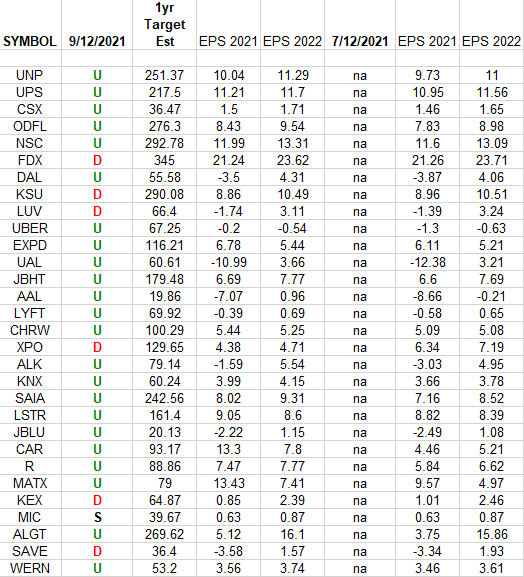

In the spreadsheet above I have tracked the earnings estimates for the Transportation Sector ETF (IYT) top 30 holdings. Continue reading “Transports Earnings Estimates/Revisions”

Be in the know. 10 key reads for Sunday…

- Economy shook after 9/11 — but thanks to heroes, it did not crumble (New York Post)

- September quarterly option expiration week: S&P 500 up 13 of last 18 (Almanac Trader)

- Citrix Activist Could Clean Up on Messy Cloud Transition (Wall Street Journal)

- No more COVID-19 lockdowns, UK health minister suggests (Reuters)

- The Sexiest Hypercars From Manhattan Motorcars’ Showcase in the Sky (Men’s Journal)

- Inside NYC’s ‘Banksy: Genius or Vandal?’ Art Exhibit (Maxim)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Sunrun Stock Surges on Needham Buy Rating, $75 Price Target (thestreet)

- Mobius hits back at Soros over ‘BlackRock’s China blunder’ comments (fnlondon)

- Fox Corp. announces $1M donation to Tunnel to Towers in support of first responders, military heroes (FoxNews)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 99

Article referenced in VideoCast above:

The AC/DC “Thunderstruck” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 89

Article referenced in podcast above:

The AC/DC “Thunderstruck” Stock Market (and Sentiment Results)…

Be in the know. 30 key reads for Saturday…

- The World Remembers 9/11 on 20th Anniversary of Attacks: Update (Bloomberg)

- It’s a new Yahoo — again: Apollo Group taps Tinder CEO as whiplashed employees hold their breath (New York Post)

- Walmart Rethinks Its China ‘Hypermarket’ Strategy Amid Alibaba Gains (Bloomberg)

- 3 reasons to stick with Chinese stocks even as they are battered by regulation, according to Allianz (Business Insider)

- 7 Stocks to Buy on a Dip (Morningstar)

- The U.S. and China Need Couples Therapy, Not a Divorce Lawyer (Barron’s)

- Apple Stock Fell After Judge Issues a ‘Legal Blow’ Against App Store (Barron’s)

- Elliott Hopes Its Magic Can Work at Citrix a Second Time (Barron’s)

- Stocks Close Lower to End Worst Week in Months (Barron’s)

- The Panic Series (Pt. I) – 1792 (investoramnesia)

- It’s Hard Times for Hard Seltzer. Boston Beer’s Tumbling Shares Look Underpriced. (Barron’s)

- Investing The Warren Buffett Way (Forbes)

- Nuclear Power Gets a Lift From Climate Change. How Uranium Plays. (Barron’s)

- When the Fed finally steps back, can the U.S. stock and bond markets stand on their own legs? (MarketWatch)

- 2 Trends Are Hurting Solar Companies — and Biden’s Big Energy Goals (Barron’s)

- Apple App-Store Ruling Should Make Tim Cook Sweat (Bloomberg)

- Why Leon Cooperman has a ‘weary eye’ on the market (CNBC)

- Remote Workers Are on the Move. What It Means for the Housing Market. (Barron’s)

- This Bentley is $2 million, roof not included (CNN)

- Two Decades After 9/11, the Fiscal Wounds Run Deep Too (Barron’s)

- The S&P 500 Has Had a Good Run. Why Wall Street Thinks a Pullback Is Coming. (Barron’s)

- Petco CEO Purchases $1 Million Worth of Company Stock (Barron’s)

- 3 Home Builder Stocks That Still Look Like Relative Bargains (Barron’s)

- Kristen Stewart, Jessica Chastain, and More Venice Film Festival Stars as Captured by Greg Williams (vanityfair)

- Some Vaccines Last a Lifetime. Here’s Why Covid-19 Shots Don’t. (Wall Street Journal)

- Alibaba’s Big Secret (vintagevalueinvesting)

- Disney Will Release Rest of 2021 Films Exclusively in Theaters (Wall Street Journal)

- Car Dealerships Seek New Model as Sales Move Online (Wall Street Journal)

- Disappointed Consumers Temper U.S. Economy’s Main Growth Engine (Bloomberg)

- The Earnings Crunch Is Getting Real (Bloomberg)

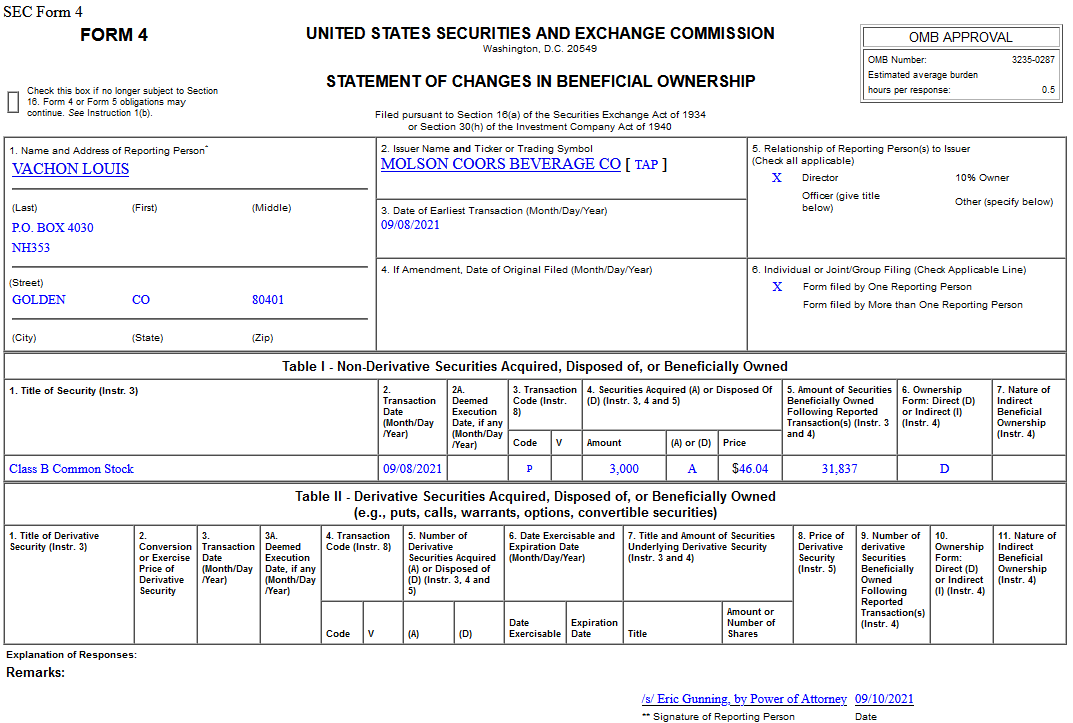

Insider Buying in Molson Coors Beverage Company (TAP)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

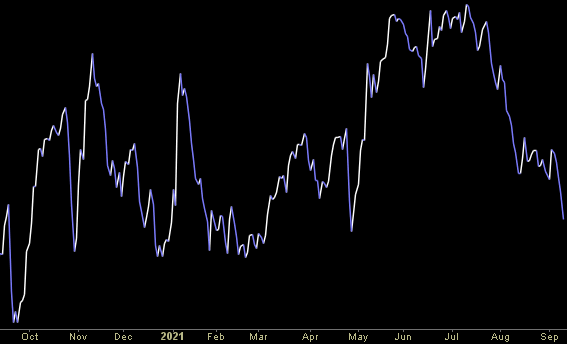

Where is money flowing today?

Be in the know. 10 key reads for Friday…

- China’s Central Bank Turns to Niche Policy Tool to Boost Growth (Bloomberg)

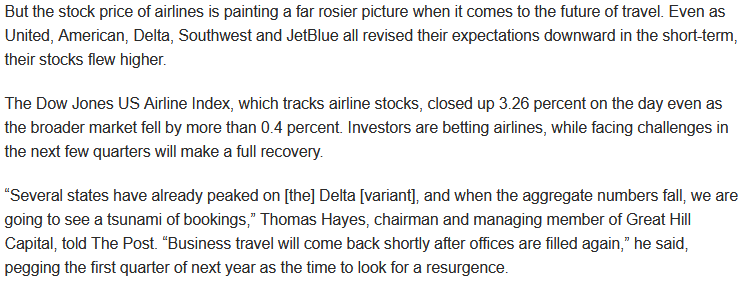

- Airlines warn sales could fall 30 percent, but investors see a chance to buy (New York Post)

- Biden Calls Xi Over U.S. Frustration With Dead-End Talks (Bloomberg)

- Stocks Relieved by Biden-Xi Talk (Barron’s)

- What Stocks Could Gain When the Chip Shortage Ends? It’s More Than Just Car Makers. (Barron’s)

- Why Sequoia Capital’s Michael Moritz Thinks SpaceX Is More Important Than Tesla (Barron’s)

- Biden Boosts Vaccine Requirements for Large Employers, Federal Workers (Wall Street Journal)

- Wholesale prices in August rose a record 8.3% from a year ago (CNBC)

- European Stocks Advance as Tapering Worries Start to Recede (Bloomberg)

- Utility Stocks Aren’t Getting Much Respect From the Market — but They Have Big Dividends (Barron’s)

Tom Hayes – Quoted in New York Post article – 9/9/2021

Thanks to Lydia Moynihan for including me in her article in the New York Post today. You can find it here: