- Fed’s Preferred Gauge Shows Lowest Annual Inflation Since April 2021 (barrons)

- Just Do It: Nike Shares Are a Buy (wsj)

- Bargains Abound in Commercial Real Estate. (barrons)

- Carnival Gets an Upgrade. The Cruise Stock Is Rising. (barrons)

- Caeleb Dressel’s Rocky Return to Competitive Swimming (wsj)

- Janet Yellen Sees Path to Cool Inflation With Healthy Job Market (bloomberg)

- China Central Bank Vows to Support the Currency as Slide Deepens (bloomberg)

- Brazil Unemployment Falls Again in Sign of Economic Strength (bloomberg)

- Alibaba expands number of physical grocery stores ahead of the unit’s IPO (cnbc)

- Paul Krugman cheers on the US economy as inflation fades and the jobs market endures (businessinsider)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 193

Article referenced in VideoCast above:

“Burdened By The Facts” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 183

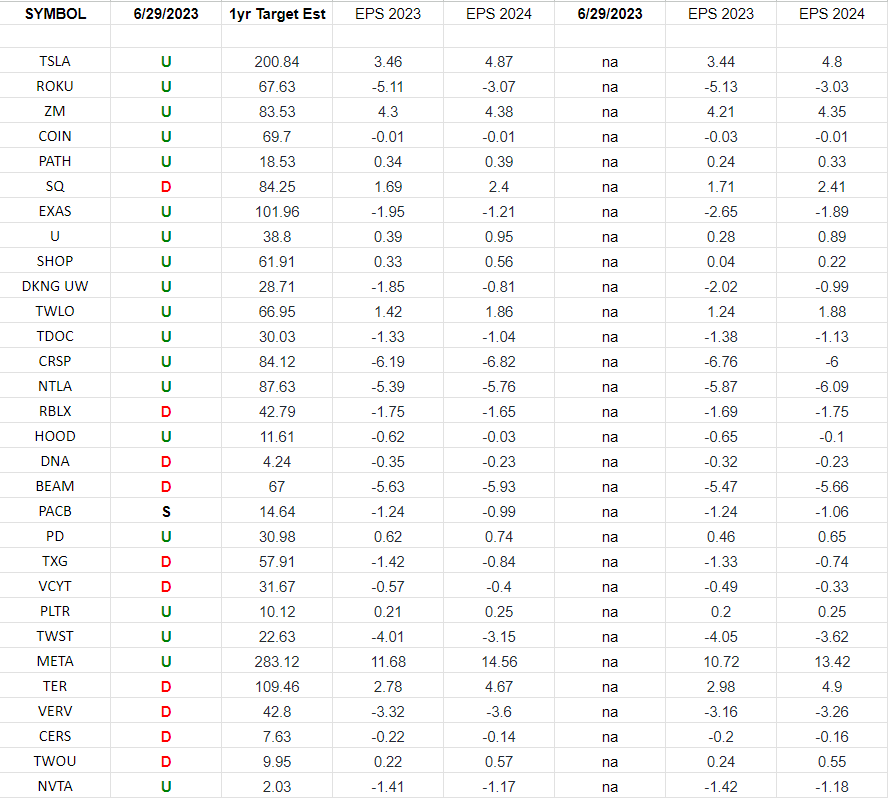

ARKK Innovation Fund Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Ark Innovation Fund (ARKK) top weighted stocks.

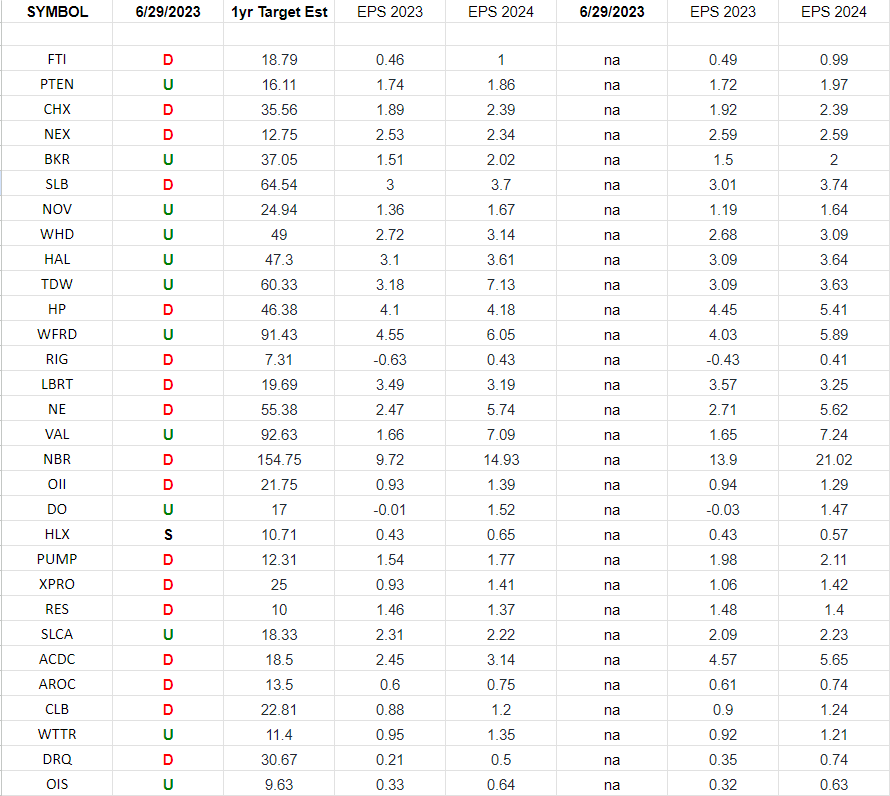

Oil & Gas Equipment & Services Earnings Estimates and Revisions

In the spreadsheet above I have tracked the earnings estimates for the Oil & Gas Equipment & Services ETF (XES) top 30 weighted stocks. Continue reading “Oil & Gas Equipment & Services Earnings Estimates and Revisions”

Where is money flowing today?

Tom Hayes – Quoted in Reuters article – 6/29/2023

Thanks to Sruthi Shankar and Johann M Cherian for including me in their article on Reuters. You can find it here:

Click Here to View The Full Reuters Article

Be in the know. 10 key reads for Thursday…

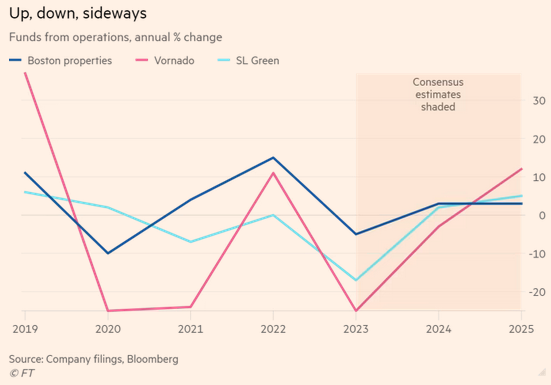

- Are office Reits on sale? (ft)

- Banks Pass Stress Test (barrons)

- Bearish Treasury Bets Could Come Back to Bite Hedge Funds (barrons)

- There’s a New Way to Watch TV. It’s Already More Popular Than HBO. (barrons)

- Hotel in Italy Named Best in World in New Global List (bloomberg)

- The Russell 2000 should beat the S&P 500, if it can overcome these 3 headwinds, Goldman Sachs says (businessinsider)

- Stocks may have rallied to new levels recently, but these 10 high-quality investments are still cheap right now, according to Morningstar (businessinsider)

- Legendary investor Seth Klarman outlines the key traits needed to become a successful investor (businessinsider)

- Jobless claims in U.S. drop to four-week low of 239,000. Still no sign of recession (marketwatch)

- July has been a top month for stocks. Here’s what it will take for the market to rally again this summer. (marketwatch)

“Burdened By The Facts” Stock Market (and Sentiment Results)…

Second Half Playbook

On Friday, I joined Seana Smith on Yahoo! Finance. Thanks to Sarah Smith and Seana for having me on the show. Watch this clip to get the playbook for the next 6 months: Continue reading ““Burdened By The Facts” Stock Market (and Sentiment Results)…”