- US Dollar To See Further Weakness? (kimblechartingsolutions)

- Economists Cut Back Recession Expectations (wsj)

- Bond King, Felon, Billionaire Philanthropist: The Nine Lives of Michael Milken (wsj)

- Jeremy Siegel says we are in a ‘Goldilocks economy’ and the Fed doesn’t need to raise interest rates anymore (fortune)

- Tom Cruise Did 13,000 Practice Jumps for Biggest Stunt Ever (mensjournal)

- 2024 Ferrari Purosangue Review: A Worthy Supercar, Now in Family Size (thedrive)

- Alibaba’s intelligent services subsidiary launches new product to serve e-commerce merchants (technode)

- China’s Cainiao Express launches distribution centers in Dallas and Chicago (technode)

- The 15 Most Beautiful Beaches In Europe, According To European Best Destinations (forbes)

- The magic move in Cam Smith’s putting stroke, explained (golfdigest)

- Aston Martin’s Valour is the ultra-exclusive heavy hitter we’ve been dreaming of (classicdriver)

- US and China Seek Climate Reset With Kerry’s Visit to Beijing (bloomberg)

Be in the know. 17 key reads for Saturday…

- 8 Most Undervalued, Quality Bank Stocks (morningstar)

- The Koenigsegg Gemera Is Officially The ‘World’s Most Powerful & Extreme Production Car’ (maxim)

- The 50 Greatest Luxury Hotels on Earth (robbreport)

- 40 Picks for the Rest of the Year, According to Barron’s Roundtable Pros (barrons)

- Banks Just Started Reporting Earnings. What They’re Signaling. (barrons)

- The Stock Rally Is Vulnerable to One Factor. It isn’t Earnings. (barrons)

- Earnings by Big Banks Show Signs of Soft Landing (wsj)

- Large US banks reap bumper profits on Fed rate rises (ft)

- Elon Musk says his new AI firm will use Twitter data, work with Tesla (nypost)

- The ‘Everything Rally’ Is Back. So Is the Casino Crowd (bloomberg)

- BlackRock chief Larry Fink says US debt is ‘out of control’ – but an accelerating economy can solve that problem (businessinsider)

- Wharton professor Jeremy Siegel says the Goldilocks inflation figures for June put stocks in the ideal environment (businessinsider)

- 5 Book Recommendations By Jamie Dimon (aquirersmultiple)

- Taking the Temperature (Howard Marks)

- Why Small-Cap Stocks Are a Good Investment for the Long Term (youtube)

- Buffett on ignoring stock price fluctuations and thinking like a business owner (dgi)

- What’s Behind the Stock Market Rally (It’s Not Just Big Tech) (wsj)

Where is money flowing today?

Be in the know. 20 key reads for Friday…

- Tumbling US dollar a boon to risk assets across the globe (reuters)

- Intel CEO wraps up low-key China trip amid ongoing tech war (scmp)

- Chinese mutual funds buy US$351 million of own products in show of confidence (scmp)

- Exclusive: China invites global investors for rare meeting (reuters)

- Goldman Sachs: These 17 stocks could earn much more than the rest of Wall Street expects following a strong second half for markets (businessinsider)

- Americans Are Borrowing Again, Which Is Great News for Big Lenders (wsj)

- CEO fires 90% of customer support staff because AI chatbot outperformed them (nypost)

- Insurer’s Retreat in Florida Signals Crisis With No Easy Fix (nytimes)

- JPMorgan Earnings Get a Boost From Higher Rates, First Republic Deal (barrons)

- SpaceX Is Now Worth More Than Boeing and Raytheon (barrons)

- Deutsche Bank currency guru says it’s ‘time to sell the dollar’ as greenback sees longest losing streak since 2021 (marketwatch)

- The Stock Market Rally Seems Unstoppable. Here’s When the Naysayers Will Give In. (barrons)

- The AI Bubble Isn’t Big Enough. Why There’s More Upside Ahead for Big Tech. (barrons)

- The Yen, the Yuan, and the Dollar: How China and Japan Could Shore Up Their Economies (barrons)

- As Inflation Goes Down, Soft Landing Odds Improve (wsj)

- Emerging-Market Growth Bets Return, Helping Stocks Beat US Peers (bloomberg)

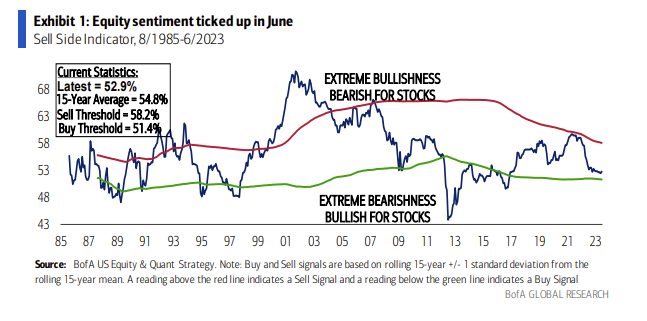

- BofA Stocks Indicator Sees S&P 500 Surging 16% in Next 12 Months (bloomberg)

- ‘I don’t see why people are going to sell their stocks.’ ‘Big Short’ investor Steve Eisman says stocks will keep rallying as long as the economy stays healthy (businessinsider)

- U.S. consumer sentiment soars in July to highest level since September 2021 (marketwatch)

- US Federal Debt Interest Payments About To Hit $1 Trillion (zerohedge)

Tom Hayes – BBC World News Appearance – 7/13/2023

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 195

Hedge Fund Tips with Tom Hayes – Podcast – Episode 185

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

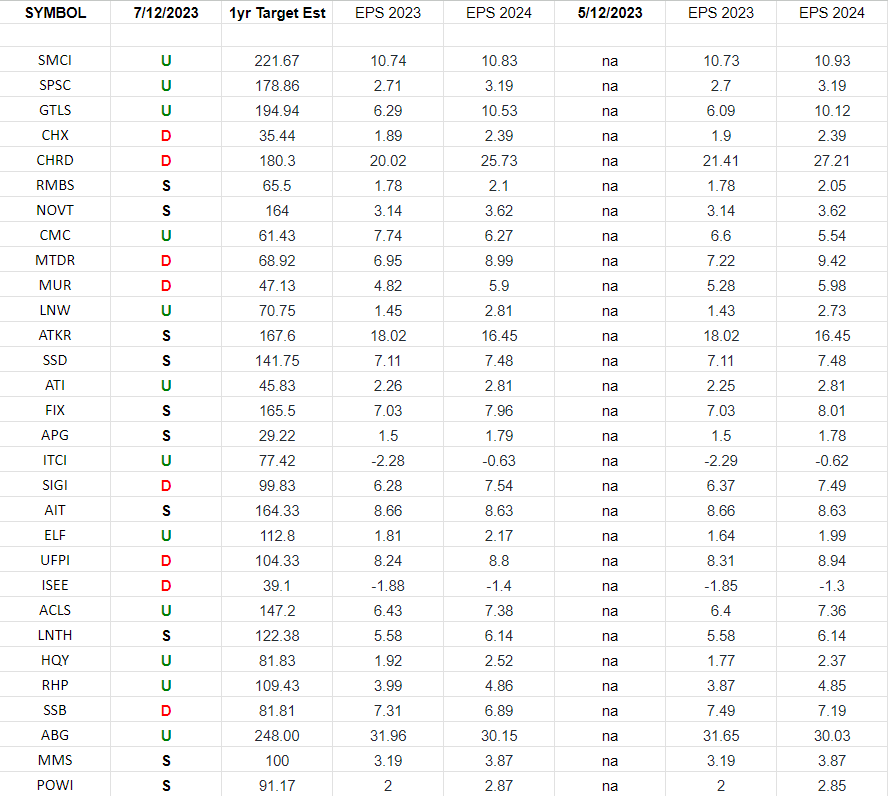

Russel 2000 (top weights) Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the top weighted Russell 2000 small cap stocks. I have columns for what the 2023 estimates were on 5/12/2023 and today (7/12/2023).

Continue reading “Russel 2000 (top weights) Earnings Estimates”