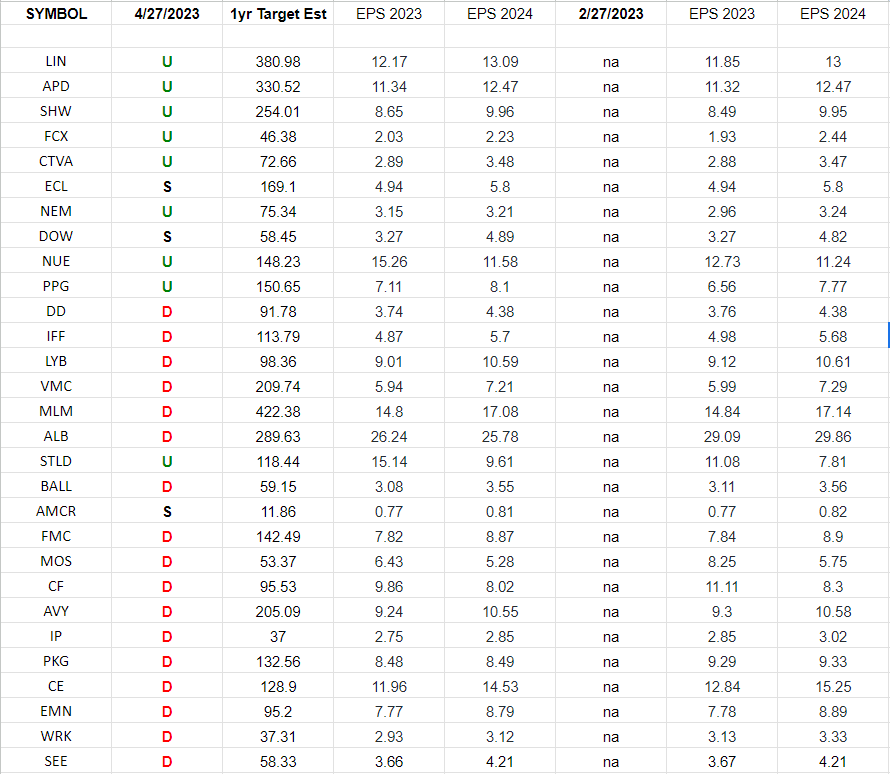

Data Source: Finviz

Basic Materials (XLB)- Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Basic Materials Sector ETF (XLB). I have columns for what the 2023 and 2024 estimates were today and 60 days ago.

Continue reading “Basic Materials (XLB)- Earnings Estimates/Revisions”

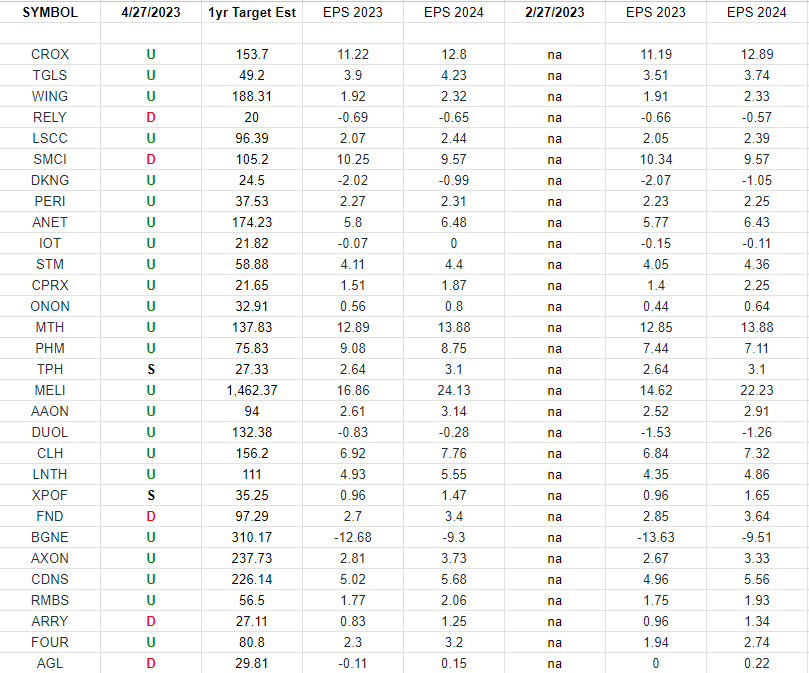

IBD 50 Growth Index (top 30 weights) Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted stocks in the IBD 50 Growth Index (ETF: FFTY) Continue reading “IBD 50 Growth Index (top 30 weights) Earnings Estimates”

