On Tuesday, I had the pleasure of joining Liz Claman on Fox Business the “Claman Countdown.” I always love going on Liz’s show because she was the first one to ever give me a break on TV (~4.5 years ago now!). I’m forever grateful. Thanks to Liz and Kathryn Meyers for having me on.

In this segment we discussed how to stay fully invested and hedge out short term risk, as well as one of our favorite turnaround stories:

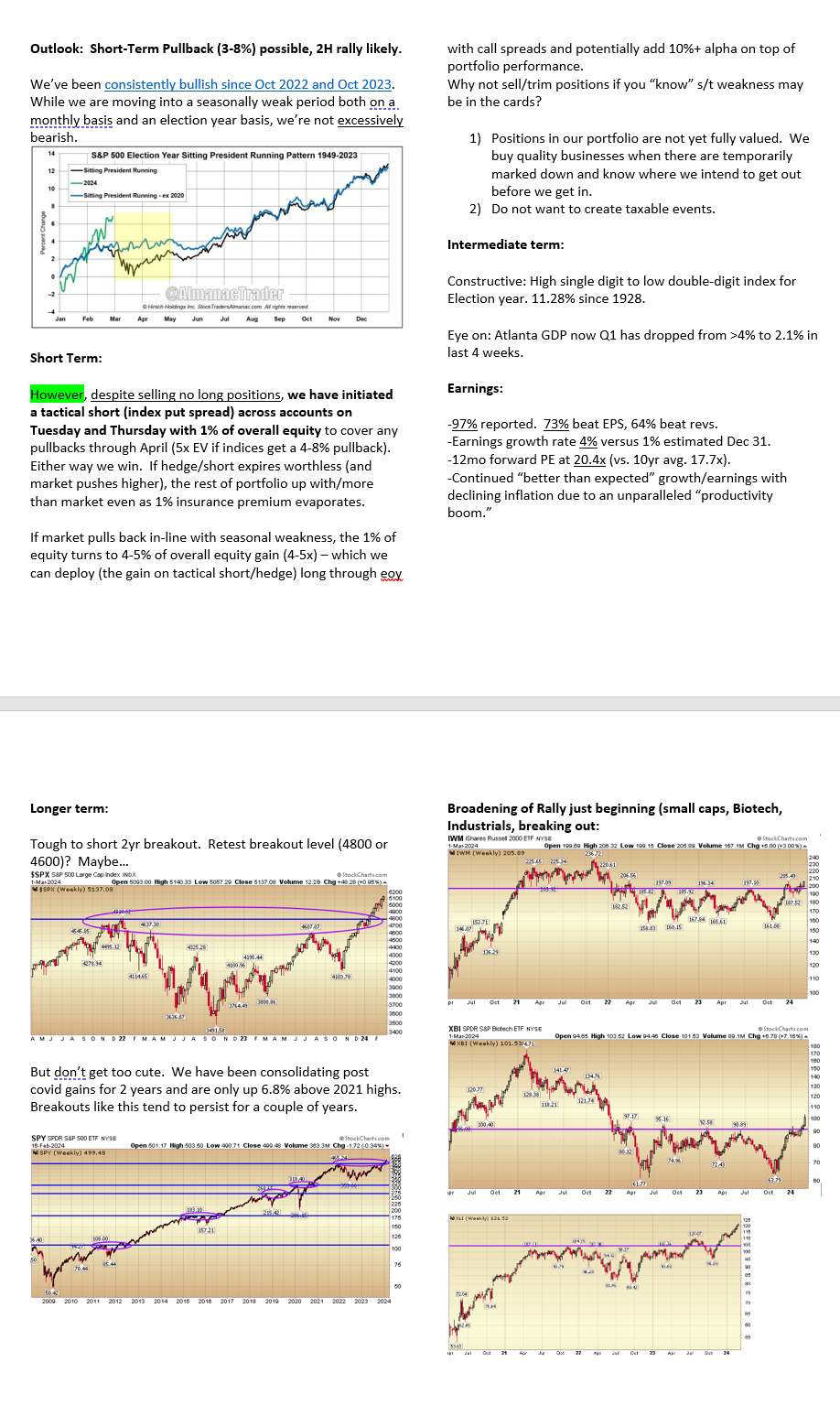

Here were my notes ahead of the segment. As you will see we tend to go with the flow and shift on the fly with live TV!

Short Term Cautious, Long Term Constructive

If you listened very carefully to what I said in my interview with Liz above, you can clearly see a shift.

I’ve said for 1.5 years – every week when people would wonder about the latest negative headline or commentator – “I’m finding a lot more great companies to buy than sell.” As you saw in my commentary above, that equation has shifted.

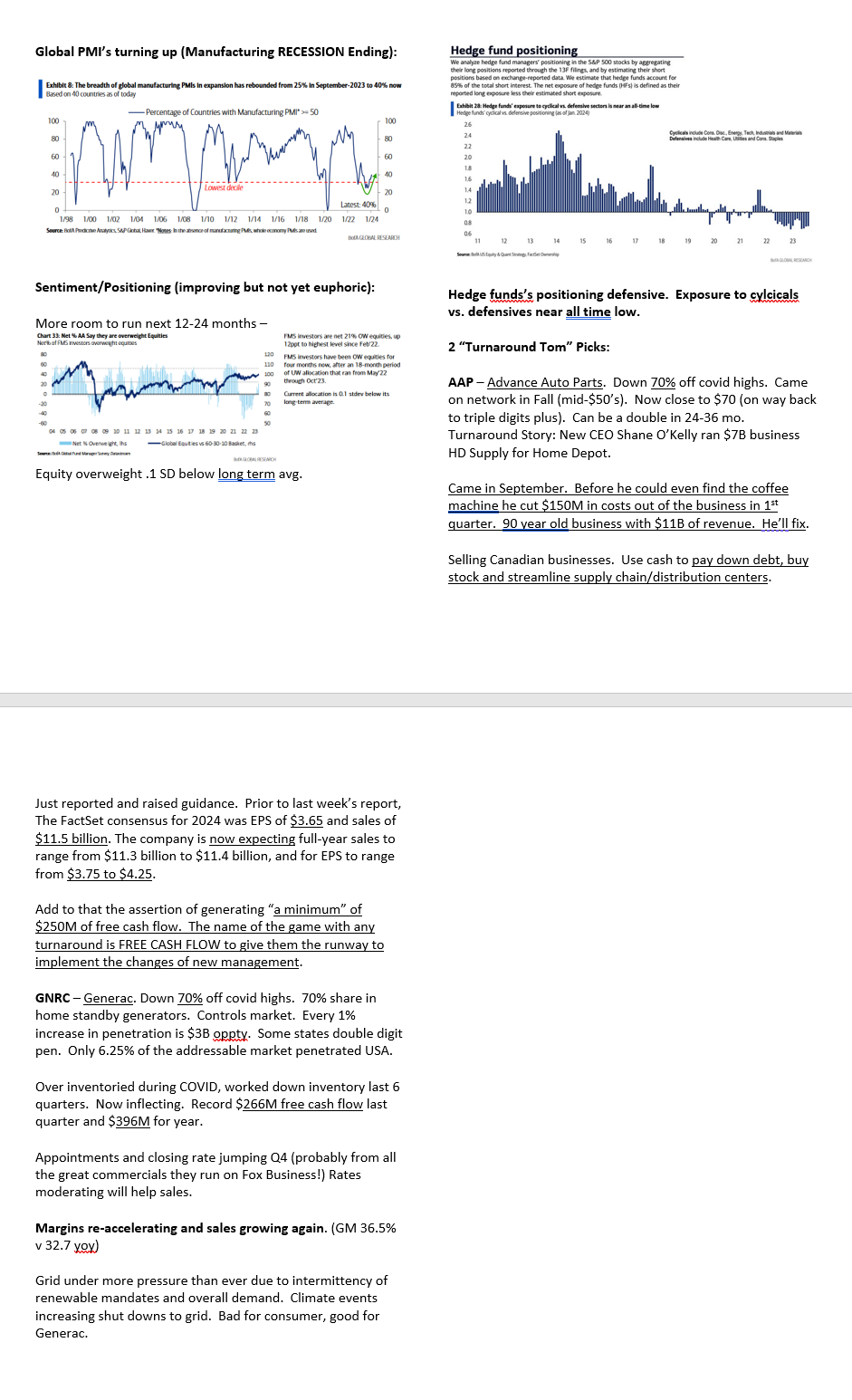

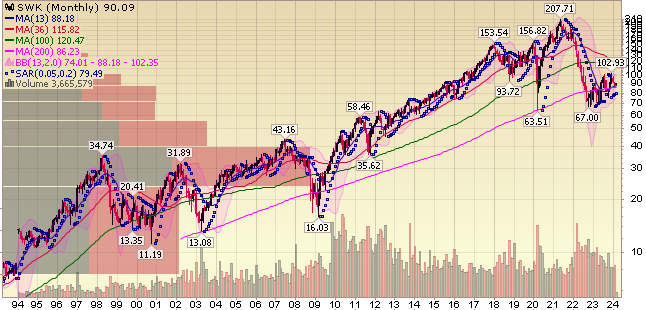

I am by no means bearish, but I think we will see some weakness in coming weeks and months EVEN IF WE GO A BIT HIGHER FIRST. I will never discuss individual shorts, but a reporter from Bloomberg reached out last night to ask whether the rally in AMD was sustainable. We have no position long or short at present, but here’s what I had to say (you can imagine this is a proxy to a number of other popular high-flyers):

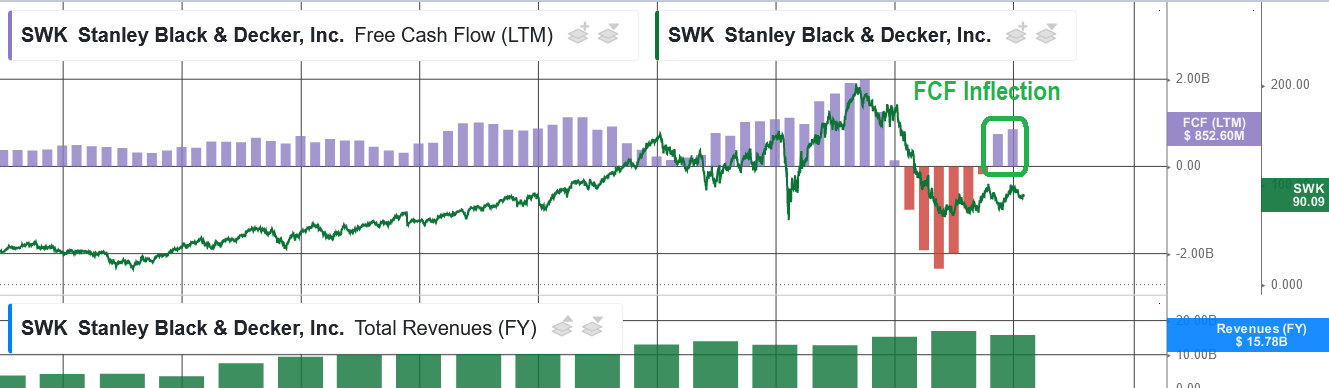

You contrast this with the type of companies we own (that have a large margin of safety) and are growing or inflecting Free Cash Flow and if you’ve been around long enough you know a shift is coming. The last shall be first, yet again…

Speaking of which:

Each week we try to cover one or two holdings or companies we have covered on previous podcast|videocast(s):

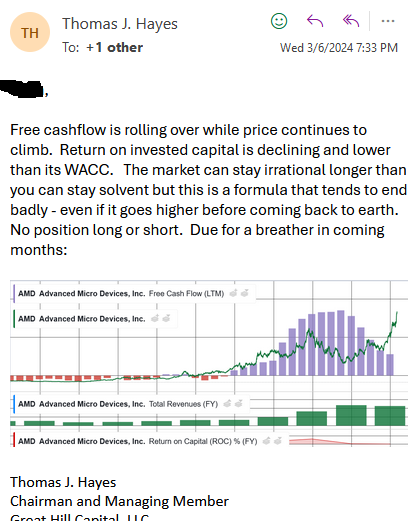

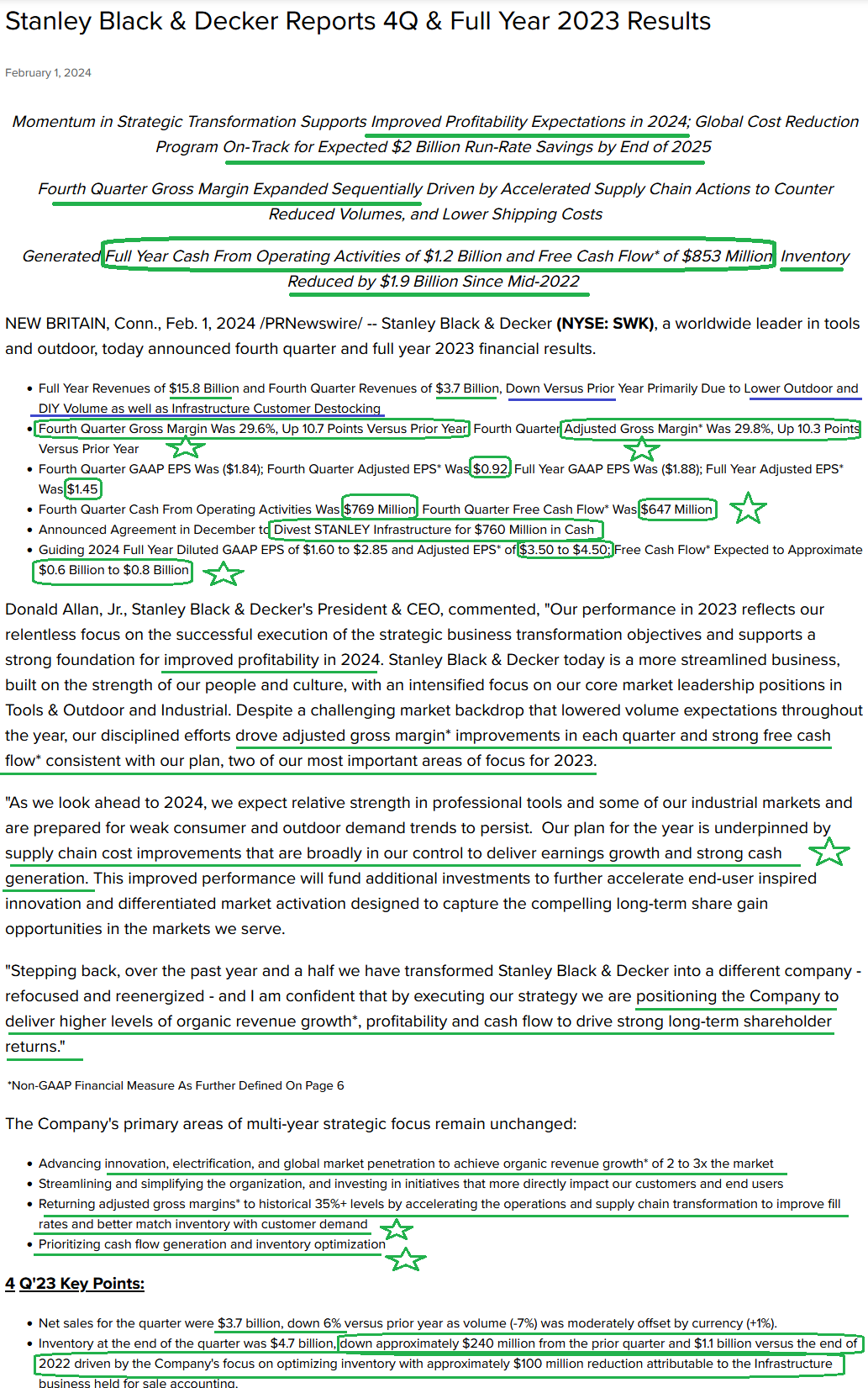

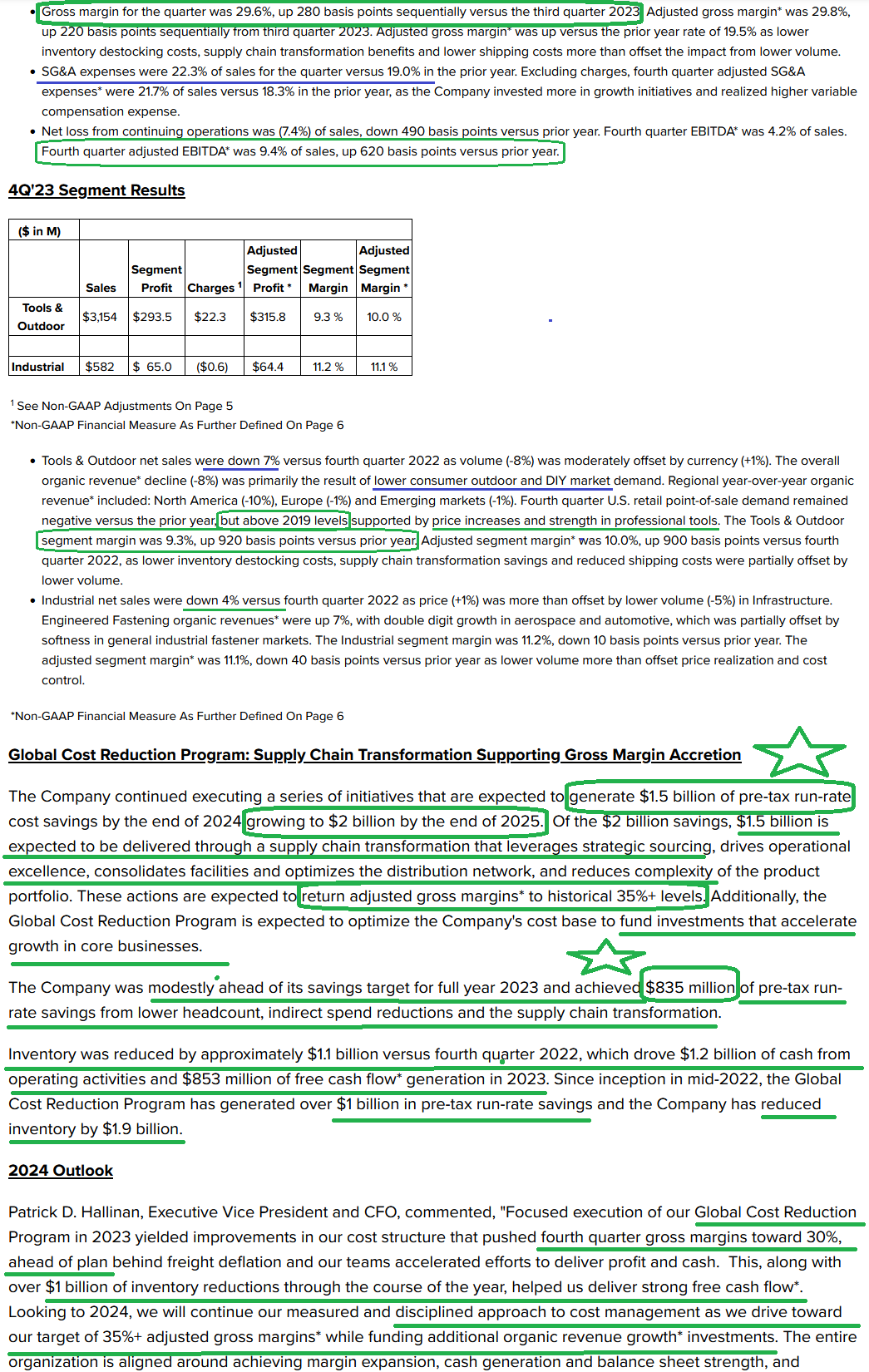

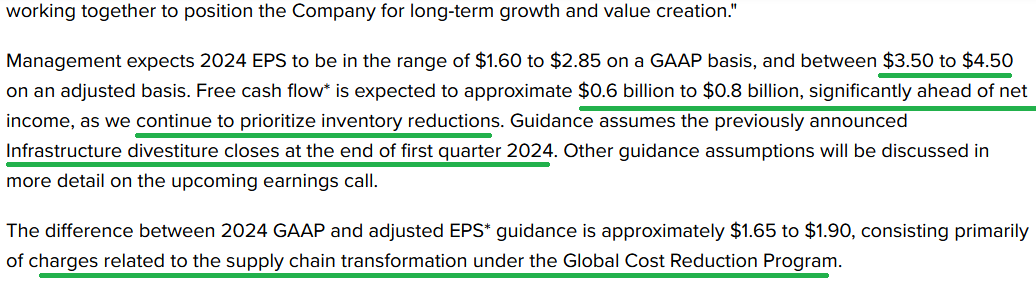

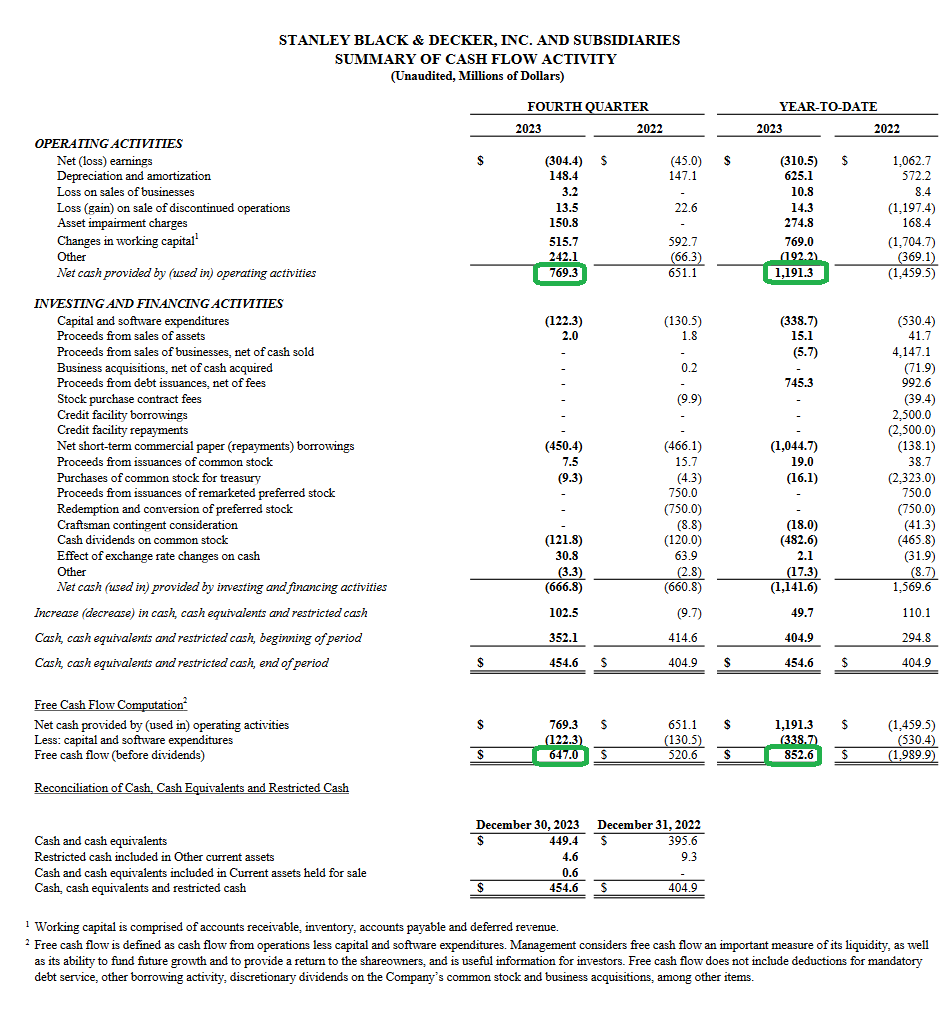

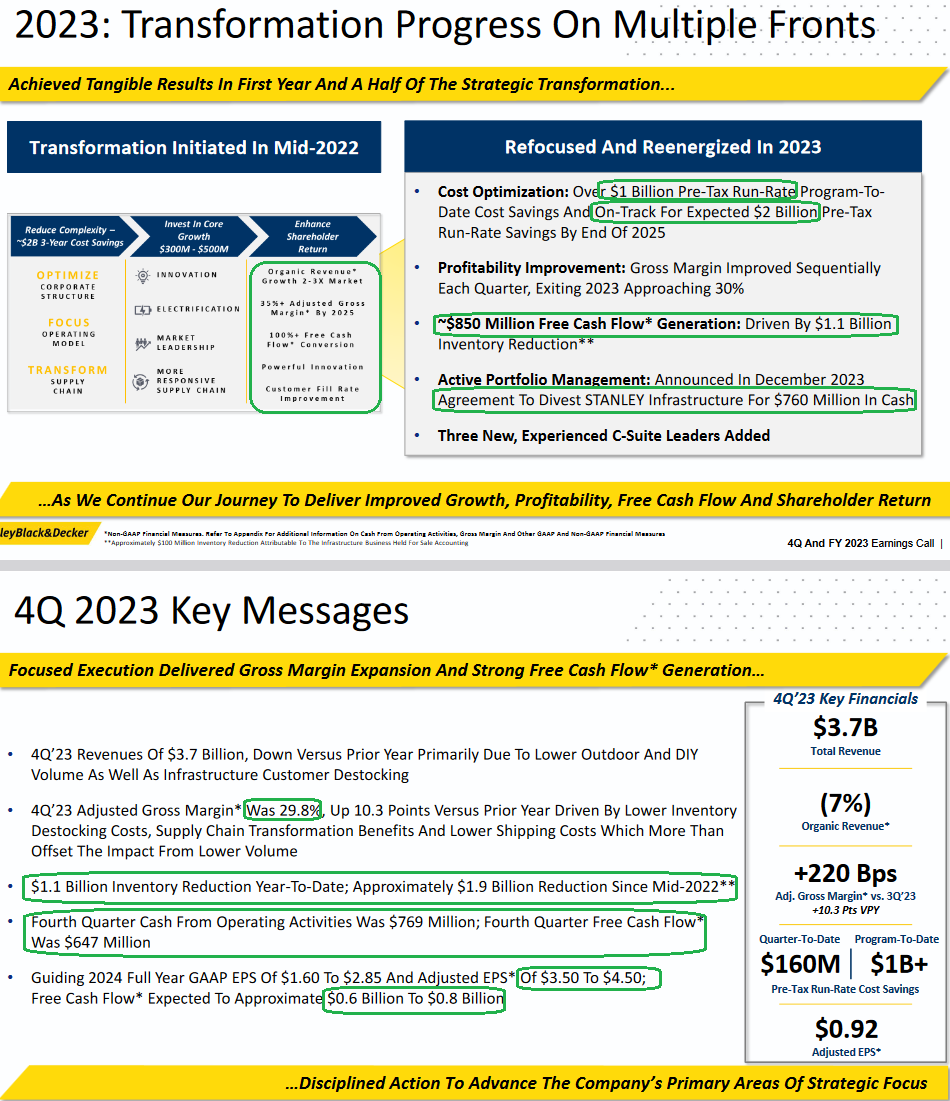

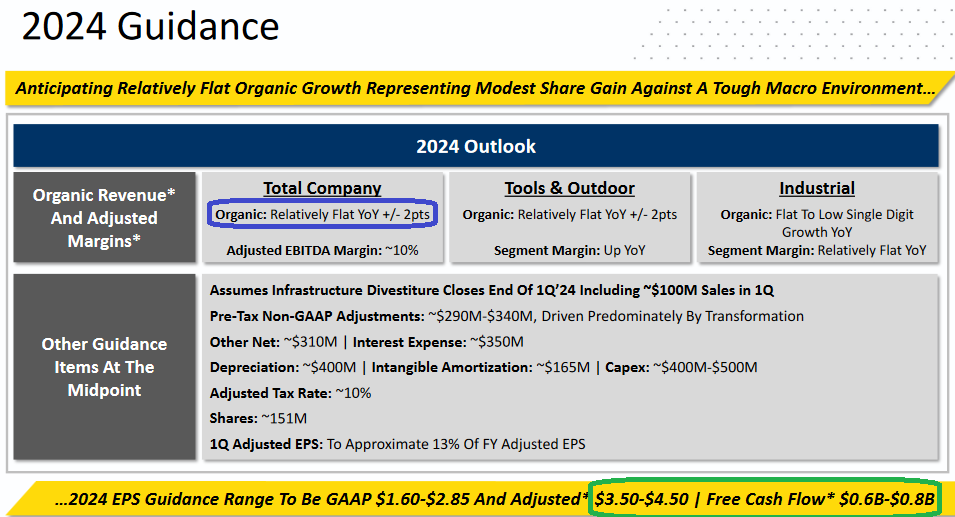

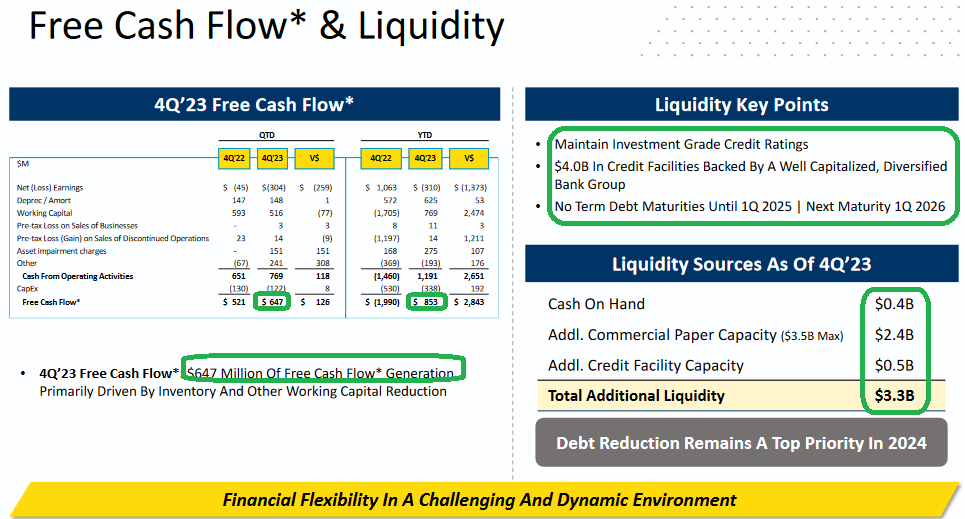

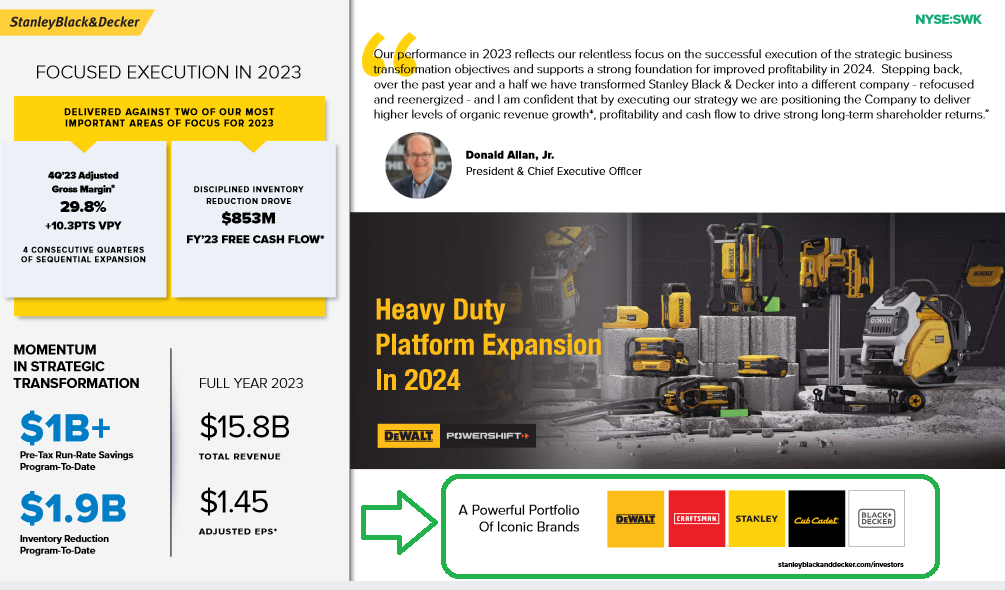

Stanley Black and Decker Update

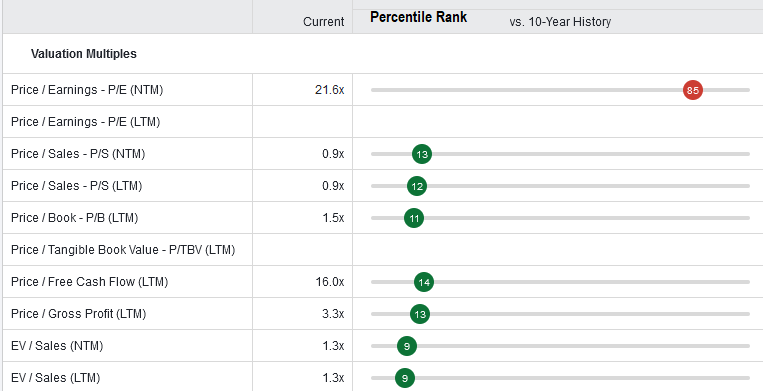

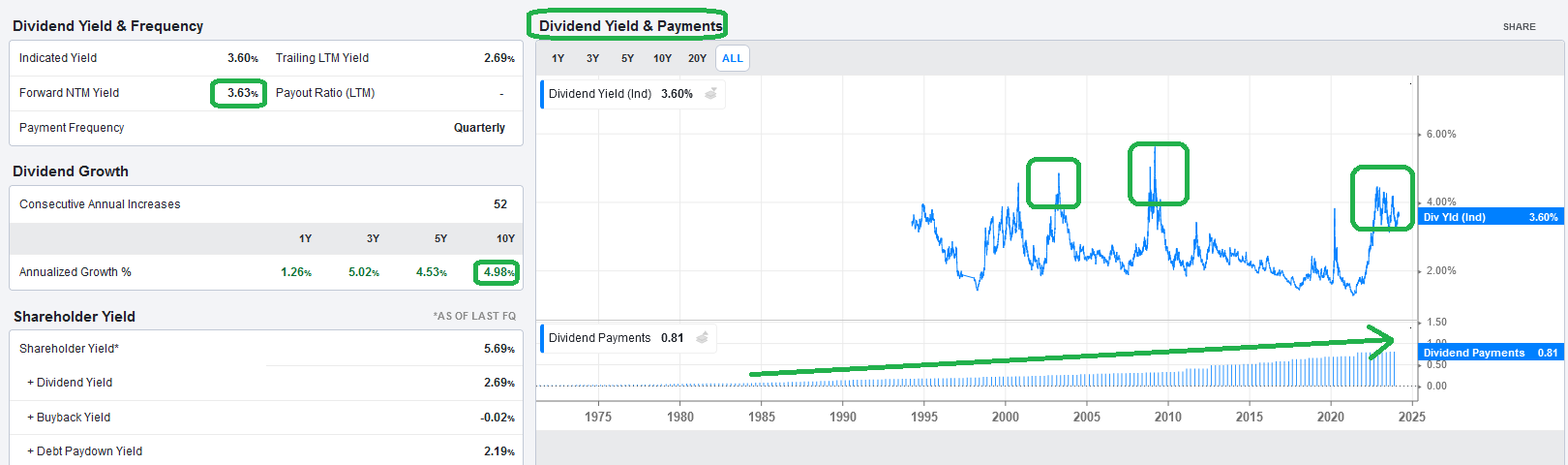

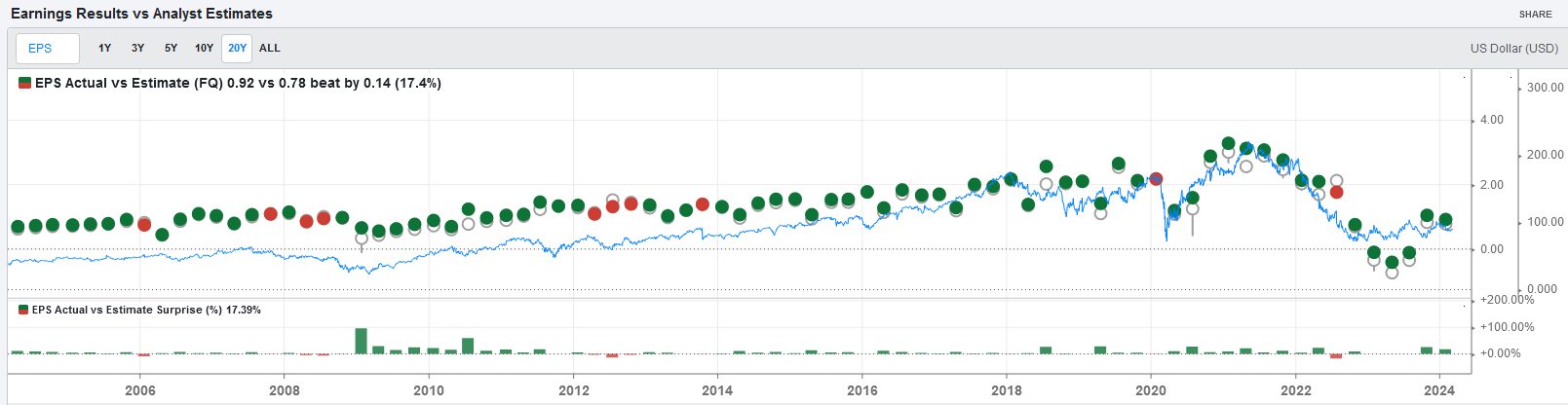

Here are the 3 things you need to know about the SWK restructuring plan – $2B (of cost cuts) and return to 35% gross margin – that started in 2023.

- It’s ahead of schedule. They will hit $1.5B in 2024 and $2B in 2025.

- $2B in savings across 151M shares = $13.25/share. The average annual historic multiple is 16x. So, excluding a re-acceleration of Revenues (which will come), they will accrete ~$212/share (of value) through cost savings alone. As business normalizes, it could be worth more.

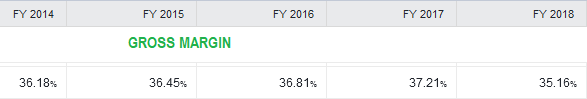

- They are ahead of schedule to return gross margins to 35%. The last time they were at that level was 2017-2018 period when they earned $8.05/share on 18% LESS REVENUES THAN TODAY and the stock was ~$153.

Now onto the shorter term view for the General Market:

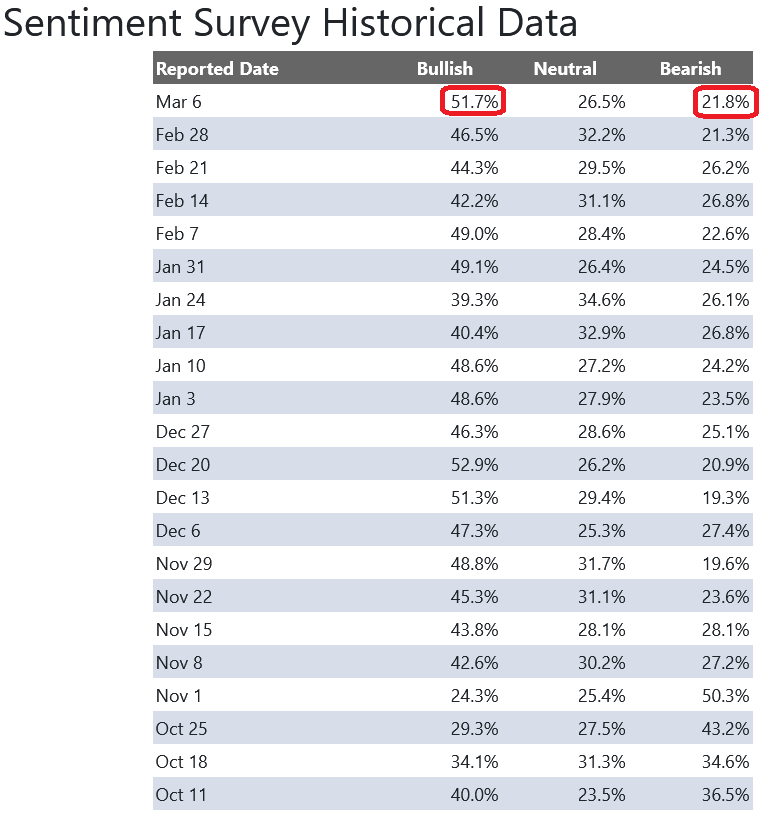

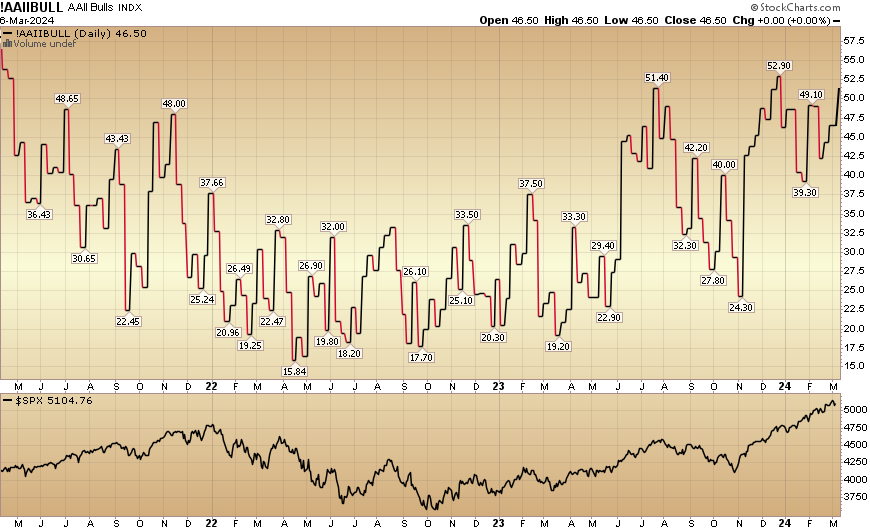

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) moved up 51.7% from 46.5% the previous week. Bearish Percent flat-lined to 21.8% from 21.3%. The retail investor is giddy.

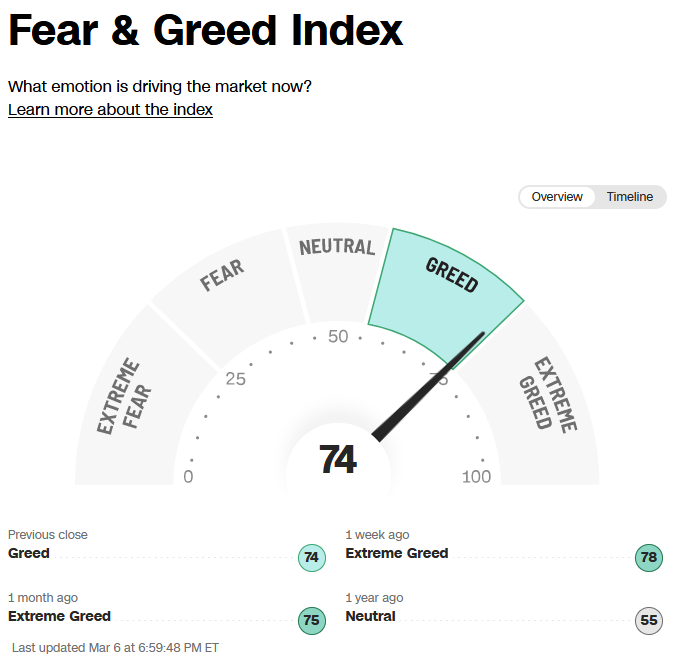

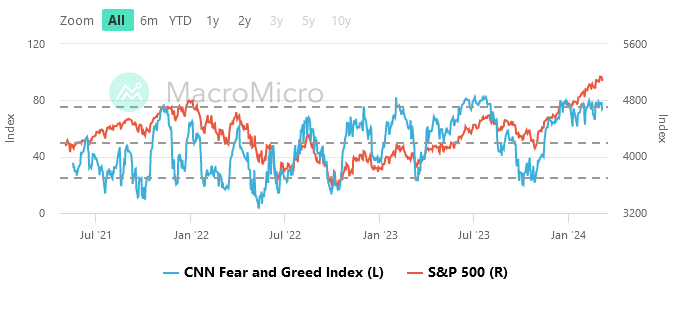

The CNN “Fear and Greed” dipped from 79 last week to 74 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” dipped from 79 last week to 74 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

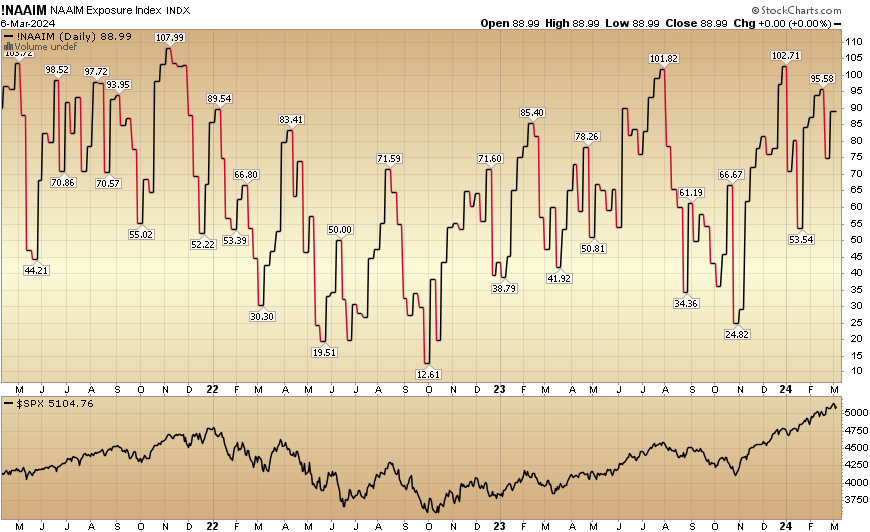

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 88.99% this week from 74.7% equity exposure last week.

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 88.99% this week from 74.7% equity exposure last week.

Our podcast|videocast will be out late today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in during our early Q1 raise. We will re-open to smaller accounts $1M+ again sometime in Q2. Larger accounts $5-10M+ can access bespoke service beforehand at their preference here.

*Opinion, Not Advice. See Terms