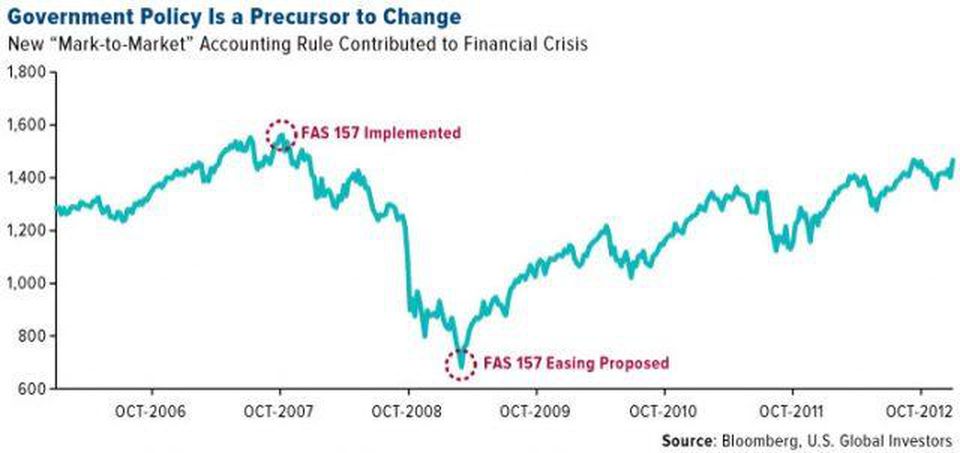

In 2007 the Financial Accounting Standards Board (FASB) made an accounting change – referred to as FAS 157. FAS 157—also known as “mark-to-market,” or “fair value accounting” was primarily responsible for putting Lehman Brothers into bankruptcy and triggering the dominoes that would subsequently fall in concert. The assets didn’t change materially, the “required” accounting of them did. This well-meaning, but utterly ham-handed effort was largely responsible for precipitating the Great Financial Crisis of 2008-2009. You can see the correlation on the chart above between the time FASB implemented the new rule (starting the crash), and when they reversed their mistake (market bottom in 2009). There is no coincidence in this timing.

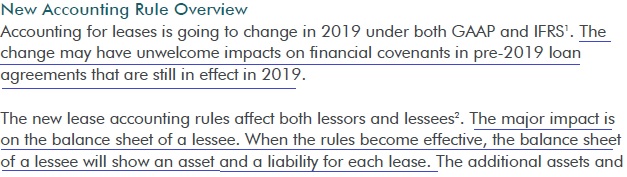

Fast forward to today. FASB is back at it again. Starting for Q1 2019 reporting, companies will be required to change how they account for Leases. It is referred to as the new FASB leasing standard (ASC Topic 842) and it will put $3 Trillion in liabilities onto corporate balance sheets. This new treatment requires companies to record operating leases on their balance sheets as debt.

While sophisticated rating agencies have usually accounted for these obligations when calculating a rating for an issuer, there is a meaningful amount of outstanding debt in the market that may have covenants tripped by the increased leverage ratios that result from this change. So while it may be in a lender’s interest to renegotiate the covenants to account for this change, if the borrower is in “technical default” for breach of covenants, it can have daisy chain ramifications (not because anything in their underlying business has changed, but because the treatment has changed). Sounds familiar?

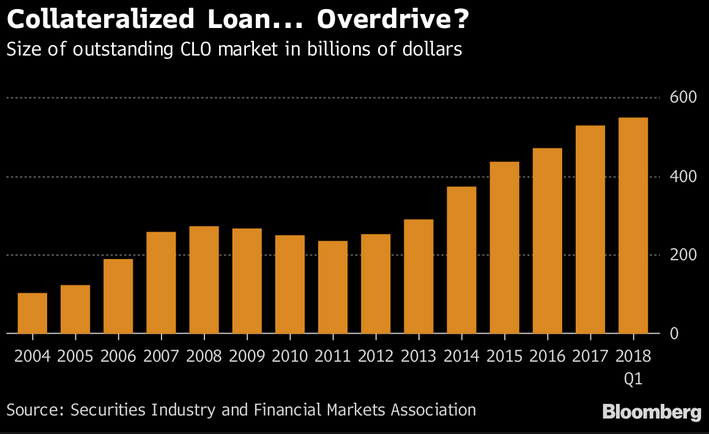

This matters because of the large amount of pooled/leveraged loans/CLO’s that could be potentially impacted by this change (on paper). It could shine a light on companies that are utilizing a significant amount of off balance sheet financing to run their business.

Here is some commentary from Watson Farley & Williams:

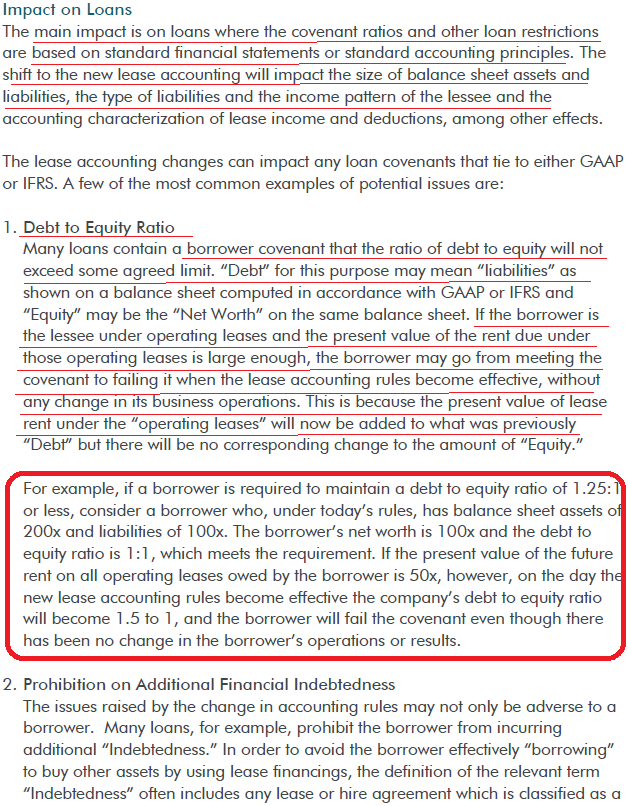

More commentary on the impacts of this change from from King & Spalding:

IMPACT ON DEBT-FACILITY COVENANTS

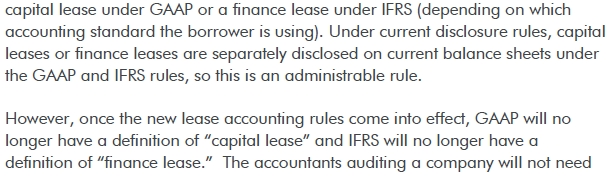

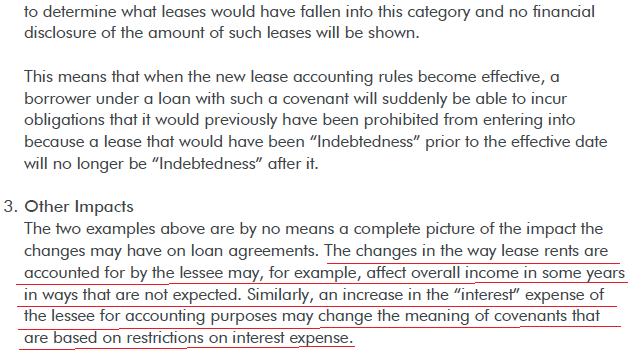

Contractual covenants that measure compliance according to financial measures such as total indebtedness are at risk of falling out of compliance as a result of the implementation of new lease accounting rules as balance sheet indebtedness will generally increase significantly. Various credit arrangements, including term loan facilities, revolving facilities, high yield notes and other arrangements, typically provide for debt covenants and financial compliance covenants that could be impacted.

Financial Ratio Covenants. Often in credit agreements and high-yield notes, companies will need to periodically comply with certain financial ratios such as a net leverage ratio. Compliance with such covenants can be measured either at the end of each quarter or pro forma upon the incurrence of new indebtedness. For example, a typical ratio will measure the amount of consolidated indebtedness at period end to consolidated EBITDA over the past four fiscal quarters. Depending on the applicable definition of indebtedness, the new lease accounting rules may result in a substantial increase in balance sheet indebtedness (with limited impact on EBITDA) for many borrowers and, as a result, compliance with financial ratios could become problematic.

Debt Covenants. Often in credit agreements and high-yield notes, the amount of indebtedness or secured liens permitted by obligors is limited subject to certain permitted baskets, including a basket specifically for leases treated as a capital lease or liability on the face of a borrower’s balance sheet under GAAP. As the new lease accounting rules take effect and operating leases are reflected on the balance sheet, borrowers with significant operating leases should pay particular attention to the criteria for the previously negotiated lease basket and may need to amend these provisions to increase the basket or exclude operating leases, reclassify existing indebtedness to find additional capacity, or risk a potential default.

So while companies have had 2+ years to prepare for this change, we will not know the impact until they start reporting and we see the impact on the financials and compliance (or lack thereof) with debt covenants.

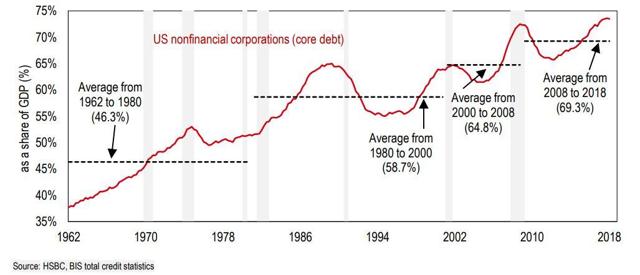

This change will occur in the face of companies carrying a record $9.1Trillion debt load (in a recently rising rate environment). It was $4.7Trillion in 2007. The cash-to-debt ratio for corporate borrowers fell to 12 percent in 2017, the lowest ever. Couple this with the fact that there has been a huge drop in lending standards. The share of leveraged loans with no requirements for borrowers to meet regular financial tests, such as maximum leverage and minimum interest coverage ratios, has risen from around a quarter in 2007 to a record high of 80% today.

So what’s the good news?

1. The tax cuts increased cashflow to service this debt (although so far the majority of this increased cahsflow has gone to return of capital to shareholders in the form of buybacks and dividends).

2. Many companies have been able to roll out/refi their existing debt.

3. Banks are well capitalized and any adverse impact from this accounting treatment (to companies) should be contained to a company/sector by company/sector basis.

4. The covenants on leveraged loans are the lightest they have been in history.

In recent years a greater part of corporate borrowing has come in the form of bank loans that are quickly packaged into securities known as CLOs, or collateralized loan obligations, which are sliced and diced and sold off to sophisticated investors just as home loans were during the mortgage bubble.

Bloomberg News recently reported that pension funds and insurance companies, particularly those in Japan, can’t get enough of the CLOs because of the higher yields that they offer. Wells Fargo estimated that a record US$150 billion would be issued by the end of 2018 – or about 2x 2017. Similar to what happened with the late-cycle home mortgages in 2007 and 2008, analysts are noticing a significant decline in the quality of loans in the CLO packages, with 3/4 of them now without the standard covenants designed to reduce the chance of default (e.g. “cov lite”).

Ultimately, there is no way to quantify what impact this change may have before the fact. Bigger companies like Microsoft have already reported this change with no material impact, but smaller companies with leveraged balance sheets and a significant amount of off-balance sheet financing/operating leases may feel the pinch in coming reporting periods. It remains to be seen, but worth keeping an eye on.