Tom Hayes – Guest on “Investing with Whales” – 4/24/2023

Be in the know. 22 key reads for Thursday…

- Nothing Would Say Forgiveness Like an Ant Group IPO (bloomberg)

- First Republic’s Catch-22 (wsj)

- Merck Beats Expectations (barrons)

- China Recognizes Ukraine’s Right to Exist. National Security Tensions Still Grip the Global Economy. (barrons)

- Mastercard Beat Shows Households Are Spending More on Travel. The Stock Rises. (barrons)

- An undiscovered universe of stocks is trading at ‘near generational lows,’ asset manager says (marketwatch)

- Powell Faces Pushback Inside Fed Over Need to Cool Wage Gains (bloomberg)

- Could the Fed pause next week? It’s not out of the question. (marketwatch)

- Consumer spending in U.S. rises at 3.7% rate in first quarter (marketwatch)

- First-quarter GDP climbs at lackluster 1.1% pace as businesses retrench (marketwatch)

- Deposit drops at First Republic and other banks merit a close look for systemic cracks, ex-Fed officials say (marketwatch)

- PacWest stock surges 14% as bank says deposits have been building in recent weeks (marketwatch)

- Amazon ripped off the Band-Aid. Does that mean big earnings are about to flow? (marketwatch)

- Comcast Tops Expectations. (barrons)

- Facebook Parent Meta Platforms Sees First Sales Increase in Nearly a Year (wsj)

- Republicans Pass Debt-Ceiling Bill Aiming to Spark Talks With Biden (wsj)

- First Republic Bank Is a Problem With No Easy Solution (wsj)

- Demand for Beer and Handbags Help Temper Recession Fears for Now (bloomberg)

- First Republic Stuck in Standoff Between US and Banking Industry (bloomberg)

- US debt limit has seen 78 changes since 1960. This time is likely no different, says Bank of America’s wealth management team (businessinsider)

- China Life Profit Rises as Industry Recovers After Pandemic (bloomberg)

- BYD Crushes The Bug as Hong Kong Internet Names Rebound & Xi Calls Zelensky (chinalastnight)

“Put It Out Of Its Misery” Stock Market (and Sentiment Results)…

Earnings are coming in nicely, but there is an overhang on this market – and until resolved, the market is stuck in the mud. First Republic (FRC) is now a zombie bank that no one wants to take over because they would need to raise a significant amount of equity capital against the upside down assets/write-downs. Continue reading ““Put It Out Of Its Misery” Stock Market (and Sentiment Results)…”

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 18 key reads for Wednesday…

- Alphabet first quarter earnings top estimates, announces $70B stock buyback (yahoo)

- Billionaire investor Stanley Druckenmiller shorts the dollar after ‘biggest miss of my career’ on Fed rate view and weaponized currency fears (businessinsider)

- The Roots of the Options Trading Revolution (barrons)

- Brazil inflation hits 30-month low as govt calls for rate cuts (reuters)

- Bullish signals are flashing that suggest the stock market is headed for a ‘summer rip’, Bank of America says (businessinsider)

- Alibaba Cuts Cloud Prices to Spur Growth Before Possible IPO (bloomberg)

- Overseas News & US Dollar Strength Outweigh China’s GDP Recovery (chinalastnight)

- Black-Scholes at 50: how a pricing model for options changed finance (ft)

- The Party for Consumer Staples Stocks Might Be Ending. Here’s Why. (barrons)

- Microsoft Profit, Sales Top Estimates on Strong Cloud Demand (bloomberg)

- J&J’s $40 Billion Spinoff Has One Rival. Who Will Rule Consumer Health. (barrons)

- Office occupancy climbs to nearly 50% in renewed push for return-to-office initiatives (yahoo)

- Boston Properties (BXP) Beats Q1 FFO and Revenue Estimates (yahoo)

- Legendary investor Peter Lynch shares the 2 things investors should look for when picking stocks – and one big pitfall to avoid (businessinsider)

- China’s Xi Makes First Call to Ukraine’s Zelensky Since Russian Invasion (wsj)

- 3M (MMM) Beats on Q1 Earnings, Announces Restructuring Plans (yahoo)

- D.A. Approves Drug for Rare Form of A.L.S. (nytimes)

- Mortgage demand rebounds, even as interest rates hit the highest level in over a month (CNBC)