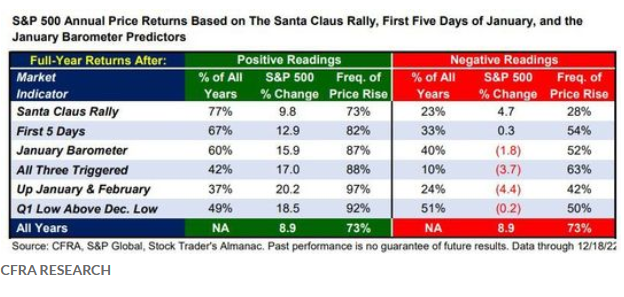

Santa managed to kick the Grinch out of the sleigh and deliver positive returns for the SCR period (last 5 trading days of 2022 + first 2 trading days 2023). As you can see above, we needed to close Wednesday above 3822 on the S&P. It closed at 3852. The period (from Dec. 23 thru Jan. 4) closed with a gain of +0.80%. What are the implications?

According to CFRA Research, since WWII the average returns for the following 12 months are 9.8%. That exceeds the average return of 8.9% in any year.

If we can add to that momentum the “First 5 Days” (i.e. finish ytd. positive on Monday), average returns increase to 12.9% for the following 12 months.

If we have a positive January, that average bumps up to 17% (when all 3 hit).

And finally, if we tack on a positive February, the average returns are 20.2%.

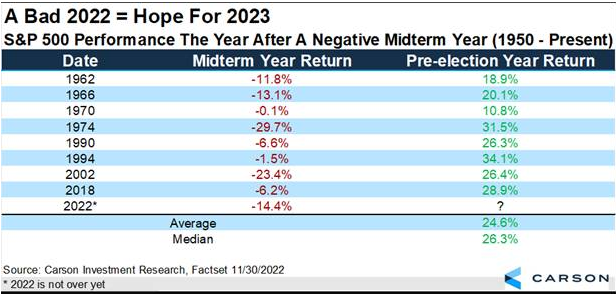

The key here is not to be fooled by randomness, but rather use history as a barometer to determine if something has changed (after a down year), or if it’s more of the same.

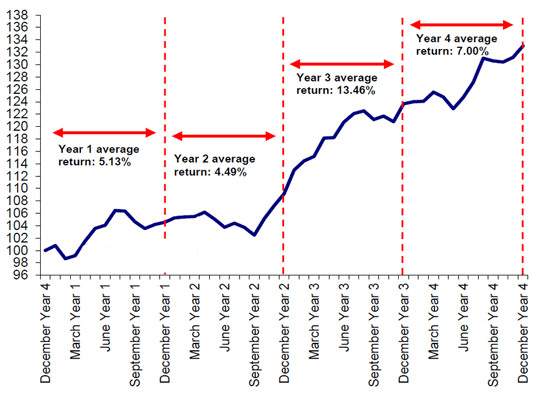

One point I’ve spent a lot of media time on of late is the Presidential Cycle. While pessimism prevailed in the back half of December, I pointed to the historical precedent that speaks to strength, not weakness in the first two quarters after a mid-term year (year 3 of the 4yr Presidential cycle).

These are all averages and there are always exceptions, but if you ask me if I want to play golf in Algarve in May or in January, I’m taking May (seasonality) every single time. What do you do?

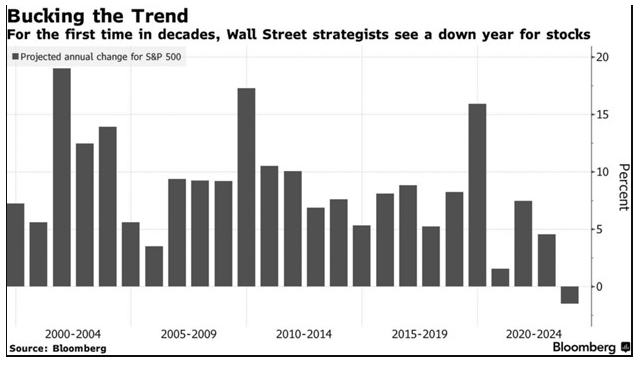

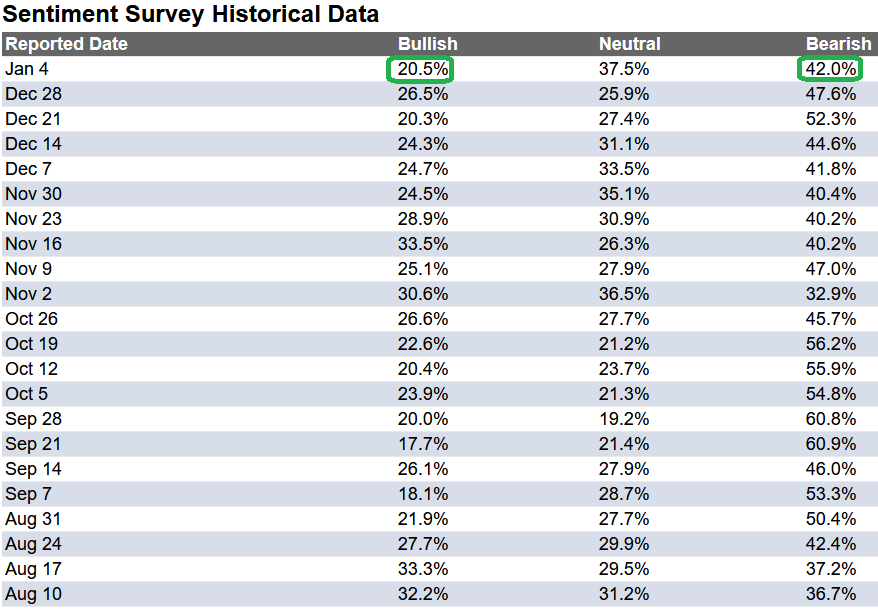

Based on the sentiment and positioning coming into the new year it appears there are quite a few money managers who book golf excursions to Scotland in the middle of January:

Source: Carson, Ryan Detrick, Bloomberg

These “winter golfers” are the same cadre of people who had consensus 5,250 targets on the S&P coming into 2022 (we got 3800 instead), and now are all convinced we’ll going to hell at 3,200 on the S&P in 2023. If you have that view, you’re consensus. Most pro’s can’t read triple break puts, but quite a few analysts are convinced they’re going to drain this one:

Anything is possible, but as we frequently say on our weekly podcast|videocast, “amateurs deal in absolutes, professionals deal in probabilities.”

Just as the herd called China “un-investable” in 2022, they are now trampling all over themselves to get a piece of the action with names like Alibaba (our largest holding), now up ~80% off of the October lows:

Here’s a clip from an interview I did near the lows in October on CNBC Asia. Will is one of the best anchors in the business, and you can see that he is chuckling out loud about the idea of buying Alibaba with all of the pessimism that was present at the time. Incidentally, Boeing is up very nicely since that interview as well:

My friend Philip – who is a great investor himself – sent me an article over the weekend that included a list of traits among the best investors of all-time:

Never forget, “Opinion Follows Trend…”

If the market goes up from here, the “3,200 camp” will miraculously become the “5,200 camp” all over again (but only after the majority of the move has already been made).

Time will tell…

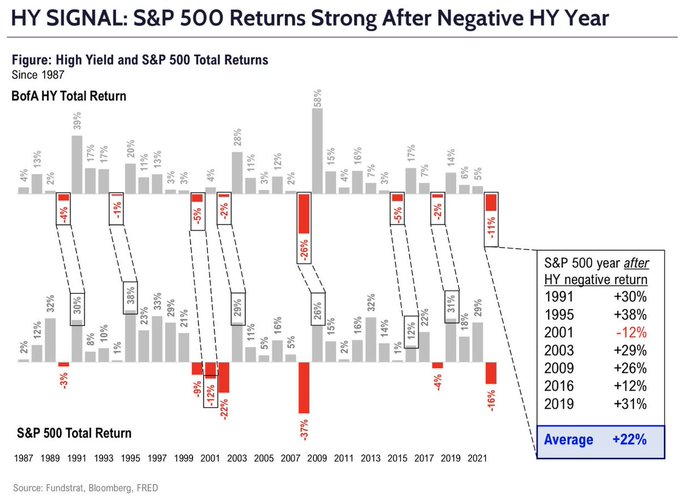

Fundstrat put out a table that shows equity returns tend to be well above average in years following a negative year for high yield bonds (like we had in 2022). Here’s the data:

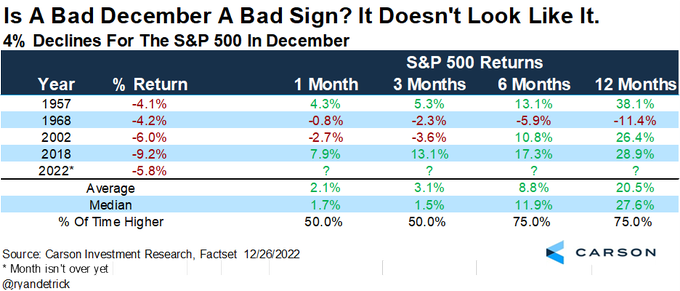

This level of return is consistent with the returns outlined by Carson showing average returns following a December that is down greater than 4%:

Just as our leaning into Emerging Markets/China trade was predicated on the dollar weakening (when everyone was long and it was the “most crowded trade” in mid-2022), our general optimism as it relates to the markets (in the face of mass pessimism) is partly predicated on:

- The impact of the second largest economy in the world reopening “overnight” (China) and hitting new 5% GDP targets in 2023 (a rising tide will lift all boats)…

- The impact of the dollar decline at current levels should have a POSITIVE ~5-8% impact on 2023 S&P earnings – which is not yet reflected in estimates.

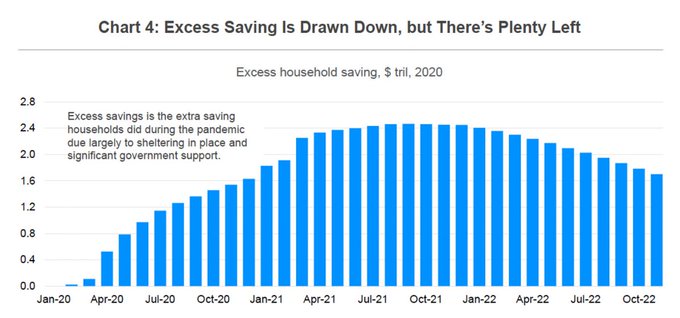

Barring a fatal error by the Fed (hiking excessively versus pausing at high levels), the consumer will be able to hold on through a modest slowdown:

Source: Seth Golden

There is ample cushion to weather a tropical storm (not a hurricane). That’s up to the Fed…

Will The Fed Break Everything?

Possibly. But we have to keep in mind, the voting composition of the FOMC becomes more dovish effective this month:

Source: Bloomberg

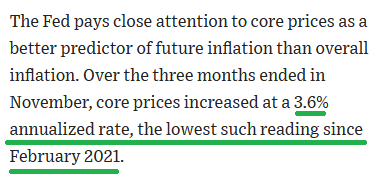

We also have to consider that this is the same body of “experts” (FOMC) who forecasted a Fed Funds rate no higher than 1% going into 2022. At this time last year, the stock market was at all time highs and this group “predicted” that inflation would fall to 2% by the end of 2022 with a 1% Fed Funds rate. They also said GDP for 2022 would be 4%. Now they are calling for a 5.1%+ Fed Funds Rate (and no cuts in 2023) and everyone believes they will be right (they are banking on it like gospel – with their defensive positioning).

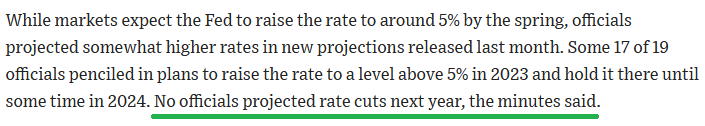

Here’s the latest take from “Fed Whisperer” Nick Timiraos at the WSJ (following the December Fed Minutes release on Wednesday):

FAMOUS LAST WORDS:

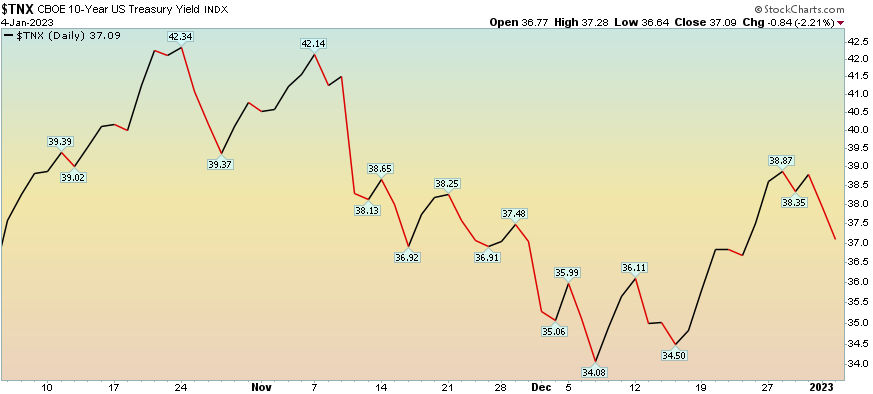

The bond market has been calling B.S. on this fantasy since November:

