- Germany’s Economy Is Stuck. But Stocks Are Looking Cheap. (barrons)

- Gym attendance falls flat as Ozempic is blamed for causing people to vomit during workouts (nypost)

- Intel and OpenAI Gauge Chip Demand, and Other Tech News Today (barrons)

- Royal Caribbean Hikes Guidance on Surging Cruise Demand. The Stock’s Rally Can Resume. (barrons)

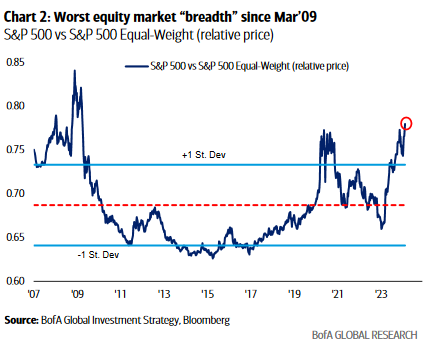

- Stocks can get more expensive, says strategist. Don’t get in front of FOMO for now. (marketwatch)

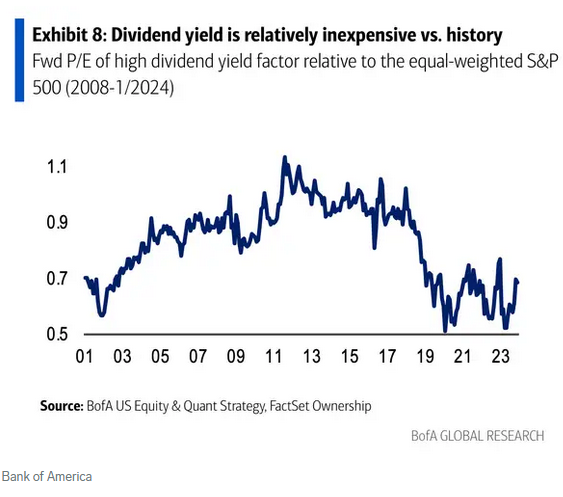

- What’s Holding Back Auto Stocks? It Could Be Dividends. (barrons)

- Nvidia Stock Surges. Earnings Answered 3 Key Questions. (barrons)

- Fed Minutes Show Embrace of Inflation Progress but No Hurry to Cut Rates (nytimes)

- The S&P 500 could hit 5,400 by year-end, says Ed Yardeni (cnbc)

- NVDA Adds Record $250BN In Market Cap Overnight: Two Goldman Sachs Or A Whole Netflix (zerohedge)

- Nvidia Declares AI a ‘Whole New Industry’—and Investors Agree (wsj)

- It’s Been 30 Years Since Food Ate Up This Much of Your Income (wsj)

- Killing Time During a Layover? These Golf Courses Near Airports Should Help (wsj)

- Rolls-Royce shares jump 10% after 2023 profits more than double (cnbc)

- Chinese tourists are driving Asia-Pacific’s travel boom — flight bookings to hit pre-pandemic levels (cnbc)

- UBS says hot, demand-driven inflation is positive for stocks, raises its S&P 500 target to a Wall Street high (businessinsider)

- These 3 charts show that today’s stock market is nowhere near the bubble extremes of 1999 (businessinsider)

Stock Market Commentary: “Volumes are the Name of the Game…”

On Monday, I joined Charles Payne on Fox Business to discuss our short, intermediate, and long term outlook on the Market. Thanks to Charles, Nick Palazzo and Kayla Arestivo for having me on. We also discussed some new hedges we initiated last week – as well as how we determine when to buy and sell – along with a few picks. Check it out here: Continue reading “Stock Market Commentary: “Volumes are the Name of the Game…””

Where is money flowing today?

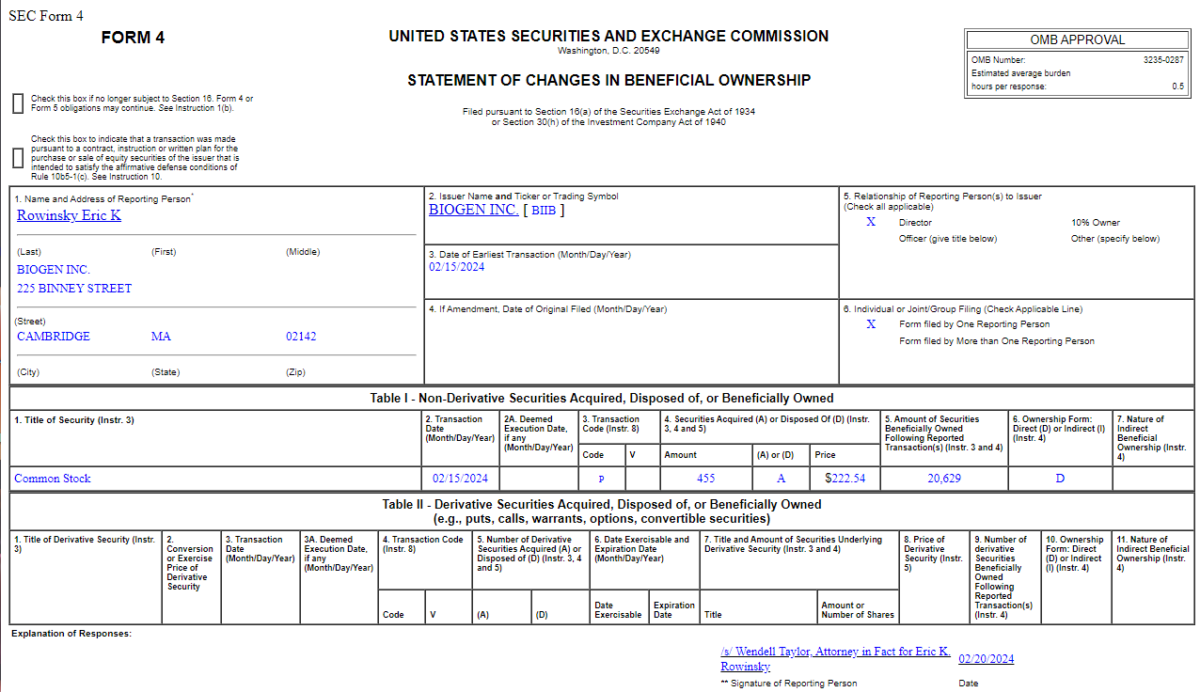

Insider Buying in Biogen Inc. (BIIB)

Tom Hayes – Benzinga Appearance – 2/20/2024

Benzinga – Thomas Hayes – Chairman of Great Hill Capital – February 20, 2024

Watch Directly On Benzinga HERE

Be in the know. 22 key reads for Wednesday…

- Will Food Prices Stop Rising Quickly? Many Companies Say Yes. (nytimes)

- China Tightens Grip on Stocks With Net Sale Ban at Open, Close (bloomberg)

- Did The India Bubble Just Burst (zerohedge)

- Natural-gas prices bounce 8% as Chesapeake plans production cuts (marketwatch)

- Bank of America: These 25 stocks with sustainable dividends trading at a 50% discount to the market should outperform during this recovery (businessinsider)

- China Drafts Law to Protect Private Firms to Boost Confidence (bloomberg)

- Quant Hedge Funds Face China Clampdown After Rare Account Freeze (bloomberg)

- China Stocks Jump to Highest in Weeks (bloomberg)

- Why Nuclear Power Should Be Ramped Up (bloomberg)

- Two years after Apple quit Russia over Ukraine, Vision Pros are for sale in Moscow (cnbc)

- Amazon to replace Walgreens in Dow Industrial Average next week (cnbc)

- Crown Castle co-founder launches proxy fight after Elliott rejection (cnbc)

- Oppenheimer’s Stoltzfus expects stock rally to expand beyond the tech sector (streetinsider)

- Goldman turns positive on global equities (streetinsider)

- UBS now sees Fed starting to cut rates in June (streetinsider)

- China circumvents US tariffs by shipping more goods via Mexico (ft)

- Mortgage Rate Cut and New CSRC Head’s Outreach Lift Markets (chinalastnight)

- Nvidia is all about risk management and exposure maintenance, says Tim Urbanowicz (cnbc)

- UBS says hot, demand-driven inflation is positive for stocks, raises its S&P 500 target to a Wall Street high (businessinsider)

- AI’s golden child takes center stage today (businessinsider)

- 3 things could pop megacap stock bubble — and ‘weigh heavily’ on broader market (marketwatch)

- Fed Minutes May Shed Light on Rate-Cut Calculus (barrons)

Tom Hayes – Quoted in Cheddar News article – 2/20/2024

Thanks to Ellen Chang for including me in her article on Cheddar.com. You can find it here: