Be in the know. 15 key reads for Saturday…

- Investors Are Running Scared From China’s Stocks. Where to Find Opportunities. (Barron’s)

- BlackRock plunges headfirst into China with debut mutual fund offering, shrugging off Beijing’s regulatory onslaught (Business Insider)

- Lawyers fight back following attack on SPACs (New York Post)

- Natural Gas Soars. Natural Gas Stocks Climb, Too. (Barron’s)

- Taper Time Is on the Way, Maybe. Powell Sets the Stage With Plenty of Caveats. (Barron’s)

- Fed Chair Powell’s Comments on Bond Buying and Interest Rates Prompt More Stock Gains (Barron’s)

- The Housing Market Isn’t a Bubble Yet. These Stocks Could Keep Climbing. (Barron’s)

- SPACs Have Run Out of Steam. That’s Created Some Opportunities for Investors. (Barron’s)

- Why Did Charles Munger Buy Alibaba? (acquirersmultiple)

- Hertz Stock Looks Appealing. The Warrants Might Be Even Better. (Barron’s)

- ConocoPhillips Director R.A. Walker Makes Largest Insider-Stock Purchase in Years (Barron’s)

- GE and Four More Industrial Stocks Due For a Bounce–For Good Reason. (Barron’s)

- Brazil Tries to Get Ahead of Inflation. What That Means for Stocks. (Barron’s)

- Why Blackstone made a $5bn bet on housing low-income Americans (Financial Times)

- OPEC+ Seen Sticking to Planned Output Hike as Oil Prices Rebound (Bloomberg)

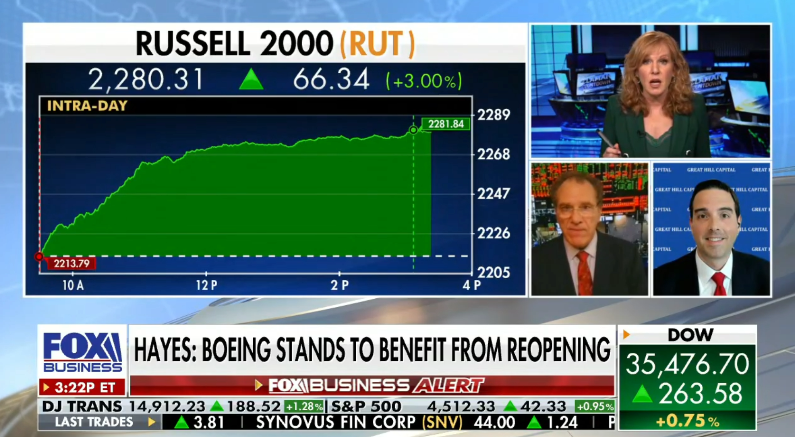

Tom Hayes – The Claman Countdown – Fox Business Appearance – 8/27/2021

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

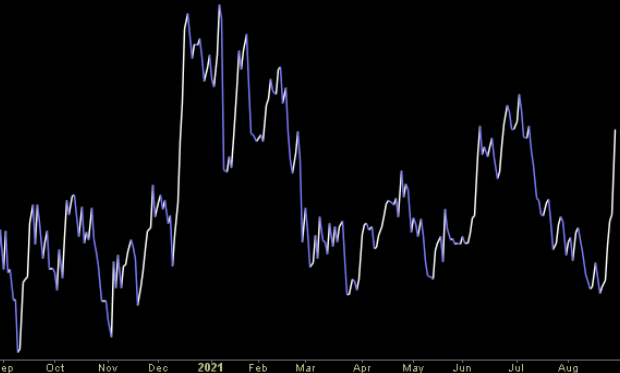

Where is money flowing today?

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 97

Hedge Fund Tips with Tom Hayes – Podcast – Episode 87

Be in the know. 14 key reads for Friday…

- Investors Are Running Scared From China’s Stocks. Where to Find Opportunities. (Barron’s)

- Boeing’s 737 MAX Is Back in India. China Is Next. (Barron’s)

- Biden Advisers Weigh Powell as Fed Chair, Brainard as Vice Chair (Bloomberg)

- China’s stock regulator plans to propose new rules that could thwart internet companies’ plans to list in the U.S. (Wall Street Journal)

- U.S. consumer spending slows in July; monthly inflation moderates (Reuters)

- Look for Taper Talk but No Clear Plans When Powell Speaks (Barron’s)

- Apple’s Changing Its App Store Rules in a Tentative Lawsuit Settlement. (Barron’s)

- Bostic Says ‘Very Close’ to Conditions to Taper: Fed Update (Bloomberg)

- New China Vaccine Shows 82% Effectiveness Against Serious Covid (Bloomberg)

- OPEC+ Seen Sticking to Planned Output Hike as Oil Prices Rebound (Bloomberg)

- Debunking the Hemline Index (Bloomberg)

- Fed’s Mester: Ready to begin taper this year and complete it by mid-2022 (MarketWatch)

- Tim Cook sells $750m of Apple stock after completing decade as chief (Financial Times)

- China’s top court takes aim at ‘996’ overtime culture in blow to tech groups (Financial Times)

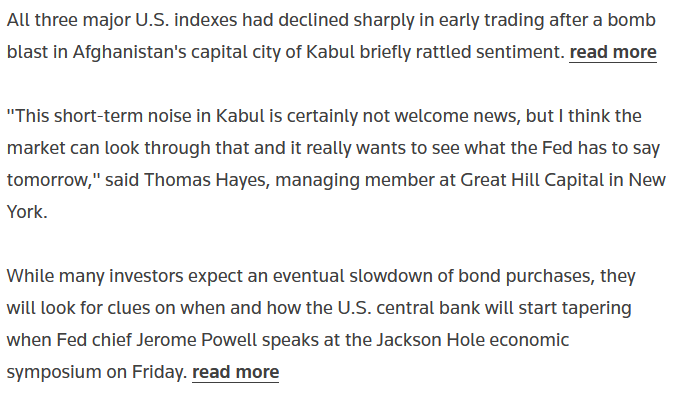

Tom Hayes – Quoted in Reuters article – 8/26/2021

Thanks to Devik Jain for including me in his article on Reuters today. You can find it here: