Data Source: Bank of America

Each month, Bank of America conducts a survey of ~200 fund managers with > $600B AUM. Here are the key takeaways from the survey published on Feb 18, 2020:

Outlook:

- Despite concerns about the economy, investors see upside of 2.7% in 2020 for the S&P 500 (to 3470)

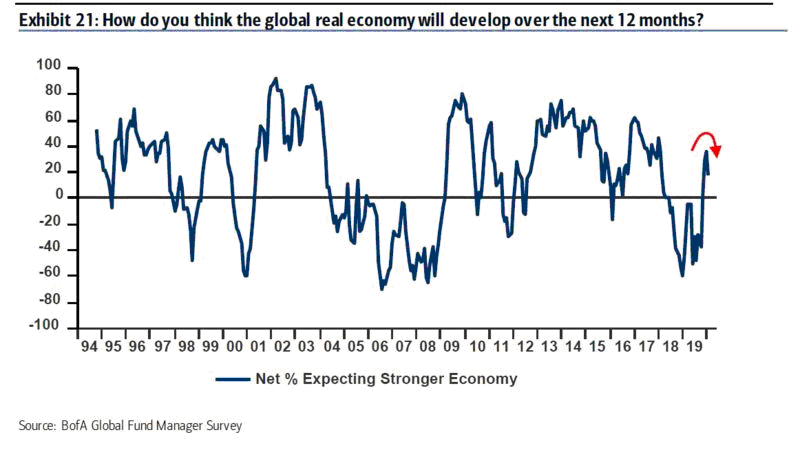

- Net 19% of fund managers had positive growth expectations for 2020 (down from 36% in January).

- Expectations for China fell to a negative 53% from positive 50% due to COVID-19 virus.

- Global corporate profit expectations dropped in February by 12 percentage points from January – to net 15%.

- China GDP growth in next 3 years taken down to 5.2% – lowest since Sept 2015.

Positioning:

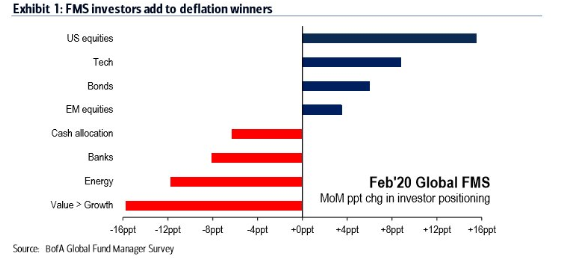

- Underweight Value, Banks and Energy.

- Allocation to banks dropped 8 percentage points in February to net 1 per cent.

- Overweight US Equities, Tech and Bonds.

- Net 6% of investors expect growth to outperform value stocks over next 12 months, the biggest jump in favor of stocks with higher earnings prospects since Dec. 2014 and highest reading since July 2008.

- Fund managers have increased their biggest positions in growth sectors since July 2008.

- Allocation to emerging markets increased by 3% month-on-month to net 36%. This is the highest since March 2019.

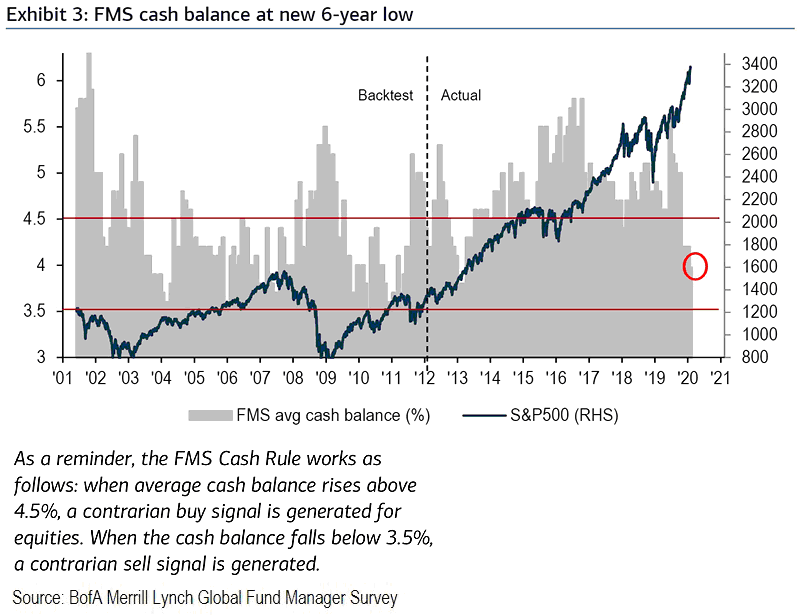

- Investors reduced cash levels to 4% in February, the lowest level since March 2013. This is well below 5-year average of 4.9%.

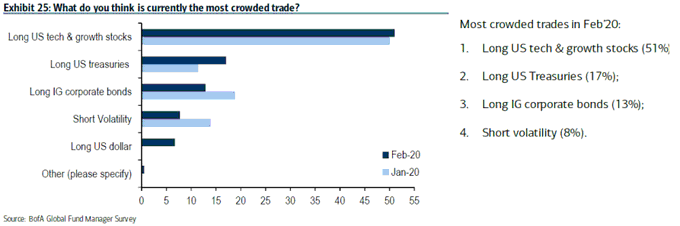

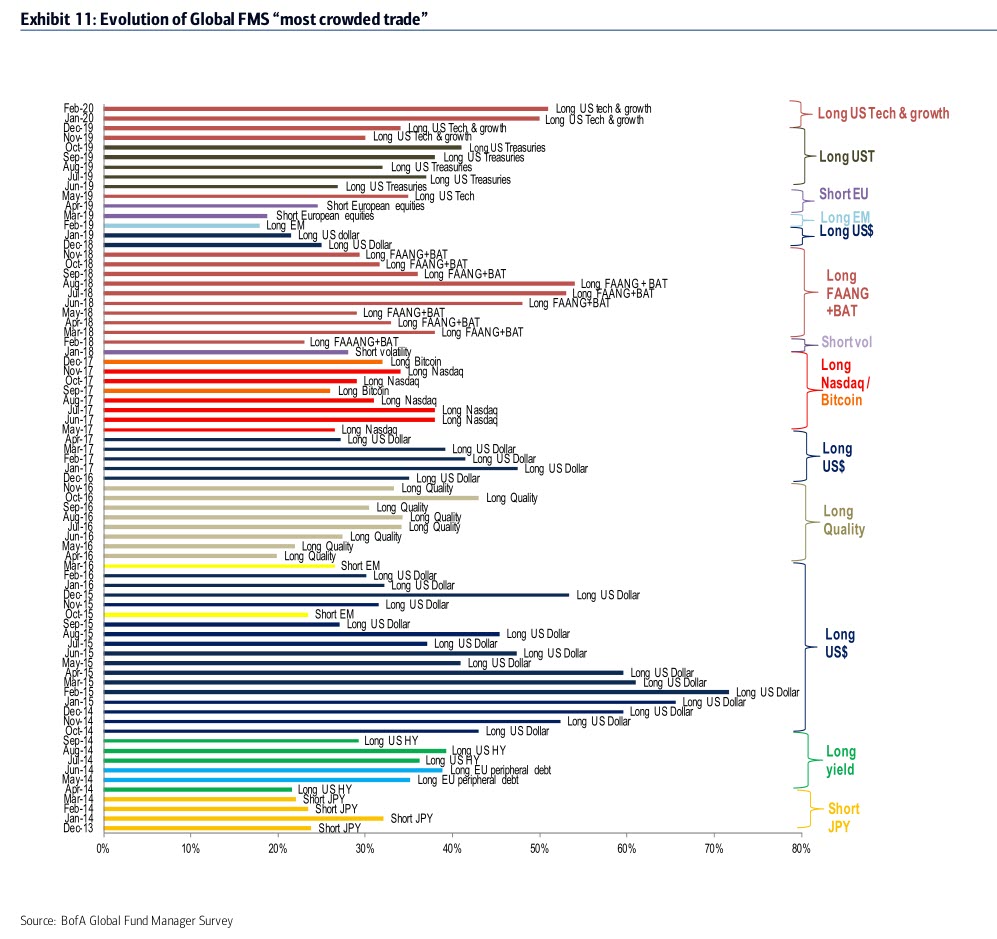

Most Crowded Trades:

- Growth and Tech

- Long Bonds

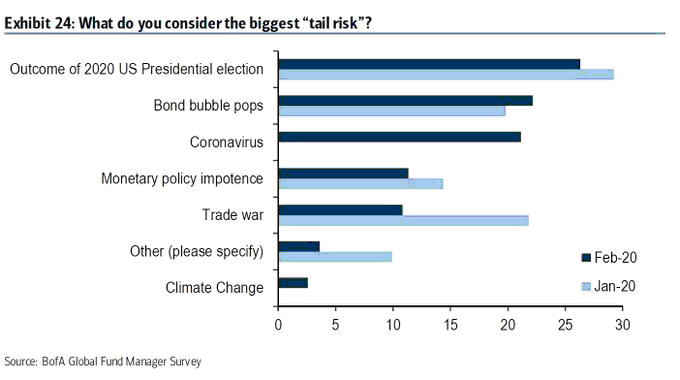

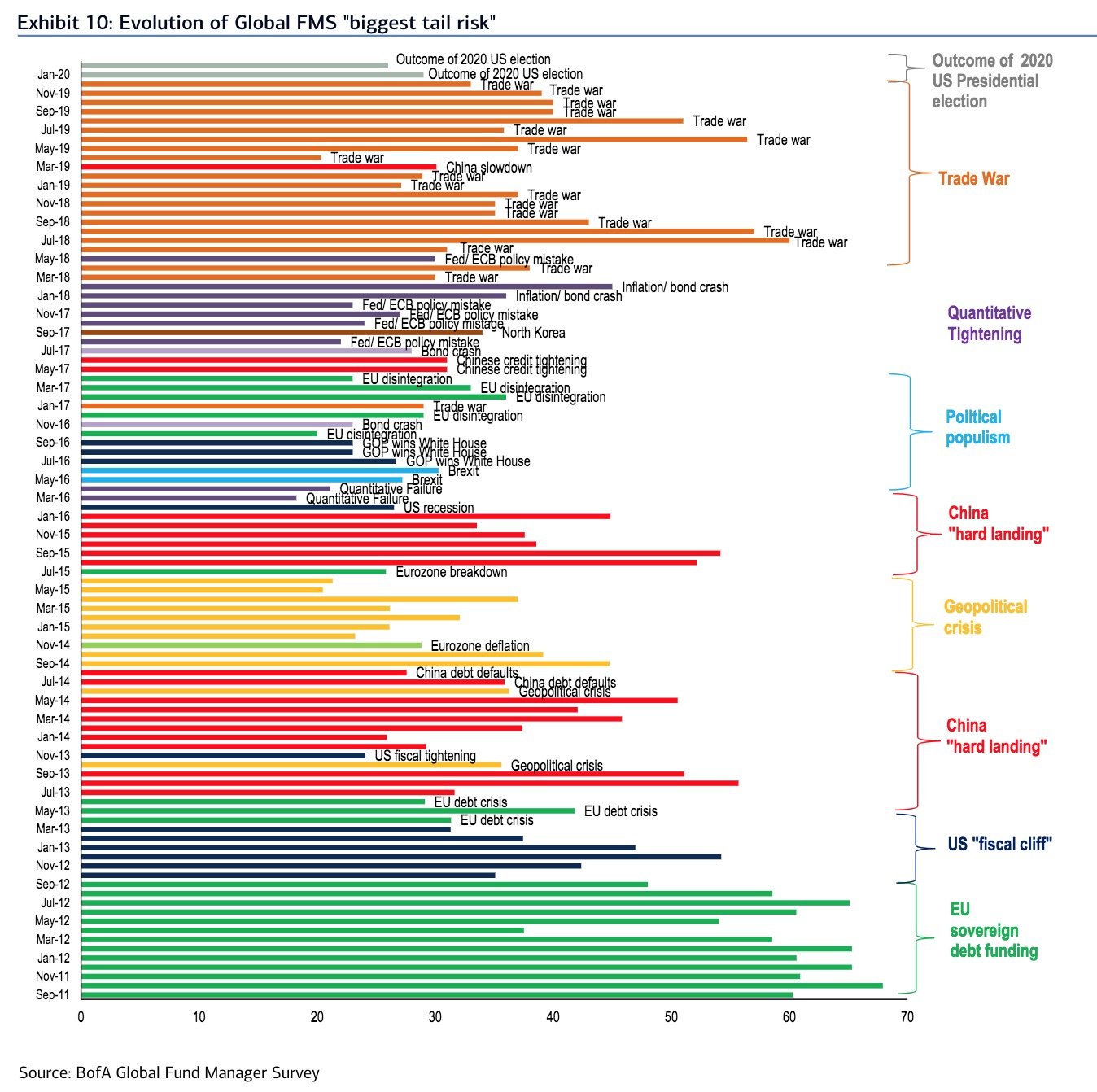

Biggest Tail Risks:

- Election

- Bond Bubble

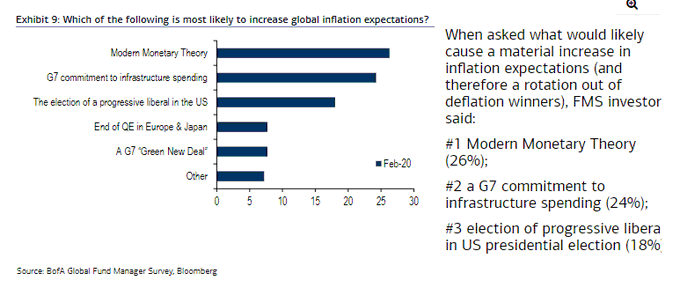

Most Likely to Increase Global Inflation Expectations:

- Modern Monetary Theory

- G7 Infrastructure Spend

- Election of Progressive Liberal in US

US Dollar:

- Net 54% of surveyed investors said U.S. dollar is overvalued. This is the second-highest reading since 2002.