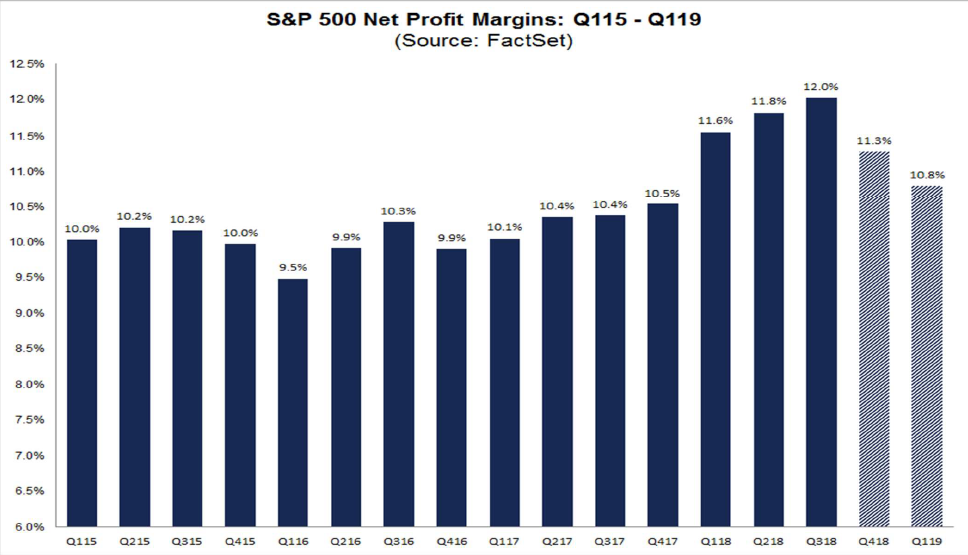

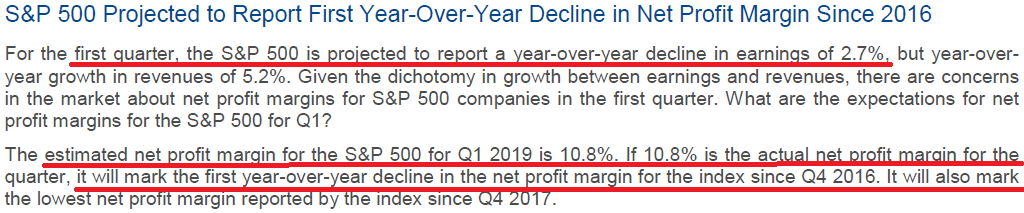

The big story for our Earnings Update this week is margins shrinking materially year on year (per Factset):

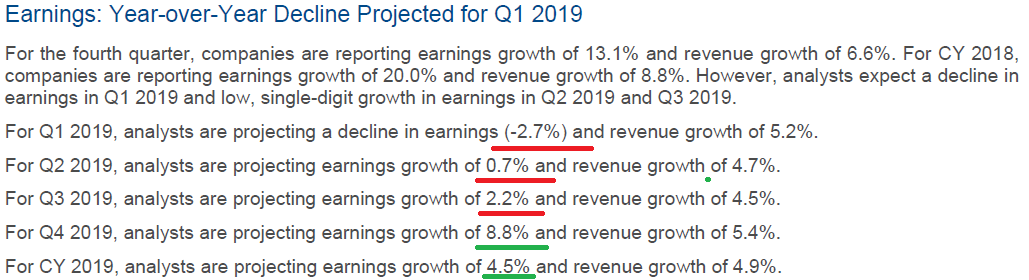

As a result, Q1 and Q2 2019 Earnings expectations are anemic – but with back-end loaded expectations (Factset still at ~$170 2019 S&P Earnings), analysts still see 4.5% earnings growth in 2019 (for now).

My takeaway – given the margin compression – is that caution is in order at this point. Assuming the current “best case” 4.5% earnings growth, you could see a peak S&P 500 hit 3073 sometime this year – but that is assuming no further EPS expectation downgrades and a retention of the 16+x forward multiple.

On the flip side, with the fed on hold, a China deal taking form (although it appears it will take at least another month to get something that could positively impact earnings expectations), and/or a positive outcome with Brexit (months away), it is possible (but not probable) expectations and the multiple could expand. More likely, we digest Jan/Early Feb gains and then see what the numbers look like in a month or so.