The song we chose to describe sentiment for the stock market this week is Tigirlily’s new hit country song, “My Thang.” The lyrics that represent the current resilient status of stock market action are as follows:

I’ma keep doing my

Thang come shine

Come rain

Whatever the weather

I’ma keep doing my thang…

On Wednesday morning I was on Cheddar News TV with Brad Smith. Thanks to Brad and Ally Thompson for having me on.

In this segment, I discussed that while it has gotten harder to find value with the market up ~90% off its pandemic lows, there are still a few areas that make sense for new capital. I go into our biggest new pick and a comprehensive explanation of why we have allocated new capital to this idea over the past few weeks:

One undervalued area we are recently focused on is Chinese Stocks:

They have been hit hard for 3 reasons:

1. Archegos Family Office/Bill Hwang Blow Up: Hwang controlled as much as $100B of Chinese stocks through “total return swaps” at multiple banks. To unwind, prime brokers sold 100M shares of Chinese stocks (their hedges against the swaps) which pressured the group: BIDU, VIPS GSX, TME, etc – but the entire basket suffered BABA, PDD, JD, XPEV, LI etc.

2. Chinese Gov’t regulation: Anti-Monopoly crackdown $2.8B fine on BABA, Crackdown on “LiveStreamers,” Crackdown on online education/tutoring providers.

3. Inflation fears: As inflation fears intensified in Q1/Q2 2021, yields rose and money came out of high multiple Tech as well as Chinese Tech stocks. With yields stabilizing and most commodities (ex-oil) retreating in recent weeks (lumber, grains, metals, etc), the fears are moderating and money can start to move back into these neglected groups that still have meaningful growth prospects.

Tech is seasonally weak (20 yr avg) in the first half of the year and starts to gain steam in the Summer through year-end:

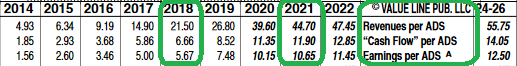

–Top Pick right now is BABA: Traded at avg PE of 28x EPS since going public. Currently trading at 18x next year’s Estimates.

-You can purchase BABA in June 2021 for the same price as June 2018. The DIFFERENCE between 20018 and NOW is that BABA has:

1. DOUBLED Revenue per Share

2. DOUBLED Cash Flow per Share

3. DOUBLED Earnings per Share

-BABA Owns 1/3 of Ant Financial – which IPO was delayed for political reasons. It looks like that should push through this year (worth ~$100B to BABA).

-Cloud business growing fast enough to be larger than AWS in 5 years.

-China Gov’t push for internal consumption and reliance on Ant Financial to test its Digital Yuan should pave the way for smoother governmental relations moving forward.

-Charlie Munger bought it for the first time in Q1 2021 (in a BIG WAY) for Daily Journal (~20% of the portfolio).

Jobs Report (Friday):

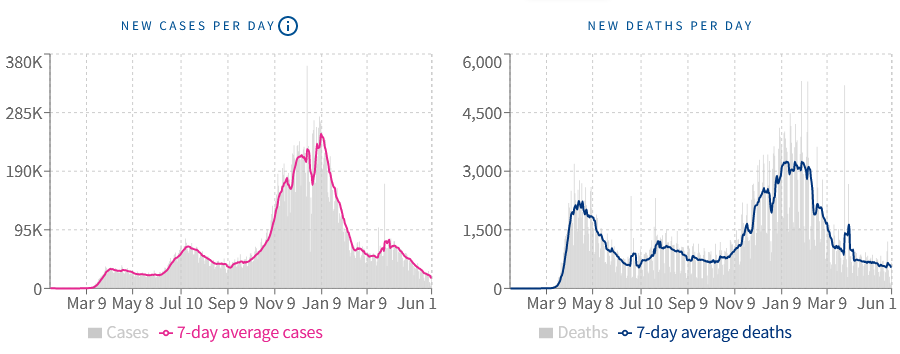

The big miss last month (Nonfarm Payrolls (Apr) 266K versus 978K est) – despite JOLTs (Job Openings) hitting a record high of 8.123M vs. 7.500M est.

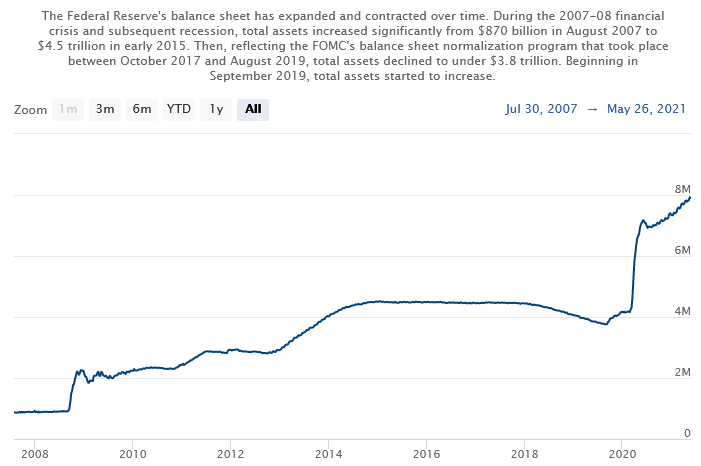

That was bad news. However, it gave Chair Power cover to defer talk about tapering bond purchases – as he has repeatedly stated he is willing to let the economy run hot until everyone who wants a job gets a job.

24 states have since stopped the Federal Extended Unemployment benefits that are due to expire in September. While that should help the jobs report (+664k jobs/5.9% unemployment est) on Friday, the 26 states that are still receiving extra benefits through September are the most populous and may weigh on getting a big beat.

The bad news is it will keep productivity down through Sept if people choose to stay home. The good news is it gives Powell cover to delay tapering from consensus Q4 2021 until Q1 2022.

Earnings:

Estimates continue to increase:

2021: 188.54

2022: 210.58

Trading at 19.95x 2022 Estimates on the S&P 500. Higher than 5yr avg but reasonable considering rates and liquidity.

Source: USAFacts

MEME STOCK AMC:

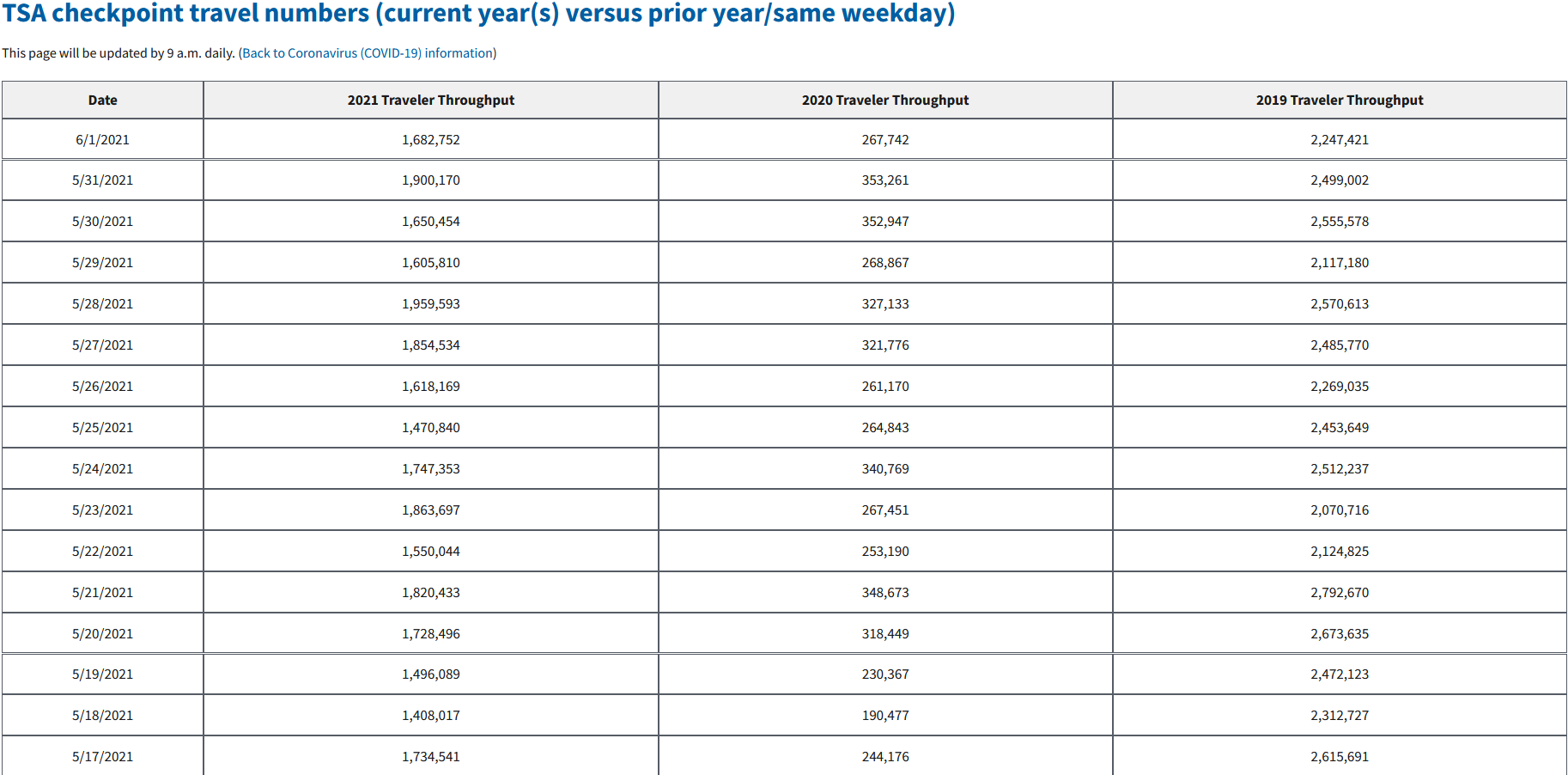

AMC Entertainment is the world’s largest film exhibitor, operating a chain of about 1,000 theaters across 15 countries in North America, Europe, and the Mideast.

2019: Did $5.4B in revenue. Lost -$1.44/share.

2022: Expected to recover to $4.7B in revenue. Estimated to lose -$0.85/share.

52 week high in 2019 was ~$16. 52 week low in 2019 was $7.

To pay over $60 per share and think this price will sustain, you have to believe that 4x as many people will go to the Movies next year than went in 2019 (pre-pandemic). This is a short term structural phenomenon that will not end well. In the short term the market is a voting machine (emotions and structural anomalies), in the long-term it is a weighing machine (fundamentals).

Mudrick Capital (who bought $230M in a secondary offering) flipped out the same day to the retail crowd – who bought it at a higher price. AMC says it will use the cash to buy distressed competitors, but investors are pushing them to pay down $5B of debt.

So while the company is wildly “overvalued” it could become even more “overvalued” until the short interest starts to come down from 21% and more funds are forced to cover.

Now onto the shorter term view for the General Market:

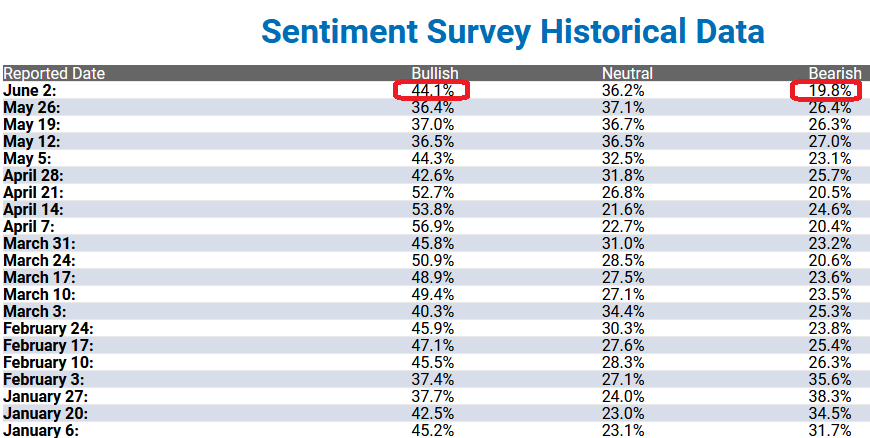

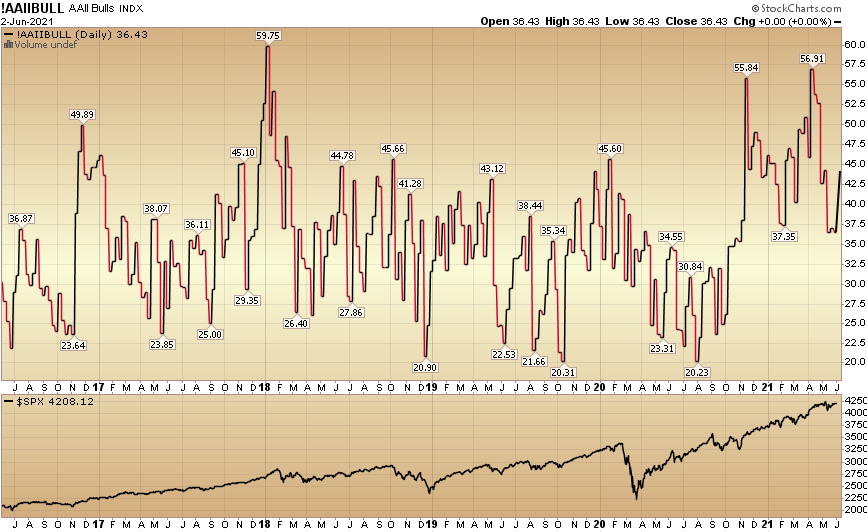

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) jumped to 44.1% from 36.4% last week. Bearish Percent dropped to 19.8% from 26.4% last week. Retail exuberance has returned.

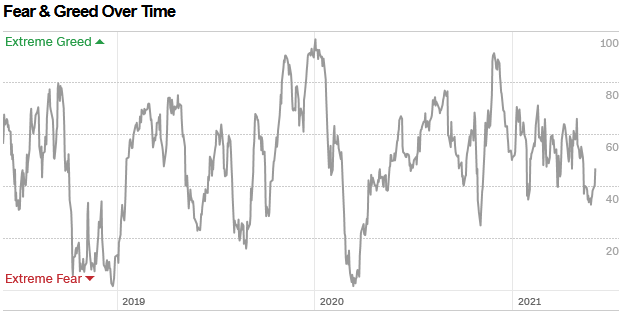

The CNN “Fear and Greed” Index rose from 35 last week to 47 this week. This is a neutral reading. You can learn how this indicator is calculated and how it works here: (Video Explanation)

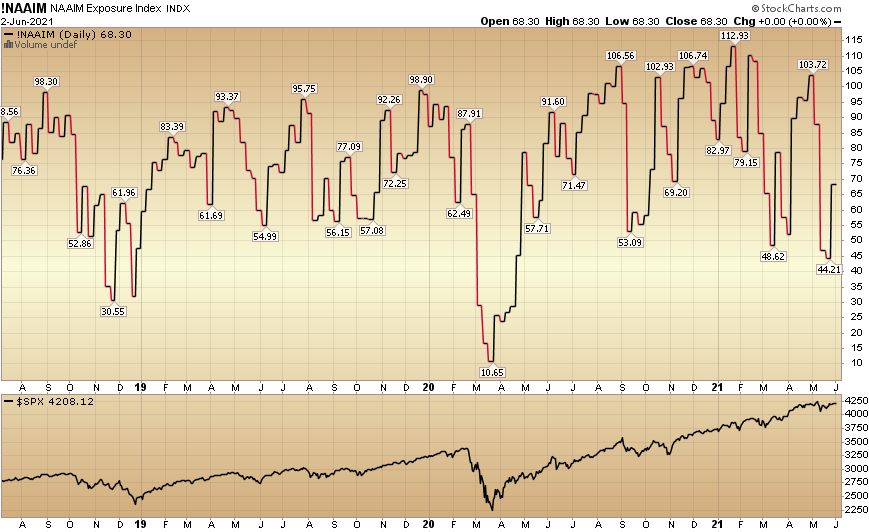

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 68.30% this week from 44.21% equity exposure last week. The chase is on…

Our message for this week:

We continue to pick our spots and look for the “rallies under the surface.” We have spent the last few weeks building China positions, selected SaaS/Tech positions, and SPAC warrants (mostly selective “busted” SPACs with announced deals that have rolled over – but have interesting businesses/sponsors for the long-term). You can explore a list of completed SPACs here.

We believe the “big money” will be made “under the surface” for the remainder of the year.

So while the indices will continue to do “Their Thang” we’ll continue to do “Our Thang” and scoop up “out of favor” stocks and derivatives. Then we patiently hold them until they return to our predetermined estimate of fair value. Finally, we return them to excited buyers in the market – who prefer to enter later at high valuations.

Rinse and repeat…