Data Source: Finviz

Quote of the Day…

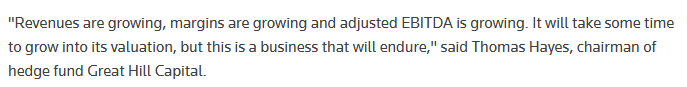

Tom Hayes – Quoted in Reuters article – 2/26/2024

Thanks to Ananya Mariam Rajesh for including me in her article on Reuters. You can find it here:

Click Here to View The Full Reuters Article

Be in the know. 17 key reads for Monday…

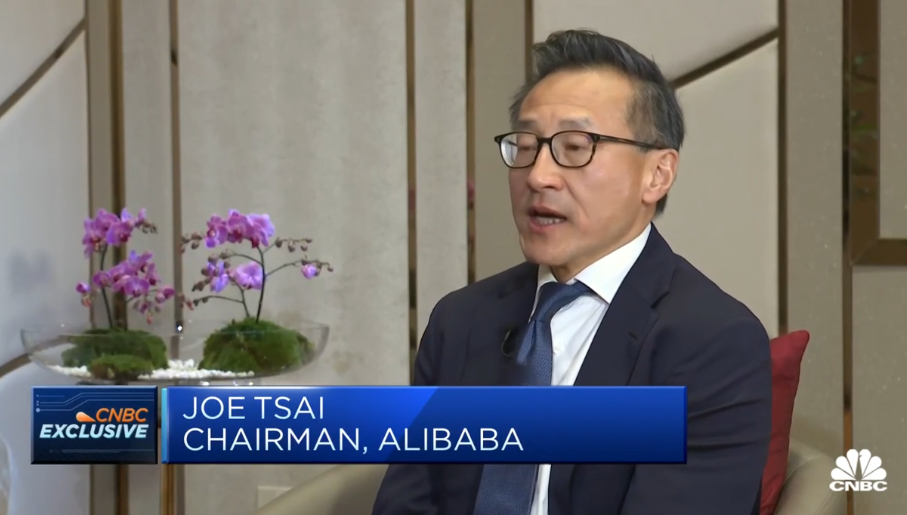

- After doubts about Alibaba’s future, co-founder Joe Tsai says: ‘We’re back’ (cnbc)

- Alibaba chairman Joe Tsai says e-commerce giant is set to bounce back: CNBC (scmp)

- Geoff Seeley Joins PayPal as Chief Marketing Officer (paypal)

- Investors Flock Back to Biotech After A Long, Cold Spell (wsj)

- China de-linking talk is overdone and it’s still key to the global economy, Asian Development Bank says (cnbc)

- US Chamber Chief Visits China in Sign of Warming Business Ties (bloomberg)

- Jack Ma’s Ant Group piles into fight with Citadel for Credit Suisse’s Chinese business: report (marketwatch)

- New Cars Are Becoming More Affordable. That’s Good for Buyers and Auto Stocks. (barrons)

- China Is Stockpiling for the Next Phase of the Chip Wars (wsj)

- Beijing Needs A Second Act After Rebound In Stocks (zerohedge)

- CEOs showing big interest in AI, former AOL CEO says (foxbusiness)

- German pharma group finds no unexpected side effects during trial, including at higher doses (ft)

- Weight-Loss Drugs Have One Big Problem. These Drugmakers Are Taking It On. (investors)

- GM returns to France with fully-electric Cadillac Lyriq (reuters)

- China State Firm Sells Bonds to Help Fund LGFV in Rare Move (bloomberg)

- China Protest Watcher Says Police Questioning His X Followers (bloomberg)

- Opinion: 9 stock tips hiding in Warren Buffett’s latest letter to Berkshire shareholders (marketwatch)

Quote of the Day…

Be in the know. 16 key reads for Sunday…

- I Read All 59 of Warren Buffett’s Annual Letters. These Are the Best Parts. (wsj)

- ASOS: The Return Grift Is Over (thecut)

- March: Historically Solid, but Plagued by Steep Losses in Election Years 1980 & 2020 (almanactrader)

- Korean Stocks Have a New Driver: The Government (wsj)

- Natural Gas Hasn’t Been This Cheap in Decades (wsj)

- Meet the Former CFO Who Thinks He Can Fix Disney (wsj)

- He Made $36 Million From LIV Golf. He’s Spending It on Bull Riding. (wsj)

- Inside Yo Gotti’s $100 Million Music Empire (forbes)

- Dozens Of KFC, Taco Bell And Dairy Queen Franchises Are Using AI To Track Workers (forbes)

- 14 Best Beaten Down Stocks To Buy Right Now (insidermonkey)

- Weekly Leading Economic Index (advisorperspectives)

- Aston Martin’s 2025 Vantage Is A Stylish Speed Demon (maxim)

- Nvidia Hardware Is Eating the World (wired)

- An oil boom, a property slump and dental deflation (npr)

- We Put a Lamborghini Miura in a Wind Tunnel to See How Far Supercar Aero Has Come (roadandtrack)

- Lunar New Year Spending Rebounds; China Box Office Record and AI Gives Gifting an Upgrade (alizila)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 227

Hedge Fund Tips with Tom Hayes – Podcast – Episode 227

Be in the know. 15 key reads for Saturday…

- Charlie Munger – The Architect of Berkshire Hathaway (berkshirehathaway)

- Berkshire Annual shareholder letter (berkshirehathaway)

- Buffett calls the late Charlie Munger ‘part older brother, part loving father’ in heartfelt tribute (cnbc)

- Bezos, Nvidia Join OpenAI in Funding Humanoid Robot Startup (bloomberg)

- “Berkshire now has – by far – the largest GAAP net worth recorded by any American business,” Buffett said in the annual letter. “Record operating income and a strong stock market led to a year-end figure of $561 billion. The total GAAP net worth for the other 499 S&P companies – a who’s who of American business – was $8.9 trillion in 2022.” (bloomberg)

- Opinion: Nvidia is the ‘Magnificent One’ now — but these rivals are closing in (marketwatch)

- It would not be surprising “if China stocks staged a bit more of a rally here,” Chris Wood, global head of equity strategy at Jefferies Financial Group Inc., wrote in a note this week. “For those investors who have conviction on particular bottom-up stories, it makes sense to add here since stocks are clearly cheap.” (bloomberg)

- The Best Technology Stocks to Buy (morningstar)

- Undervalued by 40%, This Stock Is a Buy for High-Risk Investors (morningstar)

- Michael Mauboussin on increasing returns to scale (ft)

- Michael Mauboussin – Pattern Recognition and Public Markets (EP.370) (podcast)

- Berkshire Hathaway’s Charlie Munger Was a Journalist’s Dream: He Never Held Back (barrons)

- Opinion: The ‘cardboard-box’ recession is over. An out-of-the-box economic recovery is coming. (marketwatch)

- A growing number of stocks are joining the market’s rally — even as Big Tech still gets the most attention (marketwatch)

- The AI boom of today and the telecom bubble of 1990s share these similarities (marketwatch)