Data Source: Finviz

Be in the know. 5 key reads for Friday…

- Inside the turnaround plan to make Vans, Supreme, and The North Face cool again (fortune)

- Apple Loses $113 Billion in Value After Regulators Close In (bloomberg)

- China and US Start Working Group to Combat Flood of Fentanyl (bloomberg)

- Japan’s Era of Stagnant Salaries, Steady Prices and Mortgages That Never Go Up Is Over (bloomberg)

- Magnificent Seven? It’s More Like the Blazing Two and Tepid Five (bloomberg)

Where is money flowing today?

Be in the know. 30 key reads for Thursday…

- Cowboys owner Jerry Jones puts another $100 million into Frisco’s Comstock Resources (dallasnews)

- China’s Central Bank Sees Room for More RRR Cuts (bloomberg)

- Fed Officials Still See Three Interest-Rate Cuts This Year, Buoying Stocks (wsj)

- Productivity is way up

- The Billionaire Taking on Disney Just Wants Some Respect (nytimes)

- Short Sellers Up Their Wagers Against Commercial Real Estate Again (bloomberg)

- Fed’s interest-rate decision makes bank stocks more attractive: analyst (marketwatch)

- Boeing targets a culprit of 737 MAX production woes: ‘Traveled work’ (yahoo)

- For Real Estate, Rate Cuts Can’t Come Soon Enough (zerohedge)

- Chewy (CHWY) stock jumps on better-than-anticipated Q4 top and bottom line (streetinsider)

- Reddit prices stock at top of target range in biggest social media IPO since Pinterest (streetinsider)

- 6 Highest Yielding Dividend Kings With Yields Up To 9.9% (247wallst)

- Private equity giant Apollo offers $11B for Paramount Pictures studio: report (nypost)

- SocGen’s Kabra Is Now Among the Biggest Bulls on US Stock (bloomberg)

- Apple Braces for Antitrust Lawsuit From DOJ (barrons)

- The Stock Market Is Already Way Up. 8 Stocks That Can Still Outperform. (barrons)

- Replacing Boeing CEO Calhoun Won’t Be Easy (barrons)

- Fundstrat’s Tom Lee sees small-cap benchmark Russell 2000 surging by 50% in 2024 (cnbc)

- Cheesecake Factory and 4 More Stocks Ready to Pop, From a Small-Cap Pro (barrons)

- Home Sales Jumped in February to Fastest Pace in a Year. Prices Are Up, Too. (barrons)

- Nike Reports Earnings Today. It Has Lots of Work to Do. (barrons)

- Nvidia Is Using Its Old 1990s Playbook To Best Its AI Rivals (barrons)

- Biden’s EPA Gives Automakers More Leeway to Phase Out Gas-Engine Cars (wsj)

- Elon Musk’s Neuralink Shows First Patient Using Its Brain Implant (wsj)

- Why Arizona Law Firms Are a Hot Investment for Private Equity (wsj)

- Nelson Peltz Wins Key Endorsement in Disney Battle (wsj)

- Airport Security Is a Confusing Mess Right Now (wsj)

- US Initial Jobless Claims Ease in Sign of Resilient Labor Market (bloomberg)

- The frugal life of Warren Buffett: How the billionaire spends his fortune, from McDonald’s breakfasts to a rare and ‘indefensible’ splurge (yahoo)

- Apple’s Tim Cook meets key suppliers in Shanghai as 57th China store opens (scmp)

Tom Hayes – CBS News Appearance – 3/21/2024

Tom Hayes – Quoted in Reuters article – 3/20/2024

Thanks to Savyata Mishra and Bansari Kamdar for including me in their article on Reuters. You can find it here:

Click Here to View The Full Reuters Article

Where is money flowing today?

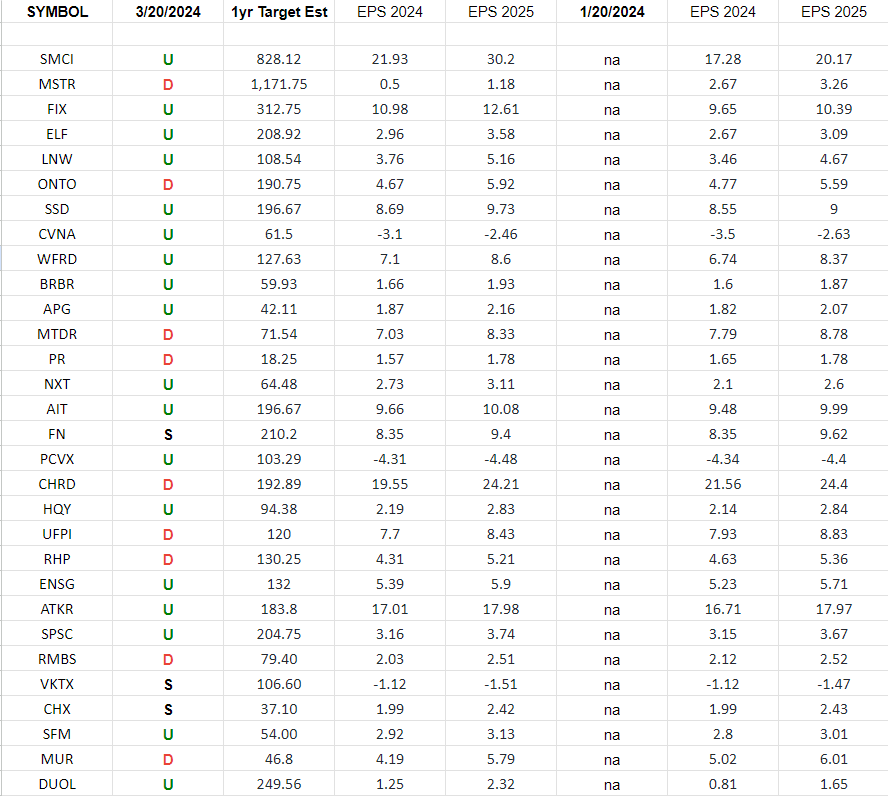

Russel 2000 (top weights) Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the top weighted Russell 2000 small cap stocks. I have columns for what the 2024 estimates were on 1/20/2024 and today.

Continue reading “Russel 2000 (top weights) Earnings Estimates”

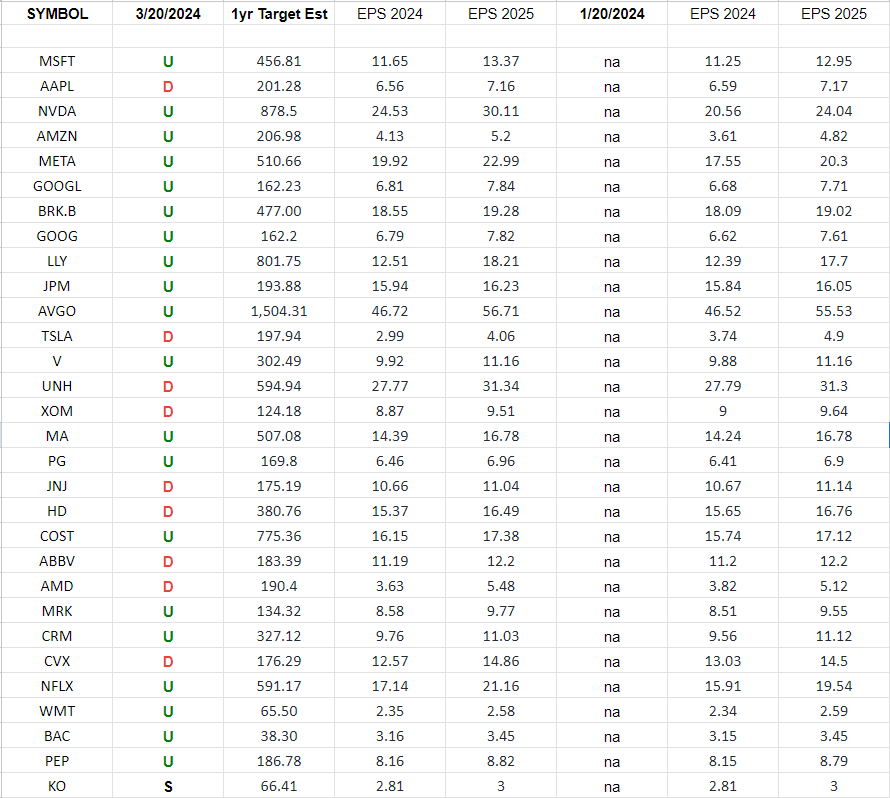

S&P 500 Earnings Estimates

In the spreadsheet above I have tracked the top 30 weights for the S&P 500 ETF (SPY).

Be in the know. 35 key reads for Wednesday…

- How Has the Fed’s Outlook Changed? Here’s What to Watch Today (wsj)

- PDD Stock Soars as Temu Parent Posts Huge Earnings Beat. What It Means for Alibaba. (barrons)

- Intel Gets Up to $8.5 Billion in Chips Act Funding from Biden Administration (barrons)

- Is a June rate cut still possible? Fed’s Powell will look to keep options open this week. (marketwatch)

- The Bank of Japan Just Handicapped a Winning Strategy. What to Know About the Yen Carry Trade. (barrons)

- Energy Suppliers Are Racing to Keep Up with the Data-Driven Energy Surge (barrons)

- The big tech rally is living on borrowed time, says UBS (marketwatch)

- ‘Mr. Yen’ says authorities may soon intervene as Japanese currency eyes multi-decade lows (marketwatch)

- Apple CEO Tim Cook Is in China After iPhone Sales Weaken. (barrons)

- The Latest Options Craze Resembles Past Manias. That’s Not a Good Thing. (barrons)

- Fed is ‘so far from equilibrium’ as markets await rate guidance, BlackRock’s Rick Rieder says (marketwatch)

- Boeing CFO Talks Cash, Spirit, And How to Fix Quality. (barrons)

- Apple Looks to External Partners to Boost AI Efforts (wsj)

- Why the Fed’s ‘Dot Plot’ Is the Center of Attention (wsj)

- The Era of No-Brainer 5% Returns on Cash Is Ending (wsj)

- Shares of Gucci Owner Tumble After Sales Warning (wsj)

- Understanding the Boeing Mess (wsj)

- NYC landlords luring workers back to offices with pickleball, golf simulators, arcade games and gourmet food (nypost)

- Here’s everything to expect from the Federal Reserve’s policy meeting (cnbc)

- Hong Kong’s national security law has analysts divided on its social and economic ramifications (cnbc)

- A Lady Gaga Google Search shows how AI is upending the world’s most profitable online business. ‘Site owners are terrified.’ (businessinsider)

- Once Again, Baltimore Hopes to Fight Blight With $1 Homes (governing)

- 4 signals that suggest the stock market’s bull rally could soon reverse (businessinsider)

- China’s Central Bank Names Two Scholars as New Policy Advisers (bloomberg)

- China to Use Public Auctions for Sale of Special Ultra-Long Debt (bloomberg)

- Intel prepares for $100 billion spending spree across four US states (reuters)

- West is ‘too optimistic’ on nuclear projects, warns engineering chief (ft)

- Alibaba-backed Moonshot AI expands Chinese-character prompt for Kimi chatbot (scmp)

- Tencent doubles share buy-backs while earnings miss estimates (scmp)

- Wouldn’t be surprised if more FOMC members predicted less than two rate cuts in 2024: Jeremy Siegel (cnbc)

- Rumors over ‘next James Bond’ left shaken and stirred by Aaron Taylor-Johnson speculation (wral)

- How the BOJ’s plan for a smooth exit from negative rates unraveled (reuters)

- BOJ Needs to Do More to Change Direction of Yen: Major (bloomberg)

- Goldman’s Hatzius Says US on Track for 2.4% Core PCE (bloomberg)

- Alibaba Raises $317 Million From Sale of Stake in EV Maker XPeng (bloomberg)