On Tuesday, I joined Kristen Scholer on Cheddar News live from the NYSE. Thanks to Kristen and Ally Thompson for having me on. In this segment we discussed a number of important topics with the KEY being what Chair Powell’s hero (former Fed Chairman Paul Volker) did RIGHT in October 1982 that Chair Powell has yet to do in 2022 (but could in coming weeks (or months)):

Watch in HD directly on Cheddar

Here were my show notes and thoughts ahead of (and since) the segment:

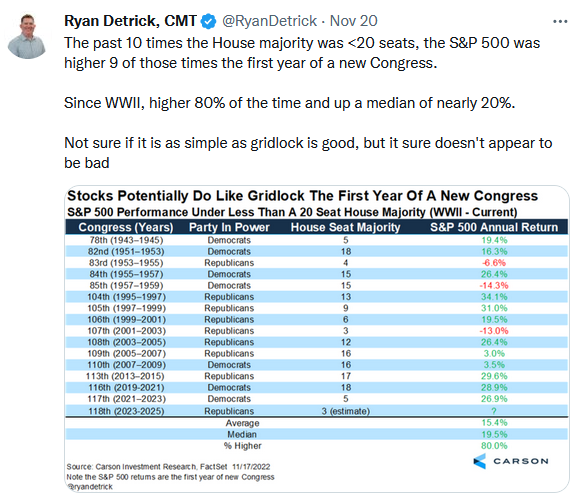

US Mid-term election: Gridlock outcome is bullish for markets – no new taxes/spending/big regulation.

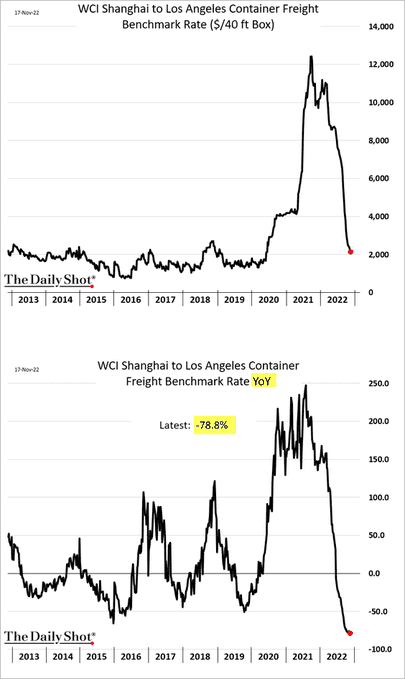

With spending now stopped, the Fed only has one battle (supply driven inflation) which is rolling over on its own:

Seasonal Strength: Market rallies ~18% in 12 months following midterm election. (Nov-May best months of year)

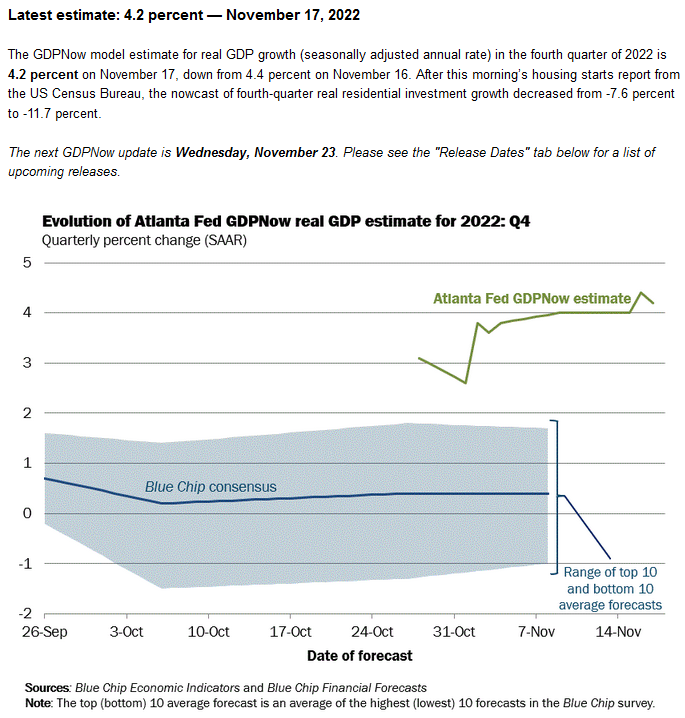

GDP: Atlanta Fed GDPNow tracking at 4.2% for Q4.

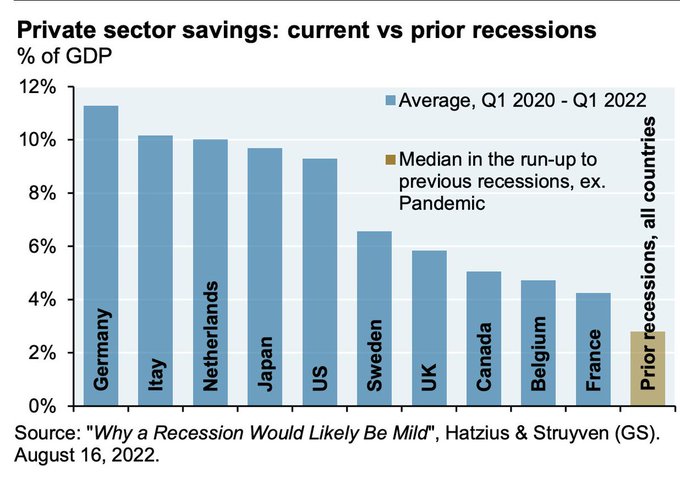

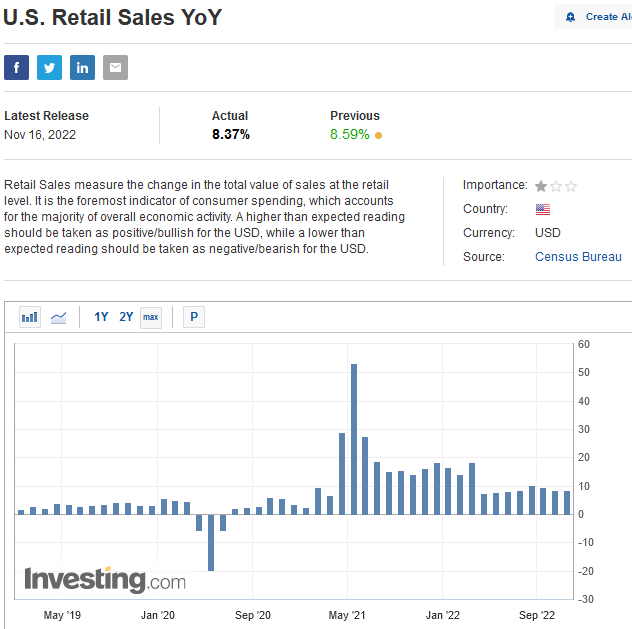

Consumer is strong: Excess savings, strong retail sales.

Source: Goldman Sachs via Seth Golden

Retail Sales remain above trend:

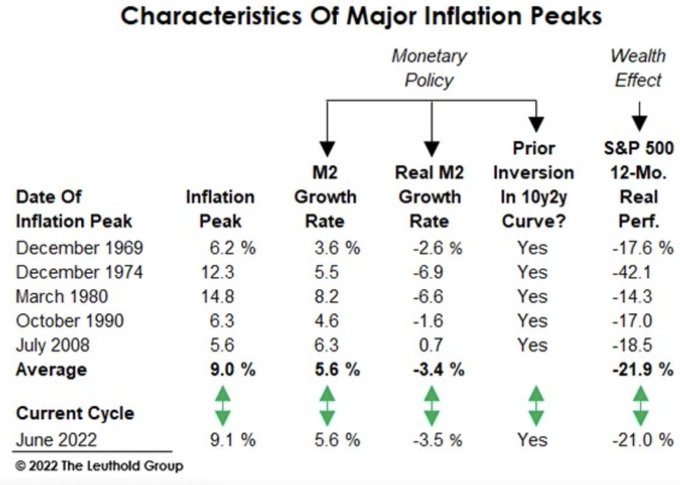

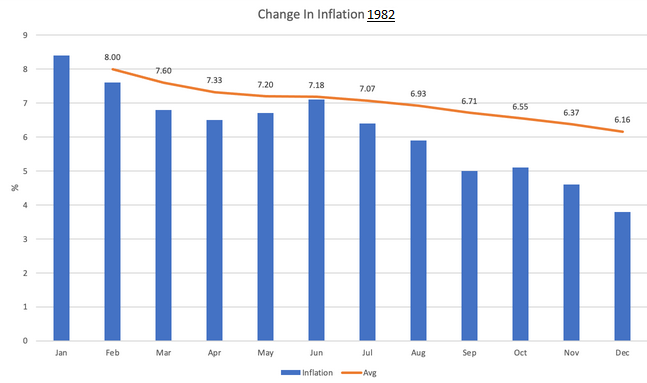

Inflation has peaked:

Inflation has peaked:

Leuthold Group via Seth Golden

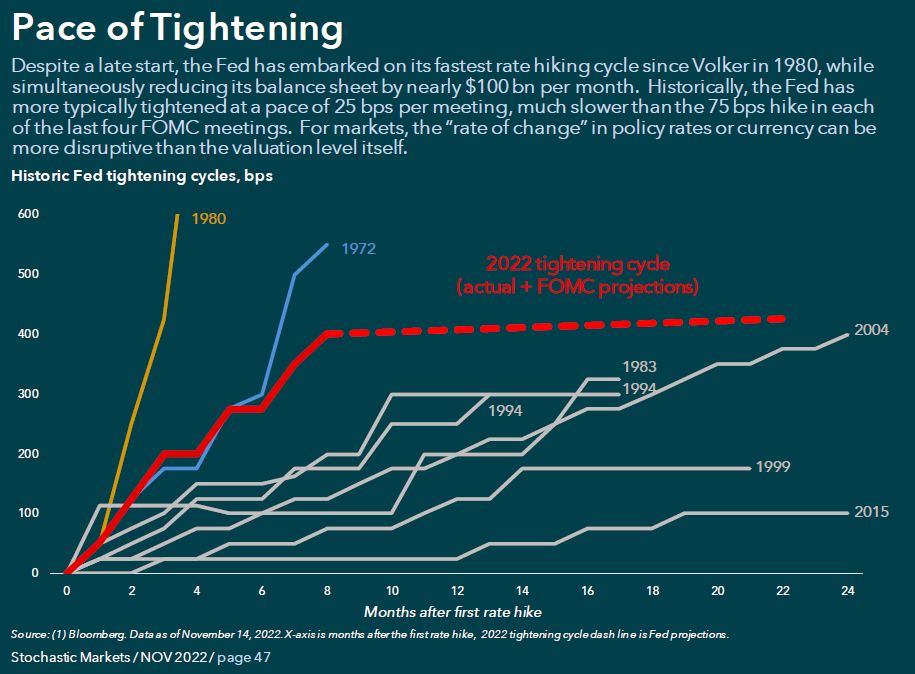

Fed Slowdown (50bps in Dec) followed by possible 25bps 2023 – then pause.

First dissenting voice showed by Mary Daly (San Francisco Fed Pres) Monday when she said in a prepared speech, “Markets are acting like the Fed Funds Rate is around 6%” (i.e. financial conditions much tighter than current 3.75-4% FFR). Her 6% “Proxy” rate (as she named it) happens to be right in line with the core inflation rate.

Earnings: Grew 2.2% in Q3 v. 2.8% estimated. 2023 estimates have come down ~8% over the last 6 months (from $252 to $232).

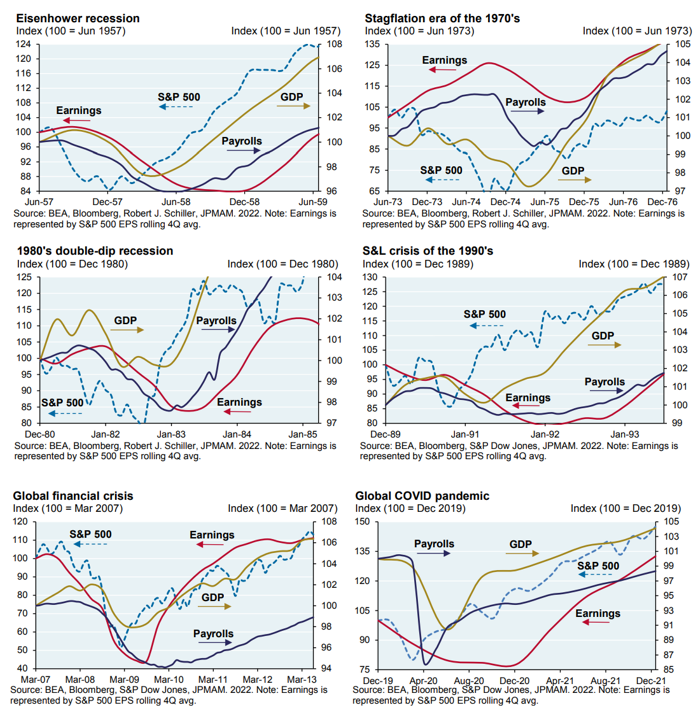

Most analysts are calling for earnings to come down another 20% and are therefore bearish on the market. History shows the stock market bottoms WELL BEFORE earnings. In most cases the S&P 500 had recovered to new highs by the time earnings bottomed 6-12 months later: 1957, 1974, 1982, 1990, 2009, 2020.

Those calling for a recession MAY be right, but with a 25% peak to trough move in the S&P much of the pain (to equity prices) may be already priced in. The market is a discounting mechanism and just as it crashed before the economic pain (earnings deterioration), it will rise well ahead of the economic recovery. In other words, the stock market can go up even as the Fed achieves its goal of putting people out of work.

Get ahead of it:

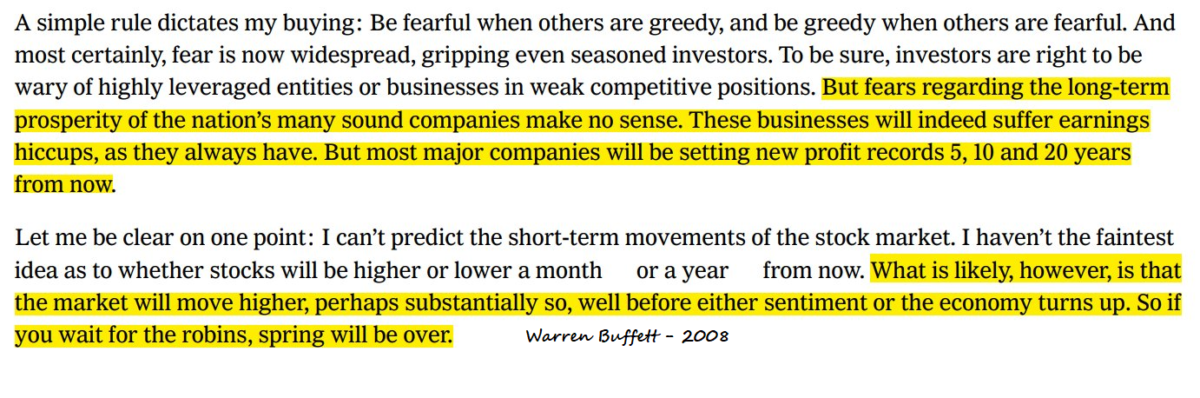

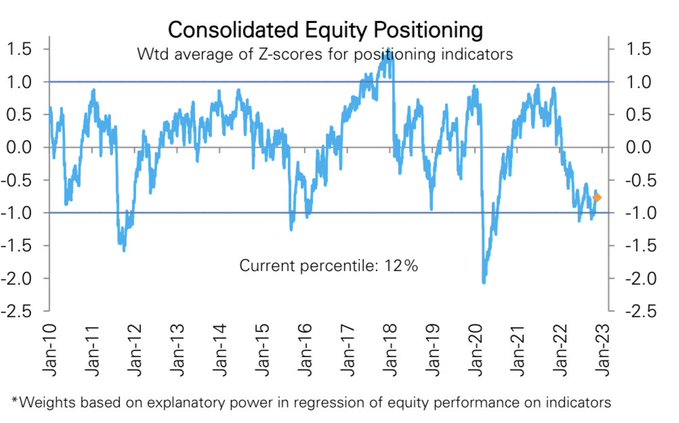

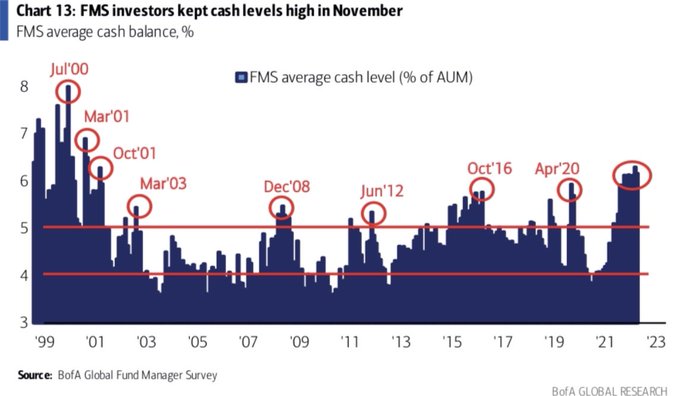

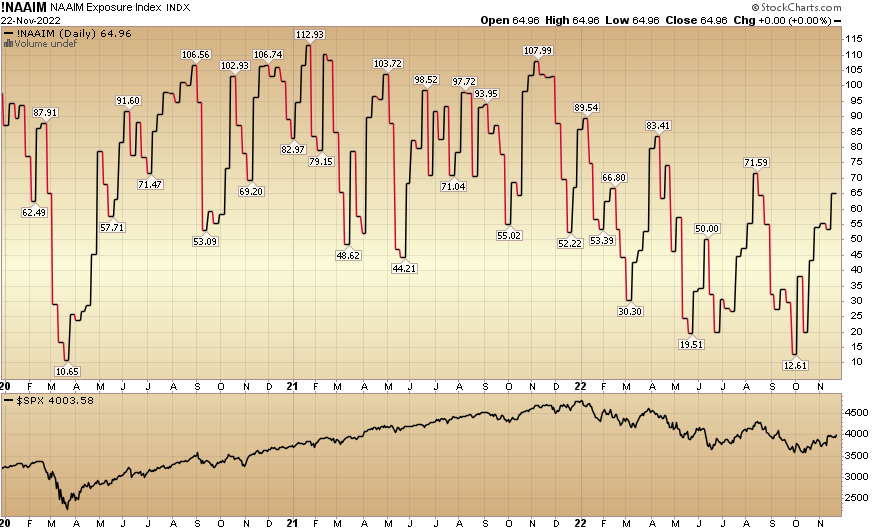

As Warren Buffet says, “if you wait for the robins to sing, it’s already Spring (and you missed it).” So while managers are still sucking their thumbs sitting in cash, know that the “Pain Trade” is UP, not down (despite any short term noise).

Source: Deutsche Bank

No one is positioned for any possible good news and the BAD NEWS is already known

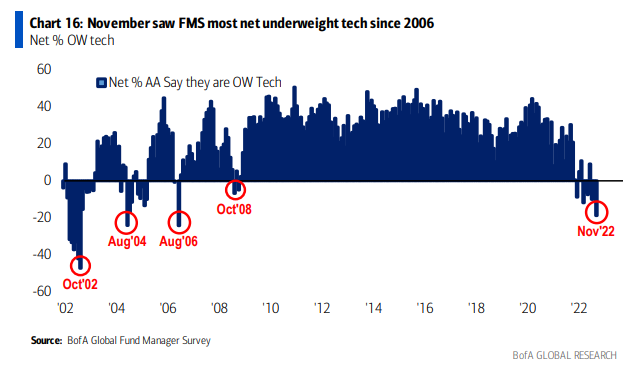

Tech:

Managers are the most underweight Tech since 2008:

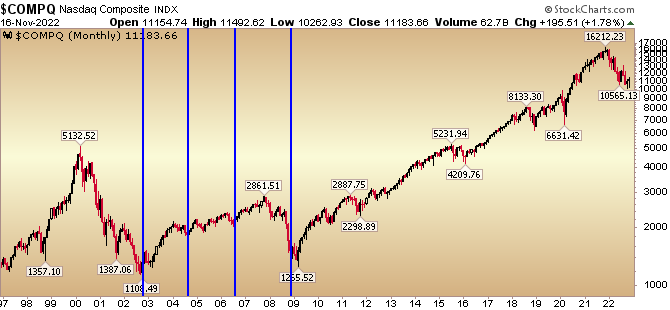

If you were buying high quality tech the last four times managers were this underweight (2008, 2006, 2004, 2002), you made money (see blue lines to the month) below:

We added select tech/semis in decent size for client portfolios in October. It seems Warren Buffett had similar thinking with his recent $4B purchase of Taiwan Semi (21% 5yr EPS growth rate – trading at 13.5x next year’s earnings). While most investors were CONVINCED China would attack Taiwan imminently, Buffett swooped in to be “greedy when others were fearful.”

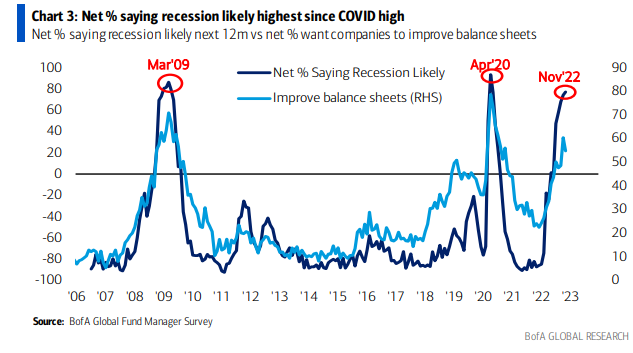

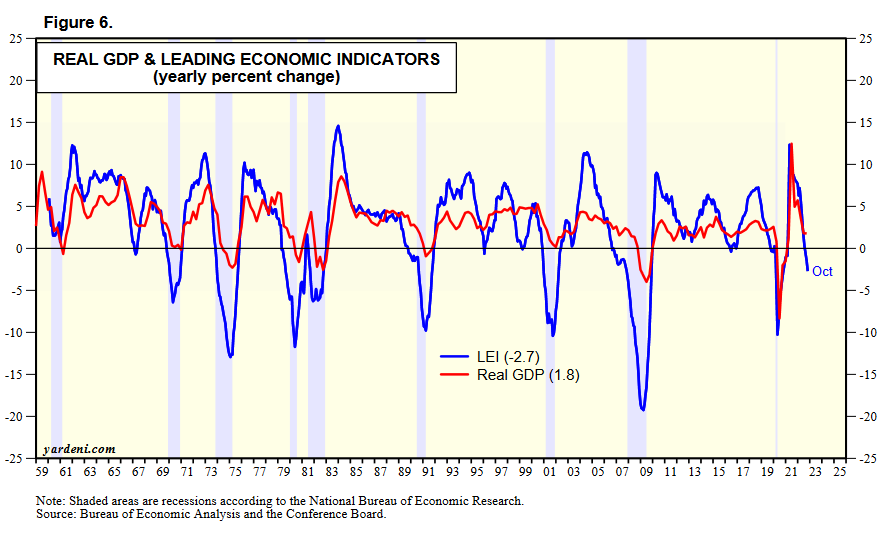

Recession Fears:

Recession Fears:

Managers are as scared of a recession today as they were in April 2020 and March 2009. While they were RIGHT to be scared, they were WRONG to be in record CASH as the stock market bottomed BEFORE the recession was declared (March 2009 bottom, March 2020 bottom):

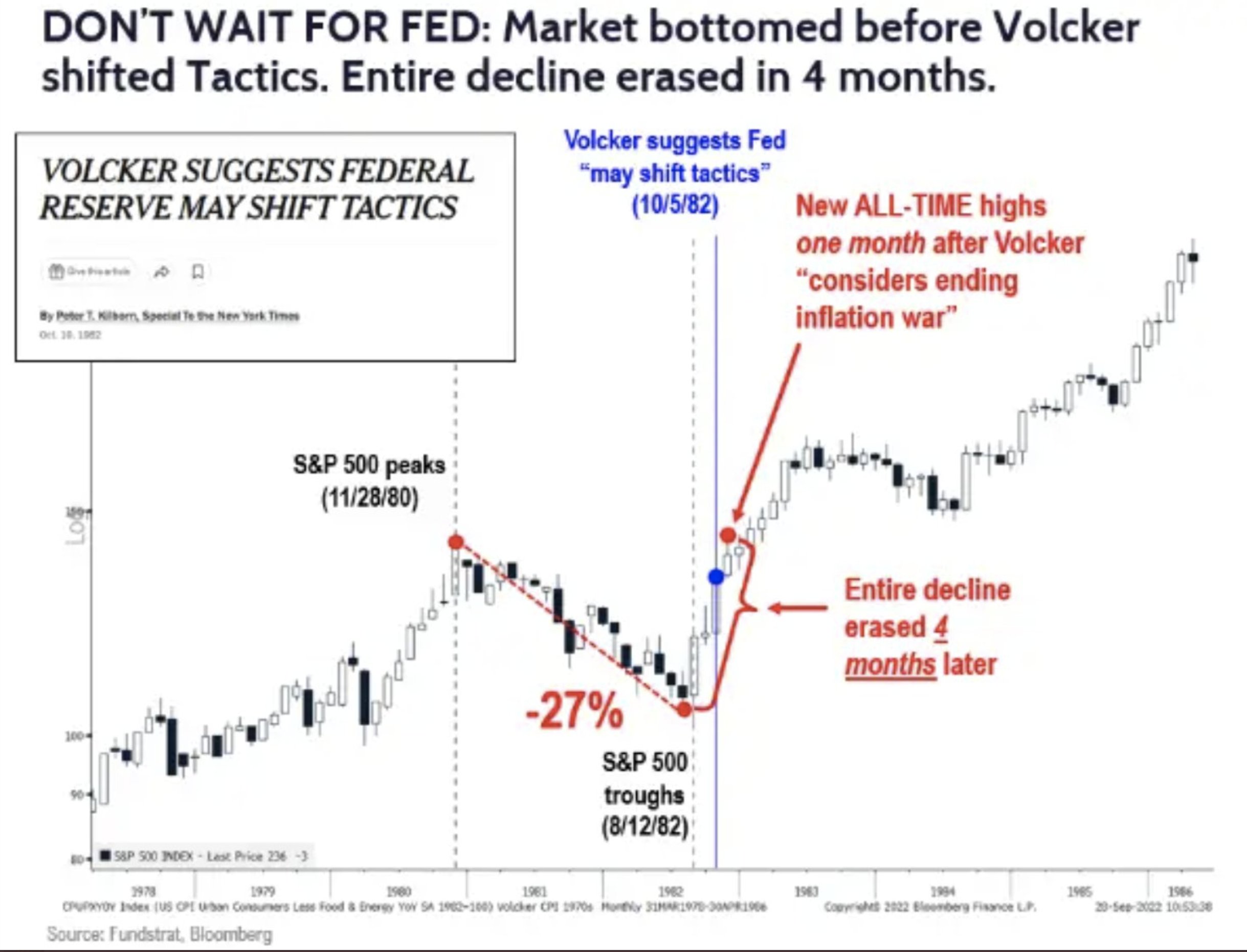

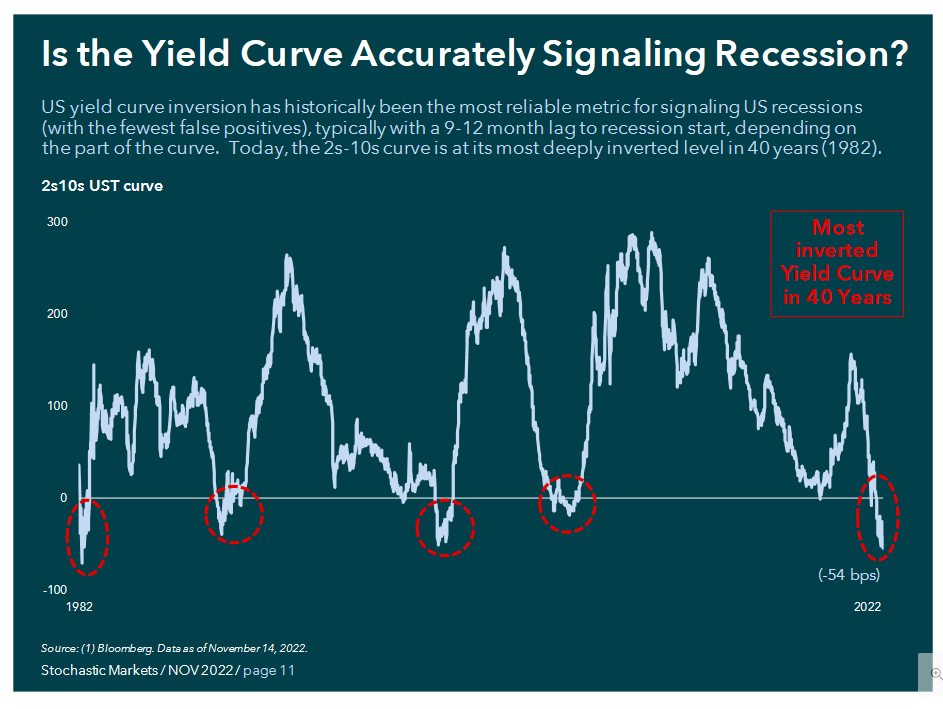

1982:

S&P dropped 27% when Volker was tightening in 1981-1982. Market bottomed in August 1982 when inflation was still at 6.93%. On October 5, 1982 (while inflation was still 6.55%), Volker said he “may shift tactics.” The stock market recovered 100% of the losses within 4 months and went on to make new ALL-TIME highs the next year.

Bottom Chart Source: Fundstrat

While Powell has acknowledged the “lagged and variable effect” of aggressively tightening monetary policy, he has yet to change his behavior. That may change soon, but it hasn’t changed yet. Perhaps one of the hundreds of PhD’s at the Fed will understand this chart properly and explain it to the FOMC like a parent trying to get their three year old to eat broccoli:

It doesn’t take a football field of PhD economists at the Fed to understand that the emergency tightening has been sufficient to destroy demand and we will unequivocally see the effect in the economy on a lagged basis. It’s time to cool down with the over-steering. They have already “overshot” (not on the basis of current numbers, but on the basis of what they will see in the economy on a lagged basis):

NOTE THE YIELD CURVE INVERSION IN 1982 AND WHAT HAPPENED TO MARKETS NEXT (above 1982 chart)…

Pace of tightening similar to early 80’s:

Source: MUFG (Joyce, Orr, Kendal)

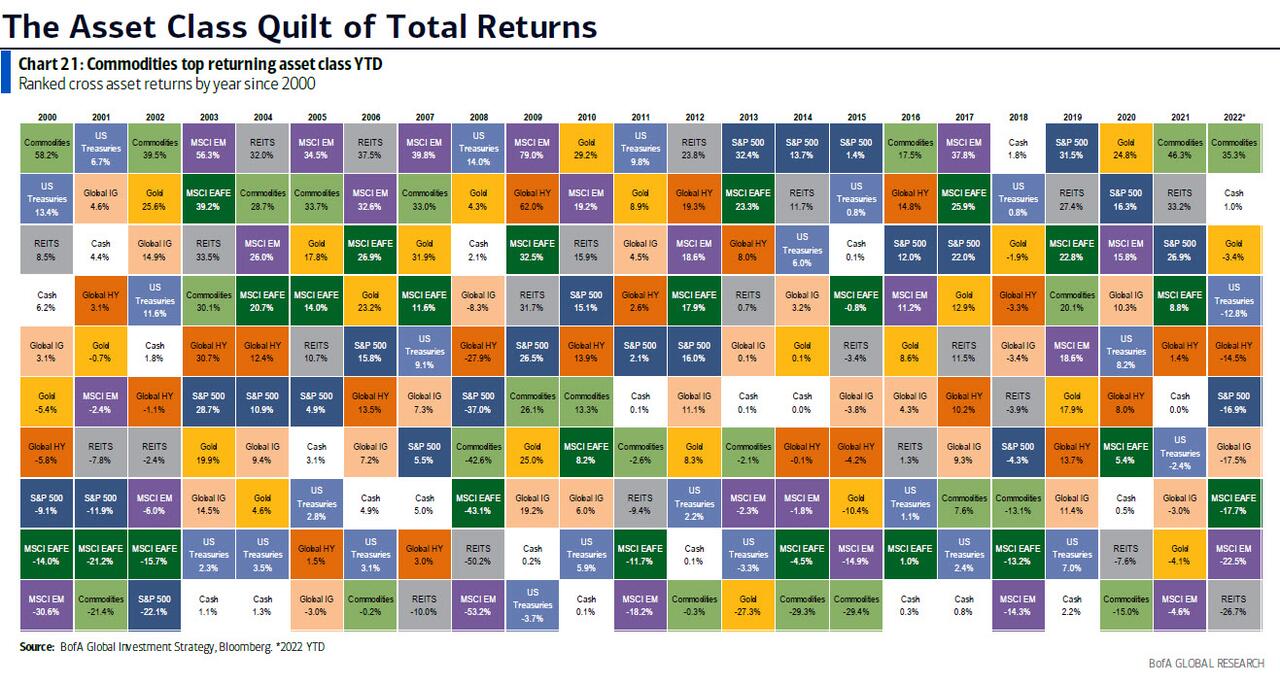

What will work in 2023

If you want to know what will perform well next year, start by looking at what performed poorly this year (Emerging Markets and REITS). As you look year by year, see what were the worst performers and how they performed in subsequent years:

This is a similar “reversion strategy” to the “Dogs of the Dow” whereby at the end of each year you invest in the 10 highest yielding (usually worst performing) stocks of the DJIA and overtime it outperforms the DJIA and S&P 500. There are variations, but the key is the mean reversion concept.

Now onto the shorter term view for the General Market:

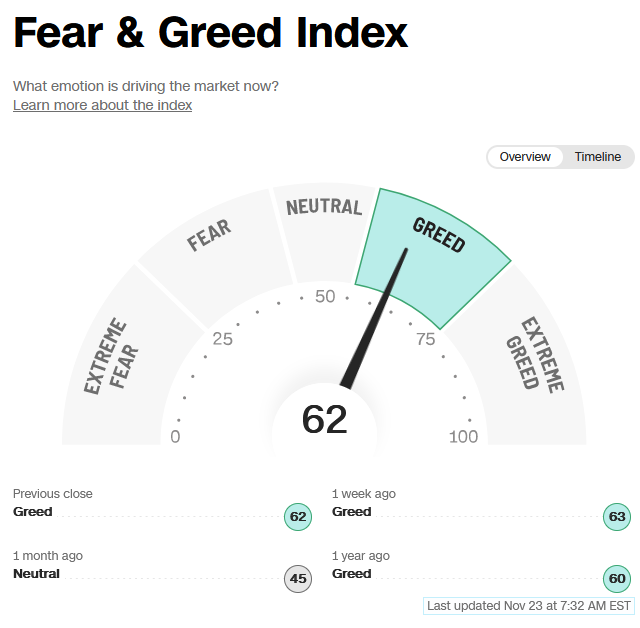

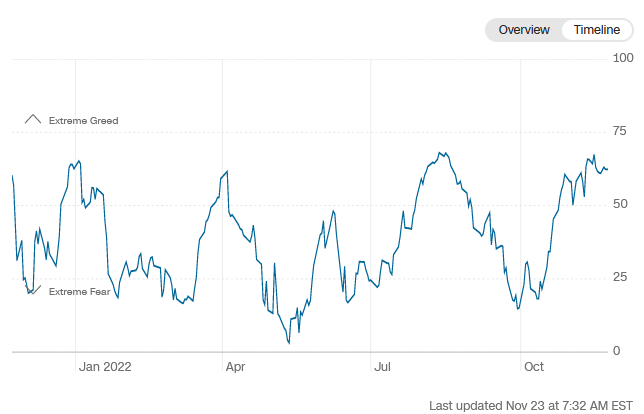

The CNN “Fear and Greed” ticked down from 65 last week to 62 this week. Sentiment is slowly stabilizing. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 64.96% this week from 53.33% equity exposure last week:

Our podcast|videocast will be out early this week (today). Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, not advice. See “terms” above.