- BOJ’s policy board becoming more concerned about effects of a weaker yen (marketwatch)

- China’s imports jump 8.4% in April, exceeding expectations as purchases from the U.S. grow (cnbc)

- Three overlooked stocks from a Spanish quant: ‘Now is not a time everyone is going to win.’ (marketwatch)

- UK’s FTSE 100 Outperforms in Europe as BOE Fuels Rate-Cut Bets (bloomberg)

- The Fed Is in a Holding Pattern. That Could Be Good for Stocks. (barrons)

- China’s foreign trade up 5.7 pct in first four months (peoplesdaily)

- China Mulls Dividend Tax Waiver on Hong Kong Stocks Connect (bloomberg)

- Hong Kong’s New Home Sales Hit Record High of $5.4 Billion (bloomberg)

- Chinese stocks hit 2024 highs on more property support, positive trade data (streetinsider)

- Solventum Reports Earnings. There Will Be No Dividend. (barrons)

- New Hertz CEO Bets $1 Million on the Battered Stock (barrons)

- Weekly jobless claims jump to 231,000, the highest since August (cnbc)

- Bruins-Panthers Game 2 ends in violence as David Pastrnak, Matthew Tkachuk fight during huge brawl: ‘Not afraid of him’ (nypost)

- ‘Seriously Underwater’ Home Mortgages Tick Up Across the US (bloomberg)

- Disney and Warner to Offer Bundle of Their Streaming Services (wsj)

Are you Mad or Glad? Stock Market (and Sentiment Results)…

During earnings season we try to cover 1-2 companies we have discussed in previous podcast|videocast(s). This week, Cooper Standard (CPS) reported results. We originally initiated this position in May of 2022 ~$5.50. You can see our original and time-stamped historic commentary in our note last quarter here.

Continue reading “Are you Mad or Glad? Stock Market (and Sentiment Results)…”

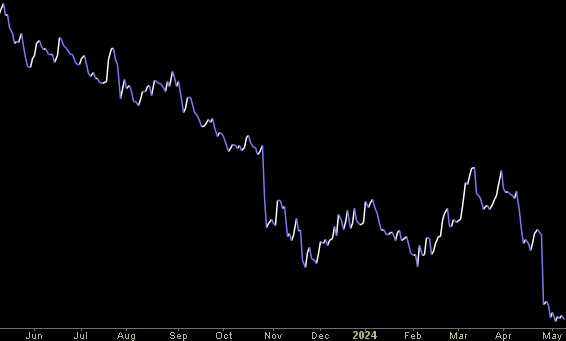

Where is money flowing today?

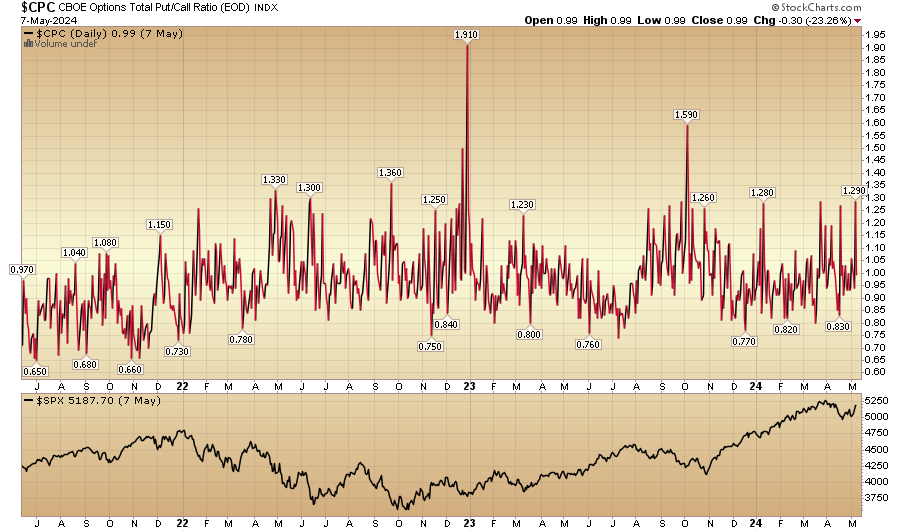

Indicator of the Day (video): CBOE Total Put/Call Ratio ($CPC)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 18 key reads for Wednesday…

- China rally hasn’t been chased by options traders, Bank of America says (marketwatch)

- Regional Bank Stocks Are Hated Again. It’s Time to Buy. (barrons)

- Media Mogul Byron Allen: This is just a speed bump for Disney, ‘Bob Iger is the best of the best’ (cnbc)

- The Fed has to cut because the economy is running out of gas, says Jim Cramer (cnbc)

- Stock buybacks hit highest level since 2018 (yahoo)

- Teva Pharmaceutical’s stock climbs as schizophrenia treatment shows promise (marketwatch)

- Billions in Chips Grants Are Expected to Fuel Industry Growth, Report Finds (nytimes)

- Celebrities pay this NYC man big bucks to get them reservations at exclusive eateries (foxbusiness)

- US 30-Year Mortgage Rate Falls for First Time Since March (bloomberg)

- Intel flags revenue hit as U.S. revokes certain export licenses to Chinese customer (reuters)

- Ledecky’s 800m gold medal hopes boosted as McIntosh opts out (reuters)

- Chinese firms’ earnings to rebound amid a pickup in the economy: UBS (scmp)

- Alibaba seeks growth in Mongolia with marketplace selling Chinese goods (scmp)

- These are the potential ‘shock’ scenarios around next week’s inflation data, says Goldman Sachs (marketwatch)

- Sweden becomes second major central bank to cut rates (marketwatch)

- Bond King Bill Gross to Bond Funds: Drop Dead (barrons)

- 3 Restaurant Stocks That Are Vying to Be the Next Chipotle (barrons)

- Rents Set to Be Last Domino to Fall in Global Inflation Battle (bloomberg)

Where is money flowing today?

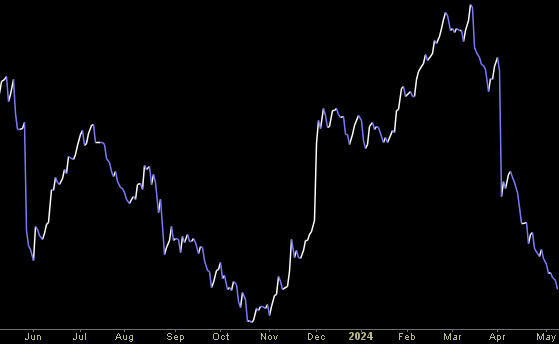

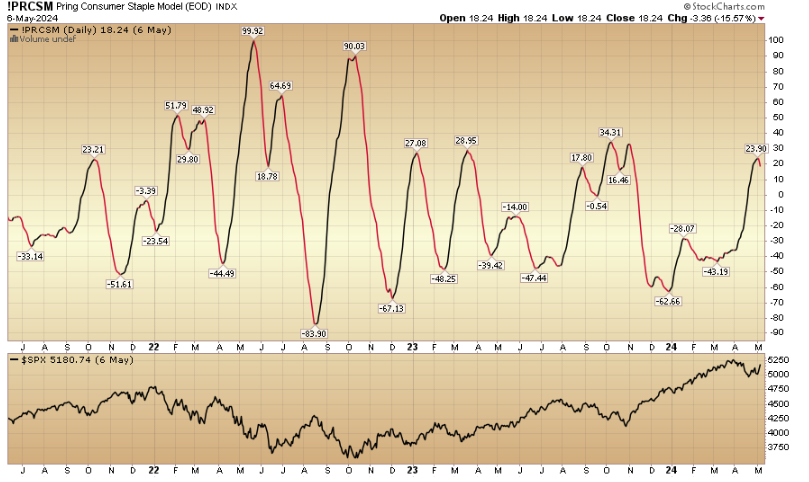

Indicator of the Day (video): Pring Consumer Staple Model

Be in the know. 15 key reads for Tuesday…

- Cooper Standard Reports Continuing Year-over-year Margin Improvement in First Quarter 2024, Sees Upside to Full-year Guidance (cooperstandard)

- China’s Ant Group doubles down on global expansion with cross-border payments offering Alipay+ (cnbc)

- 10-year Treasury yield heads for fifth day of declines after buyers emerge (marketwatch)

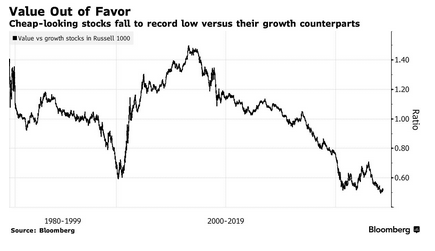

- Einhorn Says Markets Are ‘Broken.’ Here’s What the Data Shows. (bloomberg)

- Overseas institutions encouraged to invest in domestic tech companies (peoplesdaily)

- Chevron CEO says natural gas demand will outpace expectations on data center electricity needs (cnbc)

- Why Disney Stock Is Down After Earnings Topped Estimates (barrons)

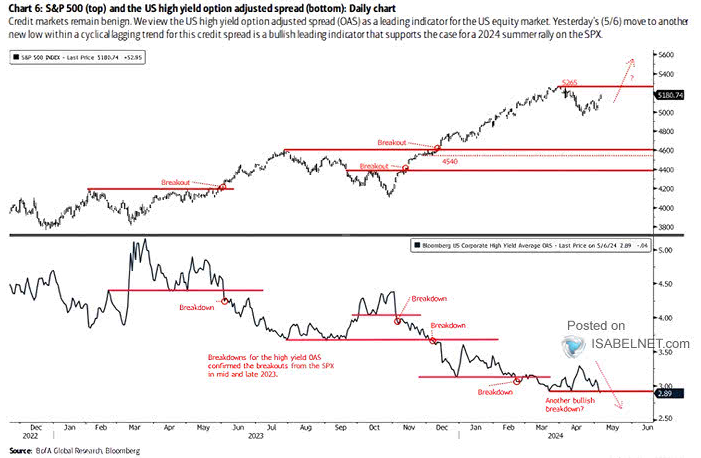

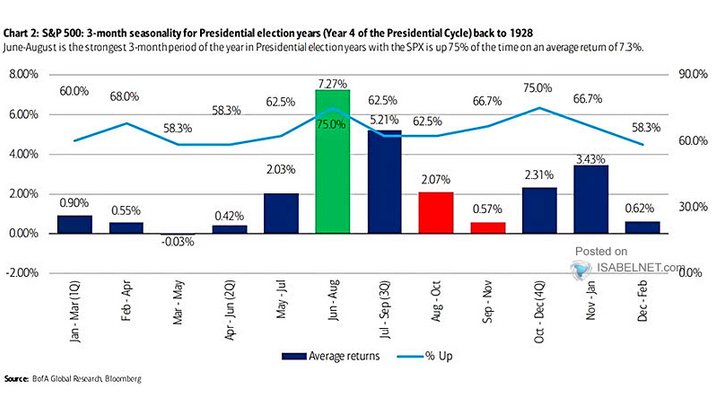

- The Stock Market Is Recovering. Why It Could Keep Gaining. (barrons)

- Pfizer Is Adding a Wall Street Analyst to Its C-Suite. What He Thinks the Company Needs to Do. (barrons)

- American Wagyu Is Drawing in a New Breed of Investors as Demand Grows (barrons)

- ‘Green Shoots’ Grow Out of Control on Wall Street (wsj)

- Buy stocks in May because inflation is set to plunge through the rest of 2024, Fundstrat’s Tom Lee says (businessinsider)

- The streaming future Disney promised is finally here as cable TV decays (cnbc)

- 3M Cut Its Dividend: It’s Time to Buy the Stock (yahoo)

- Disney CFO Hugh Johnston on Q2 results, strength of consumer and streaming growth (cnbc)