- How Has the Fed’s Outlook Changed? Here’s What to Watch Today (wsj)

- PDD Stock Soars as Temu Parent Posts Huge Earnings Beat. What It Means for Alibaba. (barrons)

- Intel Gets Up to $8.5 Billion in Chips Act Funding from Biden Administration (barrons)

- Is a June rate cut still possible? Fed’s Powell will look to keep options open this week. (marketwatch)

- The Bank of Japan Just Handicapped a Winning Strategy. What to Know About the Yen Carry Trade. (barrons)

- Energy Suppliers Are Racing to Keep Up with the Data-Driven Energy Surge (barrons)

- The big tech rally is living on borrowed time, says UBS (marketwatch)

- ‘Mr. Yen’ says authorities may soon intervene as Japanese currency eyes multi-decade lows (marketwatch)

- Apple CEO Tim Cook Is in China After iPhone Sales Weaken. (barrons)

- The Latest Options Craze Resembles Past Manias. That’s Not a Good Thing. (barrons)

- Fed is ‘so far from equilibrium’ as markets await rate guidance, BlackRock’s Rick Rieder says (marketwatch)

- Boeing CFO Talks Cash, Spirit, And How to Fix Quality. (barrons)

- Apple Looks to External Partners to Boost AI Efforts (wsj)

- Why the Fed’s ‘Dot Plot’ Is the Center of Attention (wsj)

- The Era of No-Brainer 5% Returns on Cash Is Ending (wsj)

- Shares of Gucci Owner Tumble After Sales Warning (wsj)

- Understanding the Boeing Mess (wsj)

- NYC landlords luring workers back to offices with pickleball, golf simulators, arcade games and gourmet food (nypost)

- Here’s everything to expect from the Federal Reserve’s policy meeting (cnbc)

- Hong Kong’s national security law has analysts divided on its social and economic ramifications (cnbc)

- A Lady Gaga Google Search shows how AI is upending the world’s most profitable online business. ‘Site owners are terrified.’ (businessinsider)

- Once Again, Baltimore Hopes to Fight Blight With $1 Homes (governing)

- 4 signals that suggest the stock market’s bull rally could soon reverse (businessinsider)

- China’s Central Bank Names Two Scholars as New Policy Advisers (bloomberg)

- China to Use Public Auctions for Sale of Special Ultra-Long Debt (bloomberg)

- Intel prepares for $100 billion spending spree across four US states (reuters)

- West is ‘too optimistic’ on nuclear projects, warns engineering chief (ft)

- Alibaba-backed Moonshot AI expands Chinese-character prompt for Kimi chatbot (scmp)

- Tencent doubles share buy-backs while earnings miss estimates (scmp)

- Wouldn’t be surprised if more FOMC members predicted less than two rate cuts in 2024: Jeremy Siegel (cnbc)

- Rumors over ‘next James Bond’ left shaken and stirred by Aaron Taylor-Johnson speculation (wral)

- How the BOJ’s plan for a smooth exit from negative rates unraveled (reuters)

- BOJ Needs to Do More to Change Direction of Yen: Major (bloomberg)

- Goldman’s Hatzius Says US on Track for 2.4% Core PCE (bloomberg)

- Alibaba Raises $317 Million From Sale of Stake in EV Maker XPeng (bloomberg)

“Stuck in the Middle With You” Stock Market…

In 1972, Stealers Wheel released the song “Stuck in the Middle with You.”

Continue reading ““Stuck in the Middle With You” Stock Market…”

Where is money flowing today?

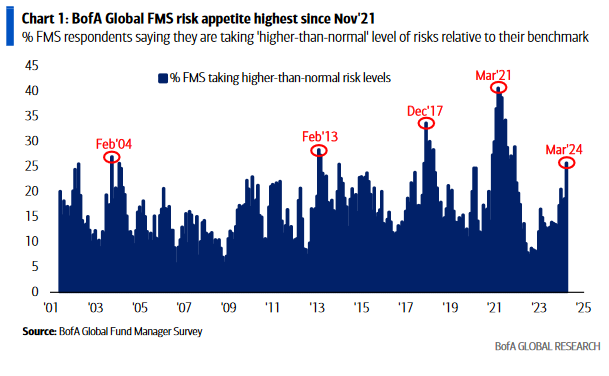

March 2024 Bank of America Global Fund Manager Survey Results (Summary)

The March survey covered 198 fund managers with $527 billion under management. Continue reading “March 2024 Bank of America Global Fund Manager Survey Results (Summary)”

Be in the know. 37 key reads for Tuesday…

- Buy 3M Stock Ahead of Healthcare Spinoff. Analyst Expects Higher Valuation. (barrons)

- Natural Gas Prices Won’t Stay Low for Long. An Export Boom Is Coming. (barrons)

- 1 No-Brainer Growth Stock to Buy Now With $100 and Hold Through 2024 (and Beyond) (fool)

- Japan Finally Raises Rates. Global Markets Will Feel It. (barrons)

- As Electric-Vehicle Shoppers Hesitate, Hybrid Sales Surge (wsj)

- UK Reality TV Stars, Influencers Join AliExpress’ New Livestreaming E-Commerce Community (alizila)

- Alibaba brings 5-day delivery to the US in race against Shein, Temu (scmp)

- Marissa Pardini Steps Down from Vans; More Layoffs Hit Office (shop-eat-surf)

- Ant Sets Up Board for International Operations in Broad Overhaul (bloomberg)

- BABA-SW’s Hema Global Shopping Biz GMV Rises 1x+ YoY in 2023 (aastocks)

- Developing | Ant Group restructures part of its businesses into units, promotes veteran finance chief as president to spur growth (scmp)

- Commercial Real Estate Is a Slow Burn,’ Says Bank of America CEO Moynihan (bloomberg)

- Small Caps Can Shine With Reasonable Rates: BofA (bloomberg)

- BofA’s Moynihan on US Consumer, Trading Activity and CRE (bloomberg)

- BofA’s Moynihan: Banks Have ‘Tremendous Amounts of Capital’ (bloomberg)

- BofA CEO Moynihan: Customers ‘Remarkably Resilient’ (bloomberg)

- Central bankers see ‘immaculate disinflation’ within reach (ft)

- The ferocious US pushback against new banking rules (ft)

- Warren Buffett Says Even The Bottom 2% Of Earners ‘All Live Better Than John D. Rockefeller’ – And He Was The Richest Man In The World (yahoo)

- New-Home Construction Rose in February. Builders Are Confident. (barrons)

- Don’t want to chase Big Tech? Money manager flags three unloved stocks to bet on now. (marketwatch)

- Fusion Pharmaceuticals Stock Soars. It’s Being Acquired by AstraZeneca in $2.4 Billion Deal. (barrons)

- Odds of a June rate cut by Fed slip below 50%, according to this gauge (marketwatch)

- ESPN Boss Jimmy Pitaro’s Chaotic Race to Remake the Sports Giant (wsj)

- Once America’s Hottest Housing Market, Austin Is Running in Reverse (wsj)

- Cities Face Cutbacks as Commercial Real Estate Prices Tumble (nytimes)

- Japan Ends Era of Negative Rates With Few Clues on Further Hikes (bloomberg)

- Warren Urges Powell to Cut Rates to Help Struggling Clean Energy (bloomberg)

- Trading Floors Buzz With Excitement as BOJ Axes Negative Rates (bloomberg)

- Real Estate Pain Is Showing Up in an Obscure Investment Product (bloomberg)

- The Fed Has a Lot of Questions to Answer About Its Balance Sheet (bloomberg)

- America’s Place in India’s Butter Chicken Fight (bloomberg)

- Harvard-trained neuroscientist with 20+ years experience: 7 tricks I use to keep my memory sharp (cnbc)

- Fed could cut rates fewer times than expected as economy keeps growing, according to CNBC survey (cnbc)

- Nordstrom shares jump more than 10% on report retailer is trying to go private (cnbc)

- Housing Starts And Permits Surged In February (Despite Plunging Rate-Cut Odds) (zerohedge)

- A Bill Gates company is about to start building a nuclear power plant in Wyoming (businessinsider)

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 55 key reads for Monday…

- China Shares Lifted by Data. Expect More Gains. (barrons)

- Meet the ‘Witch of Wall Street,’ a black-clad pioneering value investor who became the world’s richest woman—but is wrongly remembered as a cheapskate (fortune)

- China kicks off the year on strong note as retail, industrial data tops expectations (cnbc)

- Fed Rate Cuts Are on Hold. 3 Picks if They Come Sooner. (barrons)

- Why Bank of Japan may shake up financial markets before Fed’s next interest-rate decision (marketwatch)

- Inflation is NOT running hot (scottgrannis)

- Apple Is in Talks to Let Google Gemini Power iPhone AI Features (bloomberg)

- Fed rate cuts will be a tailwind for small caps, says Fundstrat’s Tom Lee (cnbc)

- PayPal Stock Has Fallen Far Enough. It’s Time to Buy. (barrons)

- A New Surge in Power Use Is Threatening U.S. Climate Goals (nytimes)

- How China Could Swamp India’s Chip Ambitions (wsj)

- The F-Bomb-Dropping Airline CEO About to Earn a $100 Million-Plus Bonus (wsj)

- Dollar Stores Get Devalued as Low-Income Consumers Struggle (wsj)

- A Big Disney Fight Isn’t Nelson Peltz’s Only Drama (wsj)

- Suspense Builds for Fed as Growth Downshifts and Inflation Lingers (wsj)

- Cisco stock still isn’t back to its 2000 high: Chart of the Week (yahoo)

- Hertz CEO resigns after push to buy Tesla fleet backfires big time for company (foxbusiness)

- Boeing bonds are still coveted by investors despite a rough 2024 for jet maker (marketwatch)

- Steven Mnuchin’s interest in TikTok and NYCB echoes his pre-Trump investment playbook (marketwatch)

- TikTok Bill’s Progress Slows in the Senate (nytimes)

- S. stocks have beaten European equities but won’t for much longer, says JPMorgan (marketwatch)

- The Fed’s Challenge: Has It Hit the Brakes Hard Enough? (wsj)

- Markets capitulate to Fed on interest rates after months-long stand-off (ft)

- US equity funds draw record inflow as investors bet on soft landing (ft)

- ‘Growth company with no growth’: Wells Fargo says Tesla stock could drop 23% in scathing downgrade (businessinsider)

- It’s actually a good time to buy a new car (businessinsider)

- The end of the Realtor monopoly (businessinsider)

- Michelin Unveils 2024 List of Starred Restaurants in Hong Kong, Macau (bloomberg)

- What Must Nelson Peltz Do to Get Some Respect? (nytimes)

- 10 Best Cheap Stocks to Buy Under $10 (morningstar)

- Wall Street Doom Prophesy Falls Flat on Hottest Rally Since 2016 (bloomberg)

- The Consumer Price Index Doesn’t Capture What’s Really Hurting Consumer Confidence (barrons)

- Fast-Food Companies Could Be Heading Toward a Price War. Why McDonald’s Could Win (barrons)

- How the Federal Reserve Could Throw Stocks for a Loop (barrons)

- Masters in Business: Mark Wiedman (bloomberg)

- remembering marcello gandini, italian car designer of lamborghini, ferrari, maserati and more (designboom)

- Ex-Ford CEO warns of ‘real financial trouble’ for EV startups as adoption takes longer than expected (fortune)

- Can Ferrari, the Winningest Team in F1 History, Get Back on Track? We Ask an Expert (robbreport)

- Weekly Leading Economic Index (advisorperspectives)

- Alexander Hamilton and the Birth of US Industrial Policy (bloomberg)

- Who Will Be the Next James Bond? (townandcountrymag)

- Scottie Scheffler defends Players Championship title with dominant Sunday charge (golf)

- The End of Japan’s Negative Rates Will Be a Slow-Moving Tsunami (wsj)

- Disney Board Seats for Nelson Peltz Are a Long Shot. He’s Winning Just the Same. (barrons)

- Park Avenue landlords boast new leases after glowing Sixth Ave. report (nypost)

- Dan Loeb Enters the Chip Wars (nytimes)

- Florida Is Not So Cheap Compared With New York These Days (bloomberg)

- Carbone Wants to Conquer the World With a Red Sauce Empire (bloomberg)

- There’s Now a Fake Santorini in Abu Dhabi to Lure Luxury Travelers (bloomberg)

- There’s really no need for the Fed to lower interest rates, says Ed Yardeni (cnbc)

- Damo Academy plans to launch latest RISC-V chip this year as chip demand grows (scmp)

- Good news is good news again in markets (ft)

- Goldman Sachs raises US real GDP growth forecast (streetinsider)

- TikTok’s Business, in Charts (wsj)

- The Fed’s Challenge: Has It Hit the Brakes Hard Enough? (wsj)

Quote of the Day…

Be in the know. 10 key reads for St. Patrick’s Day…

- How AI Is Sparking a Change in Power (barrons)

- Investors Don’t Need to Sweat the Latest Boeing 737 Safety Incident. The Data Show Why. (barrons)

- Dan Yergin Is Concerned About AI-Fueled Boom in Electricity Use (bloomberg)

- The Everything Rally Comes to Derivatives Market (bloomberg)

- Apple Without AI Looks More Like Coca-Cola Than High-Growth Tech (bloomberg)

- America’s Office Fire Sale Has Barely Begun (wsj)

- Berkshire Bought Back About $2.3 Billion in Stock (barrons)

- The Big Read. The battle over TikTok (ft)

- Barclays explains why S&P 500 keeps rallying despite hot CPI, PPI data (streetinsider)

- Investors should buy cheap portfolio insurance now before stock market turns volatile, Goldman warns (marketwatch)