- BlackRock and Ray Dalio Say Investors Should Be in China. Weighing the Risks. (Barron’s)

- S. Initial Jobless Claims Fall by Most Since Late June in Week (Bloomberg)

- ECB Slows Pandemic Bond Buying as Europe’s Economy Rebounds (Bloomberg)

- Atlanta Fed’s Bostic tells Wall Street Journal a taper decision is unlikely to come this month (marketwatch)

- Tiananmen Massacre Vigil Organizers Arrested by Hong Kong Authorities (Wall Street Journal)

- Wall Street Strategists Are Cautious About This Fall. Why They’re Worried. (Barron’s)

- 6 Energy Stocks That Don’t Deserve to Be Left Behind (Barron’s)

- 5 Incredibly Safe Dividend Stocks to Buy (247wallst)

- Intel Expects Huge Growth in Auto Chips. It’s Bulking Up in Europe. (Barron’s)

- Natural-gas futures rally to highest finish since 2014 on slow U.S. output recovery, tight supplies (MarketWatch)

- Chinese state op-ed defends Xi’s regulatory crackdown and foreign investment (New York Post)

- Hurricane Ida’s Fallout Continues to Cripple U.S. Oil Production (Wall Street Journal)

- A Vintage Lotus That Stays Ahead of the Curve (Wall Street Journal)

- China Stocks Hammered Again On Regulations Despite Some Optimism (IBD)

- Cathie Wood’s Ark cuts China positions ‘dramatically’ (Financial Times)

- As a Delta Wave Peaks in Some States, Others Brace for What’s Next (Wall Street Journal)

- BlackRock-Soros Feud Is a Microcosm of Wall Street’s China Dilemma (Wall Street Journal)

- Eric Church and Chris Stapleton top CMA Awards 2021 nominations (USA Today)

- Tencent Leads $60 Billion Loss as Game Crackdown Fears Grow (Bloomberg)

- Fidelity Cuts Ant Valuation Again as China Crackdown Spreads (Bloomberg)

- China Tells Gaming Firms to End ‘Solitary’ Focus on Profit (Bloomberg)

- What Xi Means by ‘Disorderly Capital’ Is $1.5 Trillion Question (Bloomberg)

- Walmart Rethinks Its China ‘Hypermarket’ Strategy Amid Alibaba Gains (Bloomberg)

- Traders Rush to Dump China Tech Stocks as Gaming Targeted Again (Bloomberg)

- European Central Bank slows its bond purchases as euro zone inflation surges (CNBC)

- Tencent, NetEase shares dive after Chinese regulators summon firms; report of game approval freezes (CNBC)

- Yellen urges Congress to raise debt limit, warns about extraordinary measures running out soon (CNBC)

- The six reasons why Jim Cramer is concerned about the stock market in September (CNBC)

- TEXT-Lagarde’s statement after ECB policy meeting (Reuters)

- JPMorgan Raises PT on Netflix (NFLX), Analyst Says 4Q Should Become Strongest Content Quarter Ever (StreetInsider)

- Analysis-Investors betting on ‘stable’ choice of Powell renomination at Fed (Reuters)

- China’s factory inflation hits 13-year high as materials costs soar (Reuters)

- ECB Preview: The First Taper, But Don’t Call It That (ZeroHedge)

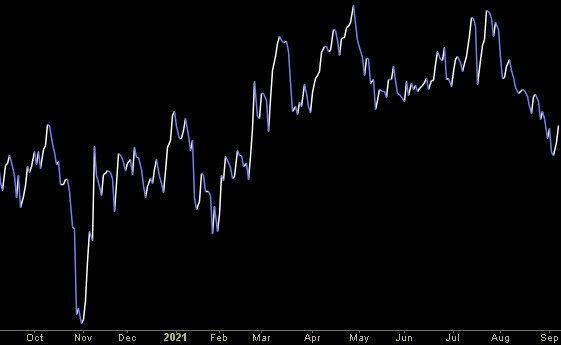

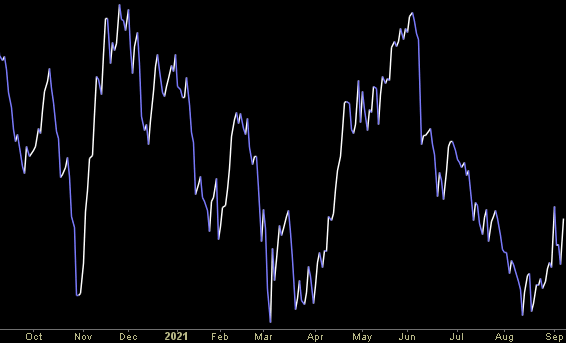

The AC/DC “Thunderstruck” Stock Market (and Sentiment Results)…

This week we chose AC/DC’s 1990 Billboard Hit, “Thunderstruck” to capture current stock market sentiment. On Friday, we got a tremendous miss with the Jobs Report coming in at +235K jobs versus +750k estimated. Continue reading “The AC/DC “Thunderstruck” Stock Market (and Sentiment Results)…”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 17 key reads for Wednesday…

- Manchin privately tells WH he’ll back $1T of Biden’s budget resolution: report (Fox Business)

- Wall Street sees as much as 56% upside for its 20 favorite stocks (MarketWatch)

- Goldman Sachs Expects Less GDP Growth This Year. Blame Delta and Consumer Spending. (Barron’s)

- 5 Utility Stocks for Investors Chasing Yield (Barron’s)

- BlackRock responds to Soros’ criticism of its China investments (Fox Business)

- Intel’s Salvation Lies in Europe—but Not With Fabs (Wall Street Journal)

- Wells Fargo Isn’t Missing the Party Yet (Wall Street Journal)

- Intel to Invest Up to $95 Billion in European Chip-Making Amid U.S. Expansion (Wall Street Journal)

- Elliott Management Has a More Than $1 Billion Stake in Citrix Systems (Wall Street Journal)

- Wall Street Can’t Get Enough Fixer-Upper Houses (Wall Street Journal)

- Apple Likely Has More App Store Deals to Make (Wall Street Journal)

- SEC needs to find a way to curb payment for order flow (Financial Times)

- Japan upgrades Q2 GDP on stronger business spending (Reuters)

- 5 reasons why UBS just boosted its year-end S&P 500 forecast to among the highest on Wall Street (Business Insider)

- China’s central bank keeps the brakes on economic stimulus (CNBC)

- Investment Banks Turn Sour on U.S. Equity Outlook (Bloomberg)

- Ray Dalio Says China Opportunities Can’t Be Neglected (Bloomberg)

Tom Hayes – Yahoo! Finance Appearance – 9/7/2021

Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – September 7, 2021

Click Here to Watch HD Version Directly on Yahoo! Finance

Unusual Options Activity – Alibaba Group Holding Limited (BABA)

Data Source: barchart

Today some institution/fund purchased 3,919 contracts of June 2022 $185 strike calls (or the right to buy 391,900 shares of Alibaba Group Holding Limited (BABA) at $185). The open interest was 1,040 prior to this purchase. Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”