Data Source: Finviz

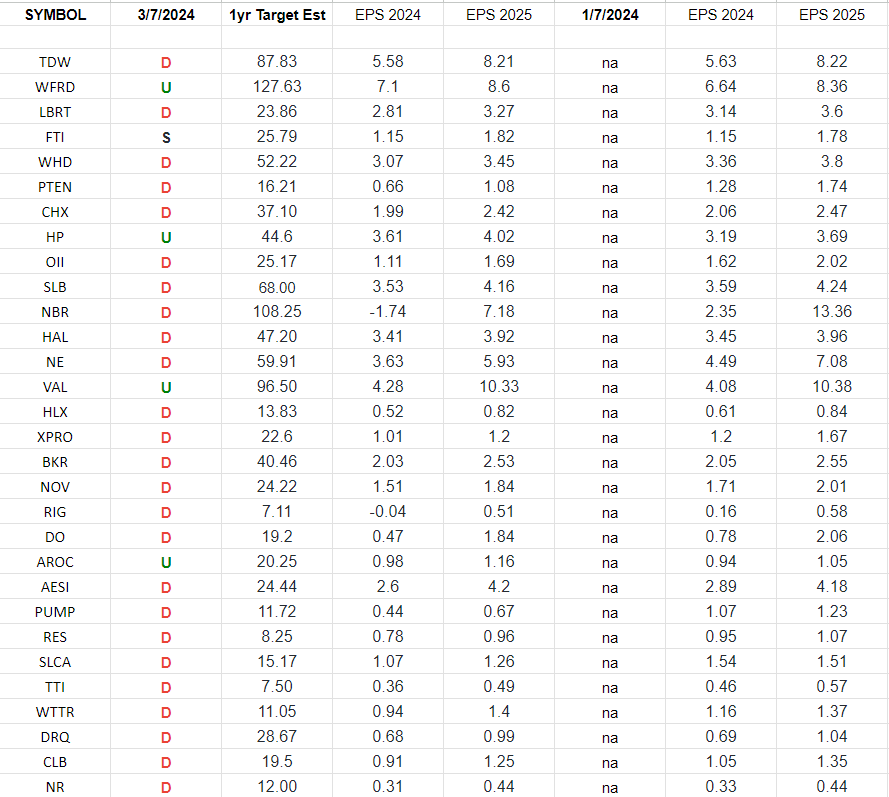

Oil & Gas Equipment & Services Earnings Estimates and Revisions

In the spreadsheet above I have tracked the earnings estimates for the Oil & Gas Equipment & Services ETF (XES) top 30 weighted stocks. Continue reading “Oil & Gas Equipment & Services Earnings Estimates and Revisions”

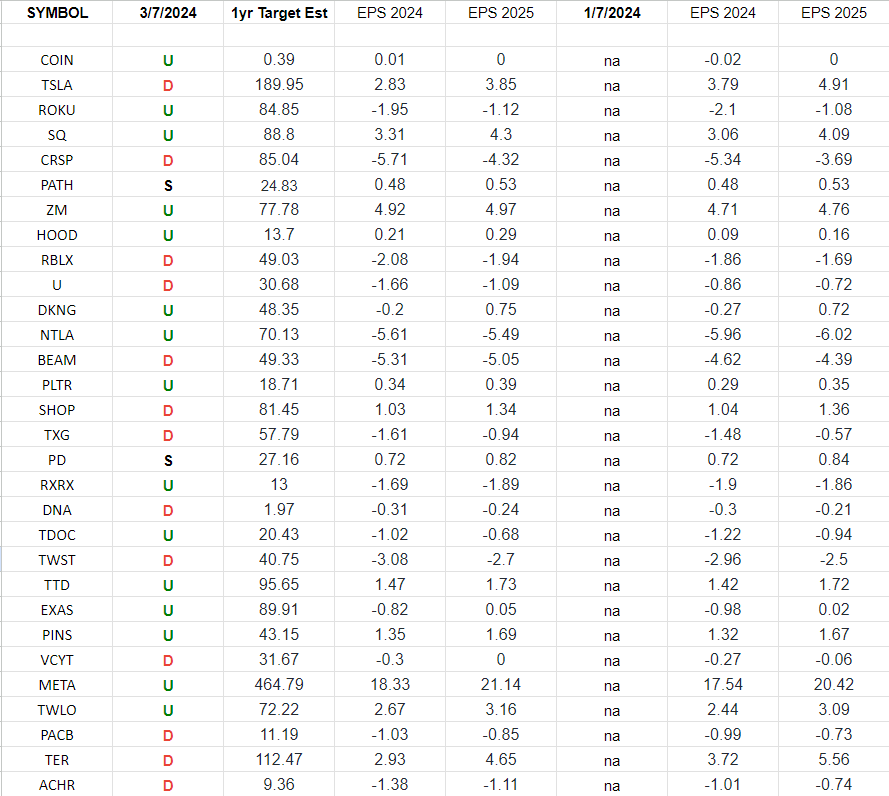

ARKK Innovation Fund Earnings Estimates/Revisions

Be in the know. 18 key reads for Thursday…

- China Scrutinizes Bond Buying at Smaller Banks (bloomberg)

- China’s exports and imports beat estimates for first 2 months, signaling improving demand (marketwatch)

- China Export Growth Jumps as Nation Looks to Bolster Demand (bloomberg)

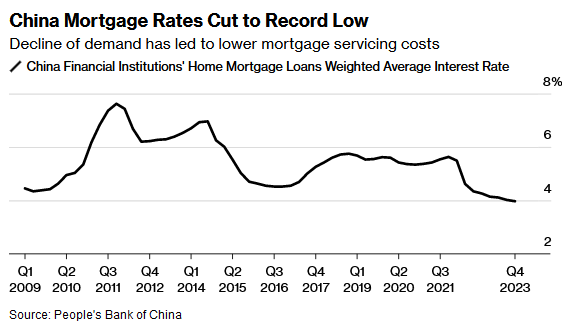

- Why China’s Property Downturn Has a Silver Lining for Consumption (bloomberg)

- Ford sales jump 10.5% in February, led by gains in hybrids and EVs (cnbc)

- Steven Mnuchin Backs New York Community Bank in $1 Billion Deal (nytimes)

- US Stock Buybacks to Hit $1 Trillion in 2025, Goldman Says (bloomberg)

- Interest Rates Will Do a “Slow Dance Downward,” This Economist Predicts (barrons)

- Jerome Powell Says Fed on Track to Cut Rates This Year (wsj)

- Chinese Officials Say Exports Are Strong but Hint at More Stimulus (wsj)

- TikTok Parent ByteDance Launches New Share Buyback After Rise in Revenue (wsj)

- ECB Interest Rates Held as Weaker Inflation Raises Prospect of Cuts (bloomberg)

- McLaren Racing Sees Every F1 Team Worth More Than £1 Billion (bloomberg)

- Discounted small-cap stocks ‘poised to outperform large-caps’ – UBS (streetinsider)

- Goldman raises 2024 S&P 500 buyback projections, unveils 2025 forecast (streetinsider)

- BofA after Powell’s testimony: June still ‘reasonable’ for the first rate cut (streetinsider)

- China vows to crack down on market manipulators (bloomberg)

- Everyone Knows That Chewy Sells Pet Food and Toys. But the Company Just Started Addressing an $11.5 Billion Market That You Might Not Expect. (fool)

“Tool Time” Stock Market (and Sentiment Results)…

On Tuesday, I had the pleasure of joining Liz Claman on Fox Business the “Claman Countdown.” I always love going on Liz’s show because she was the first one to ever give me a break on TV (~4.5 years ago now!). I’m forever grateful. Thanks to Liz and Kathryn Meyers for having me on. Continue reading ““Tool Time” Stock Market (and Sentiment Results)…”

Where is money flowing today?

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 16 key reads for Wednesday…

- Thomas Hayes: The narrative of the market has been AI and Bitcoin (foxbusiness)

- Fed Chair Powell Reiterates Hawkish Stance Ahead Of ‘Humphrey Hawkins’ Testimony (zerohedge)

- Jim Cramer hits the charts to predict if there’s stormy weather ahead for the averages (cnbc)

- China’s Xi Jinping summons ‘new productive forces’, but old questions linger (reuters)

- China Defends 5% Growth Target, Hints at Liquidity Boost (bloomberg)

- China’s central bank governor says there’s room to cut banks’ reserve requirements (cnbc)

- China’s top securities regulator vows to ‘strictly’ crack down on market manipulators (cnbc)

- China Stock Watchdog Vows Action at Times of ‘Market Failures’ (bloomberg)

- com Surges on Earnings (barrons)

- Patients Lose Access to Weight-Loss Drugs as Employers Stop Coverage (wsj)

- Dodge announces first electric muscle car in Charger lineup (foxbusiness)

- Jim Cramer hits the charts to predict if there’s stormy weather ahead for the averages (cnbc)

- Fed’s Powell still expects rate cuts, but inflation progress “not assured” (reuters)

- Alphabet’s AI Missteps Are Opportunity For One Fund Manager (bloomberg)

- Commercial real estate fears are overblown, and mortgage bonds show the sector is poised to recover, portfolio manager says (businessinsider)

- Bullish tech bets are at the highest in 3 years as market looks ‘increasingly one-sided,’ Citi says (businessinsider)

Tom Hayes – Quoted in Cheddar News article – 3/5/2024

Thanks to Ellen Chang for including me in her article on Cheddar.com. You can find it here:

Thanks to Ellen Chang for including me in her article on Cheddar.com. You can find it here:

Click Here to View The Full Article on Cheddar.com

Tom Hayes – Fox Business Appearance – The Claman Countdown – 3/5/2024

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – March 5, 2024