On last week’s podcast/videocast – in one of our “Ask Me Anything” questions – a regular viewer said:

“Thank you for taking the time to provide the weekly write ups and the podcasts. Thank you for also being the Ted Lasso of the Wall Street Crowd. It’s refreshing how positive you are considering the push back you have received in the past (XOM, Wells Fargo, etc. at lows…pounding the table).”

He was referring to the big trades we put on in Banks and Energy last year (when no one wanted them). These trades are referenced at the end of last week’s article.

I did not know who Ted Lasso was, so I took some time while I was flying this weekend to watch a few episodes on my phone. I get it now. Ted Lasso (pictured above) is a US Football Coach brought in to coach an English soccer team. He brings a down home optimistic style to a complex role/subject and ultimately has a positive impact on all of the players he coaches. It’s what I attempt to do on a weekly basis in my weekly notes and podcasts/videocasts that are now approaching two consecutive years.

This week, Myles Udland (of Yahoo! Finance) noted that strategists all across Wall Street have been panic chasing the market to raise their 2021 and 2022 S&P targets:

- On Tuesday, Wells Fargo’s Chris Harvey raised his year-end S&P 500 price target to 4,825 from 3,850.

- This weekend, David Lefkowitz, head of equities for the Americas at UBS Wealth Management, raised his year-end price target for the S&P 500 to 4,600 from 4,500.

- Lefkowitz also raised his June 2022 price target to 4,800 from 4,650, with the real headline coming from his year-end 2022 S&P 500 price target — 5,000.

- Earlier this month Credit Suisse’s Jonathan Golub put a price target of 5,000 on the S&P 500 for the end of 2022.

- Earlier this month, the equity strategy team at Goldman Sachs raised their year-end price target to 4,700 from 4,300 while putting a year-end 2022 price target of 4,900.

The price target increases are predicated not on multiple expansion, but rather, continued earnings growth. From the time that 2022 S&P earnings estimates were hovering around $200, we’ve repeatedly made the case that they would push over $220 and ultimately to $230+ before the end of this year. They are currently around $220.

Yesterday, I joined David Lin on Kitco News for a ~half hour segment on the China crackdown and Chinese stocks (and a bit about the expected year-end re-opening trade resurgence).

My key opener was that we’ve just experienced another instance of “Sell the rumor (China crackdown), Buy the news (China regulation announcements)” and that the bottom appears to be in (or close to in) for this beaten-up group.

Every 3-5 years the Chinese Communist Government feels like they are losing a bit of control and crack down hard on big tech players. The last instance was 2018, which we covered in detail here:

The Yogi Berra “Deja Vu” Stock Market (and Sentiment Results)…

TIMELINE (sell the rumor):

2020:

- Jack Ma goes “missing.”

- Ant Financial IPO pulled.

2021:

- April – Alibaba fined $2.7B for monopolistic behaviors.

- July – Chinese Education Stocks Contemplated Being Turned into non-profits.

- August – Video Games called “Spiritual Opium” by Chinese Gov’t.

- President Xi calls for “common prosperity.”

Resolution (buy the news):

- 5 year plan to strengthen control over Tech Healthcare sectors announced last week.

- China passed the Personal Information Protection Law (PIPL) on Friday, which lays out for the first time a comprehensive set of rules around data collection. Similar to EU GDPR privacy law.

- On Tuesday, China’s cyberspace regulator laid out two main conditions for companies wanting to go public overseas.

- Wall Street, China to Revive Talks in Hunt for Common Ground.

- On Tuesday, China’s central bank vowed to boost credit support and stabilize money growth.

As it relates to Alibaba, we said on last week’s podcast/videocast to look for a day where the stock rallies on bad news. On Monday, we seem to have gotten one. It sold off big (on the opening) on further crackdowns news and then finished the day positive.

It followed through for a total of 12.9% move off the lows – in 24 hours – before resting yesterday. While the stock is still vulnerable in its overshoot, and still hanging out on the “skinny branches” (and could fail) it has made a valiant effort on “bad news” to claw back to safety and potentially begin an aggressive move back toward intrinsic value (discussed in previous notes):

As for the resurgence of the “recovery trade” in Q3 and Q4 we will spend more time on that in this week’s podcast/videocast.

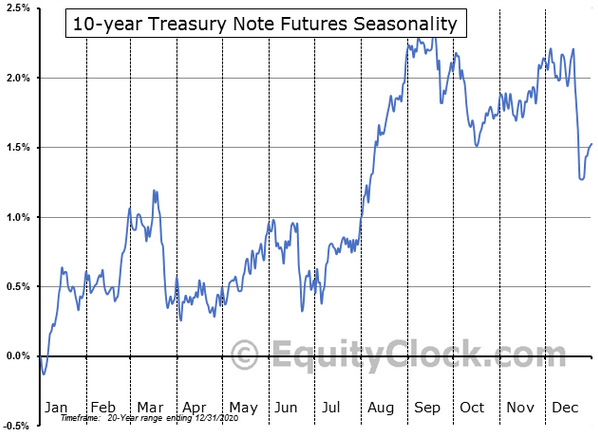

The key determinant of when the re-opening trade returns (value, cyclicals, re-opening) will be interest rates. We will spend time discussing the following two charts as they relate to seasonality and commercial positioning. Tune in…

Now onto the shorter term view for the General Market:

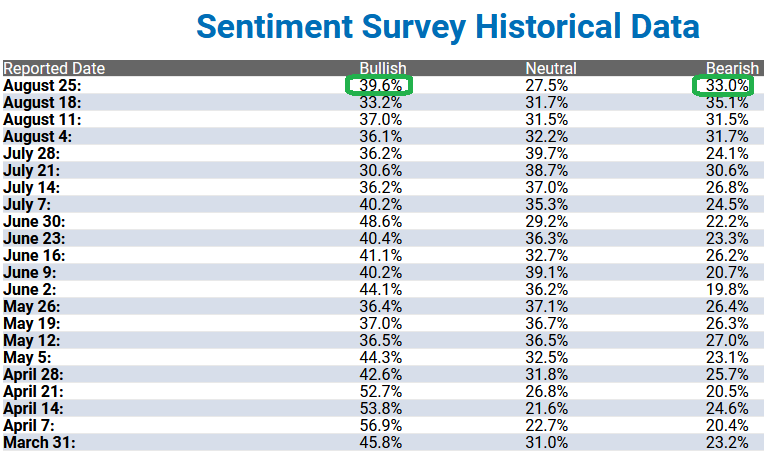

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose to 39.6% from 33.2% last week. Bearish Percent decreased to 33% from 35.1% last week.

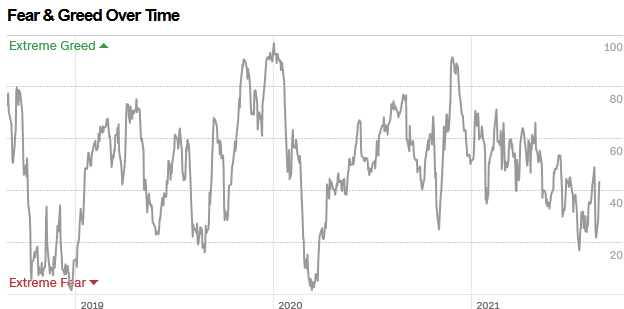

The CNN “Fear and Greed” Index rose from 25 last week to 44 this week. Fear is still present in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” Index rose from 25 last week to 44 this week. Fear is still present in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

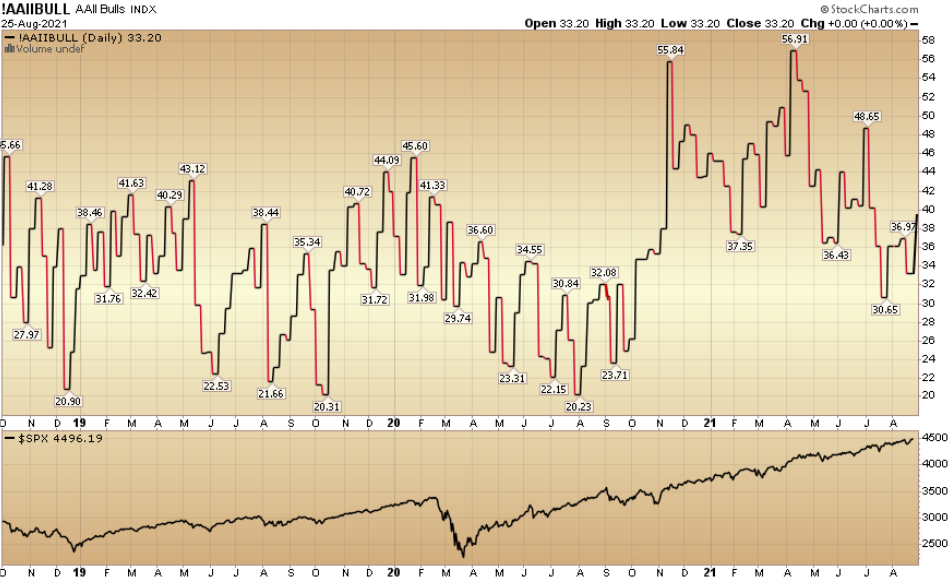

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 70.57% this week from 97.55% equity exposure last week.

Our message for this week

In the picture of coach Ted Lasso above, he is talking to his players about a local community slogan that says “it’s the hope that kills.” Ted belittles the statement and replaces the pessimism with a more upbeat slogan, “do you believe in miracles?”

When Banks and Energy doubled after we bought them in the hole (scroll to bottom of article) last year, people thought it was a miracle. You will see David’s disbelief in the video segment above (from my interview yesterday) when I lay out the case for BABA potentially working its way back up to its current intrinsic value of ~$300 over the next 12-24 months. I don’t blame him, I’d be skeptical too based on current headlines and price action…

It’s very tough to see the possibilities when all the news is bad, but if you can’t see what I see, I invite you to borrow my glasses. It won’t be easy, certain (or a straight line), but I “BELIEVE” it will be worth it over time…

*Opinion, not advice (see terms).