In early 2019, during his 2018 annual letter, annual meeting and media appearances surrounding it, Warren Buffett made a few key points that seem more salient today than ever before:

On March 11, 1942 – at age 11 – Warren Buffett purchased his first shares in a business. At the time of the 2018 annual letter (early 2019) 77 years had passed since this purchase. He made this analysis:

“Those who regularly preach doom because of government budget deficits (as I regularly did myself for many years) might note that our country’s national debt has increased roughly 400-fold during the last of my 77-year periods. That’s 40,000%! Suppose you had foreseen this increase and panicked at the prospect of runaway deficits and a worthless currency. To “protect” yourself, you might have eschewed stocks and opted instead to buy gold…”

Here’s what happened over the 77 years from March 11, 1942 – early 2019:

$10,000 invested in GOLD became:

$400,000

The same $10,000 invested in the S&P 500 (with dividends reinvested) became:

$51,000,000

On Monday, I was on Fox Business with Liz Claman on the Claman Countdown. Thanks to Liz and Ellie Terrett for having me on. I was asked to speak on former President Trump’s comments from earlier in the day (when he said):

“Bitcoin, it just seems like a scam,” President Trump said.

“I don’t like it because it’s another currency competing against the dollar,” President Trump continued. “I want the dollar to be the currency of the world.”

The key point I made was that most “rational” participants are buying bitcoin as an inflation hedge against government fiat money printing. However, history has proven that PRODUCTIVE assets that have yield are a better inflation hedge than non-productive/speculative assets in the long term.

If President Trump is correct (that bitcoin is a scam), that “scam” could possibly get even more irrational longer than the doubters can remain solvent. 400 years ago we had “Tulip Mania” in which the price of a “scarce” Tulip Bulb reached the value of an average house in Amsterdam – or about ~$350,000 in today’s terms – before crashing and never recovering.

Whether bitcoin lasts as a store of value as gold has, we continue to believe that productive assets will ALWAYS outperform non-productive assets in the long term regardless of how irrational prices become in the short term.

Even if bitcoin becomes a long term store of value as gold has (you have maintained your purchasing power owning gold over cash), the question is HOW MUCH WILL YOU LOSE over time owning non-productive/speculative assets? In the case of $10,000 in gold or the S&P 500 index, it was >$50,000,000. What will it be with bitcoin?

No one knows, but my bet is that the biggest companies in the biggest economy in the world will have more pricing power than a digital currency over time. There may be a limited supply of bitcoin, but there is an unlimited supply of digital coins. As of January 2021 there were over 4000 digital coins.

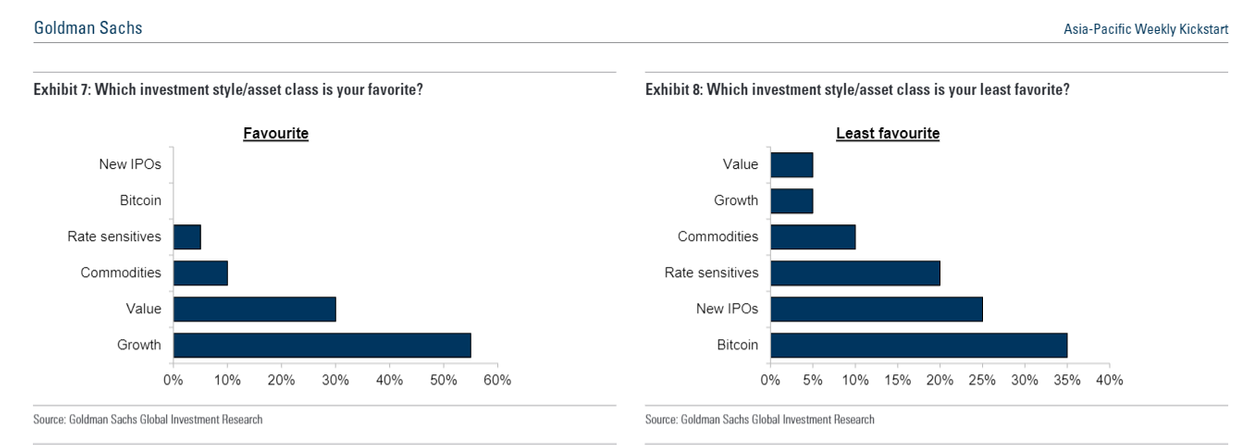

So far, institutions aren’t buying it. That may change, but it hasn’t changed yet:

The old saying is that if you own gold you will be able to purchase the same suit 50 years later (with the same amount of gold). While that has held true, and gold HAS preserved purchasing power, had you just owned productive assets instead, you could have OWNED the entire suit factory!

Jobs and Taper

On Friday I was on Fox Business with Liz Claman on the Claman Countdown. Thanks to Liz and Ellie Terrett for having me on. I was asked to speak on the Jobs report, Fed’s next move, and what’s “the trade” moving forward:

The jobs miss on Friday morning (559k v 650k est) is the second in a row (last month 266k vs 978k est). With the exception of two weeks ago, continuing claims have come in higher than estimates every week for months (including yesterday’s miss). Leisure and hospitality increased by 292,000 (biggest gainer).

In response to last month’s disappointment, 24 of the 50 States have extinguished the Federal extended unemployment benefits in the past month. This helped the “miss” narrow, but 26 of the (most populous) states will keep the Federal benefits through September expiry. This means that jobs reports will likely remain subdued through October.

GOOD NEWS: This gives the Fed cover to defer Tapering until Q1 2022. Consensus had been that Tapering would begin in Q4 after August jawboning. It now looks like that will be pushed back – particularly as we are seeing most commodities (ex-energy) weaken in the past few weeks.

Also keep in mind Chair Powell is up for re-appointment in February. It is unlikely he would want to cause market turmoil ahead of time (unless inflation got out of control – which is unlikely once base-effects are worked through). Chair Powell has repeatedly said he is battling AGAINST the type of structural long term unemployment we saw post-Great Financial Crisis (’08-’09). He is willing to run the economy hot until everyone who wants a job has a job. There are still 9.3M unemployed (5.8% unemployment rate). This compares to the economy pre-covid in Feb 2020 when the numbers were: 3.5% unemployment and 5.7 million unemployed.

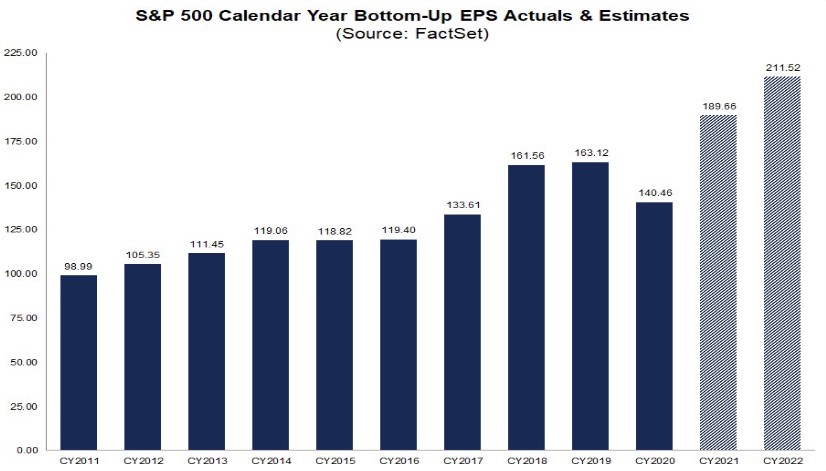

While the economy may be back 93% (according to Oxford Economics), the biggest companies are doing better than ever – as many were allowed to stay open while small businesses struggled or shut down. They were deemed “essential” and the results are clear:

S&P Earnings are expected to be 16.27% higher in 2021 (post pandemic), than they were in 2019 (pre-pandemic). Big business got bigger, and small business is trying to recover and catch up now that high populous states have allowed them to get back to work and re-open their livelihoods.

The “trade” I presented to play the jobs miss was Tech (and defensive sectors). My top new pick in Tech was Alibaba.

On Tuesday I joined Nicole Petallides on TD Ameritrade network to talk more about Alibaba and other cloud stocks that we believe could work well in this environment. Nicole asked me about Fastly because of their outage (I have no view on that name either way). Thanks to Nicole and Declan Murphy for having me on:

While it has gotten harder to find value with the market up ~90% off its pandemic lows, there are still a few areas that make sense for new capital.

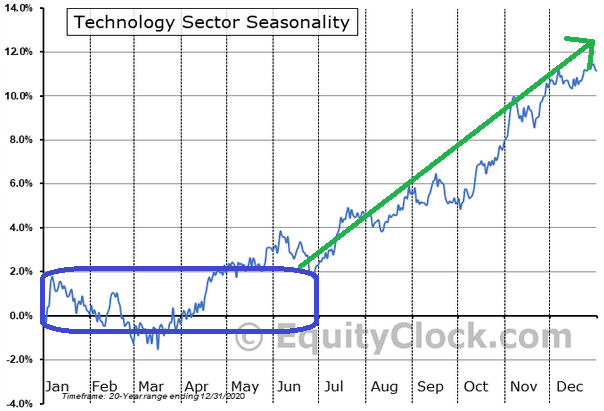

Tech is seasonally weak (20 yr avg) in the first half of the year and starts to gain steam in the Summer (June) through year-end:

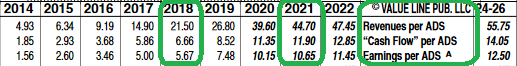

–Top Pick right now (for new money) is BABA: Traded at avg PE of 28x EPS since going public. Currently trading at 18x next year’s Estimates.

-You can purchase BABA in June 2021 for the same price as June 2018. The DIFFERENCE between 20018 and NOW is that BABA has:

1. DOUBLED Revenue per Share

2. DOUBLED Cash Flow per Share

3. DOUBLED Earnings per Share

-BABA Owns 1/3 of Ant Financial – which IPO was delayed for political reasons. It looks like that should push through this year (worth ~$100B to BABA).

-Cloud business growing fast enough to be larger than AWS in 5 years.

-China Gov’t push for internal consumption and reliance on Ant Financial to test its Digital Yuan should pave the way for smoother governmental relations moving forward.

-Charlie Munger bought it for the first time in Q1 2021 (in a BIG WAY) for Daily Journal (~20% of the portfolio).

Our Second Pick (for new money right now) in Tech is SPLK:

This is an enterprise data-mining company. The stock is down almost 50% off its 2020 high because its transition from a licensing model to a subscription model has been a bit bumpy. Last week’s earnings were encouraging because while the stock was down on increased expenses, those expenses were related to sales commissions being higher than expected (due to more sales made than expected).

-Revenue of $502 million for its quarter ended April 30. That marks an increase of 16% from a year earlier, and was modestly above both the company’s guidance range of $480 million to $500 million and the Wall Street analyst consensus at $491 million.

-Its cloud-based annual recurring revenue was $877 million, up 83%.

-Total annual recurring revenue was $2.47 billion, up 39%.

-Cloud revenue in the quarter was $194 million, up 73%.

-The company had 203 customers with annualized cloud revenue of more than $1 million, up 99% from a year ago.

-Overall, Splunk had 537 customers with annualized revenue above $1 million, up 46%.

-Splunk sees revenue of $550 million to $570 million, at the midpoint of the range just a hair above the previous Street consensus forecast at $561.4 million.

-The market’s short term impatience is our long-term opportunity.

OTHER BIG TECH NAMES (Growth versus Multiple):

| Other Tech | MSFT | GOOGL | AMZN | AAPL | FB |

| Avg P/E last ~15 yrs | 27x | 25x | 40x | 22x | 25x |

| 2022 P/E | 30.3x | 25.31x | 44.23x | 23.53x | 22.1x |

| EPS Growth 2022 | 7.5% | 8.2% | 29.4% | 3.1% | 15.8% |

If I had to put new money to work in 1 of the FAANG stocks (in addition to BABA and SPLK tech picks we recently bought), it would be AMZN. While AWS was up 32% yoy, their “Other” segment (which is mostly selling Ads), grew 77% yoy. This ad business is now 2.4x bigger than SNAP, TWTR, ROKU and PINS combined. Prime day in June 21-22 – which may finally snap it out of its 11 month sideways consolidation.

Now onto the shorter term view for the General Market:

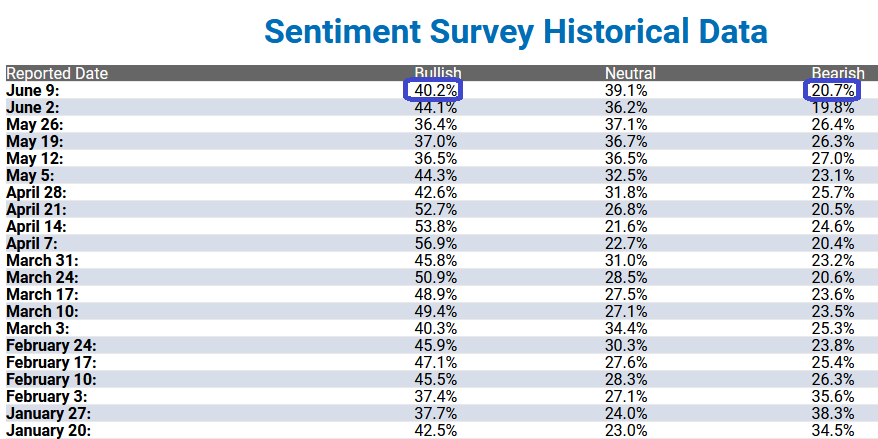

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) moderated to 40.2% from 44.1% last week. Bearish Percent ticked up to 20.7% from 19.8% last week.

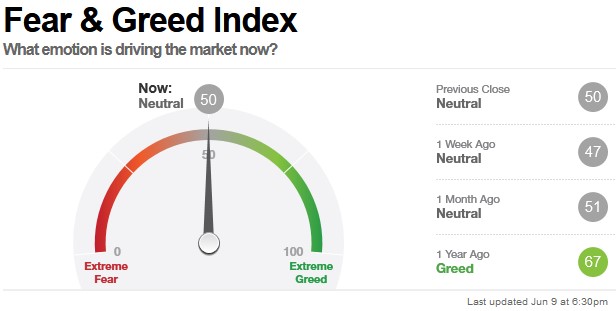

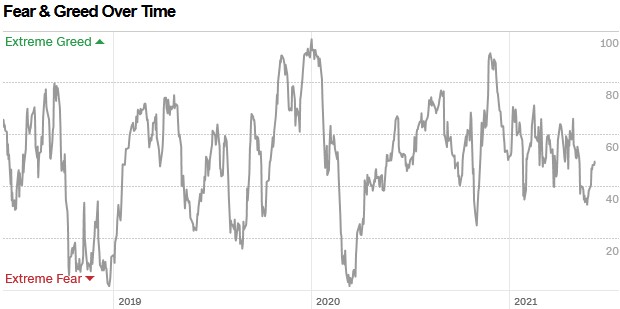

The CNN “Fear and Greed” Index flat-lined from 50 last week to 50 this week. This is a neutral reading. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 82.27% this week from 68.30% equity exposure last week.

Our message for this week:

We continue to pick our spots and look for the “rallies under the surface.” We have spent the last few weeks building China positions, selected SaaS/Tech positions, and SPAC warrants (mostly selective “busted” SPACs with announced deals that have rolled over – but have interesting businesses/sponsors for the long-term).

We believe the “big money” will be made “under the surface” for the remainder of the year.

Last year we were pounding the table on “new business cycle” stocks like banks, energy, and defense stocks. Now that everyone wants them (after 100%+ moves), we have pivoted to areas where there is pessimism (selected pockets of US Tech/Chinese Tech, SPAC warrants and defensive groups utilities, staples, big pharma).

We still believe banks and energy will do very well in coming years of this new business cycle, but short term “late money” is probably due for a temporary shakeout.