- The Disney Magic Will Return. It’s Time to Buy the Stock. (barrons)

- China Moves to Bolster Consumer Industries, Grow Fledging Bourse (bloomberg)

- Billionaire Mark Mobius says he’s so bullish on emerging markets that all his money is outside the US (businessinsider)

- Investing in Liberty Stock Is Tricky. Do It Anyway. (barrons)

- ‘It’s a great, great time for bulls’: Soft-landing views solidify in U.S. stock market (marketwatch)

- Investing in Liberty Stock Is Tricky. Do It Anyway. (barrons)

- For the Stock Market, Earnings Are Everything—and More Than Enough (barrons)

- Eli Lilly, Pfizer, and Others Are Working on Weight-Loss Pills. What to Know. (barrons)

- Small-Cap Stocks Have Struggled. Here Are 6 Whose Time Has Come. (barrons)

- The U.S. Economy Is Sticking the Soft Landing (wsj)

- Biogen Deal for Reata Signals a Turn to Rare Diseases (bloomberg)

- China’s Central Bank Chief Is Task Master Xi Couldn’t Let Retire (bloomberg)

- Hedge Funds Turn More Bullish Across Energy as Prices Rally (bloomberg)

- Traders Are Risking It All on Bets That Market Boom Will Last (bloomberg)

- Intel stock rallies after earnings show AI data-center beat, strong PC sales (marketwatch)

- The Fed’s favorite inflation measure cooled down even further in June (cnn)

- 8 Book Recommendations By Joel Greenblatt (acquirersmultiple)

- The Pritzkers: Buffett’s Blueprint (substack)

- Billionaire Ken Fisher on how to invest in AI, intelligently (theglobeandmail)

- Ford Earnings: Remarkable Strength As Pro Segment Profits Explode (morningstar)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 197

Hedge Fund Tips with Tom Hayes – Podcast – Episode 187

Where is money flowing today?

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 10 key reads for Friday…

- Intel jumps 7% as it returns to profitability after two quarters of losses (cnbc)

- China Bulls Look for Redemption as Beijing Shows Policy Resolve (bloomberg)

- Biogen agrees to acquire Reata Pharmaceuticals for $7.3 billion in cash (marketwatch)

- China’s housing ministry is getting ‘bolder’ about real estate support (cnbc)

- The Disney Magic Will Return. It’s Time to Buy the Stock. (barrons)

- Drugmakers Want to Crush Medicare’s Pricing Power. They’ll Probably Succeed. (barrons)

- Fed Goes From Stocks’ Boogeyman to Markets’ Pal (barrons)

- Key US Inflation, Wage Measures Cool in Boost for Soft Landing (bloomberg)

- US Consumer Sentiment Rises to Highest Since 2021 as Prices Ease (bloomberg)

- Bank of Japan Surprise Foreshadows End to Key Anchor for Global Bond Yields (bloomberg)

Where is money flowing today?

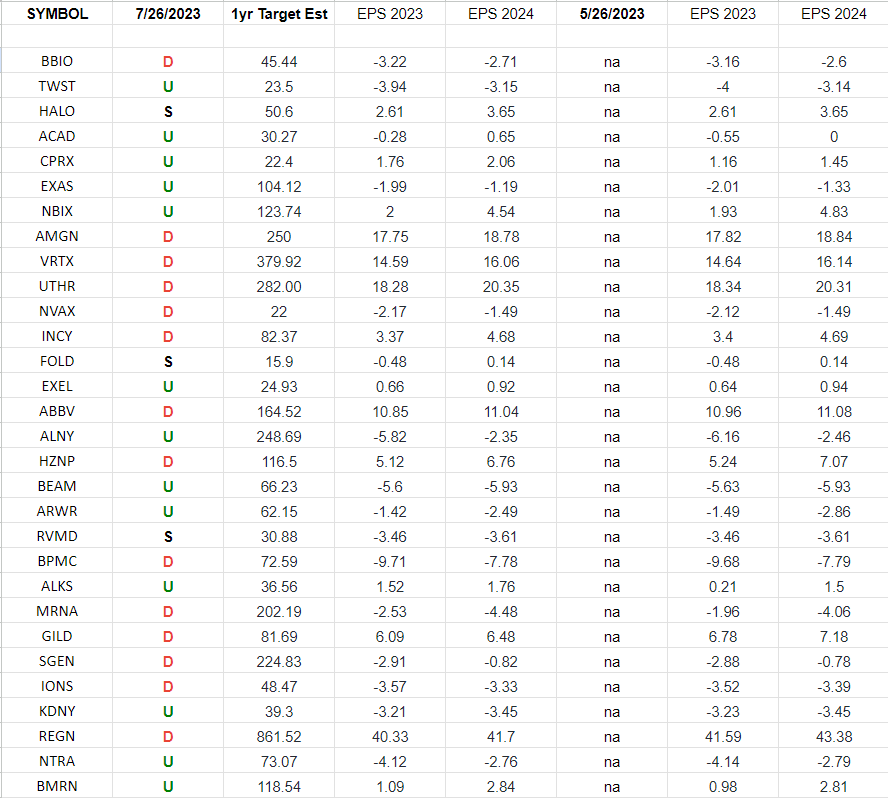

(Equal Weight) Biotech Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Equal Weighted Biotech ETF (XBI) top 30 holdings.

Continue reading “(Equal Weight) Biotech Earnings Estimates/Revisions”

Biotech Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Biotech ETF (IBB) top 30 holdings.

Be in the know. 18 key reads for Thursday…

- Hedge funds rush to buy China stocks on economy stimulus prospects – Goldman (reuters)

- China Asks Banks to Bankroll Tech in Latest Private Sector Boost (bloomberg)

- GDP grew at a 2.4% pace in the second quarter, topping expectations despite recession calls (cnbc)

- The Most Interesting Economic News This Week Won’t Come From the Fed (barrons)

- The S&P 500 Hasn’t Had Many Ugly Days This Year. That’s a Pretty Good Sign. (barrons)

- Federal Reserve Raises Interest Rates to 22-Year High (wsj)

- Dow Notches Longest Winning Streak Since 1987 (wsj)

- Biotech Stocks Join AI-Fueled Rally (wsj)

- PacWest, Banc of California Merge to Get Smaller. Others May Follow. (wsj)

- Investors Can Read the Fed’s Poker Face (wsj)

- What Fed Hikes? Much of Americans’ Debt Is Still Riding Ultralow Rates (wsj)

- Inside the world’s hardest place to get a reservation with a 4-year waitlist (nypost)

- How Regional Banks Got Healthy Again (nytimes)

- A Beach Club Dinner and Jamie Dimon’s Touch: How PacWest Was Rescued (bloomberg)

- Rolls-Royce Takes the Fast Lane Out of Pity City (bloomberg)

- Meta stock gains after earnings, guidance from Facebook parent top expectations (yahoo)

- Ant IPO Gets Back To Where It All Began (chinalastnight)

- Big Tech earnings are sending the bears into hibernation mode, says Dan Ives (cnbc)