- China Scrutinizes Bond Buying at Smaller Banks (bloomberg)

- China’s exports and imports beat estimates for first 2 months, signaling improving demand (marketwatch)

- China Export Growth Jumps as Nation Looks to Bolster Demand (bloomberg)

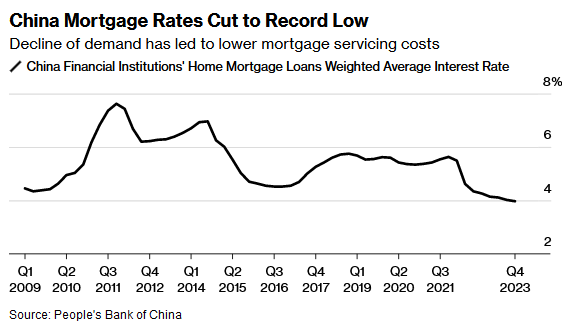

- Why China’s Property Downturn Has a Silver Lining for Consumption (bloomberg)

- Ford sales jump 10.5% in February, led by gains in hybrids and EVs (cnbc)

- Steven Mnuchin Backs New York Community Bank in $1 Billion Deal (nytimes)

- US Stock Buybacks to Hit $1 Trillion in 2025, Goldman Says (bloomberg)

- Interest Rates Will Do a “Slow Dance Downward,” This Economist Predicts (barrons)

- Jerome Powell Says Fed on Track to Cut Rates This Year (wsj)

- Chinese Officials Say Exports Are Strong but Hint at More Stimulus (wsj)

- TikTok Parent ByteDance Launches New Share Buyback After Rise in Revenue (wsj)

- ECB Interest Rates Held as Weaker Inflation Raises Prospect of Cuts (bloomberg)

- McLaren Racing Sees Every F1 Team Worth More Than £1 Billion (bloomberg)

- Discounted small-cap stocks ‘poised to outperform large-caps’ – UBS (streetinsider)

- Goldman raises 2024 S&P 500 buyback projections, unveils 2025 forecast (streetinsider)

- BofA after Powell’s testimony: June still ‘reasonable’ for the first rate cut (streetinsider)

- China vows to crack down on market manipulators (bloomberg)

- Everyone Knows That Chewy Sells Pet Food and Toys. But the Company Just Started Addressing an $11.5 Billion Market That You Might Not Expect. (fool)

Be in the know. 18 key reads for Thursday…