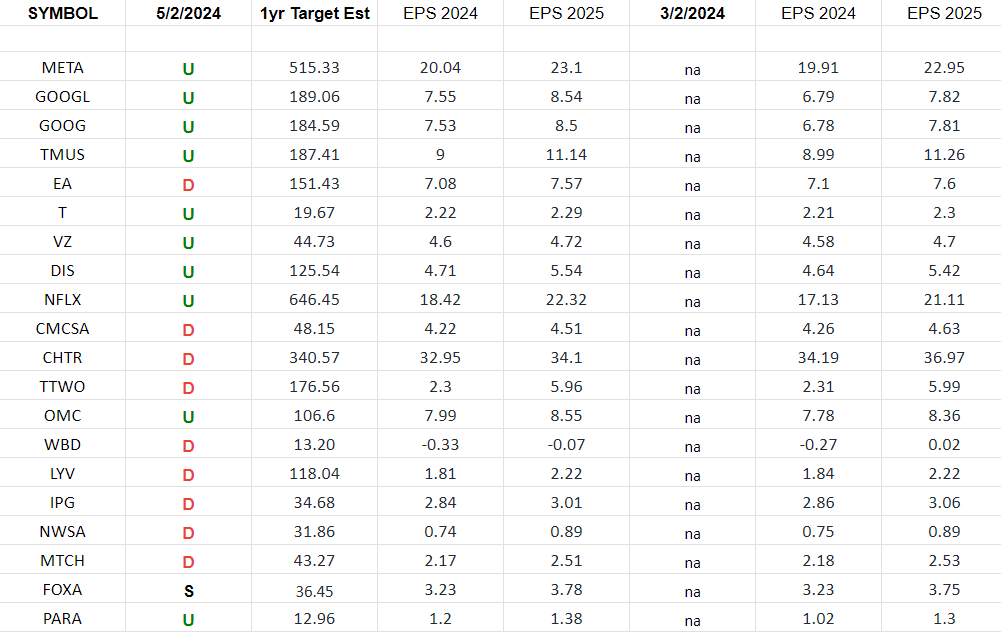

In the spreadsheet above I have tracked the earnings estimates for the Communication Services Sector ETF (XLC). Continue reading “Communication Services Earnings Estimates/Revisions”

Be in the know. 25 key reads for Thursday…

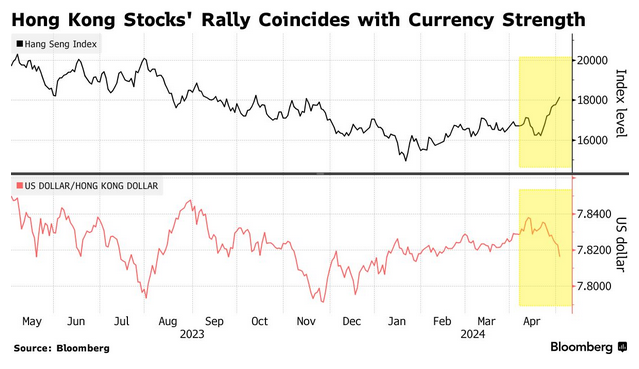

- Hong Kong Stocks March Into Bull Market as Global Money Returns (bloomberg)

- New stimulus is coming as Politburo pledges to cut housing inventory: analysts (scmp)

- MGM Stock Rises as Wall Street Praises Earnings. There’s ‘Momentum in Macau.’ (barrons)

- Third Point made ‘substantial investment’ in Alphabet as shares fell on Google’s Gemini fiasco (marketwatch)

- Fed Chair Projects Optimism Despite Stubborn Inflation (wsj)

- BorgWarner raises full-year 2024 adjusted profit outlook (reuters)

- Intel Bets $28 Billion Comeback on High-Tech US Chip Designs (bloomberg)

- Unforgiving Investors Want Bumper Earnings After Record Rally (bloomberg)

- Japan Likely Spent About $23 Billion in Latest Yen Intervention (bloomberg)

- Powell Keeps Rate Cuts on Table But Leaves Timing Less Certain (bloomberg)

- Odd Lots: Duolingo CEO on the Power of AI Learning (bloomberg)

- Apple’s Earnings Come With a Low Bar and Big Buyback Hopes (bloomberg)

- Number of Chinese Tourists Traveling Overseas Jumps (bloomberg)

- Hybrid Cars Are Surging in Popularity Over EVs. Here’s the Real Reason They’re So Popular. (barrons)

- The Reign of Portland, Maine, as the Top U.S. Luxury Hot Spot Continues for Third-Straight Quarter (barrons)

- Opinion: Mario Gabelli reveals his market-beating secrets and offers some favorite stock picks (marketwatch)

- The Fed Will Be Stuck On Hold Until Something Gives (barrons)

- Albemarle Beats Earnings Estimates. Investors Hope for a Commodity Trough. (barrons)

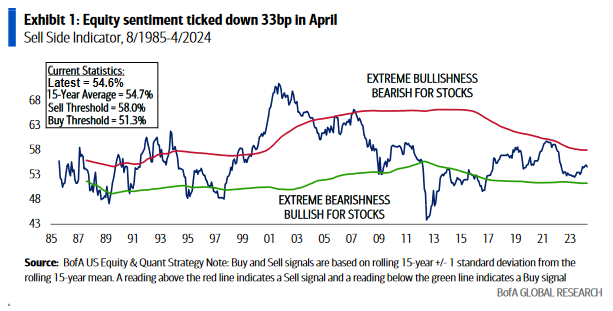

- Why ‘sell in May and go away’ could be a bit premature for stocks, according to one chart (marketwatch)

- Fed Says Inflation Progress Has Stalled and Extends Wait-and-See Rate Stance (wsj)

- Amazon Gets More Fuel for AI Race (wsj)

- Bored Ape Yacht Club NFTs sold for millions in 2021—prices have dropped 90% since then (cnbc)

- Goldman Sachs still sees two rate cuts this year after Powell speech (streetinsider)

- Berkshire after Buffett: the risk ‘genius’ pulling the insurance strings (ft)

- There are ‘very favorable signs’ inflation will come down, says Wharton’s Jeremy Siegel (cnbc)

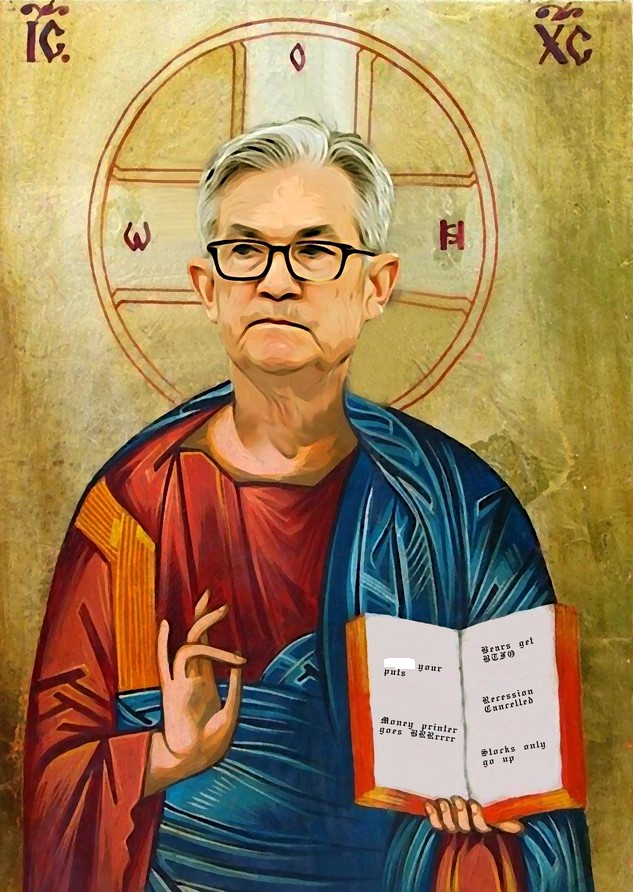

Powell’s, “Let There Be Light” Stock Market (and Sentiment Results)…

image source: Reddit

Chair Powell came to play yesterday and the market liked it. Is this the bottom in the short term 3-8% pullback we started calling for in Q1 on our podcast|videocast(s)?

Continue reading “Powell’s, “Let There Be Light” Stock Market (and Sentiment Results)…”

Tom Hayes – CGTN America Appearance – 5/1/2024

Where is money flowing today?

Quote of the Day…

Be in the know. 10 key reads for Wednesday…

- Chinese Stocks See Longest Foreign-Buying Streak in a Year (bloomberg)

- Fed to Signal Delay of Interest-Rate Cuts (bloomberg)

- NYCB’s Results Are Better Than Worst Fears After Rocky Quarter (bloomberg)

- Intel’s Gelsinger Fights Ghosts of History as Well as Rivals Nvidia, AMD (bloomberg)

- Beijing ends curbs on home ownership in outer districts to stimulate buying (scmp)

- Amazon’s Twitch launches TikTok rival amid push to ban the Chinese app (scmp)

- Berkshire after Buffett: can any stockpicker follow the Oracle? (ft)

- Amazon Q1 results top estimates as cloud demand rides AI wave higher (streetinsider)

- The Fed Certainly Won’t Cut Rates. Here’s What to Focus on Instead. (barrons)

- Generac Holdings Inc. (GNRC) Q1 2024 Earnings: Surpasses Revenue Estimates and Demonstrates … (yahoo)

Where is money flowing today?

Be in the know. 27 key reads for Tuesday…

- PayPal lifts 2024 profit forecast as spending stays resilient, margins improve (reuters)

- PayPal’s stock climbs as company boosts its earnings forecast (marketwatch)

- PayPal Earnings Pop 27% Under New Reporting Method. PayPal Stock Is Set To Break Out. (investors)

- PayPal’s Payment Volume Rises in Beginning of ‘Transition Year’ (bloomberg)

- China Factory Activity Holds Up, Signaling Recovery Has Legs (bloomberg)

- 3M ‘Reset’ Its Dividend. Why Its Stock Is Soaring. (barrons)

- BofA on China’s Recovery as Factory Activity Holds Up (bloomberg)

- Beijing Further Loosens Home Buying Curbs in Non-Core Areas (bloomberg)

- Goldman Says Funds Likely Selling Japan Stocks to Buy Hong Kong (bloomberg)

- China Stock Rebound Driven by Earnings Growth: JPMorgan (bloomberg)

- 3M’s stock surges toward a 14-month high after profit, sales beat expectations (marketwatch)

- China’s Leaders Hint at New Plan to Fix Biggest Drag on Economy (bloomberg)

- Amazon Earnings Day Is Here. Focus On AWS, AI, and Advertising. (barrons)

- Amazon Can Afford a Dividend. Its Earnings Will Underscore That. (barrons)

- Fed to Signal It Has Stomach to Keep Rates High for Longer (WSJ)

- Office-Loan Defaults Near Historic Levels With Billions on the Line (wsj)

- The Yen’s Plunge and Dollar Devaluation (wsj)

- China Hints at Rate Cuts, Property-Market Support (wsj)

- China’s Leaders Hint at New Plan to Fix Biggest Drag on Economy (bloomberg)

- McDonald’s Supersizes China Bet as Corporate America Pulls Back (wsj)

- Buyers Are Back in Control as Luxury Home Sellers Slash Prices (wsj)

- Bruins, Hurricanes, Avalanche, Canucks can clinch tonight: How to watch (usatoday)

- China to Hold Delayed Party Conclave On Reform in July (bloomberg)

- Molson Coors beats Q1 estimates on higher prices, strong demand (reuters)

- China’s problem is excess savings, not too much capacity (ft)

- Outlook ‘significantly brighter’ as Hong Kong attracts investors from US, Japan shares (scmp)

- Hong Kong stocks round out biggest monthly gain since January 2023 (scmp)

Tom Hayes – Quoted in Reuters article – 4/29/2024

Thanks to Chibuike Oguh for including me in his article on Reuters today. You can find it here: