We don’t know (if that’s it), but in our July 27 note, we put out the following warning:

In our weekly podcast|videocast – we also emphasized the probability of 3-5% pullbacks coming in this normal seasonally weak period – that would be bought by institutions having to play “catch up.” So now we got it, and we think getting close to the point where we should begin to see some institutional cash step in:

What Now?

Last night I joined Phil Yin on CGTN America “Global Business” to discuss the Fed Minutes, Earnings, Stock Market Outlook, what we’re buying and selling – and more. Thanks to Phil and Ryan Gallagher for having me on:

Some notes ahead of my segment:

- 10 of 12 days down. We were out 2 weeks ago expecting a 3-5% pullback. We’re at 4.3% now. Seasonally weak period.

source: Ryan Detrick

source: Ryan Detrick - Dips will be back because managers who missed 1H rally have to play “catch up.”

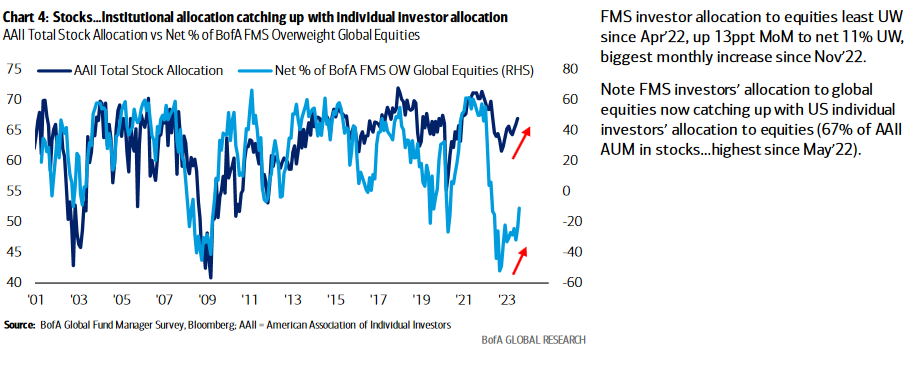

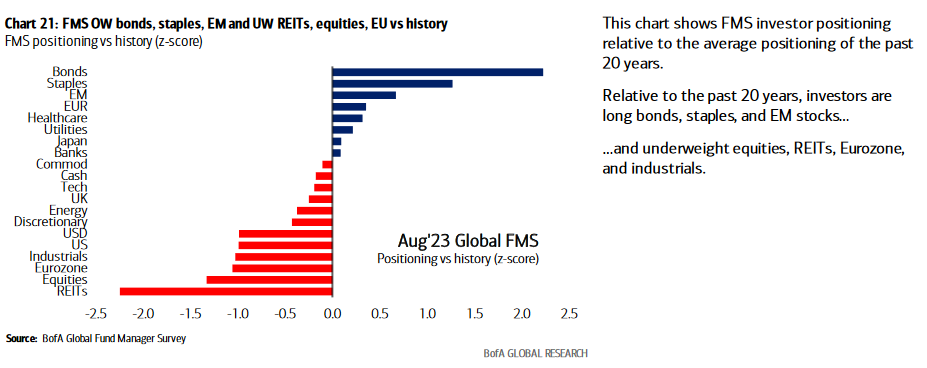

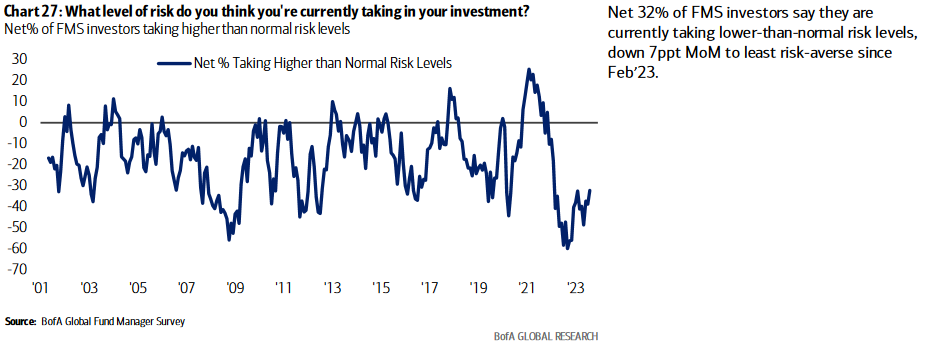

- Managers still taking as low of risk in their portfolio as Covid lows and 2009 lows.

- Still overweight t-bills and underweight equities relative to 20yr history. Cash levels slowly coming down but elevated.

- Q2 Earnings +3% YOY (ex-energy).

- GDPNow +5.8% Q3

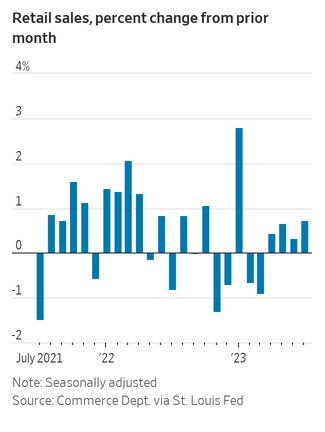

Retail Sales:

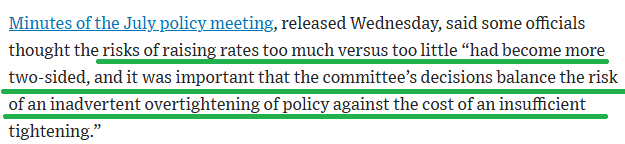

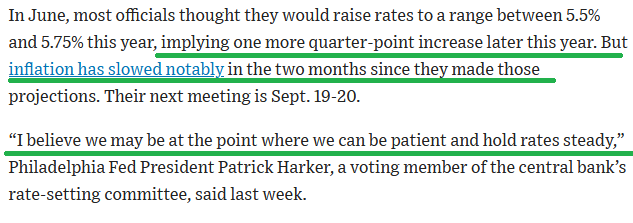

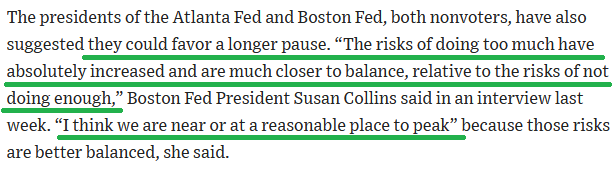

Federal Reserve’s minutes for its July meeting:

2 dissenters. This is NEW. Prior to these minutes all members were UNANIMOUS.

Source: WSJ Timiraos 8-16-23

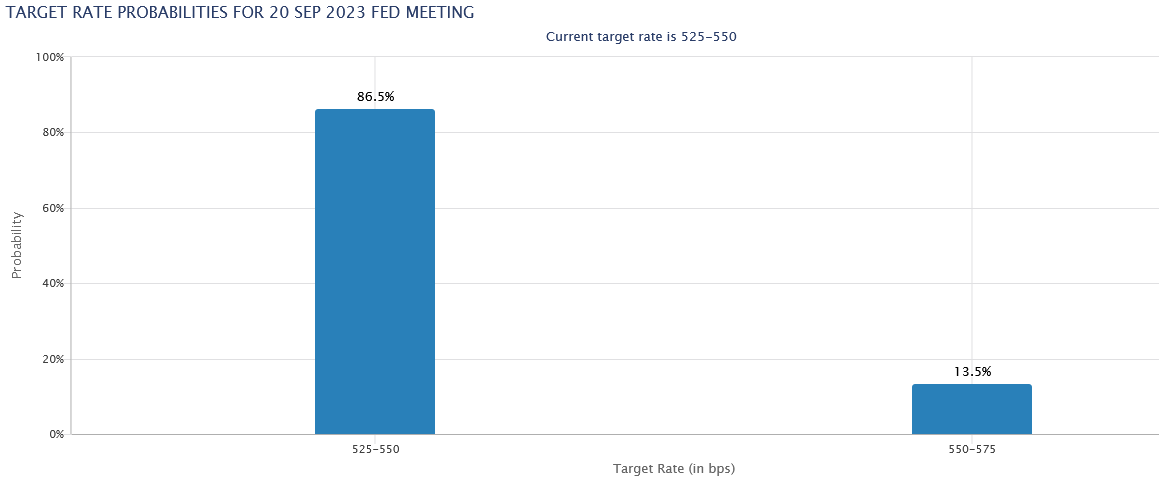

13.5% chance of September hike following Fed Minutes – up from 11%:

Source: CME

PYPL: EPS GROWTH Next Year 13.90%.

Next 5 Years (per annum) 17.37%

10.5x forward PE vs. historic avg 35x

Mid-Teens return on capital compounded over a decade:

The new PayPal CEO will be will be Alex Chriss (46yo), president and general manager of Intuit’s small business and self-employed group. 25-bagger over the past 15 years. One of the greatest growth stories in history. He was responsible for 1/2 of the revenues.

2H Playbook

On Friday morning I joined Ann Berry and Khloe Hale on Public to discuss our playbook for the rest of the year. Inflation, Rates, Dollar, Banks, what to do with “Big Tech” (AMZN, GOOGL) and a lot more..

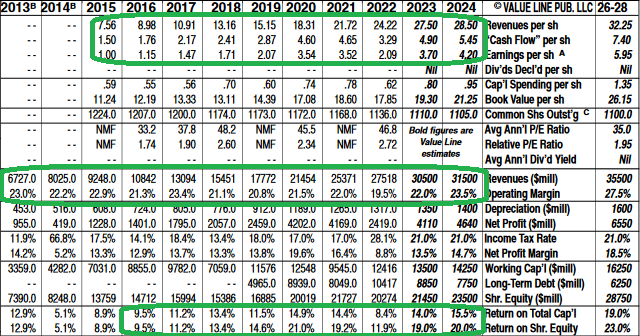

Alibaba Update and the Most Important Investing Lesson I Can Share With You:

And finally, I joined Marcel Munch on his podcast “East West Investment Opportunities” this Tuesday. The podcast is focused on China. You can find it on youtube or twitter. We couldn’t have picked a better day to do it as all of the Chinese stocks were swimming in a sea of RED (pun intended)!

That said, if you listen to this full interview and internalize the investment concept I am emphasizing, you can make exceptional amounts of money over a career. Understand the concept fully and it will change how you think about investing for good:

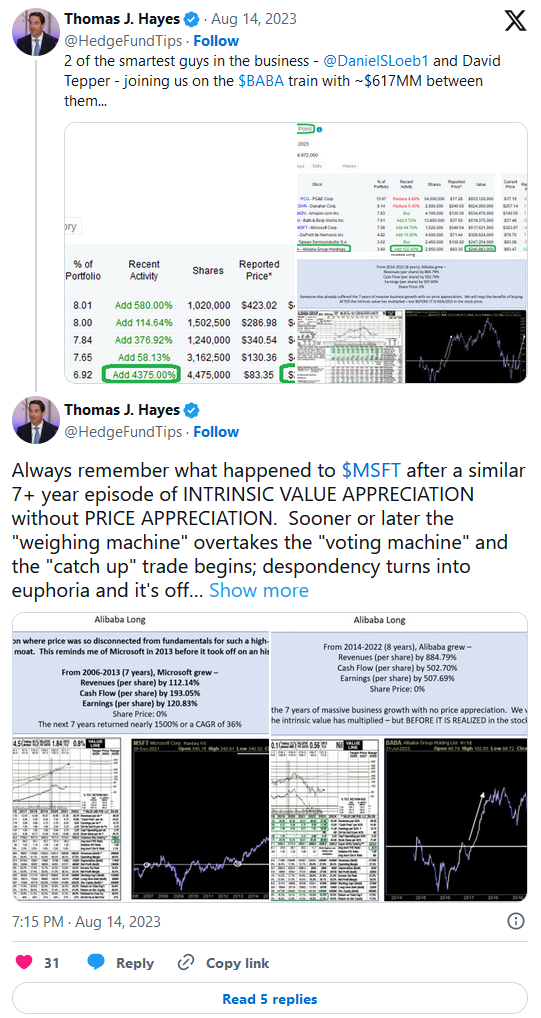

Two of the best in the business joining us on the BABA train!

2 of the smartest guys in the business – @DanielSLoeb1 and David Tepper – joining us on the $BABA train with ~$617MM between them… pic.twitter.com/akdv7JWh6v

— Thomas J. Hayes (@HedgeFundTips) August 14, 2023

Sentiment

This Tuesday, Bank of America published its monthly “Fund Manager Survey.” I posted a summary here:

August 2023 Bank of America Global Fund Manager Survey Results (Summary)

Here were the 7 key points:

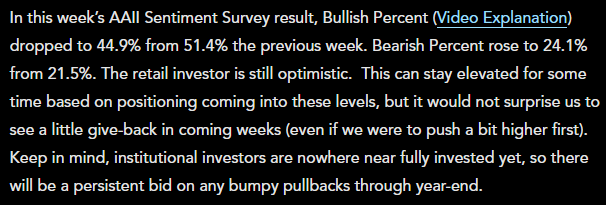

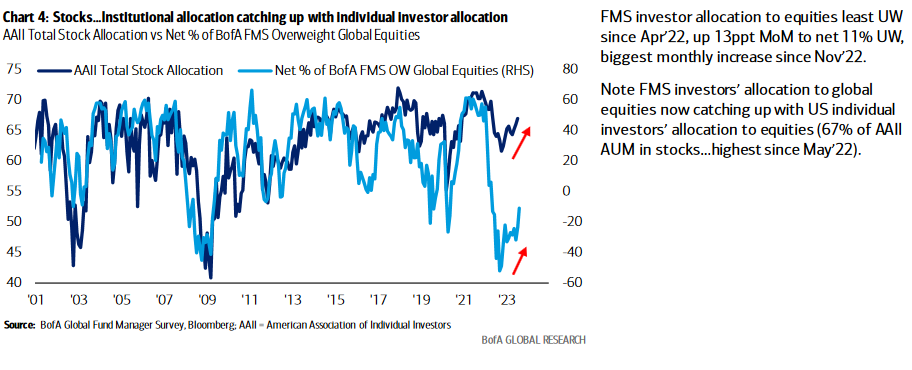

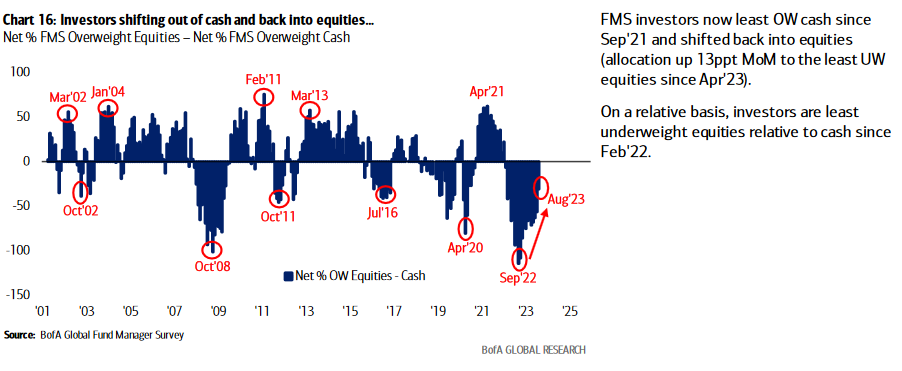

1. Institutions still playing “catch up”:

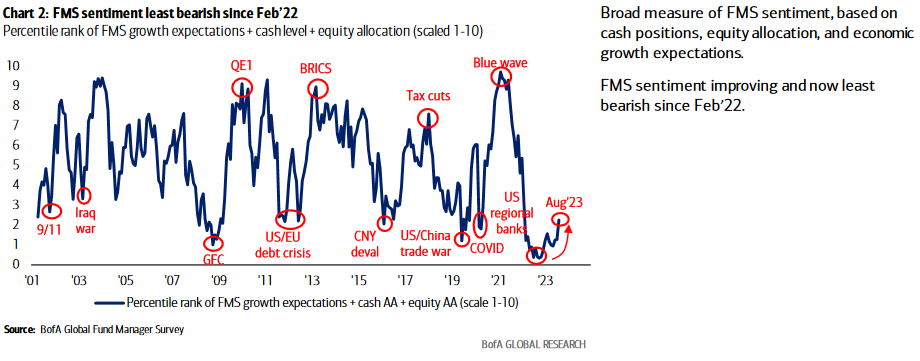

2. Sentiment has A LONG WAY TO GO BEFORE WE HIT EXUBERANCE: 3. Managers still taking the lowest risk since the Covid and GFC lows:

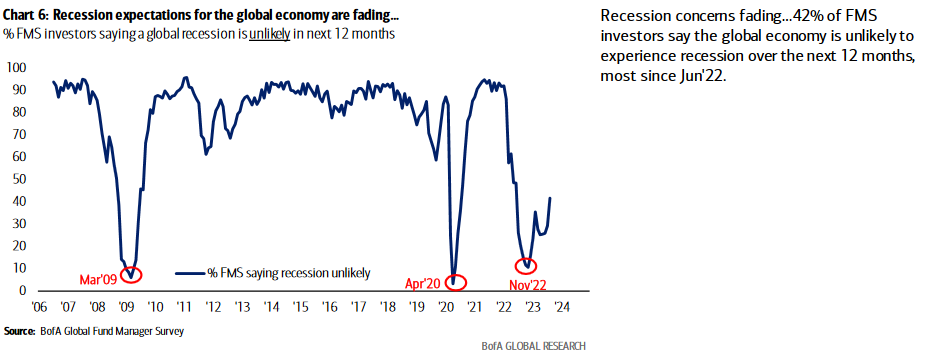

3. Managers still taking the lowest risk since the Covid and GFC lows: 4. Recession expectations JUST STARTING TO RECOVER:

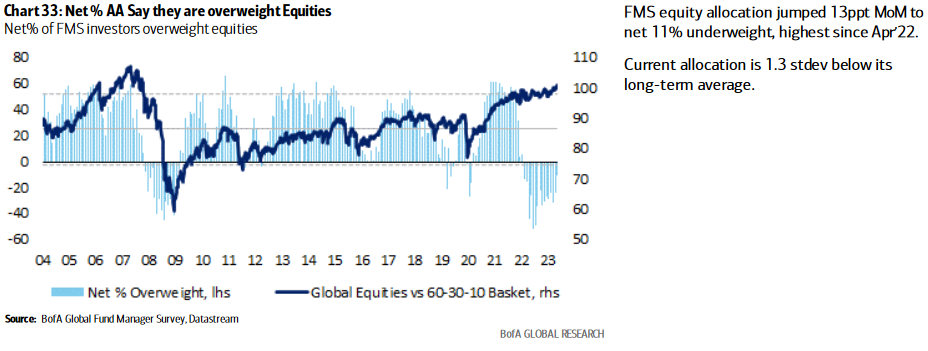

4. Recession expectations JUST STARTING TO RECOVER: 5. Equity allocation 1.3SD below long term average:

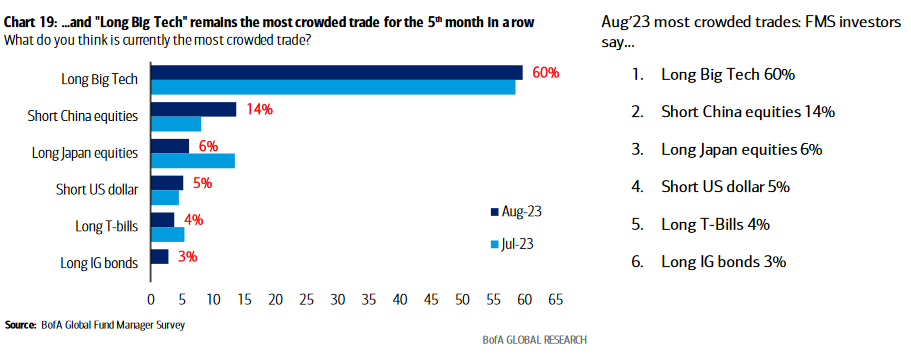

5. Equity allocation 1.3SD below long term average: 6. 2nd most crowded trade is short China!

6. 2nd most crowded trade is short China!

7. A long way to go until managers are at an extreme (OW and exuberant equities):

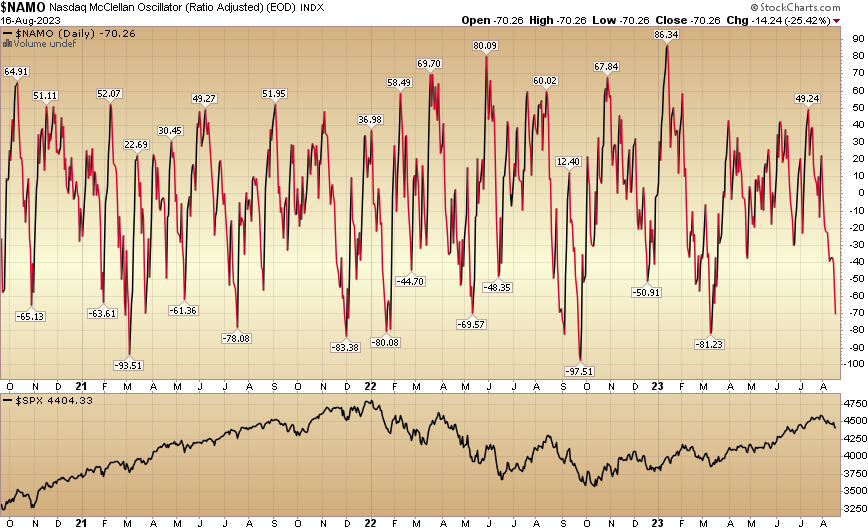

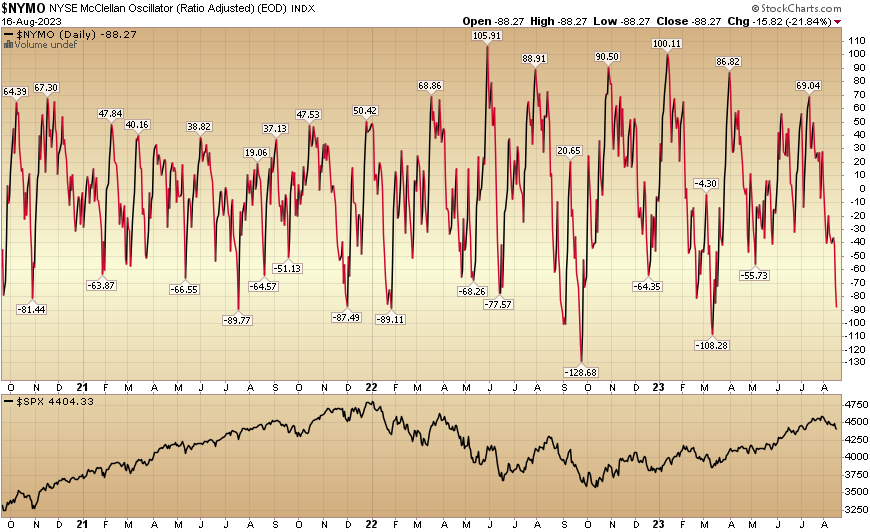

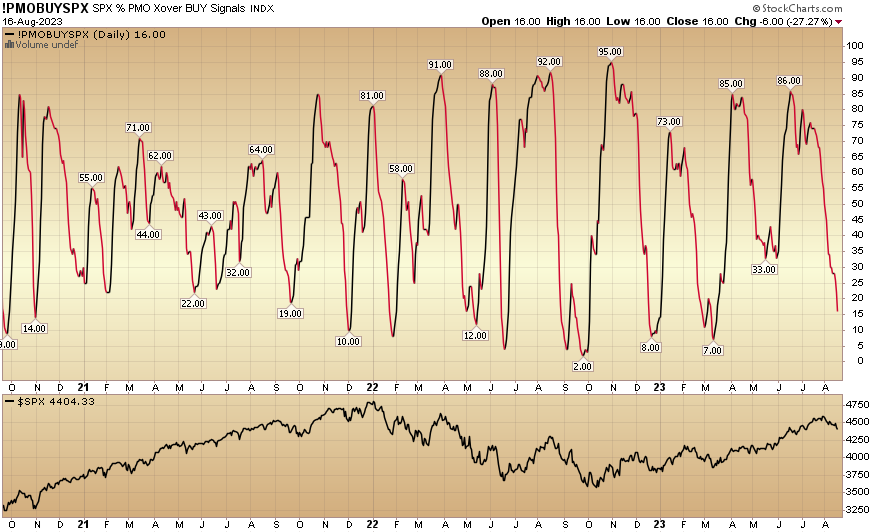

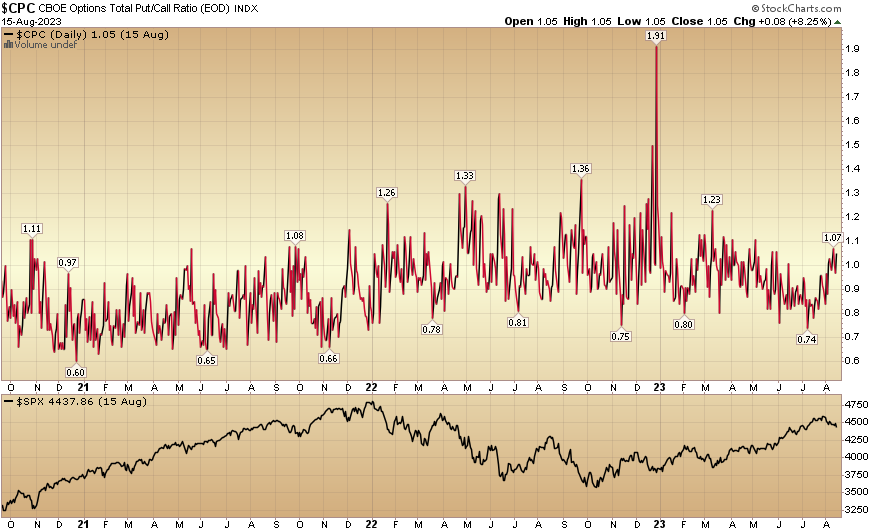

Now onto the shorter term view for the General Market:

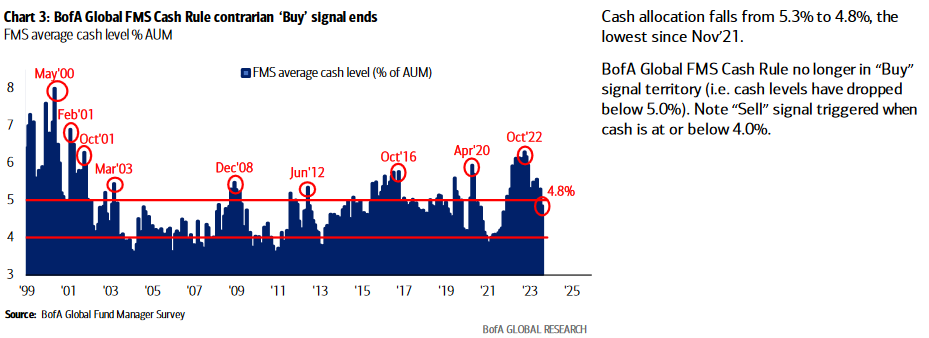

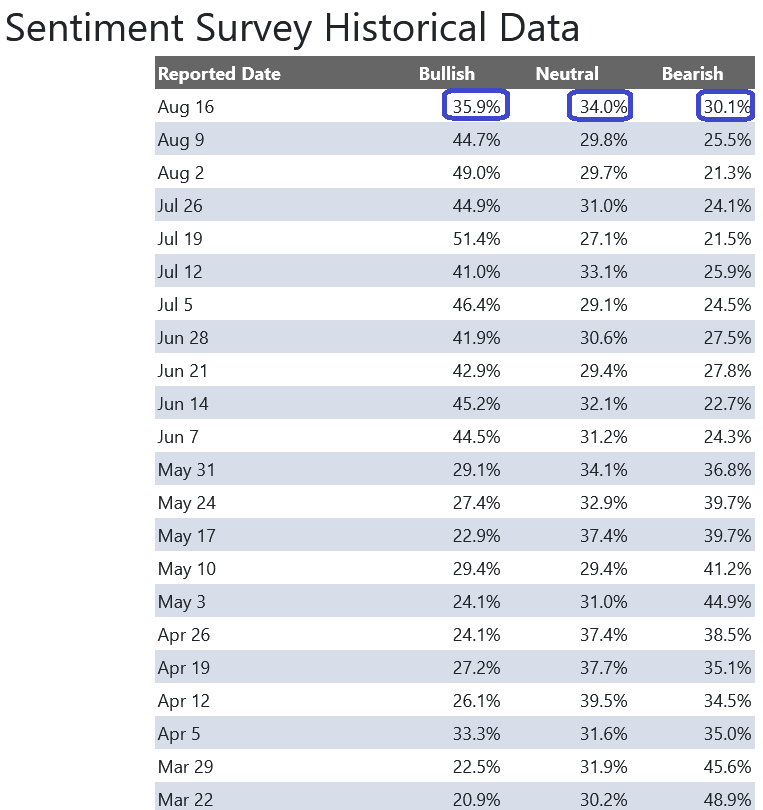

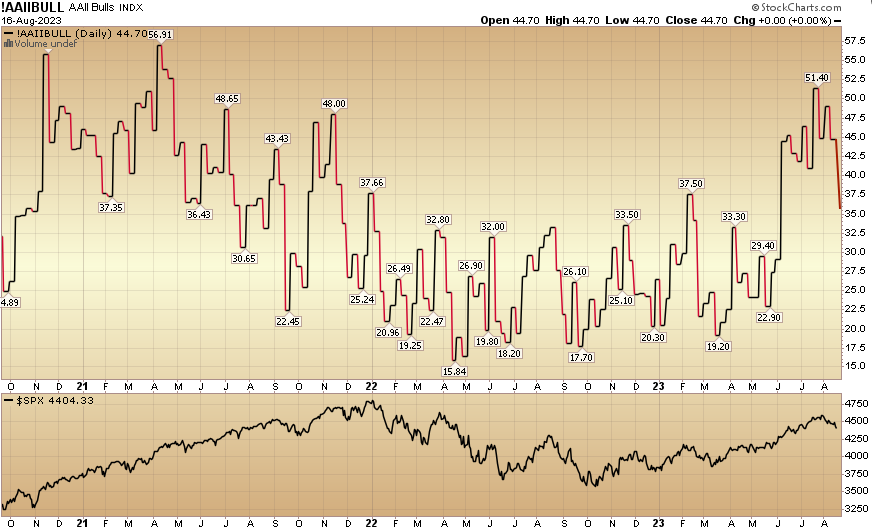

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 35.9% from 44.7% the previous week. Bearish Percent rose to 30.1% from 25.5%. The retail investor is showing some renewed trepidation.

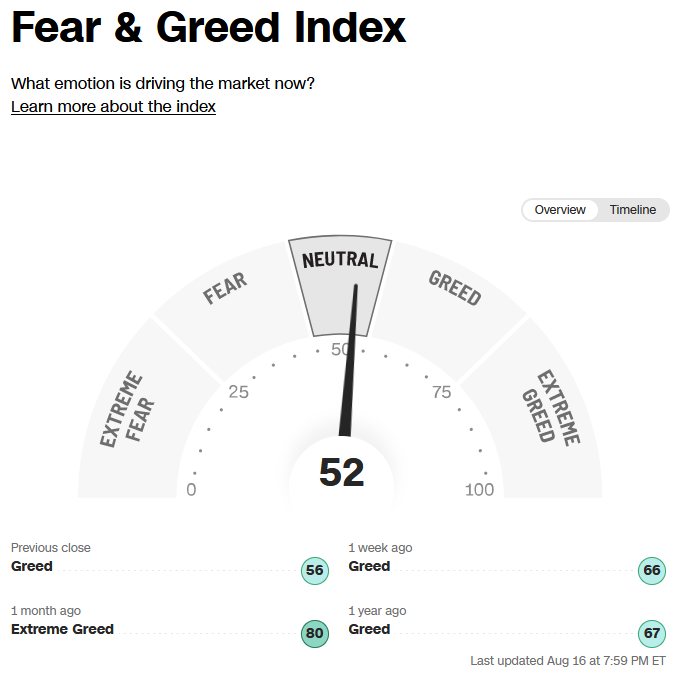

The CNN “Fear and Greed” dropped from 67 last week to 52 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

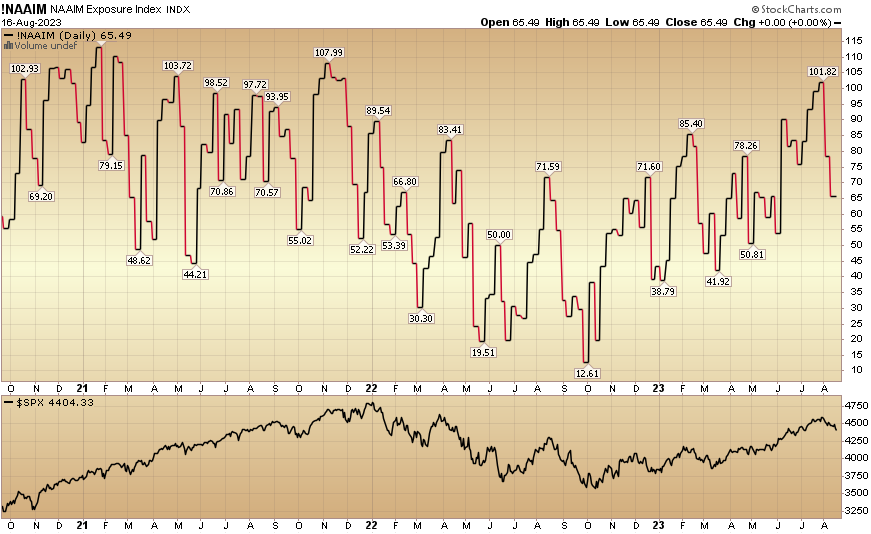

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 65.49% this week from 78.4% equity exposure last week.

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 65.49% this week from 78.4% equity exposure last week.

Our podcast|videocast will be out late today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, not advice. See “terms” above.