Some would say this projection (raising and holding rates well above 5% with no cuts in 2023) is “funny” given their recent accuracy (or lack thereof) with predictions. As Joe Pesci queried in Martin Scorsese’s classic film Goodfellas, “funny how?”

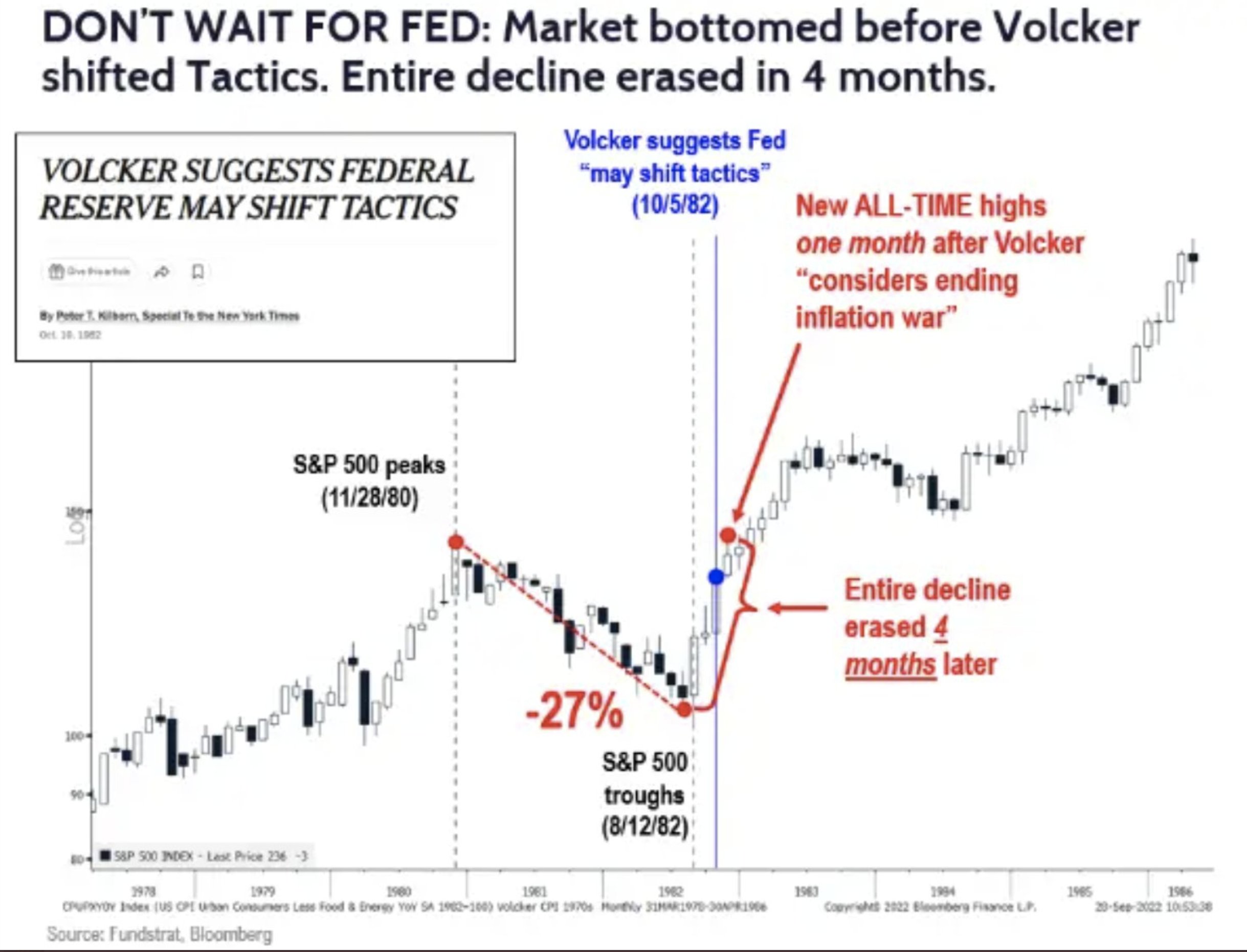

Just as 1982 “Keep At It” Volker was a Hawk until he switched overnight to 1982 “May Shift Tactics” Volker, Powell will be no different. There will be no invitation in the mail giving you a heads up and inviting you to buy equities a few weeks ahead of time. When it happens, it happens all at once (in this instance [1982] the flip happened while inflation was still hovering near 7% and heading down):

Source: Fundstrat

Salesforce cut 10% of their workforce (8,000 people) yesterday. Amazon just cut 18,000 jobs (more than planned) overnight. Now that it’s January (no one cuts before the Holidays – except META who did 13,000), expect a slew of these type of announcements in coming weeks (ahead of the February Fed meeting). If you are wondering what will cause the Fed to blink/pause and feel the wrath of influential, angry politicians, now you know. It’s coming…

The Last Shall Be First

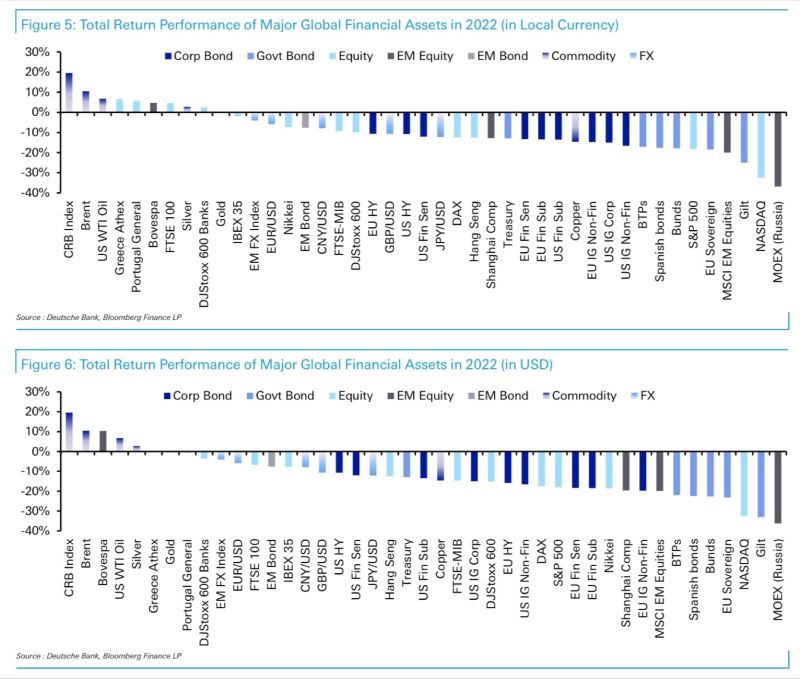

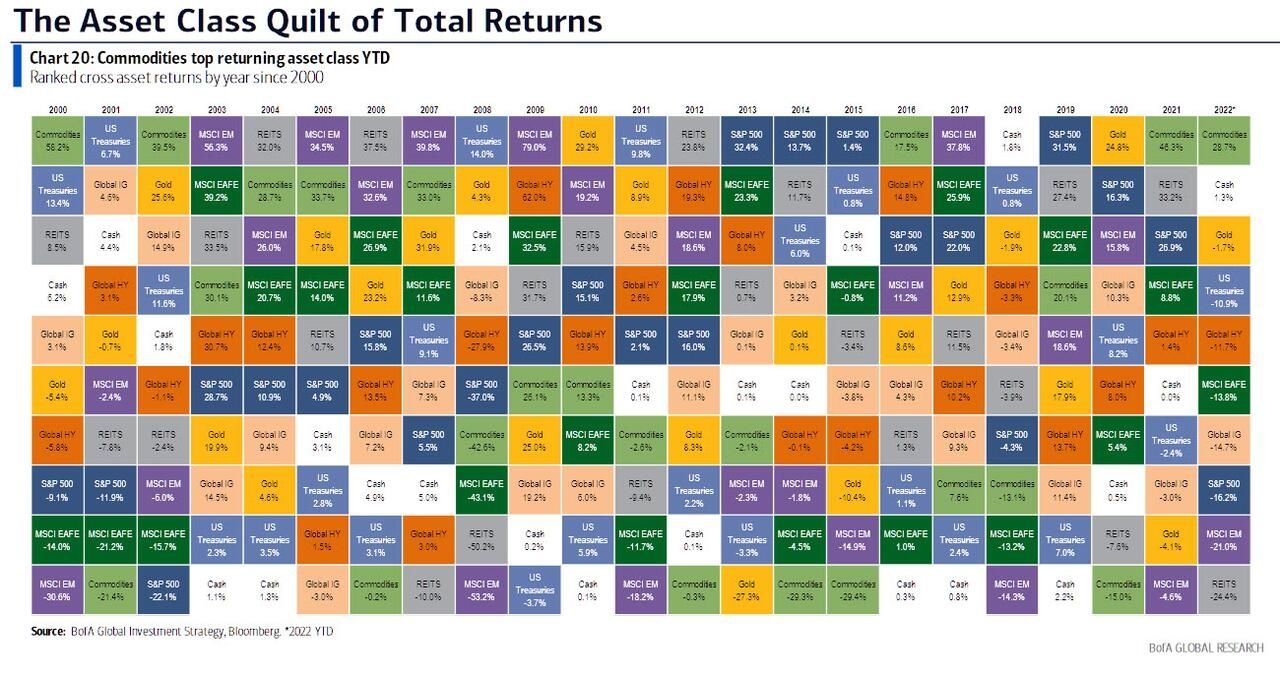

As we’ve covered in our past podcast|videocast‘s, the place to begin looking for what will outperform this year is what under-performed last year:

If you look at the color mosaic below, it’s plain to see that those asset classes that finish at the bottom one year don’t tend to stay there very long:

We’ve covered our 2023 focus in recent episodes of our podcast|videocast(s).

Now onto the shorter term view for the General Market:

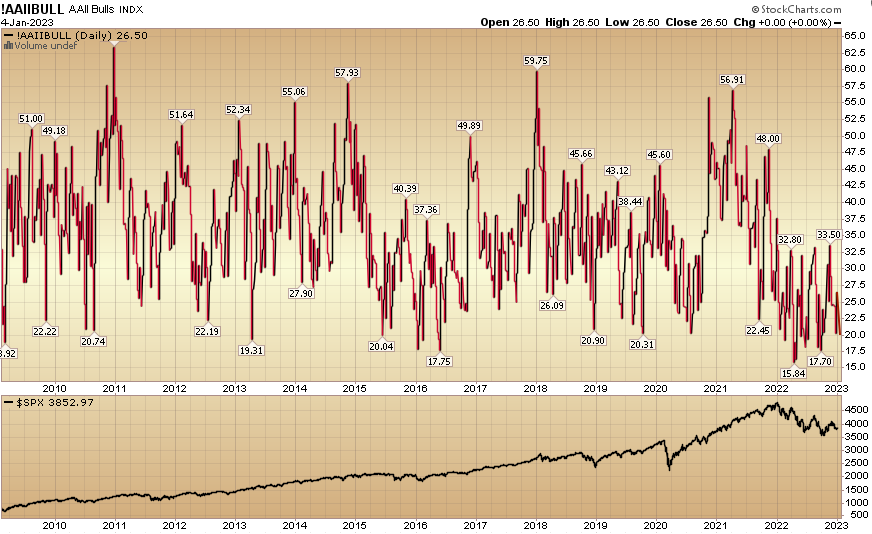

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) collapsed to 20.5% from 26.5% the previous week. Bearish Percent also fell to 42.0% from 47.6%. Sentiment is still scared for retail traders/investors.

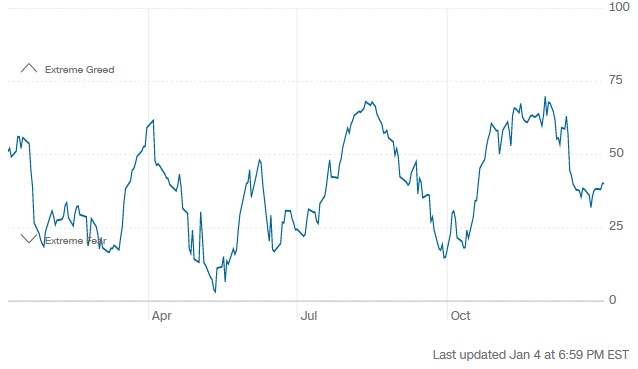

The CNN “Fear and Greed” rose from 31 last week to 40 this week. Sentiment is still fearful. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” rose from 31 last week to 40 this week. Sentiment is still fearful. You can learn how this indicator is calculated and how it works here: (Video Explanation)

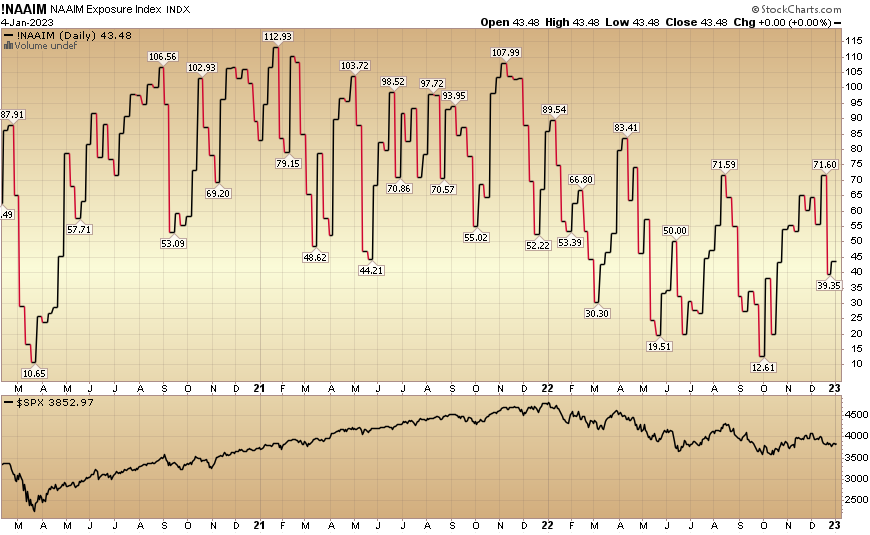

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 43.48% this week from 39.35% equity exposure last week.

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 43.48% this week from 39.35% equity exposure last week.

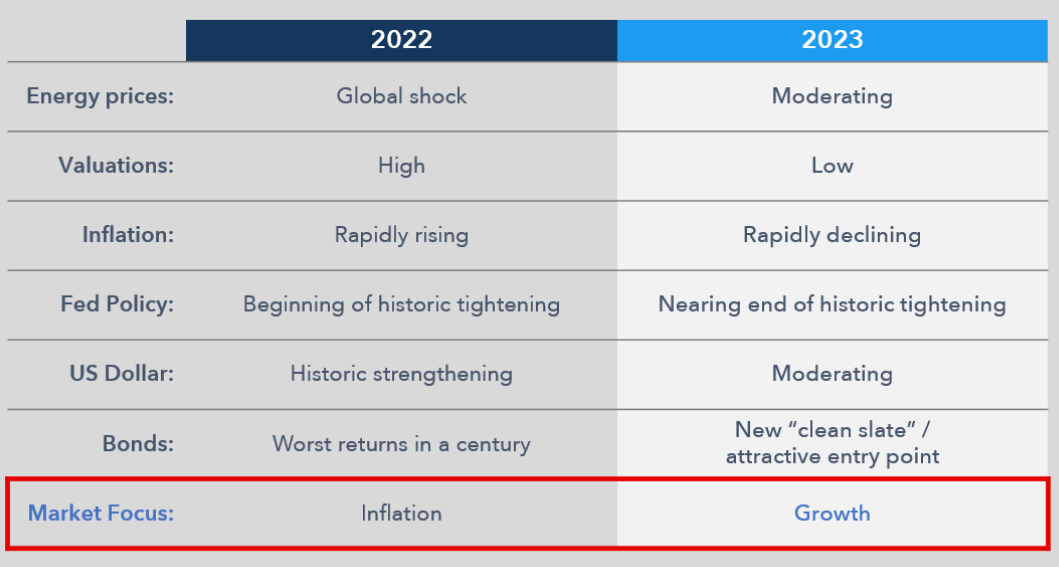

As we wade into 2023, bear in mind that as the calendar has changed, so have conditions. Be open to all possibilities as the weeks unfold:

Source: Mitsubishi UFJ

Our podcast|videocast will be out today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, not advice. See “terms” above.