- Jamie Dimon and Ray Dalio Warned of an Economic Disaster That Never Came. What Now? (wsj)

- Jack Ma, the founder of Alibaba, is back in the public eye after a hiatus. Here’s how the Alibaba and Ant Group founder got started and amassed a huge fortune. (businessinsider)

- Chinese Consumer Prices Edge Higher, Break Four-Month Slide (wsj)

- Regional Bank Stocks Could Be the Next Hot Play. Here’s Why. (barrons)

- Walt Disney Stock Is Set to Rise on Growth and Lower Costs (barrons)

- Nvidia Sheds $128 Billion in Market Cap, Its Largest Drop on Record (barrons)

- Fundstrat’s Tom Lee sees opportunities in small-caps this year (cnbc)

- Fed will cut rates four times this year, says Goldman Sachs’ Jan Hatzius (cnbc)

- JPMorgan’s Kelly: Friday’s jobs report is ‘very good news’ as immigration fills unemployment gap (cnbc)

- Wells Fargo’s Mike Mayo on why Citi is his top bank stock pick (cnbc)

- Alibaba pushes AI tools to merchants wanting to tap overseas markets (scmp)

- Alipay, WeChat Pay ease the way for foreign travellers to make payments in China (scmp)

- Hong Kong sees 30% more IPO applicants, HKEX CEO Bonnie Chan says (scmp)

- ‘Curb’ Fans Are Pretty, Pretty Good at Unleashing Their Inner Larry David (wsj)

- US Jobless Rate Hits Two-Year High Even as Hiring Stays Strong (bloomberg)

- Nvidia Heads to Biggest Drop Since August After 19% Six-Day Gain (bloomberg)

- Family offices have tripled since 2019, creating a new gold rush on Wall Street (cnbc)

- China doubles down on manufacturing, leaving real estate behind (cnbc)

- Watch This Number to Figure Out When the Fed Will Cut Rates (barrons)

- Wegovy and Zepbound Are King. Who’s Coming for Their Crowns. (barrons)

- Hiring Boom Continues, but Signs of a Cooling Labor Market Boost Rate-Cut Hopes (wsj)

- A $400 Million Bet Says This Is the Mall of the Future (wsj)

- Weight-loss drug Wegovy approved by FDA to cut heart attack, stroke risk (nypost)

- Central bankers see victory within reach in push to tame inflation (ft)

- Instagram overtakes TikTok in app downloads in race for new users (ft)

- Nvidia Is the Latest Shiny Object to Spur Stocks to New Heights (bloomberg)

- Powell Says US Banking System Can Withstand Commercial Real Estate Threats (bloomberg)

- 3 reasons why stocks will continue to set new records highs, according to Fundstrat (businessinsider)

- 2 signals suggest breadth in the stock market is healthy despite mega-cap tech dominance (businessinsider)

- Disney+ is bundling with Hulu, cracking down on passwords: What you need to know (usetoday)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 229

Hedge Fund Tips with Tom Hayes – Podcast – Episode 229

Where is money flowing today?

Quote of the Day…

Be in the know. 20 key reads for Friday…

- The mysterious rise of the Chinese ecommerce giant behind Temu. “The tale told by those incredible numbers is a mystery that raises more questions than it answers. Based on the transaction fee rate PDD reported in 2021, that would suggest an improbable level of activity, making the PDD ecosystem twice the size of Alibaba and on a par with the $2.2tn annual output of the Italian economy. (ft)

- BofA Says Tech Stocks Post Largest Weekly Outflows on Record (bloomberg)

- These companies are finally making real money from AI (marketwatch)

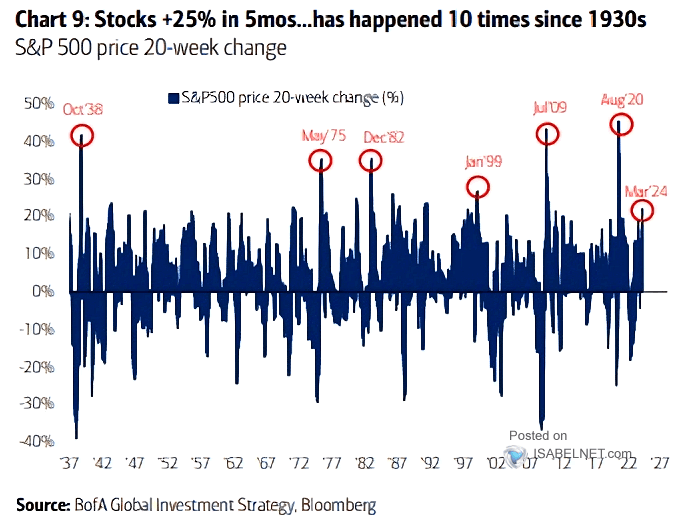

- Stocks are taking the elevator up and the escalator down, which is very unusual (marketwatch)

- Nvidia’s stock continues to hit new highs. Why that may be ‘a bit unhealthy.’ (marketwatch)

- Jerome Powell Testifies Before Senate Banking Committee (bloomberg)

- Fed Is ‘Not Far’ From Confidence Needed to Cut Rates, Powell Says (bloomberg)

- China to Mobilize Nation as It Fights US for Tech Supremacy (bloomberg)

- Ken Griffin, Rudin and Vornado to Spend $78M for Air Rights Above Historic Cathedral (commercialobserver)

- Instagram overtakes TikTok in app downloads in race for new users (ft)

- Cliff Asness: AI is ‘still just statistics’ (ft)

- Cathie Wood Has Fears for Nvidia. She’s Not Alone. (barrons)

- Strong Jobs Growth Won’t Slow the Fed’s Rate Cut Plans (barrons)

- Buy the pound, Bank of America says, as U.K. currency hits seven-month high (marketwatch)

- Dollar skid vs. yen continues as report says BOJ hike may come this month (marketwatch)

- Technical Analysts Are Getting Nervous. How to Play the Looming Drop. (barrons)

- This isn’t a bull market — it’s a ‘duck’ market. Here’s why. (marketwatch)

- Here’s what 100 years of history shows about periods of extreme market concentration, according to Goldman Sachs (marketwatch)

- February gains exceed expectations; jobless rate ticks up to 3.9% (wsj)

- Cruises Are More Popular Than Ever—and Investors Are Late to the Party (wsj)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

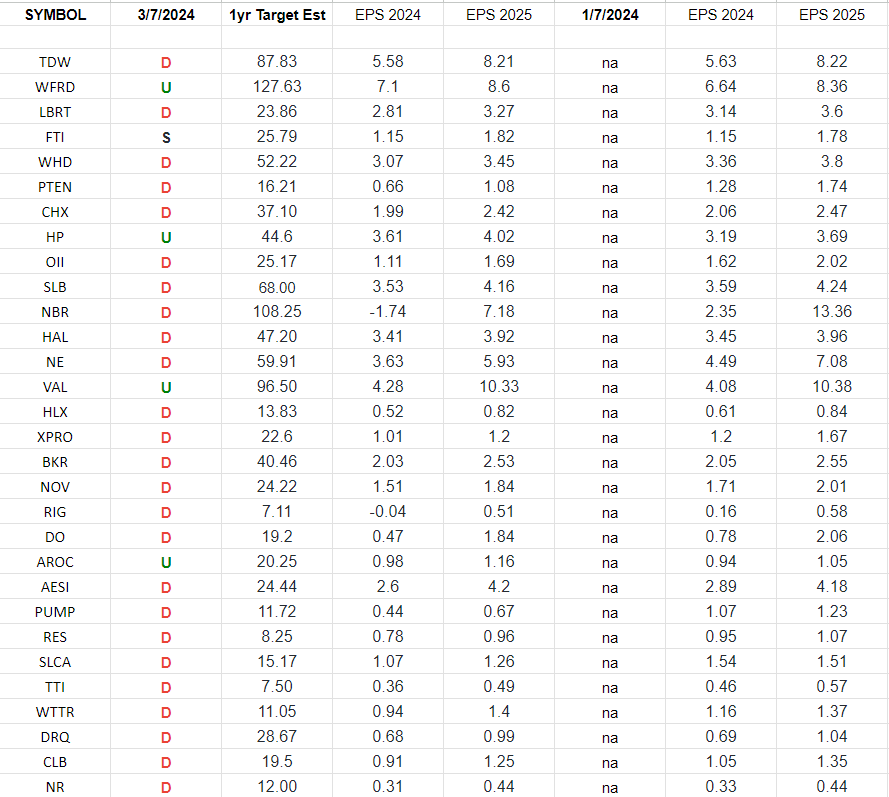

Oil & Gas Equipment & Services Earnings Estimates and Revisions

In the spreadsheet above I have tracked the earnings estimates for the Oil & Gas Equipment & Services ETF (XES) top 30 weighted stocks. Continue reading “Oil & Gas Equipment & Services Earnings Estimates and Revisions”