- Here’s What Could Stop Inflation in Its Tracks (Barron’s)

- GE Stock Is Getting a Boost From Wall Street (Barron’s)

- Lumber prices fall for a 5th straight day in a reprieve for surging commodity prices (Business Insider)

- Inflation Is Here and Hotter Than It Looks. Why It’s Time to Worry. (Barron’s)

- Shares of Realogy, an Unlikely Hero of the Realty Revolution, Look Cheap (Barron’s)

- Income Investors, Meet GARY: It Brings Growth and Reasonable Yield (Barron’s)

- Disney CEO: CDC mask rule will spur ‘immediate’ jump in theme park attendance (New York Post)

- Value Investing Still Beats Growth Investing, Historically (Alpha Architect)

- Lessons from the 2021 Berkshire Meeting (Novel Investor)

- U.S. Shoppers Continued Stimulus-Fueled Spending in April (Wall Street Journal)

- Marijuana Medical Research Growers Receive U.S. Approval (Wall Street Journal)

- The Capitalist Culture That Built America (Wall Street Journal)

- The summer of inflation: will central banks and investors hold their nerve? (Financial Times)

- Israel’s Iron Dome keeps toll of rockets in check (Finacial Times)

- US day trading frenzy eases as investors ‘move on to other things’ (Financial Times)

- Solar panels are key to Biden’s energy plan. But the global supply chain may rely on forced labor from China (CNN)

- When Inflation Is High, Hedge Fund Managers Thrive (Institutional Investor)

- A Look Under the Hood For Inflation (DGI)

- David Swensen: The Peter Lynch of Institutional Investing (Morningstar)

- The Pygmalion Effect: Proving Them Right (Farnam Street)

Unusual Options Activity – Las Vegas Sands Corp. (LVS)

Data Source: barchart

Today some institution/fund purchased 2,840 contracts of Jan 2023 $57.5 strike calls (or the right to buy 284,000 shares of Las Vegas Sands Corp. (LVS) at $57.50). The open interest was just 497 prior to this purchase. Continue reading “Unusual Options Activity – Las Vegas Sands Corp. (LVS)”

Where is money flowing today?

Be in the know. 10 key reads for Friday…

- Is the Stock Market’s Inflation Reset Over? (Barron’s)

- The New York Mets’ Record-Breaking Folk Hero (Wall Street Journal)

- Airbnb Sales Top Estimates as Some Travel Resumes (Barron’s)

- DoorDash Stock Rallies as Earnings Top Expectations (Barron’s)

- Fully Vaccinated People Can Stop Wearing Face Masks and End Physical Distancing in Most Settings, CDC Says (Wall Street Journal)

- Fisker (FSR) Announces Framework Agreement with Foxconn (Street Insider)

- McDonald’s to boost wages by 10 percent amid worker shortage (New York Post)

- U.S. Retail Sales Stall After Latest Wave of Stimulus Spending (Bloomberg)

- Opinion: These big bank stocks may be a great three-year play on the economy and inflation (MarketWatch)

- Israel steps up battle against communal violence and Gaza rocket attacks (Financial Times)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 82

Article referenced in VideoCast above:

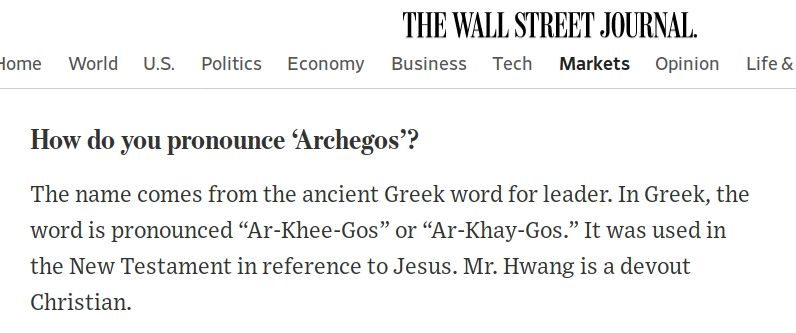

The “Archegos’ Loss is Your Gain,” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 72

Article referenced in podcast above:

The “Archegos’ Loss is Your Gain,” Stock Market (and Sentiment Results)…

Unusual Options Activity – TAL Education Group (TAL)

Data Source: barchart

Today some institution/fund purchased 42,009 contracts of Jan $80 strike calls (or the right to buy 4,200,900 shares of TAL Education Group (TAL) at $80). The open interest was just 578 prior to this purchase. Continue reading “Unusual Options Activity – TAL Education Group (TAL)”

Where is money flowing today?

Be in the know. 15 key reads for Thursday…

- XPeng’s Earnings Have a Lot to Like. That’s Good News for Weary EV Investors. (Barron’s)

- Tesla Stops Accepting Bitcoin for Environmental Reasons (Barron’s)

- SoftBank Boosts Size of Vision Fund 2 to $30 Billion (Barron’s)

- The Stock Market Selloff Has Hit Everything. Why It’s Not Time to Panic. (Barron’s)

- Alibaba posts loss due to anti-monopoly fine but beats revenue expectations (MarketWatch)

- As World Runs Short of Workers, a Boost for Wages—and Inflation (Wall Street Journal)

- CDC Recommends Pfizer-BioNTech Covid-19 Vaccine for 12- to 15-Year-Olds (Wall Street Journal)

- US Producer Prices Surge Most On Record (ZeroHedge)

- Why Is New TV So Much Like Cable? (New York Times)

- Carnival Cruise Line aims for July restart from Florida and Texas, cancels other sailings through July (USA Today)

- Fed Lists Six Reasons in Arguing Inflation Surge Will Pass (Bloomberg)

- Billionaire investor Bill Ackman hopes to close his mega SPAC deal within weeks — and called his target an ‘iconic’ business (Business Insider)

- The current stock market sell-off is rotational rather than toppy, and a bullish backdrop supports a summer rally, according to Bank of America (Business Insider)

- How mRNA became a vaccine game-changer (Financial Times)

- Pentagon delays report on Chinese companies with military ties (Financial Times)

The “Archegos’ Loss is Your Gain,” Stock Market (and Sentiment Results)…

Last week we spoke about opportunities starting to present themselves in selective Chinese Stocks and “Broken SPACs/SPAC warrants.” Continue reading “The “Archegos’ Loss is Your Gain,” Stock Market (and Sentiment Results)…”