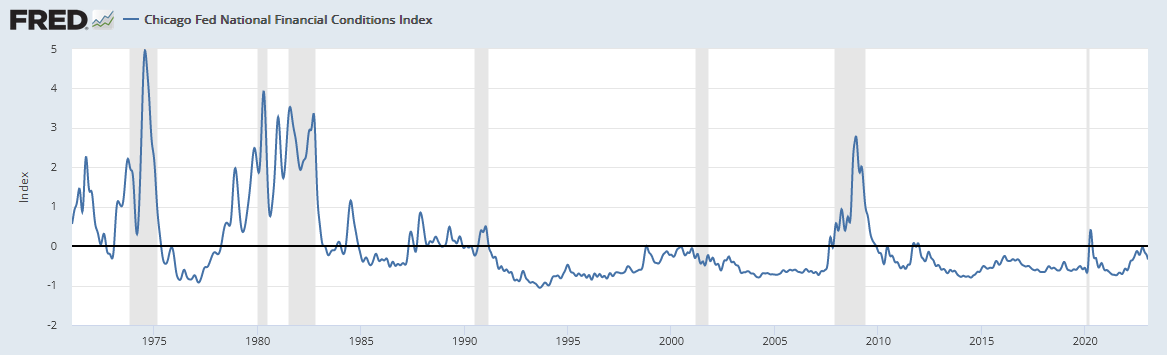

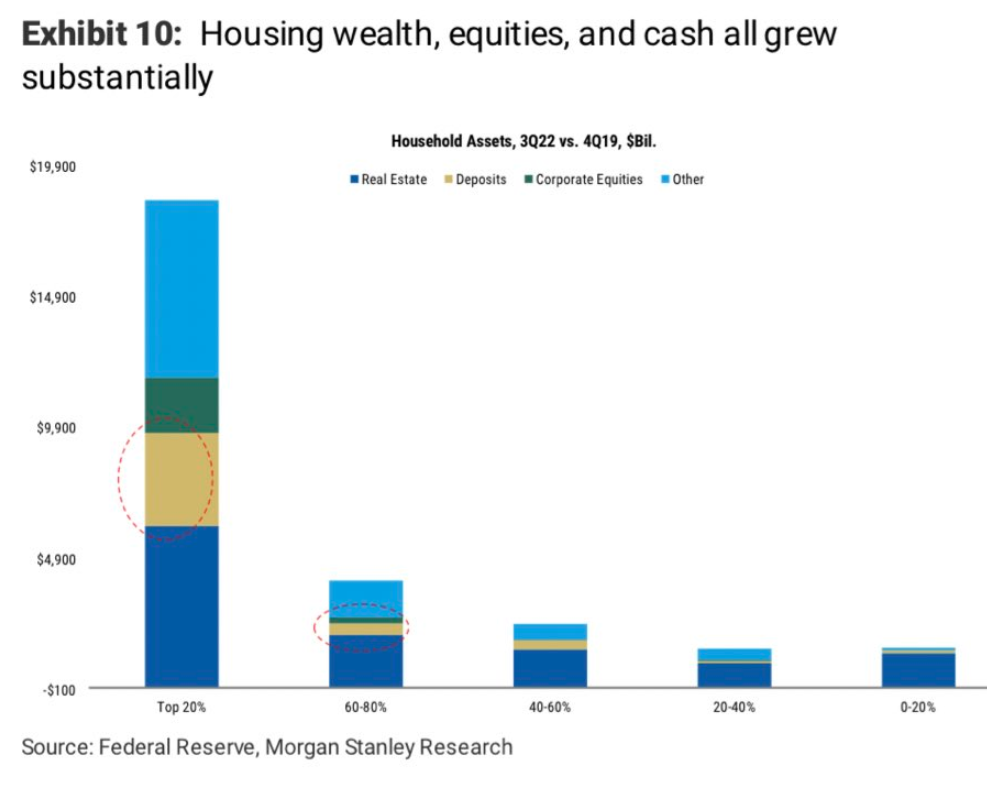

Despite the Fed’s relentless efforts to slow down the economy and talk down markets, the the Chicago Fed’s National Financial Conditions Index (which provides a comprehensive weekly update on U.S. financial conditions in money markets, debt and equity markets, and the traditional and “shadow” banking systems) is staying tame and signaling improving conditions:

High yield credit spreads are singing the same tune:

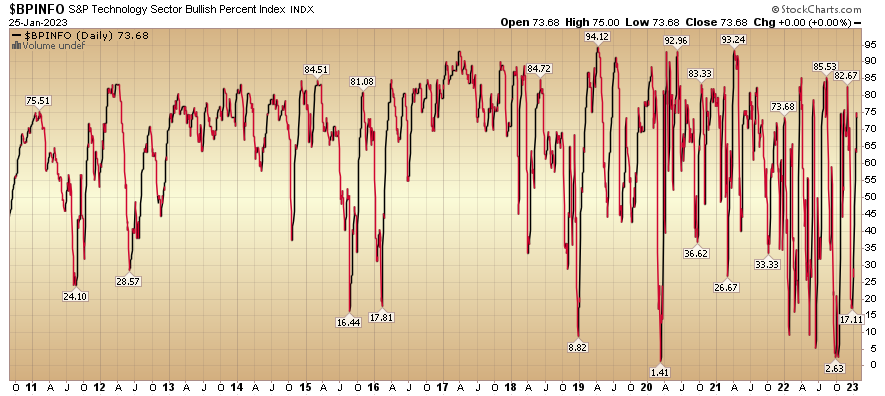

Tech

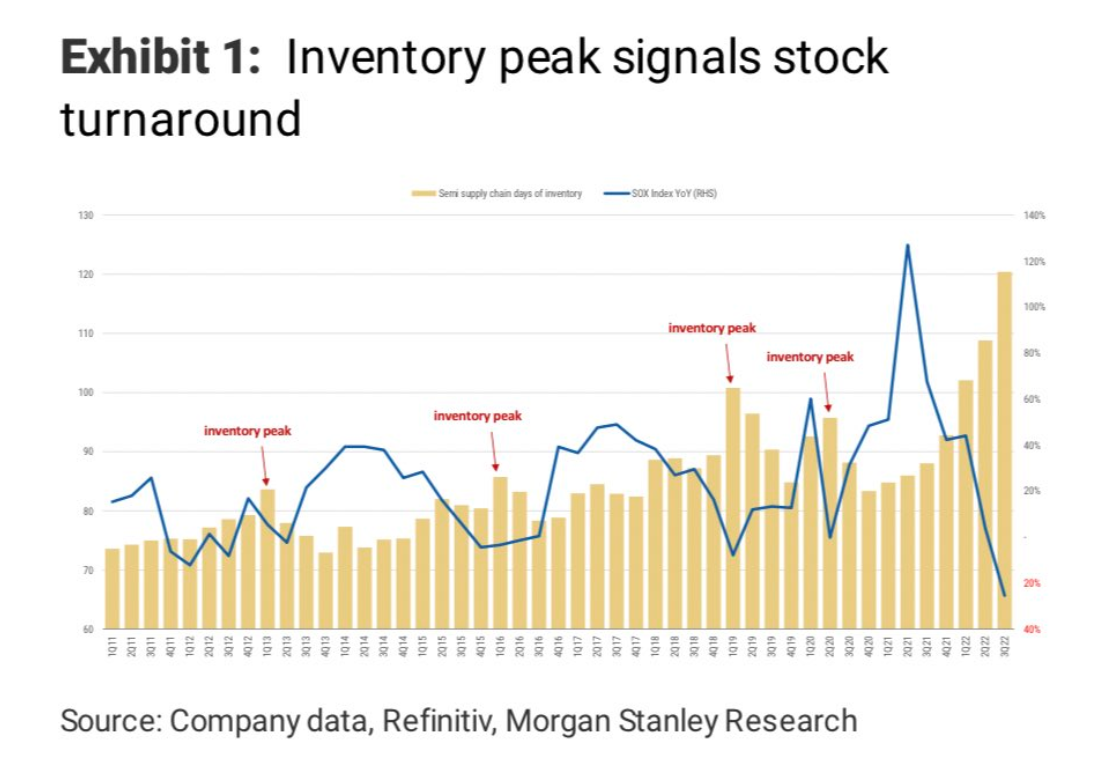

Of note, for the S&P to turn, Tech has to begin turning. Semiconductors have started to lead the way, and this table from Morgan Stanley may be telling us why:

General Data Points

General Data Points

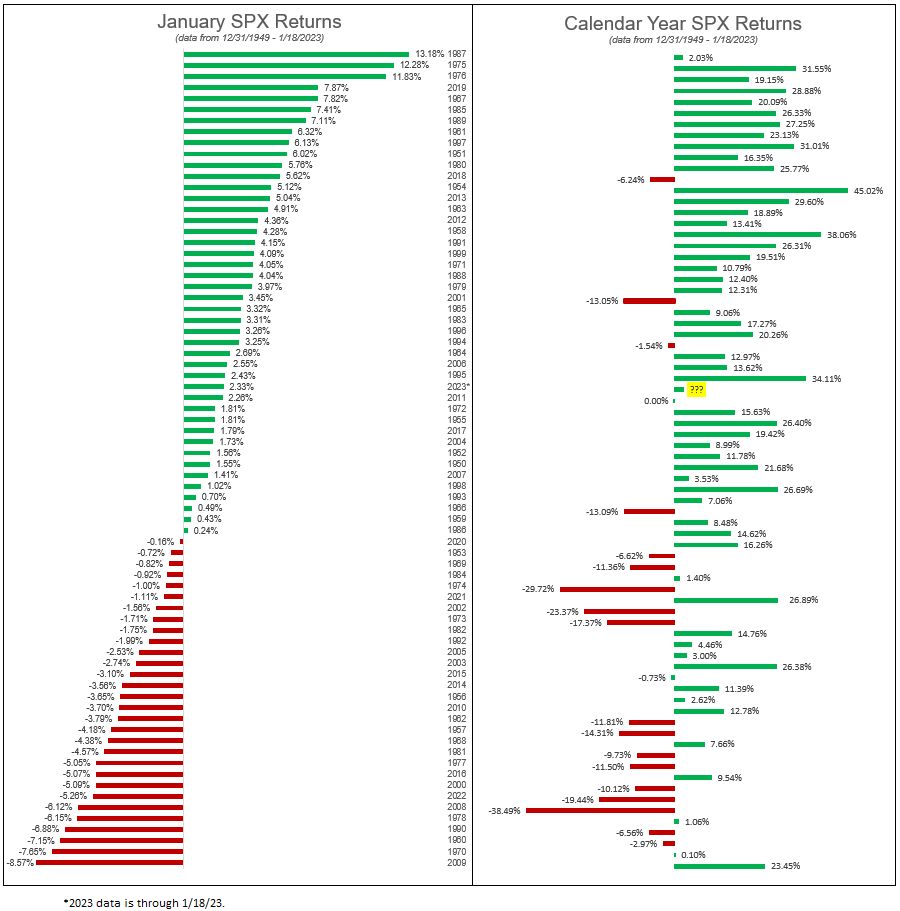

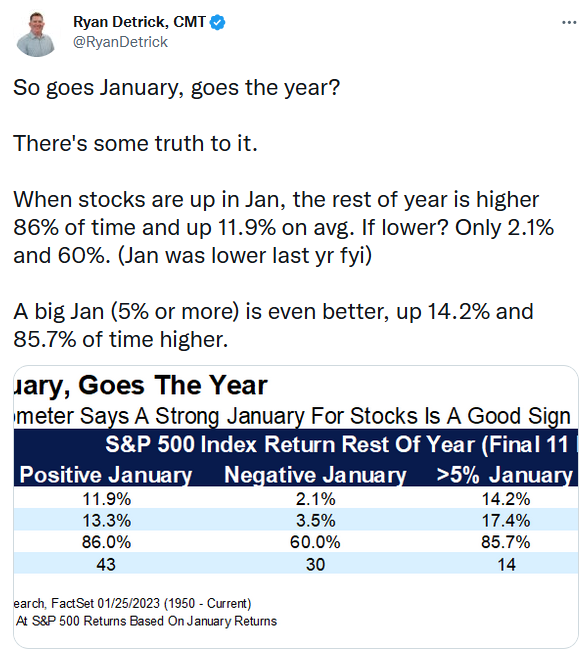

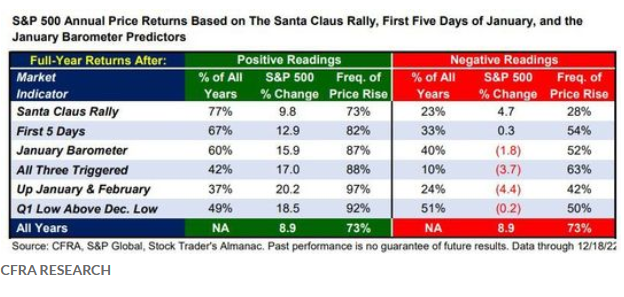

As Goes January:

As Goes January:

Source: Dorsey Wright

Source: Dorsey Wright

Now onto the shorter term view for the General Market:

Now onto the shorter term view for the General Market:

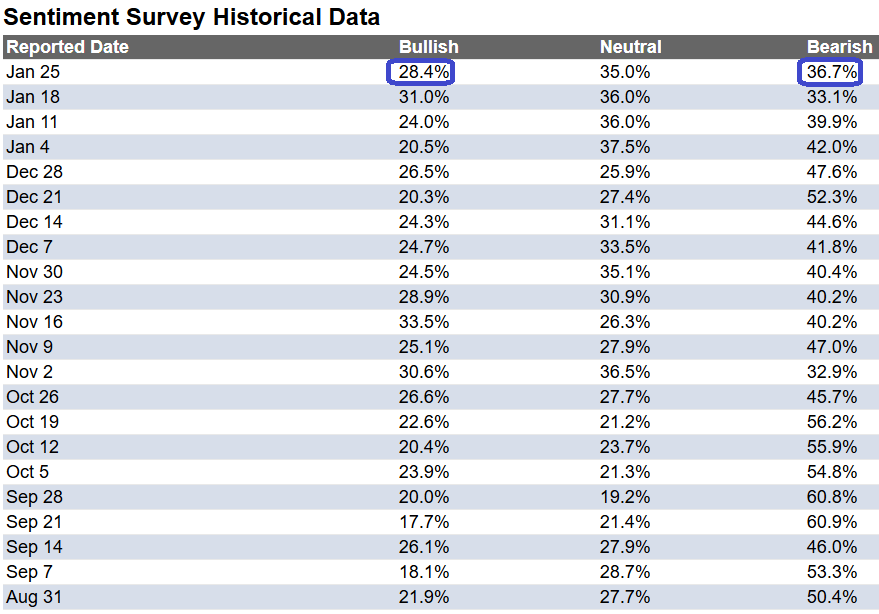

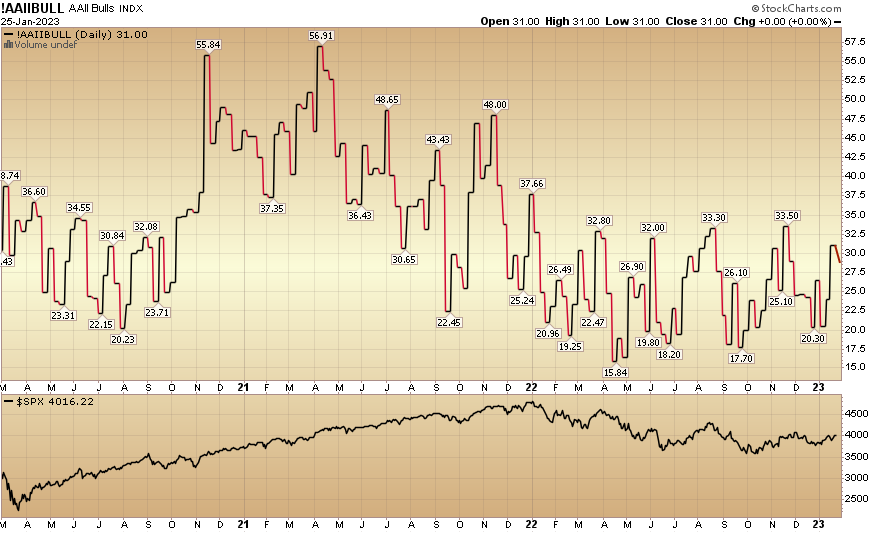

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked down to 28.4% from 31% the previous week. Bearish Percent rose to 36.7% from 33.1%. Sentiment is still weak for retail traders/investors.

The CNN “Fear and Greed” rose from 57 last week to 64 this week. Sentiment is moving higher. You can learn how this indicator is calculated and how it works here: (Video Explanation)

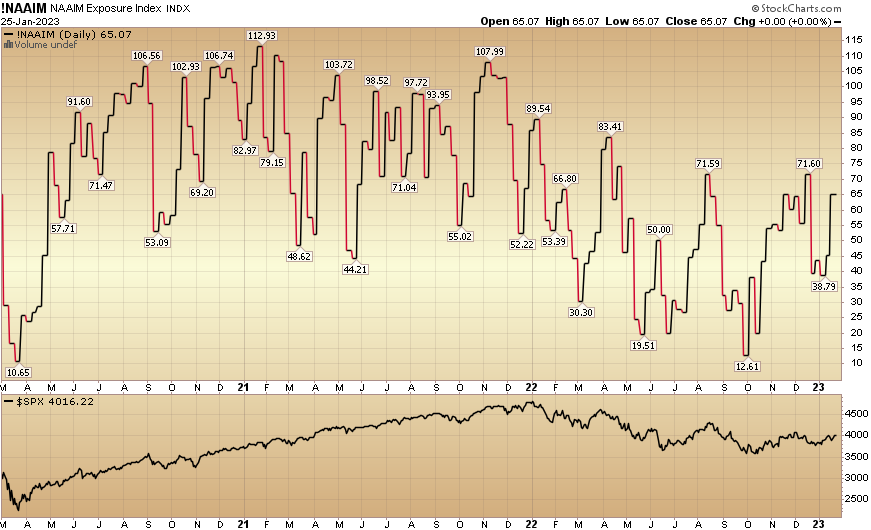

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 65.07% this week from 45.31% equity exposure last week.

Our podcast|videocast will be out today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, not advice. See “terms” above.