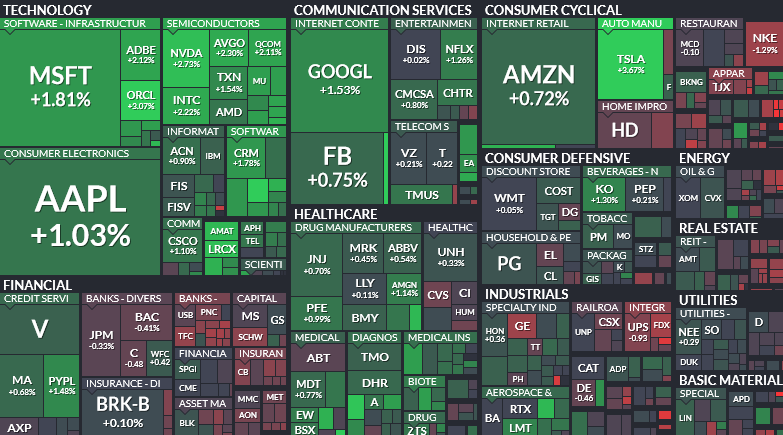

Data Source: Finviz

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 85

Be in the know. 25 key reads for Friday…

- FDA’s Call on Biogen’s Alzheimer’s Drug Is Coming Soon (Barron’s)

- Viva Las Vegas: Sin City Presses Its Luck in the Postpandemic Era (Barron’s)

- May’s Employment Report Is Another Disappointment (Barron’s)

- Buy Take-Two Interactive Because a Whole Lot of Videogames Are in the Works (Barron’s)

- Alibaba, Alphabet, and Amazon Stock Are Bargains, This Value Manager Says (Barron’s)

- How Pitchers Are Conquering Baseball’s Home Run Revolution (Wall Street Journal)

- Ant to Change How It Makes Loans With New Consumer-Finance Company (Wall Street Journal)

- Services Boom? You Ain’t Seen Nothing Yet (Wall Street Journal)

- Biden Narrows Infrastructure Request, but Hurdles Remain for Bipartisan Deal (New York Times)

- The Momentum Is With Active Fund Managers for Now (Bloomberg)

- Texas Rising: Hedge Funds, Big Tech Drive Lone Star Wealth Boom (Bloomberg)

- Palantir gets aggressive in SPAC investments, backing digital health, aviation and robot companies (CNBC)

- Billionaire hedge-fund manager Julian Robertson endorses high-flying US tech stocks — and says their valuations aren’t lofty (Business Insider)

- Apple’s Big Show May Not Be Enough (Wall Street Journal)

- Cloud Software’s Low-Hanging Fruit Is a Tempting Target (Wall Street Journal)

- Apple stock on track for longest weekly losing streak in more than 2 1/2 years (MarketWatch)

- Is the Fed ‘tightening cycle’ already happening? (MarketWatch)

- Italian Artist Sells Invisible Sculpture For $18,000 (ZeroHedge)

- Strong Inflows to Cash Continue, Largest Selling of Tech Stocks Since December 2018 – BofA’s Flow Show (Street Insider)

- Northrop Grumman (NOC) Upgraded to ‘Buy’ at Stifel on Compelling Valuation (Street Insider)

- Apple’s (AAPL) WWDC Unlikely to Blunt the Deceleration Narrative – Wolfe Research (Street Insider)

- Biden open to dropping corporation tax rise in infrastructure talks (Financial Times)

- UK approves Pfizer jab for younger adolescents (Financial Times)

- Tiger’s Julian Robertson bets big tech stocks will keep marching higher (Finaicial Times)

- Washington to bar US investors from 59 Chinese companies (Financial Times)

Hedge Fund Tips with Tom Hayes – Podcast – Episode 75

Unusual Options Activity – JD.com, Inc. (JD)

Data Source: barchart

Today some institution/fund purchased 18,260 contracts of Sept. $77.5 strike calls (or the right to buy 1,826,000 shares of JD.com, Inc. (JD) at $77.5). The open interest was just 1,592 prior to this purchase. Continue reading “Unusual Options Activity – JD.com, Inc. (JD)”

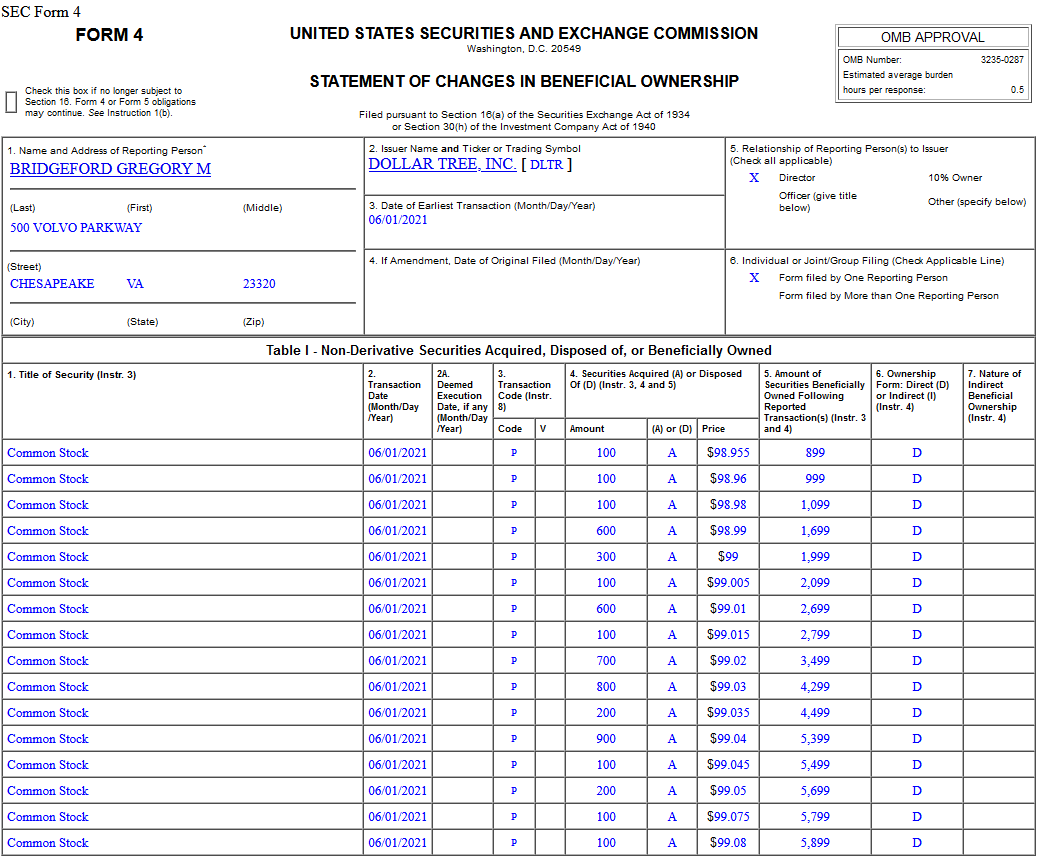

Insider Buying in Dollar Tree, Inc. (DLTR)

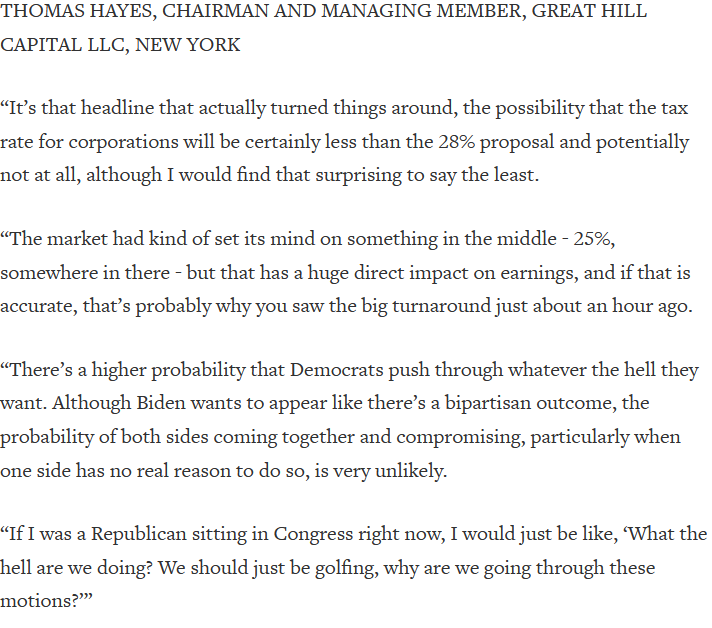

Tom Hayes – Quoted in Reuters article – 6/3/2021

Thanks to Herb Lash for including me in his article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 20 key reads for Thursday…

- What’s In Store For Biogen If Alzheimer’s Drug Gains FDA Approval? (Investor’s Business Daily)

- 2022 Defense Department Budget Bodes Well for 4 Top Stocks to Buy Now (247wallst)

- This Nobel Laureate In Physics Looks To The Next Huge Thing (Investor’s Business Daily)

- Alibaba, Alphabet, and Amazon Stock Are Bargains, This Value Manager Says (Barron’s)

- Discovery’s ‘K’ Shares Are One Way to Play the Merger With Warner Media (Barron’s)

- Business Travel Is Coming Back (Wall Street Journal)

- Traveling to Europe? Here’s What’s Open to U.S. Tourists (Wall Street Journal)

- Elon Musk’s Starlink Could Get Boost From German Subsidies (Wall Street Journal)

- No Grave Dancing for Sam Zell Now. He’s Paying Up for Hot Properties. (Wall Street Journal)

- The Fed announces plans to sell off its corporate bond holdings. (New York Times)

- AMC files to sell 11 million shares (CNBC)

- Jack Ma’s Ant Group gets China’s approval to operate consumer finance firm (CNBC)

- US weekly jobless claims tumble to new pandemic-era low of 385,000 (Business Insider)

- Fed’s Beige Book sees pickup in U.S. economic growth (MarketWatch)

- United Plans to Buy 15 Supersonic Planes (Wall Street Journal)

- Carbon Price Boom Attracts Investors to Emissions-Trading Market (Wall Street Journal)

- Tracking Covid-19 Vaccine Distribution (Wall Street Journal)

- World Food Prices at 10-Year Highs in May, Says United Nations Food Agency, Biggest Monthly Jump Since 2010 (Street Insider)

- Tellurian signs 10-year LNG agreement with Vitol for 3 MTPA (Reuters)

- Spac promoter Palihapitiya seeks $800m to target biotech companies (Financial Times)